Audited Financial Statements for NLB d.d.

Notes to Financial Statements

Notes to Financial Statements

1. GENERAL INFORMATION

Nova Ljubljanska banka d.d., Ljubljana ("the Bank" or "NLB") is incorporated in Slovenia as a joint stock company providing universal banking services.

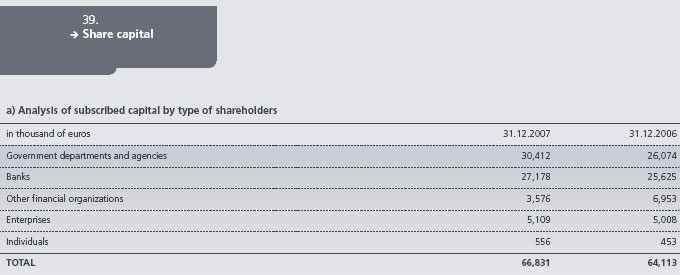

The largest shareholders of Nova Ljubljanska banka d.d. are the Republic of Slovenia, owning 35.41% of the shares, and KBC Bank N.V., Brussels ("KBC Bank"), owning 34% of the shares.

The address of its registered office is: Nova Ljubljanska banka d.d., Ljubljana, Trg republike 2, Ljubljana

The increase in the general price index for the year 2007 was 5.6% (2006: 2.8%). In the period from 1 January 2007 to 31 December 2007 the exchange rate for the US dollar changed from 1.3170 US dollars for 1 Euro to 1.4721 US dollars for 1 Euro. The functional and presentation currency of the Bank in year 2006 was the tolar (note 2.26.).

All amounts in the financial statements and in the notes to the financial statements are expressed in thousand of euros unless otherwise specified.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies adopted for the preparation of the financial statements are set out below:

2.1. Statement of compliance

The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union.

Single entity ultimate parent company financial statements have been prepared in addition to consolidated financial statements according to the requirements of local legislation.

The Bank has also prepared consolidated financial statements in accordance with IFRS as adopted by the EU for the Bank and its subsidiaries (the Group). In the consolidated financial statements, subsidiary undertakings, which are those companies in which the Group, directly or indirectly, has an interest of more than half of the voting rights or otherwise has the power to exercise control over the operations, have been fully consolidated. The consolidated financial statements can be obtained from the Bank’s registered office.

Users of these stand alone financial statements should read them together with the Group’s consolidated financial statements as at and for the year ended 31 December 2007 in order to obtain full information on the financial position, results of operations and changes in financial position of the Group as a whole.

2.2. Basis of preparation of financial statements

The financial statements have been prepared under the historical cost convention as modified by the revaluation of available for sale financial assets, financial assets and financial liabilities at fair value through profit or loss, including all derivative contracts and investment property.

The preparation of financial statements in conformity with IFRS requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although these estimates are based on management’s best knowledge of current events and actions, actual results may ultimately differ from those estimates. Critical accounting estimates are disclosed in note 2.28.

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all the years presented.

2.3. Foreign currency translation

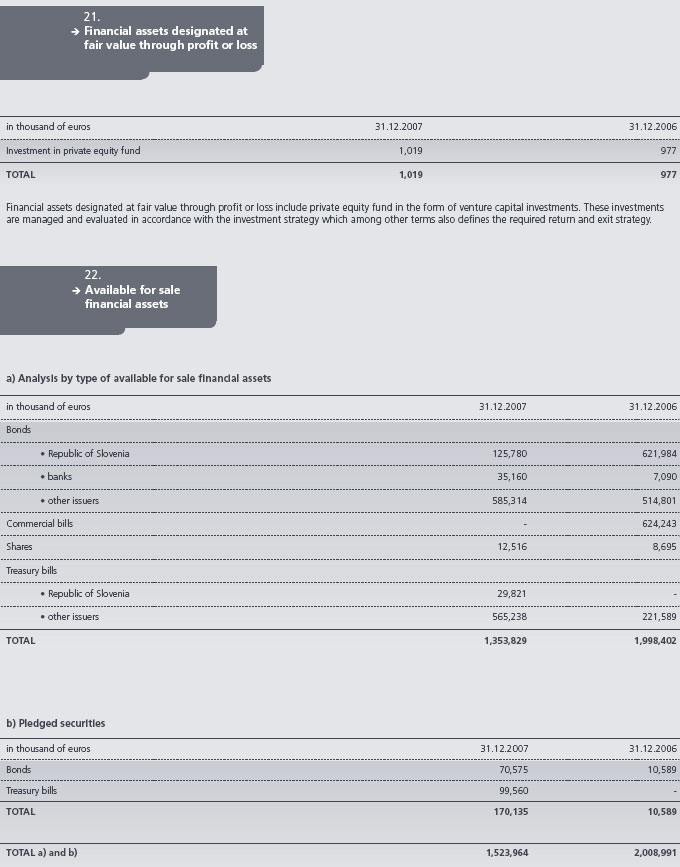

Functional and presentation currency

Items included in the financial statements are measured

using the currency of the primary economic environment

in which the Bank operates. Financial statements are

presented in euros, which is the Bank’s functional and

presentation currency.

Transactions and balances

Foreign currency transactions are translated into

functional currency at the exchange rates prevailing at

the dates of the transactions. Foreign exchange gains and

losses resulting from the settlement of such transactions

and from the translation of monetary assets and liabilities

denominated in foreign currencies are recognized in the

income statement, except when deferred in equity as

qualifying cash flow hedges.

Translation differences resulting from changes in the amortized cost of monetary items denominated in foreign currency and classified as available for sale financial assets, are recognized in profit or los. Translation differences on non-monetary items, such as equities at fair value through profit or loss, are reported as part of the fair value gain or loss. Translation differences on non-monetary items, such as equities classified as available for sale, are included in the revaluation reserve in equity.

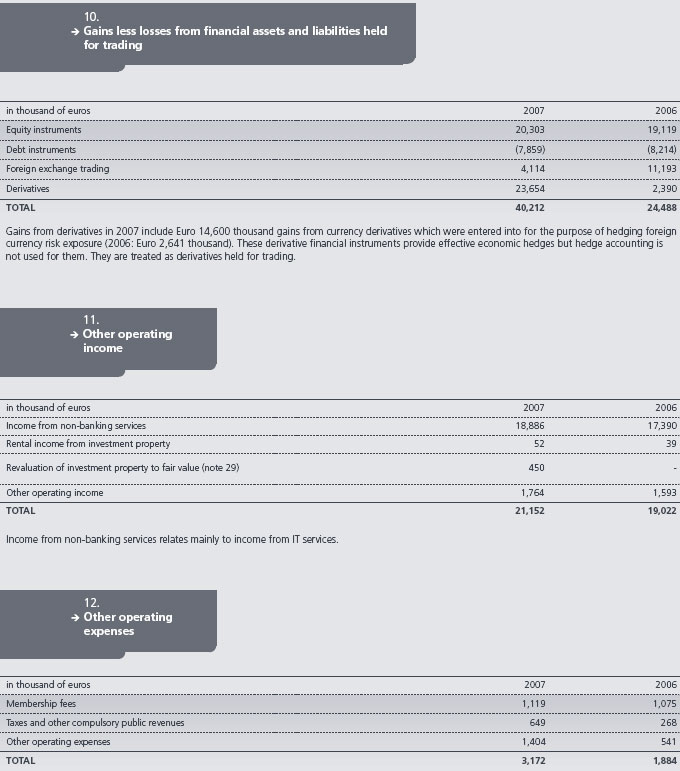

Gains and losses resulting from foreign currency purchases and sales for trading purposes are included in the income statement as gains less losses from financial assets and liabilities held for trading.

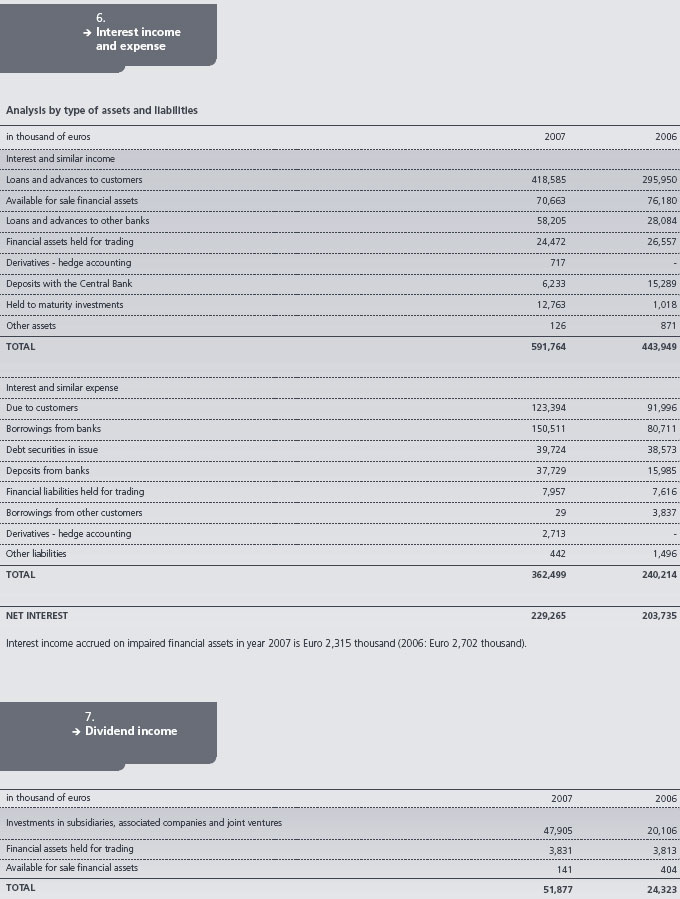

2.4. Interest income and expense

Interest income and expense are recognized in the income statement for all interest-bearing instruments on an accruals basis using the effective yield method based on the actual purchase price. Interest income includes coupons earned on fixed income investment and trading securities and accrued discounts and premiums on securities. The calculation of effective interest rate includes all fees and points paid or received between parties to the contract and all transaction costs. Once a financial asset or a group of similar financial assets has been written down as a result of an impairment loss, interest income is recognized using the rate of interest used to discount the future cash flows for the purpose of measuring the impairment loss.

Interest income and expense from all financial assets and liabilities are disclosed as part of net interest income.

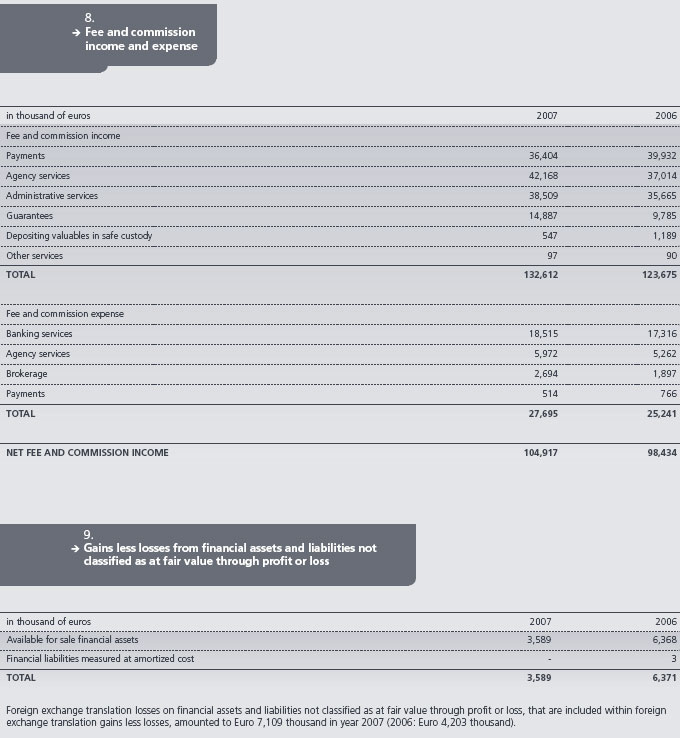

2.5. Fee and commission

Fees and commissions are generally recognized when the service has been provided. Fees and commissions consist mainly of fees received from payment and from the managing of funds on behalf of legal entities and individuals, together with commissions from guarantees.

2.6. Dividend income

Dividends are recognized in the income statement when the Bank’s right to receive payment is established.

2.7. Financial instruments

a) Classification

Financial instruments at fair value through profit or loss

This category has two sub-categories: financial instruments held for trading and financial instruments designated at fair value through profit or loss at inception. A financial instrument is classified in this group if acquired principally for the purpose of selling in the short term or if so designated by management. Derivatives are also categorized as held for trading unless they are designated as hedging instruments.

The Bank designates a financial instrument as at fair value through profit or loss when:

- it eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise from measuring assets or liabilities on different basis or

- a group of financial assets, financial liabilities or both is managed and its performance is evaluated on fair value basis, in accordance with documented risk management or investment strategy, and information about the group is provided internally on that basis to the Bank’s key management or

- a financial instrument contains one or more embedded derivatives that can significantly modify the cash flows otherwise required by the contract.

Loans and receivables

Loans and receivables are non-derivative financial instruments with fixed or determinable payments that are not quoted in an active market, other than: (a) those that the Bank intends to sell immediately or in the short term, which are classified as held for trading, and those that the Bank upon initial recognition designates as at fair value through profit or loss; (b) those that the Bank upon initial recognition designates as available for sale; or (c) those for which the Bank may not recover substantially all of its initial investment, other than because of credit deterioration.

Held to maturity investments

Held to maturity investments are non-derivative financial instruments with fixed or determinable payments and fixed maturity that the Bank has the positive intention and ability to hold to maturity.

Available for sale financial assets

Available for sale financial assets are those intended to be held for an indefinite period of time, which may be sold in response to needs for liquidity or changes in interest rates, exchange rates or equity prices.

b) Measurement and recognition

Financial assets are initially recognized at fair value plus transaction costs for all financial assets not carried at fair value through profit or loss. Financial assets carried at fair value through profit and loss are initially recognized at fair value, and transaction costs are expensed in the income statement.

Regular way purchases and sales of financial instruments at fair value through profit or loss, held to maturity and available for sale, are recognized on trade date. Loans are recognized when cash is advanced to the borrowers. All other purchases and sales are recognized as derivative forward transactions until settlement.

Financial assets at fair value through profit or loss and financial assets available for sale are subsequently measured at fair value. Gains and losses from changes in the fair value of the financial assets at fair value through profit or loss are included in the income statement in the period in which they arise. Gains and losses from changes in the fair value of available for sale financial assets are recognized in equity until the financial asset is derecognized or impaired, at which time the effect previously included in equity is recognized in the income statement. However, interest calculated using the effective interest method and foreign currency gains and losses on monetary assets classified as available for sale are recognized in the income statement. Dividends on available for sale equity instruments are recognized in the income statement when the Bank’s right to receive payment is established.

Loans and held to maturity investments are carried at amortized cost.

c) Derecognition

A financial asset is derecognized when the contractual rights to the cash flows from the financial asset expire or the financial asset is transferred and transfer qualifies for derecognition. A financial liability is derecognized only when it is extinguished - i.e. when the obligation specified in the contract is discharged, cancelled or expires.

d) Fair value measurement principles

The fair value of quoted financial instruments in active markets is based on current bid price at the balance sheet date. If there is no active market, the fair value of the instruments is estimated using discounted cash flow techniques or pricing models.

Where discounted cash flow techniques are used, estimated future cash flows are based on the management’s best estimates and the discount rate is a market-related rate at the balance sheet date for an instrument with similar terms and conditions. Where pricing models are used, inputs are based on market related measures at the balance sheet date.

e) Derivative financial instruments and hedge accounting

Derivative financial instruments, including forward and futures contracts, swaps and options, are initially recognized on the balance sheet at fair value. Derivative financial instruments are subsequently remeasured at their fair value. Fair values are obtained from quoted market prices, discounted cash flow models or pricing models, as appropriate. All derivatives are carried at their fair value within assets when favourable to the Bank, and within liabilities when unfavourable to the Bank.

The method of recognizing the resulting fair value gain or loss depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged. The Bank designates certain derivatives as either:

- Hedges of the fair value of recognized assets or liabilities or firm commitments (fair value hedge) or

- Hedges of highly probable future cash flows attributable to a recognized asset or liability, or a forecasted transaction (cash flow hedge).

Hedge accounting is used for derivatives designated in this way provided certain criteria are met.

The Bank documents, at the inception of the transaction, the relationship between hedged items and hedging instruments, as well as its risk management objective and strategy for undertaking various hedge transactions. The Bank also documents its assessment, both at hedge inception and on an ongoing basis, of whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flows of hedged items.

Fair value hedge

Changes in the fair value of derivatives that are

designated and qualify as fair value hedges are recognized

in the income statement, together with any changes in

the fair value of the hedged asset or liability that are

attributable to the hedged risk. Effective changes in fair

value of hedging instruments and related hedged items

are reflected in “fair value adjustments in hedge

accounting”. Any ineffectiveness is recorded in “gains and

losses on financial assets and liabilities held for trading”.

If the hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedged item for which the effective interest method is used is amortized to profit or loss over the period to maturity. The adjustment to the carrying amount of a hedged equity security remains in retained earnings until the disposal of the equity security.

Cash flow hedge

The effective portion of changes in the fair value of

derivatives that are designated and qualify as cash flow

hedges is recognized in equity. The gain or loss relating to

the ineffective portion is recognized immediately in the

income statement – “gains and losses on financial assets

and liabilities held for trading”.

Amounts accumulated in equity are recognized in the income statement in the periods when the hedged item affects profit or loss.

When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, any cumulative gain or loss existing in equity at that time remains in equity and is recognized when the forecast transaction is ultimately recognized in the income statement. When a forecast transaction is no longer expected to occur, the cumulative gain or loss that was reported in equity is immediately transferred to the income statement.

Derivatives that do not qualify for hedge accounting

Certain derivative instruments do not qualify for hedge

accounting. Changes in the fair value of such derivative

instruments are recognized immediately in the income

statement within gains and losses on financial assets and

liabilities held for trading.

2.8. Impairment of financial assets

a) Assets carried at amortized cost

The Bank assesses at each balance sheet date whether there is objective evidence that a financial asset or group of financial assets is impaired. A financial asset or group of financial assets is impaired and impairment losses are incurred if, and only if, there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset and that event has an impact on the future cash flows of the financial asset or group of financial assets that can be reliably estimated.

The criteria that the Bank uses to determine that there is objective evidence of an impairment loss include:

- Delinquency in contractual payments of principal or interest,

- Cash flow difficulties experienced by the borrower,

- Breach of loan covenants or conditions,

- Initiation of bankruptcy proceedings,

- Deterioration of the borrower’s competitive position,

- Deterioration in the value of collateral and

- Downgrading below investment grade level.

The estimated period between a loss occurring and its identification is determined by management for each identified portfolio. In general, the periods used vary between three and six months.

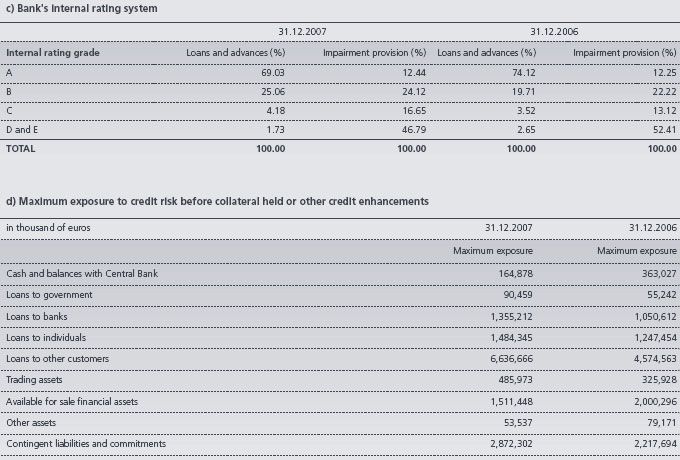

The Bank first assesses whether objective evidence of impairment exists individually for financial assets that are individually significant, and individually or collectively for financial assets that are not individually significant. The Banks regards all exposures to A, B and C rated customers over Euro 1,500 thousand and exposures to D and E rated customers over Euro 10 thousand as individually significant financial assets. If the Bank determines that no objective evidence of impairment exists for an individually assessed financial asset, whether significant or not, it includes the asset in a group of financial assets with similar credit risk characteristic and collectively assesses them for impairment. Assets that are individually assessed for impairment and for which an impairment loss is or continues to be recognized are not included in a collective assessment.

If there is objective evidence that an impairment loss on loans and receivables or held to maturity investment has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate. The carrying amount of the asset is reduced through an allowance account and the amount of the loss is recognized in the income statement. If a loan or held to maturity investment has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate determined under the contract.

The calculation of the present value of the estimated future cash flows of collateralized financial assets reflects the cash flows that may result from foreclosure, less costs of obtaining and selling the collateral, whether or not foreclosure is probable.

For the purpose of collective evaluation of impairment, the Bank uses migration matrices, which show expected migration of customers between internal rating classes. The probability of migration is assessed on the basis of past years’ experience, that is annual migration matrices for different types of customers. Exposures to individuals are additionally analyzed with regard to type of products. Based on the migration matrices and assessment of average repayment rate for D and E rated customers, the Bank recognizes impairment losses also for clients that currently show no signs of impairment, but on the basis of past experience the Bank justifiably estimates that some losses have already incurred.

If the amount of the impairment subsequently decreases due to an event occurring after the write down, the reversal of loss is recognized as a reduction of an allowance for loan impairment.

When a loan is uncollectible, it is written off against the related allowance for loan impairment. Such loans are written off after all the necessary procedures have been completed and the amount of the loss has been determined. Subsequent recoveries of amounts previously written off decrease the amount of the provision for loan impairment in the income statement.

Objective criteria that the Bank uses to determine that a loan should be written off include:

- the debtor no longer performs his regular activities (termination of the legal entity),

- the Bank holds no adequate collateral to be used for repayment and

- judicial recovery proceeding have concluded.

b) Assets classified as available for sale

The Bank assesses at each balance sheet date whether there is objective evidence that financial assets available for sale are impaired. In the case of equity investments classified as available for sale, a significant or prolonged decline in the fair value of security below its cost is considered in determining whether the assets are impaired. If any such evidence exists for available for sale financial assets, the cumulative loss is removed from equity and recognized in the income statement. Impairment losses recognized in the income statement on equity instruments are not reversed through the income statement. If, in a subsequent period, the fair value of a debt instrument classified as available for sale increases and the increase can be objectively related to an event occurring after the impairment loss was recognized in profit or loss, the impairment loss is reversed through the income statement.

c) Renegotiated loans

Loans that are either subject to collective impairment assessment or individually significant and whose terms have been renegotiated due to deterioration of the borrower’s financial position are no longer considered to be past due but are treated as new loans. In subsequent years, the asset is considered to be past due and disclosed only if renegotiated.

2.9. Offsetting

Financial assets and liabilities are offset and the net amount reported in the balance sheet when there is a legally enforceable right to set off the recognized amounts and there is an intention to settle on a net basis, or to realize the asset and settle the liability simultaneously.

2.10. Sale and repurchase agreements

Securities sold under sale and repurchase agreements (repos) are retained in the financial statements, and the counterparty liability is included in financial liabilities associated to the transferred assets. Securities sold subject to sale and repurchase agreements are reclassified in the financial statements as pledged assets when the transferee has the right by contract or custom to sell or repledge the collateral. Securities purchased under agreements to resell (reverse repos) are recorded as loans and advances to other banks or customers, as appropriate.

The difference between the sale and repurchase price is treated as interest and accrued over the life of the repo agreements using the effective interest rate method.

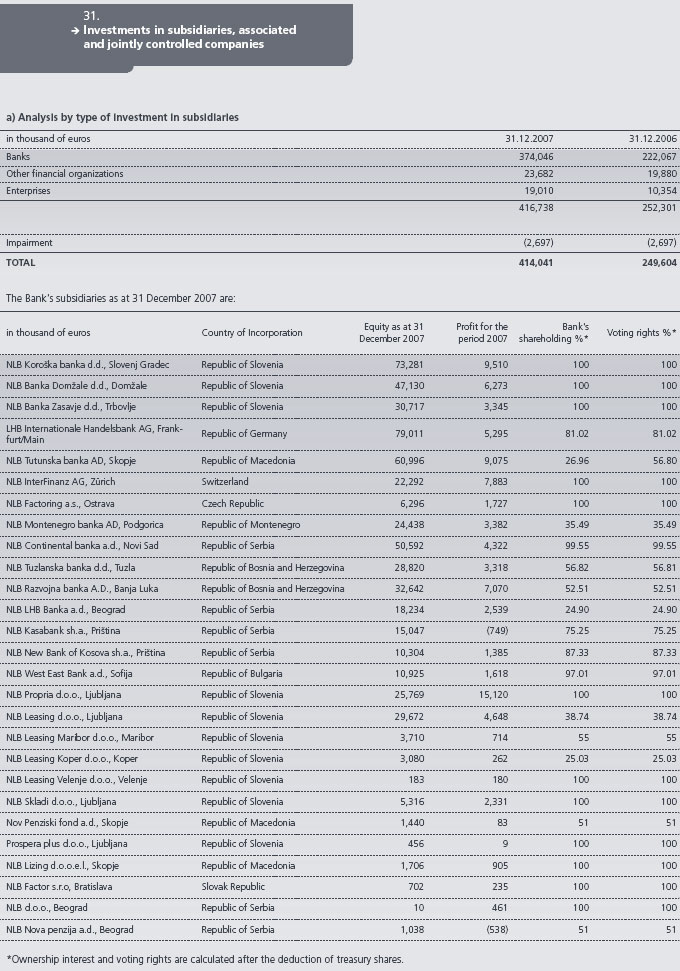

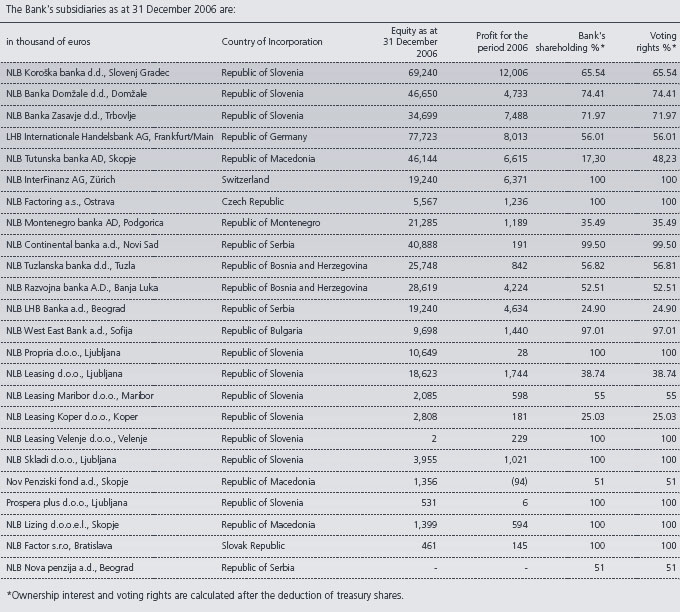

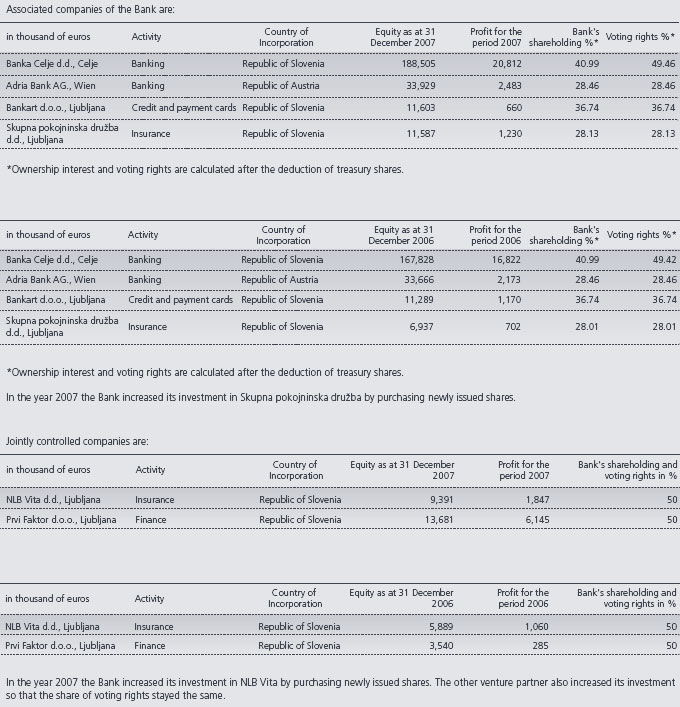

2.11. Investments in subsidiaries, associated and jointly controlled companies

Investments in subsidiaries, associated and jointly controlled companies are accounted for using the cost method.

Under a cost method the investor recognizes income from the investment only to the extent that the investor receives distributions from accumulated profits of the investee arising after the date of acquisition. Distributions received in excess of such profits are regarded as a recovery of investment and are recognized as a reduction of the cost of the investment.

2.12. Property and equipment

All property and equipment is initially recognized at cost. Subsequently it is measured at cost less accumulated depreciation and any accumulated impairment loss.

The Bank assesses each year whether there are indications that assets may be impaired. If any such indication exists, the Bank estimates the recoverable amount. Recoverable amount is the higher of net selling price and value in use. If value in use exceeds the carrying value, the assets are not impaired.

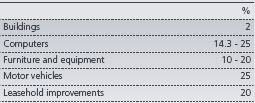

Depreciation is provided on a straight-line basis at rates designed to write off the cost of buildings and equipment over their estimated useful lives. The following are approximations of the annual rates used: Assets in the course of transfer or construction are not

depreciated until they are available for use.

The assets' residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date.

Gains and losses on disposal of property and equipment are determined by reference to their carrying amount and are taken into account in determining operating profit. Maintenance and repairs are charged to the income statement during the financial period in which they are incurred.

Day-to-day servicing costs are recognized in profit or loss as incurred. Subsequent costs which increase future economic benefits are recognized in the carrying amount of an asset.

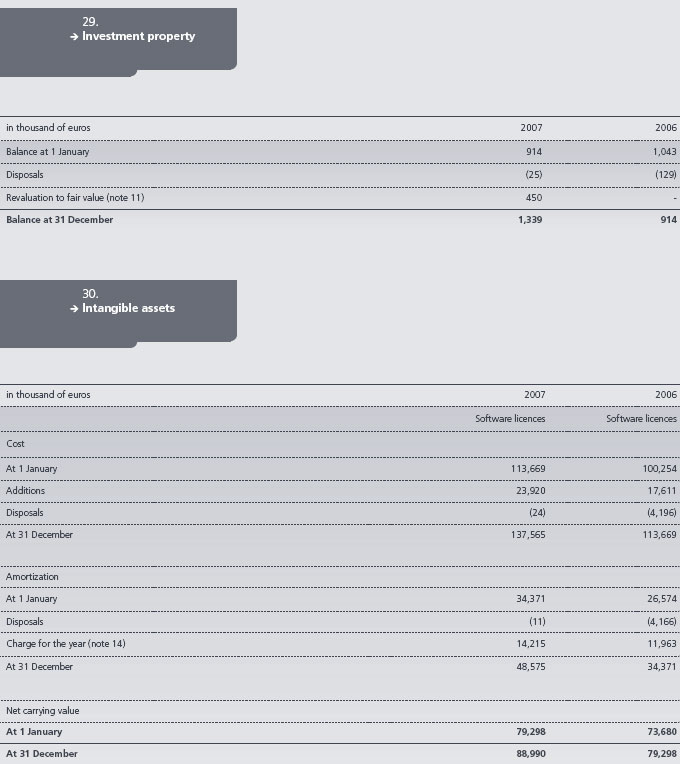

2.13. Intangible assets

Intangible assets, which relate solely to software licenses, are stated at cost, less accumulated amortization and impairment losses.

Amortization is provided on a straight-line basis at rates designed to write off the cost of software over its estimated useful life. Core banking systems are amortized over a period of 10 years and other software over a period of 3 - 5 years.

Assets in the course of transfer or construction/implementation are not amortized until they are available for use.

2.14. Investment property

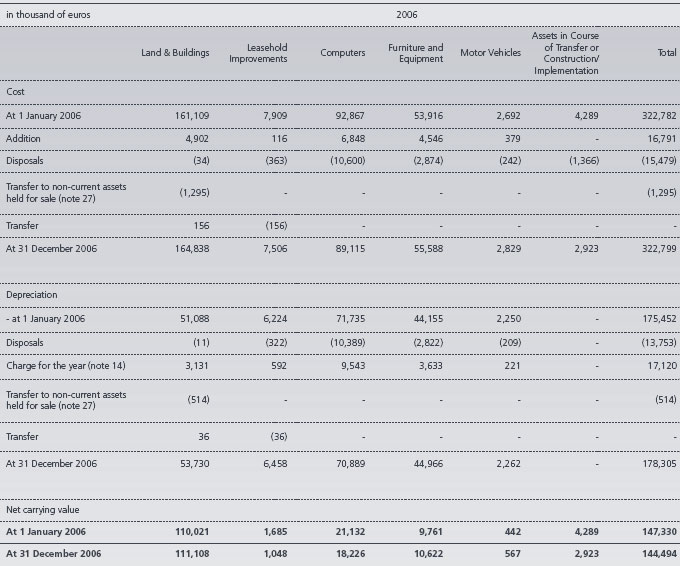

Investment property includes buildings held for rental yields and not occupied by the Bank. Investment property is stated at fair value determined by an independent registered valuer. Fair value is based on current market prices. Any gain or loss arising from a change in fair value is recognized in the income statement. If there is a change in use due to the commencement of owner occupation, investment property is transferred to owner occupied property.

2.15. Non-current assets held for sale

Non-current assets are classified as held for sale if their carrying ammount will be recovered through a sale transaction rather than through continuing use. This condition is regarded as met only when the sale is highly probable and the asset is available for immediate sale in its present condition. Management must be committed to the sale, which should not be expected to qualify for recognition as a completed sale within one year from the date of clasification. Non - current assets classified as held for sale are measured at the lower of the assets’ previous carrying amount and fair value less costs to sell. The effects of sale and valuation are included in the income statement as profit or loss from non - current assets held for sale.

2.16. Accounting for leases

- Where the Bank is the lessee

Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made under operating leases are charged to the income statement on a straight-line basis over the period of the lease. When an operating lease is terminated before the lease period has expired, any payment required to be made to the lessor by way of penalty is recognized as an expense in the period in which termination takes place. - Where the Bank is the lessor

All leases where the Bank is the lessor are operating leases. Payments are recognized as an income on a straight-line basis over the period of the lease. Assets leased under operating leases are presented in the balance sheet as an investment property.

2.17. Cash and cash equivalents

For the purpose of the cash flow statement, cash and cash equivalents comprise cash and balances with Central Bank except for obligatory reserve, securities held for trading, loans to banks and debt securities not held for trading with original maturity of up to 90 days.

2.18. Borrowings

Borrowings are recognized initially at fair value, that is their issue proceeds (fair value of consideration received) net of transaction cost incurred. Borrowings are subsequently stated at amortized cost and any difference between net proceeds and the redemption value is recognized in the income statement over the period of the borrowings using the effective interest method.

If the Bank purchases its own debt, it is removed from the balance sheet. Difference between the carrying amount of the purchased debt and the amount paid is recognized immediately in the income statement.

2.19. Provisions

Provisions are recognized when the Bank has a present legal or constructive obligation as a result of past events and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate of the amount of the obligation can be made.

2.20. Financial guarantee contracts

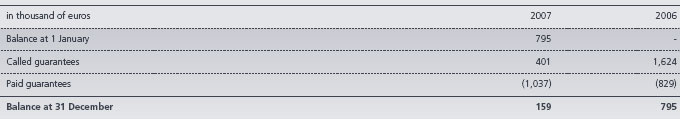

Financial guarantee contracts are contracts that require the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payments when due, in accordance with the terms of debt instruments. Such financial guarantees are given to banks, financial institutions and other bodies on behalf of customer to secure loans, overdrafts and other banking facilities.

Financial guarantee contracts are initially recognized at fair value which is equal to the fee received. Fee is amortized to the income statement by using the straightline method. The Bank’s liabilities under guarantees are subsequently measured at the higher of the initial measurement, less amortization calculated to recognize fee income and the best estimate of the expenditure required to settle the obligation.

2.21. Inventories

Inventories are measured at the lower of cost and net realizable value. Cost is determined using the weighted average cost method.

2.22. Taxation

Slovenian corporation tax is provided on taxable profits at the rate prescribed by the Corporate Income Tax Law.

Deferred income tax is provided in full, using the liability method, for all temporary differences arising between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes. The principal temporary differences arise from the valuation of financial instruments and investment property at fair value in years 2005 and 2006 and provisions.

Deferred tax assets are recognized where it is probable that future taxable profit will be available against which the temporary differences can be utilized.

Deferred tax related to fair value re-measurement of available for sale investments and cash flow hedges is charged or credited directly to equity and subsequently recognized in the income statement together with the deferred gain or loss.

Deferred tax assets and liabilities are measured at tax rates that are expected to apply to the period when the asset is realized or the liability is settled. The applied rate for the calculation of deferred tax assets and liabilities was 23% in 2006 and 22% in 2007.

As at 1 January 2007 a new Corporate Income Tax Law came into force in Slovenia. The new law eliminates temporary differences relating to the financial instruments at fair value through profit or loss and impairment of tangible and intangible assets, but it retains temporary differences associated with provisions and depreciation. Temporary differences relating to valuation of financial instruments at fair value through profit or loss prior to 1 January 2007 still affect the balance of deferred taxes and also income statement when these securities are sold or derivatives settled. In the future deferred taxes will be calculated using decreasing rates: 21% in 2008 and 20% in 2009.

2.23. Fiduciary activities

The Bank manages a significant amount of assets on behalf of legal entities and individuals and charges fees for such services. These assets are not shown in the Bank’s balance sheet but details of the funds under management are given in note 44.

2.24. Employee benefits

Employee benefits include jubilee benefits, retirement indemnity bonuses and other long-service benefits. Valuations of these obligations are carried out by independent qualified actuaries. The main actuarial assumptions included in the calculation of the obligation for other long-term employee benefits are:

- Applicable discount rate,

- Number of employees eligible for benefits and

- Future salary increases using general salary inflation index, promotions and increases in salaries according to past years of service.

According to Slovenian legislation, employees retire after 35-40 years of service, when, if they fulfill certain conditions, they are entitled to an indemnity paid in lump sum. Employees are also entitled to a long service bonus for every ten years of service.

These obligations are measured at the present value of future cash outflows. All gains and losses are recognized in the income statement.

The Bank contributes to the State Pension Scheme (8.85% of gross salaries). The Bank makes payments to a contribution plan according to Slovenian legislation. Once contributions have been paid, the Bank has no further payment obligation. The regular contributions constitute net periodic costs for the year in which they are due and are included in employee costs as they are incurred.

Provisions for termination benefits are provided as a result of an offer made to employees in order to encourage retirements before normal retirement date.

2.25. Share capital

Dividends on ordinary shares

Dividends on ordinary shares are recognized in equity in

the period in which they are approved by the Bank’s

shareholders.

Treasury shares

Where the Bank purchases own shares, the consideration

paid is deducted from total shareholders’ equity as

treasury shares until they are cancelled. Where such shares

are subsequently sold, any consideration received is

included in shareholders’ equity. If some of the Bank’s

shares are held by the Bank or its subsidiaries, the Bank is

obliged to have reserves for treasury shares.

Share issue costs

Incremental costs directly attributable to the issue of new

shares are shown in equity as a deduction from the

proceeds.

2.26. Comparatives

Where necessary, comparative figures have been adjusted to conform to changes in presentation in the current year. Financial statements are prepared on schemes, prescribed by the Bank of Slovenia. Since these schemes have changed in the year 2007, the Bank has adjusted comparative figures. This had no material impact on the financial statements, nor did it affect total assets or net profit for the year.

The Euro became the functional and presentation currency of the Bank at 1 January 2007. In previous years the Bank’s financial statements were presented in tolars. Comparatives have been converted from tolars to euros using the official conversion rate applied at the adoption of the Euro, which was 239.64 tolars for 1 Euro.

2.27. Segment reporting

Business segments provide products or services that are subject to risks and returns different from those of other business segments.

Geographical segments are not presented as majority of revenue, assets and profit is earned from single geographical segment (i.e. Slovenia). No other geographical segment meets the threshold for reportable segment.

2.28. Critical accounting estimates and judgments in applying accounting policies

a) Impairment losses on loans and advances

The Bank reviews its loan portfolio to assess impairment on a quarterly basis. In determining whether an impairment loss should be recorded in the income statement, the Bank makes judgments as to whether there is any observable data indicating that there is a measurable decrease in the estimated future cash flows from a portfolio of loans before the decrease can be identified with an individual loan in that portfolio. This evidence may include observable data indicating that there has been an adverse change in the payment status of borrowers in a group, or national or local economic conditions that correlate with defaults on assets in the group. Management uses estimates based on historical loss experience for assets with credit risk characteristics and objective evidence of impairment similar to those in the portfolio when scheduling its future cash flows. Individual estimates are based on future cash flows assessed by accounting officers using all relevant information on counterparty and its ability to meet specific obligations. Scheduled cash flows are reviewed by independent bodies. Low-value exposures are reviewed on the pool basis. This includes all loans to individuals. The methodology and assumptions used for estimating both the amount and timing of future cash flows are reviewed regularly to reduce any differences between loss estimates and actual loss experience.

b) Fair value of financial instruments

The fair values of quoted investments in active markets are based on current bid prices (financial assets) or offer prices (financial liabilities). The fair values of financial instruments that are not quoted in active markets are determined by using valuation techniques. These include the use of recent arm’s length transactions, discounted cash flow analysis, option pricing models and other valuation techniques commonly used by market participants. The valuation models reflect current market conditions at the measurement date which may not be representative of market conditions either before or after the measurement date. As at the balance sheet date management has reviewed its models to ensure they appropriately reflect current market conditions, including the relative liquidity of the market and credit spreads. Changes in assumptions about these factors could affect reported fair values of trading assets and liabilities and available for sale financial assets.

c) Impairment of available for sale equity investments

The Bank determines that available for sale equity investments are impaired when there has been a significant or prolonged decline in the fair value below its cost. The determination of what is significant or prolonged requires judgment. In making this judgment, the Bank evaluates among other factors, the normal volatility in share price. In addition, impairment may be appropriate when there is evidence of deterioration in the financial health of the investee, industry and sector performance, changes in technology, and operational and financing cash flows. At the end of both presented years there are no available for sale equity investments with fair value below cost.

d) Held to maturity investments

The Bank classifies non-derivative financial assets with fixed or determinable payments and fixed maturity as held to maturity investments. Before making this classification the Bank evaluates its intention and ability to hold such investments to maturity. If the Bank fails to keep these investments to maturity other than for the specific circumstances it will be required to reclassify the entire class as available for sale. The investments would therefore be measured at fair value not amortized cost. If the entire class of held to maturity investments is tainted, the fair value would decrease by Euro 8,270 thousand (31 December 2006: Euro 492 thousand), with a corresponding entry in the fair value reserve in shareholders’ equity.

e) Fair values of derivative financial instruments

The Bank measures fair values of derivative financial instruments by using market prices (Mark to Market), in accordance with the Methodology for Valuation of Derivative Financial Instruments. Foreign exchange rates, interest rates and volatility curves are based on the Market Snapshot principle. Market data is saved daily at 4 p.m. and later used for calculation of fair values (Market value, NPV) of derivative financial instruments. For valuation of derivatives the Bank applies market yield curves.

2.29. Adoption of new and revised International Financial Reporting Standards

In the current year, the Bank has adopted all of the new and revised Standards and Interpretations issued by the International Accounting Standards Board (the IASB) and the International Financial Reporting Interpretations Committee (IFRIC) of the IASB that are effective for accounting periods beginning on 1 January 2007. The adoption of new and revised Standards and Interpretations has affected mostly the Bank’s disclosures relating to financial instruments and did not have any impact on the classification and valuation of the Bank’s financial instruments.

Amendments to IAS 1 – Capital Disclosures were already early adopted in 2006.

IFRS 7 – Financial instruments: The standard introduces new disclosures relating to financial instruments and does not change the recognition and measurement of financial instruments. It has no effect on net profit and equity. The new standard requires entities to make enhanced quantitative and qualitative risk disclosures for all major categories of financial instruments in their financial statements. IFRS 7 is effective from 1 January 2007 and supersedes IAS 30 and the disclosure requirements of IAS 32.

IFRIC 8 – Scope of IFRS 2, requires consideration of transactions involving the issuance of equity instruments, where the identifiable consideration received is less than the fair value of the equity instruments issued in order to establish whether or not they fall within the scope of IFRS 2. This standard does not currently have any impact on the Bank’s financial statements.

IFRIC 9 – Reassessment of embedded derivatives, concludes that an entity must assess whether an embedded derivative is required to be separated from the host contract and accounted for as a derivative when the entity first becomes a party to the contract. Subsequent reassessment is prohibited unless there is a change in the terms of the contract that significantly modifies the cash flows that otherwise would be required under the contract, in which case reassessment is required. This standard does not have any impact on the Bank’s financial statements.

IFRIC 10 – Interim financial reporting and impairment, prohibits the impairment losses recognized in an interim period on goodwill and investments in equity instruments and in financial assets carried at cost to be reversed at a subsequent balance sheet date. This standard does not have any impact on the Bank’s financial statements.

The following standard and interpretation are not relevant to the Bank’s operations:

- IFRS 4 – Insurance contracts (effective from 1 January 2005) and

- IFRIC 7 – Applying the restatement approach under IAS 29, Financial reporting in hyperinflationary economies (effective from 1 January 2007).

2.30. IFRS issued but not yet effective

The following standards, amendments and interpretations to existing standards have been published and are mandatory for the Bank’s accounting periods beginning on or after 1 January 2008 or later periods, but the Bank has not early adopted them:

- IAS 1 (Amendment), Presentation of financial statements (effective from 1 January 2009). The amendment to the standard requires entities to present all non- owner changes in equity either in one statement of comprehensive income or in two statements (a separate income statement and a statement of comprehensive income). It also requires presenting a statement of financial position (balance sheet) as at the beginning of the earliest comparative period in a complete set of financial statements when the entity applies an accounting policy retrospectively or makes a retrospective restatement.

- IAS 23 (Amendment), Borrowing costs (effective from 1 January 2009). The amendment to the standard is still subject to endorsement by the European Union. It requires an entity to capitalize borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. The option of immediately expensing those borrowing costs will be removed. The Bank will apply IAS 23 (Amended) from 1 January 2009 but is currently not applicable to the Bank as there are no qualifying assets.

- IAS 27 (Amendment), Consolidated and Separate financial statements (effective from 1 July 2009). The objective of IAS 27 is to enhance the relevance, reliability and comparability of the information that a parent entity provides in its separate financial statements and in its consolidated financial statements for a group of entities under its control. This amendment will not have a material impact on the Bank's financial statements.

- IAS 32 (Amendment), Puttable financial instruments and obligations arising on liquidation (effective from 1 January 2009). The amendments result from proposals that were contained in an exposure draft of proposed amendments to IAS 32 and IAS 1 Financial Instruments Puttable at Fair Value and Obligations Arising on Liquidation published in June 2006. The amendment will not have a material impact on the Bank's financial statements.

- IFRS 3 (Amendment), Business combination (effective from 1 July 2009). The objective of the IFRS is to enhance the relevance, reliability and comparability of the information that an entity provides in its financial statements about a business combination and its effects. The use of this standard shall not affect the Bank's financial statements.

- IFRS 8, Operating segments (effective from 1 January 2009). IFRS 8 replaces IAS 14. It requires a “management approach” under which segment information is presented on the same basis as that used for internal reporting purposes. It will not effect the Bank’s operations, but only the required disclosures about its operating segments.

- IFRIC 11, IFRS 2 – Group and treasury share transactions (effective from 1 March 2007) provides guidance on whether share-based transactions involving treasury shares or involving group entities should be accounted for as equity-settled or cash-settled share-based payment transactions in the stand-alone accounts of the parent and Group companies. This interpretation does not have an impact on the Bank’s financial statements.

- IFRIC 12, Service concession arrangements (effective from 1 January 2008). IFRIC 12 applies to contractual arrangements whereby a private sector operator participates in the development, financing, operation and maintenance of infrastructure for public sector services. IFRIC 12 is not relevant to the Bank’s operations.

- IFRIC 13, Customer loyalty programmes (effective from 1 July 2008). IFRIC 13 clarifies that where goods or services are sold together with a customer loyalty incentive, the arrangement is a multiple-element arrangement and the consideration receivable from the customer is allocated between the components of the arrangement in using fair values. IFRIC 13 is not relevant to the Bank’s operations.

- IFRIC 14, IAS 19, The limit on a defined benefit asset, minimum funding requirements and their interaction (effective from 1 January 2008). IFRIC 14 provides guidance on assessing the limit in IAS 19 on the amount of the surplus that can be recognized as an asset. It also explains how the pension asset or liability may be affected by a statutory or contractual minimum funding requirement. IFRIC 14 will not have any impact on the Bank’s financial statements.

3. RISK MANAGEMENT POLICIES OF THE BANK

The Bank’s approach to risk management includes clear organizational structure, effective risk management procedures and appropriate system of internal controls. The goal is to achieve planned results with minimal risk taking and to optimize the use of regulatory and internal capital.

In managing risks NLB d.d. takes into consideration rules and regulations prescribed by the Bank of Slovenia and internal acts of the Bank. The basic strategy and internal acts, which are regularly updated, discussed at Supervisory Board and approved by the Management Board, define objectives, procedures and methodologies for monitoring, measuring and managing different risks.

In 2007 there has been a sharp rise in foreclosures in the US subprime mortgage market. The effects have spread beyond the US housing market as global investors have reevaluated their exposure to risks, resulting in increased volatility and lower liquidity in the fixed income, equity, and derivative markets and increased preasure on interest margins.

The Bank regularly monitors all risks that it is exposed to.

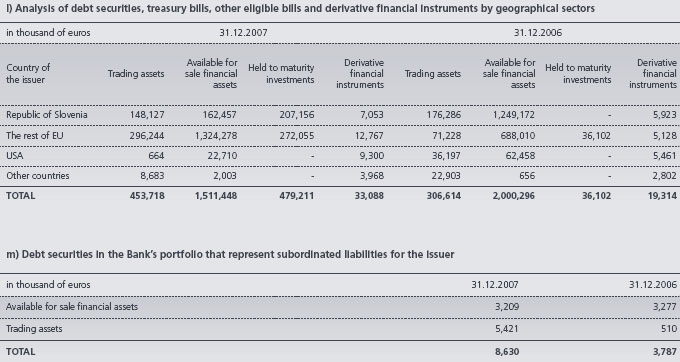

3.1. Credit Risk Management

The Bank’s credit portfolio includes balance sheet items (loans, securities, interest, fees, commission, etc.) as well as off-balance sheet items (guarantees, letters of credits, commitments and contingencies, derivatives, etc.) towards corporate customers, banks, financial institutions, public sector, entrepreneurs, retail customers and other customers. By entering into any of the abovementioned transactions the Bank exposes itself to credit risk, which is the risk that counterparty will cause a financial loss for the Bank by failing to discharge an obligation.

Prior to credit approval or entering into a contract, which exposes the Bank to credit risk, every customer receives a rating and individual limit. The rating of a customer depends on its financial position, business performance, relationship with the Bank to date, the ability to provide sufficient finance to meet future obligations, taking into account also country risk exposure.

Risk of individual credit is additionally considered in connection to the whole credit portfolio. Trends in the movements, risks and concentrations of credit portfolio as a whole and separately for different segments of customers and loans or advances are considered based on the analysis of time series.

Impairment losses and provisions are measured in accordance with the International Financial Reporting Standards as adopted by the European Union, according to the risk of a loan and existence of objective signs of impairment. The amount of impairment loss is also influenced by the collateral if it represents a successful means of repaying the debt in the event of customer’s default. The majority of loan portfolio is assessed for impairment on individual basis and only minor part of exposure is reviewed in groups, based on historical information.

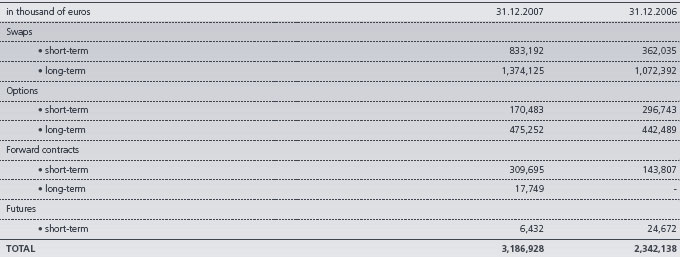

a) Derivatives

The Bank maintains strict control limits on net open derivative positions, i.e. the difference between purchase and sale contracts, both by amount and term. The bank enters mostly into currency, interest rate and equity derivative contracts. The amount subject to credit risk is limited to the credit replacement value of an instrument which is determined in accordance with the regulation (based on the sum of current and potential exposure). This credit risk exposure is managed as part of the overall lending limits with customers, together with potential exposures from market movements.

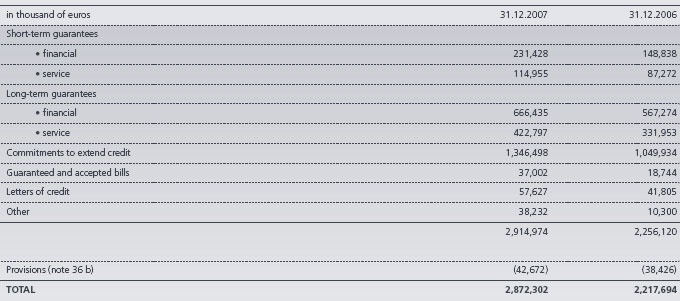

b) Credit related commitments

The primary purpose of these instruments is to ensure that funds are available to customers when required. Guarantees and standby letters of credit, which represent irrevocable assurance that the Bank will make payments in the event that a customer cannot meet its obligations to third parties, carry the same credit risk as loans. Documentary and commercial letters of credit, which are written undertakings by the Bank on behalf of a customer authorizing a third party to draw drafts on the Bank up to a stipulated amount under specific terms and conditions, are collateralized by the underlying shipments of goods to which they relate and therefore carry less risk than direct borrowing. Commitments to extend credit represent unused portions of authorizations to extend credit in the form of loans, guarantees or letters of credit. With respect to credit risk on commitments to extend credit, the Bank is potentially exposed to loss in an amount equal to the total unused commitments. However, the likely amount of losses is less than total unused commitments, since most commitments to extend credit are contingent upon customers maintaining specific credit standards. The Bank monitors the term to maturity of credit commitments because longer-term commitments generally have a greater degree of credit risk than shorter-term commitments.

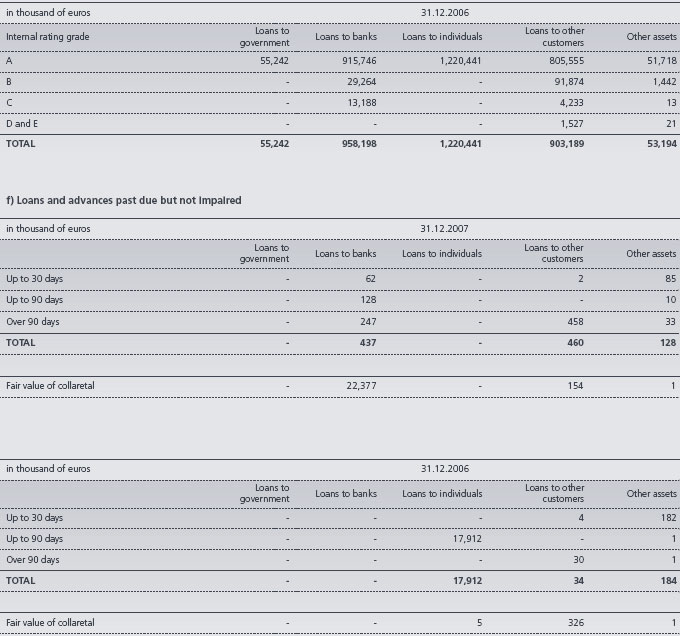

Maximum exposure to credit risk represents a worst case scenario of credit risk exposure, which is the maximum possible loss of the Bank without taking account of any collateral held. For on-balance sheet assets, the exposures set out above are based on net carrying amounts as reported in the balance sheet and for off-balance sheet items they are based on nominal value.

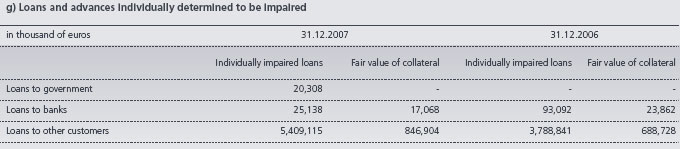

According to internal methodology for loan impairment, all individually significant customers are individually assessed for impairment and if needed, impairment loss is recognized. This represents almost 90% of all corporate customers and entrepreneurs and all banks. 28% of loans and advances are neither past due nor impaired nor 0.1% of loans and advances are past due but not impaired.

In-debt analyses of customers and due risk management result in a high quality of the credit portfolio. The coverage of portfolio with allowances for impairment has been steadily decreasing and has stabilized at 2.45% at the end of year 2007. 95% of portfolio is considered to be quality portfolio.

The Bank receives different types of collateral to mitigate credit risk. The decision about the type and value of collateral depends on customer analysis. The bank is trying to receive high-quality collateral, which among other things also improves capital the Bank’s capital and results in lower allowances for loan losses. Long-term loans in particular are collateralized, mostly with mortgages and charges over business assets such as premises, inventory and accounts receivable. The value of collateral is regularly reviewed and in the event of its decrease the Bank requires from the customer to provide additional collateral.

h) Loans and advances renegotiated

Restructuring activities include extended payment arrangements, approved external management plans, modification and deferral of payments. Following restructuring, a previously overdue customer account is reset to normal status and managed together with other similar accounts. Restructuring policies and practices are based on indicators or criteria which, in the judgment of management, indicate that payment will most likely continue.

Renegotiated loans that would otherwise be past due or impaired totaled Euro 15,277 thousand at 31 December 2007 (31 December 2006: Euro 40,483 thousand).

i) Repossessed collateral

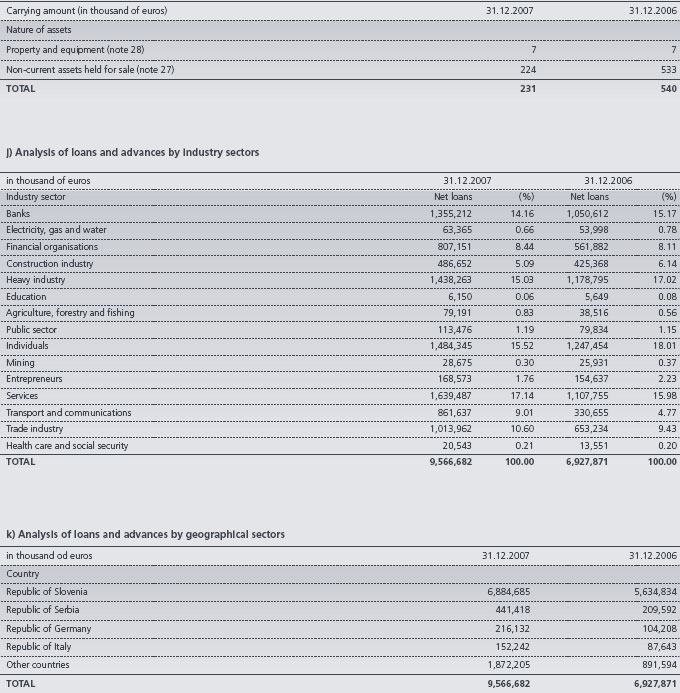

During 2007, the Bank obtained assets by taking possession of collateral held as security, as follows:

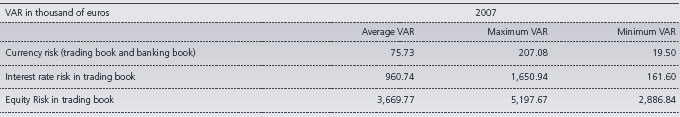

The majority of these securities in the amount of Euro 4,910 thousand (31 December 2006: Euro 0) represent subordinated bonds of domestic issuer with Fitch LT Issuer Default Rating BBB.

Other issuers (Slovenian banks and financial institutions) don’t have external ratings. Internally they are all rated as A, except for one issuer with B rating. Subordinated liabilities of this issuer in the Bank’s portfolio amounted to Euro 2,189 thousand as at 31 December 2007 (31 December 2006: Euro 2,228 thousand).

3.2. Market risk management

Market risk is the risk that the fair value of future cash flows of financial instrument could fluctuate due to changes in the interest rate, foreign exchange and equities markets. Market risk management is a process comprising the monitoring and measurement of individual risks with the aim to actively manage potential negative financial effects that could arise as a result of changes in market prices.

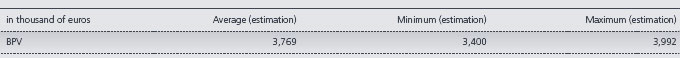

a) Monitoring of market risks in year 2007

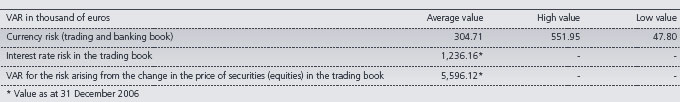

The Bank’s exposure to market risks is shown through “Value at Risk” (VAR) methodology for currency and other market risks in the trading book (interest rate risk and equity risk). The Bank uses VAR methodology on a daily basis for monitoring and managing these risks. The Bank regularly monitors and manages interest rate exposure in the banking book by sensitivity analysis based on the »Basis Point Value« (BPV) method, the figures of which are presented below.

Currency risk

For currency risk the Bank uses an internal »Value at Risk« (VAR) model based on open FX positions. Calculation of the VAR value is adjusted to Basel

standards (99% confidence interval, monitored period of 300 business days, 10-day of holding a position) and based on the historical simulation method.

VAR is calculated for exchange risk for the whole open bank position (position of trading and banking book together) as the position is managed at the

whole level by the Treasury department.

Currency exposure in the year 2007 was low. This is shown in a rather low average VAR value which was Euro 75.7 thousand. The maximum VAR value in the amount of Euro 207 thousand was reached on 30 May 2007 as a consequence of an extraordinary event (long position in USD). The position was closed the next day and the VAR value decreased to Euro 49 thousand. In November 2007 the Bank extended the monitored period from 250 days to 300 business days. The extension of monitoring did not essentially influence the result of the VAR.

Other market risks in trading book

The Bank uses an internal VAR model based on the variance-covariance method for other market risks. The daily calculation of the VAR value is adjusted

to Basel standards (99% confidence interval, monitored period of 250 business days, 10-day of holding a position).

Interest rate risk in the trading book varied from Euro 161.6 thousand to 1,650.9 thousand. The bulk of the exposure arose from the portfolio of debt securities while the minor part of exposure came from derivatives and money market repos. At the beginning of August, interest rate exposure decreased by deals for hedging as a response to the financial crisis in quite volatile markets.

The equity risk in the trading book in 2007 moved from Euro 2,886.8 thousand to 5,197.6 thousand. The maximum amount of VAR was reached at the beginning of 2007 and in February when there was more volatility on the domestic and foreign market.

The amount of VAR was gradually decreased as a result of the decreasing value of existing portfolios particularly in the last quarter of the year.

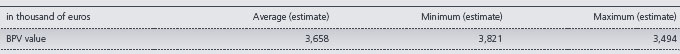

Interest rate risk in the banking book

Interest rate exposure is monitored and managed by using the methodology of interest rate gaps as a foundation for further analysis of interest rate sensitivity by individual time periods. On the basis of BPV methodology one estimates the change in the market value of the banking book position as a result of parallel movement of yield curves by +/- 10 base points.

Estimation of interest rate sensitivity of +/- 10 base points (BPV) for the banking book in 2007 is shown in the table below:

A greater part of exposure arose from primary debt securities which represent a source of secondary liquidity. On the other side, exposure from classical credit deposit banking deals was relative low.

b) Monitoring of market risks in 2006

At the end of 2006 the Bank established VAR calculation for all types of market risks as well as for separate calculations concerning the banking and trading books.

It is due to this reason that the data concerning the VAR for interest rate risks and the VAR for the risk represented by the change in the price of securities (equities) in the trading book is represented only for the end of 2006. VAR for interest rate risks in the trading book amounted to Euro 1,236 thousand while VAR for the risk represented by the change in the price of securities (equities) in the trading book amounted to Euro 5,596 thousand at 31 December 2006.

When calculating “Value at Risk” (VAR for currency risk, the Bank supervises and monitors the entire Bank position and does not conduct it separately for the banking and the trading book. Subsequently, the average, high and low values of VAR for currency risk for the entire Bank position for the financial year 2006 are presented as follows:

In the last quarter of 2006 the Bank implemented a system, which enabled it to monitor VAR and BPV figures for interest risk in trading book. During 2006, the exposure of the Bank to interest rate risks was supervised, monitored and managed on the basis of interest rate gap methodology. In assessing the exposure to interest rate risks, the Bank also implemented additional sensitivity analyses.

The assessment of the change in the market value of the banking book position as a consequence of a parallel shift of the yield curve by +/- 10 basis points was done on the basis of BPV (Basis Point Value) methodology. The BPV method represents the measure of sensitivity of the value of financial instruments to market interest rates - that is the change in the required yield. Basis Point Value is a measure of the potential change in the market value of a specific position due to an anticipated change in the interest rates by 10 basis points and is expressed in monetary units. The usual approach is to discount the expected cash flows with their required market rates and subsequently modify them by the perceived change in market interest rates (that is by +/- 10 basis points). This method presumes a parallel shift in the yield curve.

In accordance with the aforementioned method, the Bank prepared an assessment of the effect of a change in the interest rates by 10 basis points (+/- 0.1%) on the change in the portfolio value (BPV) for the banking book position in 2006:

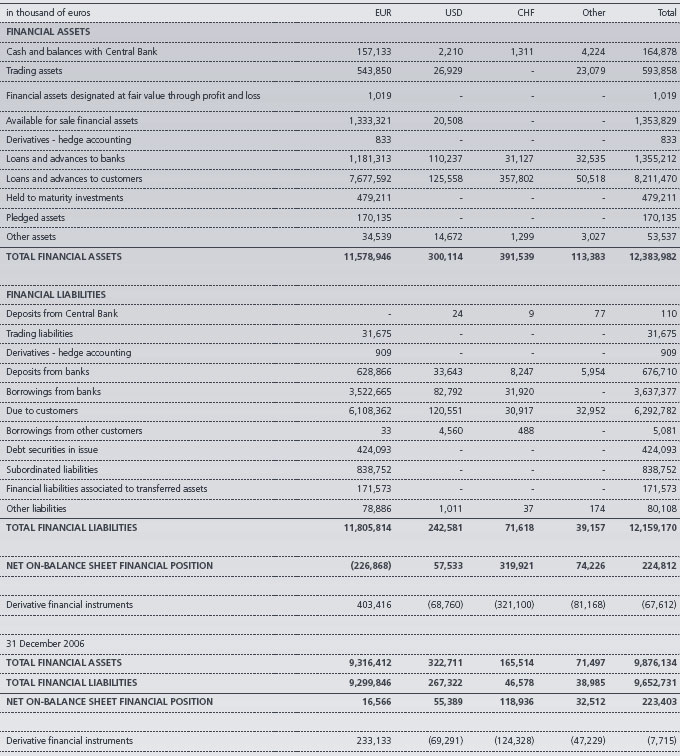

c) Currency risks (FX)

The amount of financial instruments denominated in Euros and in foreign currency as at 31 December 2007 is analyzed below:

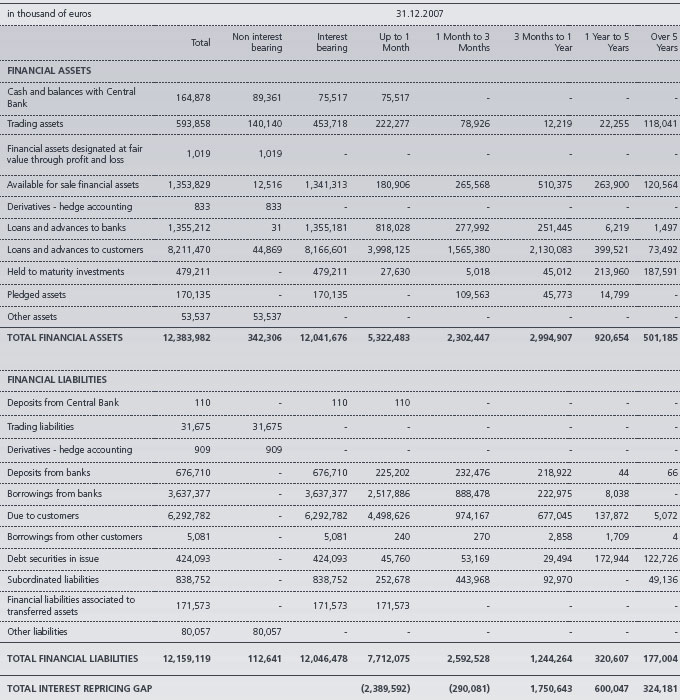

d) Interest rate risks

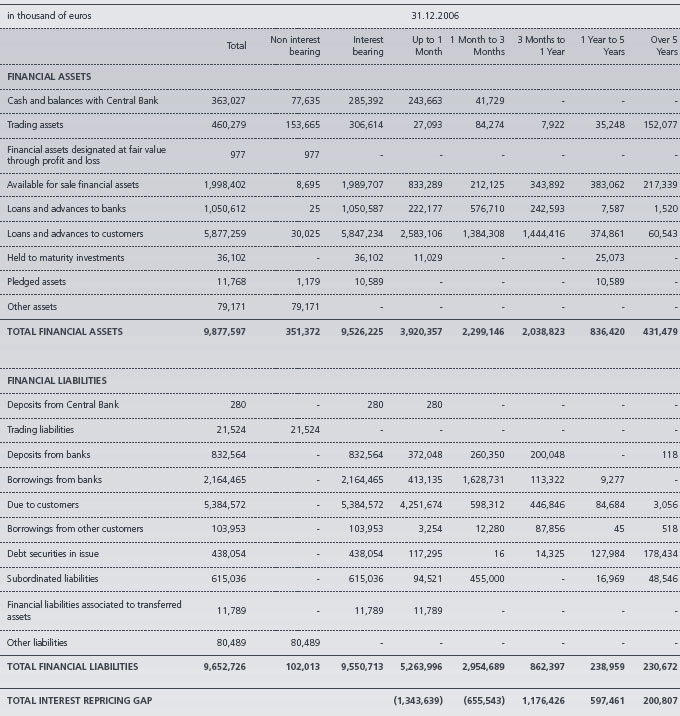

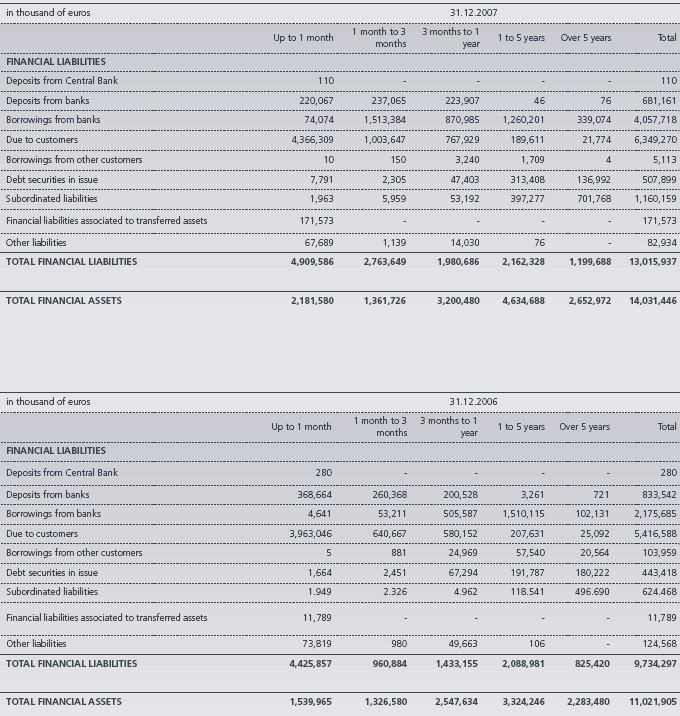

The tables below summarize the Bank’s exposure to interest rate risks. They include the Bank’s financial instruments at carrying amounts, categorized by the earlier of contractual repricing or maturity dates.

e) Structural Liquidity

The Bank’s liquidity situation cannot be viewed solely from the liability side as a set of activities for meeting required cash outflows, but also as the availability of liquid assets in form of liquid securities and money market deposits that at all times assures immediate fulfillment of matured financial obligations towards its customers. Therefore several structural liquidity ratios (concerning assets, liabilities and relationship among them) are calculated and reported on a regular basis.

The Bank’s liquidity management process, as carried out within the Bank and monitored by a special department, includes:

- Day to day funding, managed by monitoring future cash flows to ensure that requirements can be met. This includes replenishment of funds as they mature or are borrowed by customers. The Bank maintains an active presence in global money markets to enable this to happen;

- Maintaining a portfolio of highly marketable assets that can easily be liquidated as protection against any unforeseen interruption to cash flow;

- Monitoring balance sheet liquidity ratios against internal and regulatory requirements; and

- Managing the concentration and profile of debt maturities.

Monitoring and reporting take the form of cash flow measurement and projections for the next day, week and month respectively, as these are key periods for liquidity management. The starting point for those projections is an analysis of the contractual maturity of the financial liabilities and the expected collection date of the financial assets.

The Bank also monitors unmatched medium-term assets, the level and type of undrawn lending commitments, the usage of overdraft facilities and the impact of contingent liabilities such as standby letters of credit and guarantees.

Non-derivative cash flows

The tables below present the cash flows payable by the Bank under non-derivative financial liabilities by remaining contractual

maturities at the balance sheet date. The amounts disclosed in the table are the contractual undiscounted cash flows, prepared on the

basis of spot rates at the balance sheet date.

Subordinated liabilities with no contractual maturity are included in the maturity group based on periods when the call options can be exercised according to the characteristics described in a note 35.

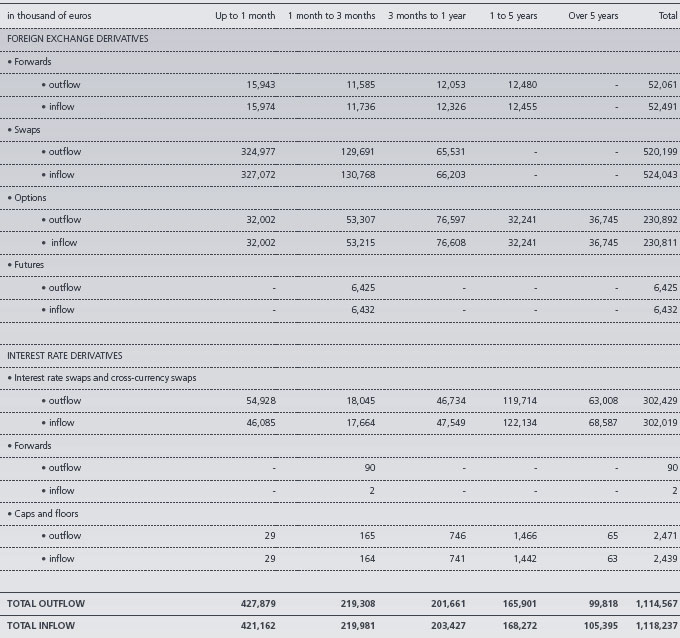

Derivative cash flows

All the Bank’s derivatives, except for some interest rate swaps, are settled on a gross basis. The table below analyses the Bank’s derivative financial

instruments into relevant maturity groupings based on the remaining contractual maturity at the balance sheet date. The amounts disclosed in the table

are the contractual undiscounted cash flows, prepared on the basis of spot rates as at 31 December 2007.

f) Equity risks

In the area of equity investments the Bank follows its investment policies, which have been approved by the management board. These policies define permissible investment structures within a portfolio, its diversification, the associated monitoring and managing of risk, and potential hedging strategies for the portfolios. The major part of the portfolio is relatively stable. For monitoring and measuring equity risks the Bank uses standardized approach as well as internal model, adjusted to Basel standards.

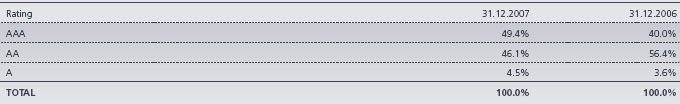

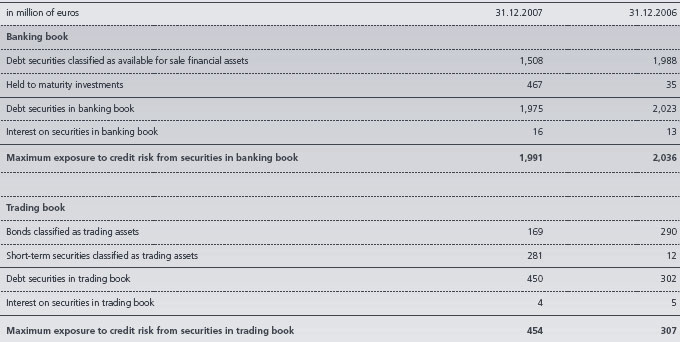

3.3. Information about the quality of debt securities

Debt securities are classified either into trading book or into banking book, according to the purpose of acquisition and how they are going to be managed. Securities that the Bank acquires principally for generating profits between purchase price and selling price are classified into trading book. Securities within trading book are in financial statements always classified as financial assets held for trading. Securities for which the Bank has intention to hold to maturity are part of the banking book. In financial statements they are classified as financial assets available for sale or held to maturity investments.

The portfolio of debt securities in banking book ensures secondary liquidity and manages interest rate risk of the Bank. When managing the portfolio, the Bank uses conservative principles, especially with respect to issuers’ ratings and maturity of the portfolio. As at 31 December 2007 debt securities in banking book amounted to Euro 1,975 million (31 December 2006: Euro 2,023 million), share of government debt securities (only EU countries and US) was 98% (31 December 2006: 99.6%) and the average modified maturity of the portfolio 1.7 years (31 December 2006: 1.2 years).

Structure of banking book according to Standard&Poor’s ratings:

The portfolio of bonds in the trading book amounted to Euro 169 million as at 31 December 2007 (31 December 2006: Euro 290 million). Bonds of the Republic of Slovenia (rating RS AA-S&P and Aa2-Moody’s) in the amount of Euro 80 million and bonds of DARS (Company for construction of highways in Republic of Slovenia) in the amount of Euro 60 million form the majority of the portfolio. These bonds are guaranteed by the Republic of Slovenia (guarantee on the basis of applicable law). The remaining part of the portfolio comprises financial institutions bonds. The average duration of the portfolio is 0.98 years, since some bonds are hedged against risk. The Bank also has some short-term securities (certificates of deposits from domestic banks and commercial papers issued by foreign banks). As at 31 December 2007 these securities amounted to Euro 280.6 million, comprising:

- Euro 3.3 million certificates of deposits from domestic banks (31 December 2006: Euro 6.5 million),

- Commercial papers issued by banks with high (only A) ratings Euro 277,3 million (31 December 2006: 0 euros).

As at 31 December 2006 the Bank’s portfolio also included also treasury bills in the amount of Euro 5.5 million.

4. SEGMENTAL ANALYSIS

The Bank is organized into four main business segments

1. Corporate business presenting transactions with:

- large companies,

- state,

2. Retail banking including:

- individuals,

- entrepreneurs,

- small and medium enterprises,

- local community,

3. Financial markets presenting activities of:

- treasury,

- investment banking,

- operations with international financial institutions,

- transactions with other banks,

4. Equity investments and

5. Other - presenting activities that cannot be allocated in first four businesses.

The basis for segmentation is internal organization of the Bank, based on Value Creating Centers. This is supplemented by incorporation of organizational units and allocation of income and expenses into main business segments, according to their nature.

5. SIGNIFICANT EVENTS AFTER THE BALANCE SHEET DATE

In May 2008 NLB Banka Domžale, d.d. Domžale, NLB Banka Zasavje, d.d., Trbovlje and NLB Koroška banka d.d., Slovenj Gradec will officially be merged with NLB. These three banks are currently included into the consolidated financial statements as subsidiaries.

The strategy of the Bank is based on future growth of the Bank as well as the Group. To succeed in its goal, the Bank must actively manage its capital and sustain an appropriate capital adequacy ratio according to requirements of regulators and risks that the Bank is exposed to. One of the means for achieving this is with a share capital increase. In the beginning of 2008 the Bank initiated a process of issuing new shares in the amount of Euro 300 million. Existing shareholders will have the priority right to buy new shares, the rest will be offered to the public. New shares will have the same rights as existing ordinary shares of NLB. The Bank expects the transaction to be completed by the end of June 2008.

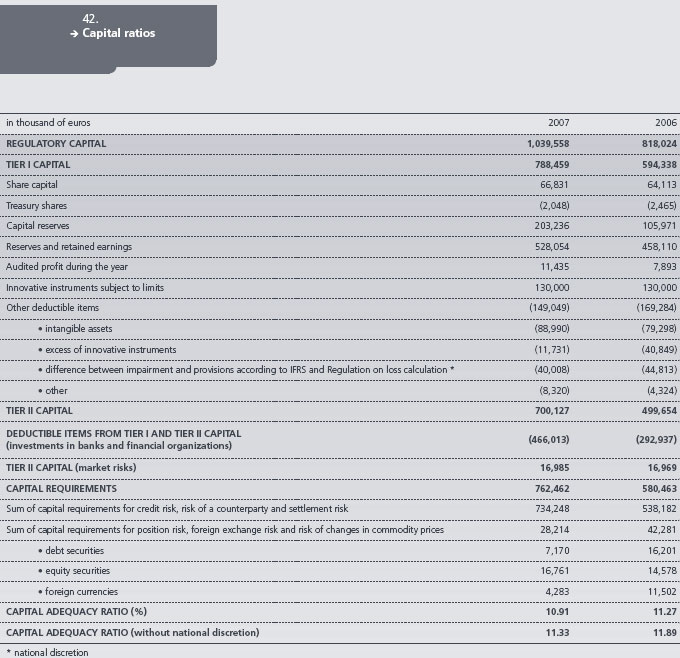

In the year 2007 new legislation regarding capital management and capital adequacy calculation, based on European capital directive (CAD), was enacted in Slovenia. NLB already adjusted its calculation of capital requirements for market risk in the year 2007. In line with new directive the Bank will also calculate capital requirements for credit risk as well as additional capital requirements for operational risk. First calculation according to these new requirements will be performed as at 31 March 2008.

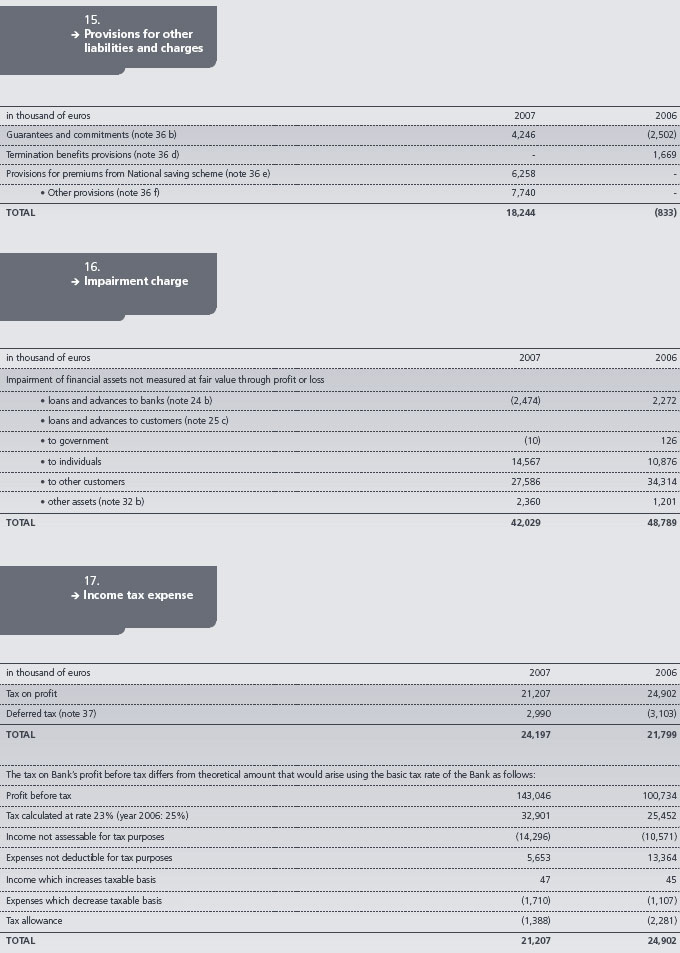

Income not assessable for tax purposes relates mainly to dividend income, which can be, if fulfilling all requirements of Corporate Income Tax Law, eliminated from tax base.

The tax authorities may at any time inspect the books and records within 5 years subsequent to the reported tax year, and may impose additional tax assessments and penalties. The Bank’s management is not aware of any circumstances that may give rise to a potential material liability in this respect.

Last inspection by the tax authorities was performed in year 2002 when they inspected the books and records for years 2000 and 2001.

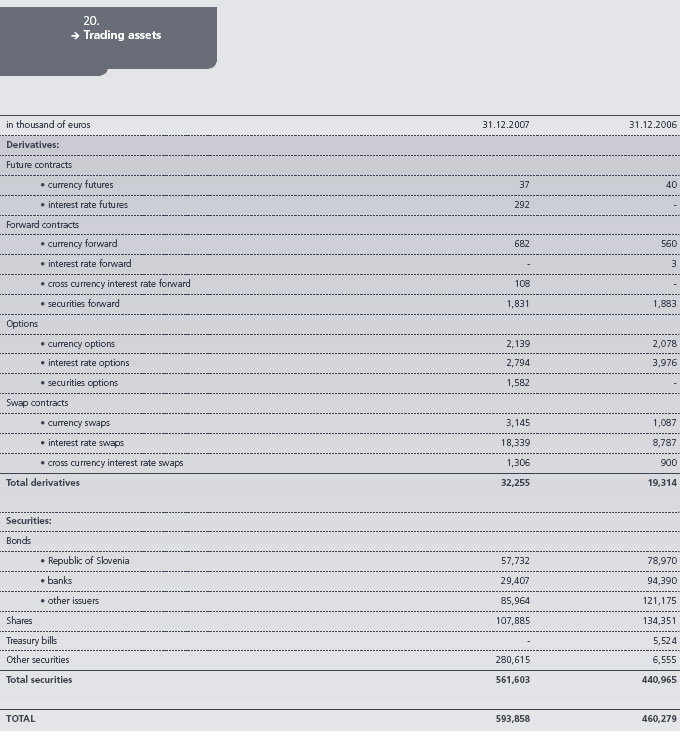

The Bank is required to maintain an obligatory reserve with the Bank of Slovenia, relative to the volume and structure of its customer deposits.

The current requirement of the Bank of Slovenia regarding the calculation of the amount to be held as obligatory reserve is 2% of all time deposits with maturity up to 2 years.

As at 31 December 2007 securities held for trading amounting to Euro 258,248 thousand were listed on the stock exchange (31 December 2006: Euro 386,868 thousand).

Trading assets in the amount of Euro 49,869 thousand (31 December 2006: Euro 648 thousand) have original maturity up to three months and are included within cash equivalents.

Bonds from other issuers include bonds with the nature of subordinated debt with the total value of Euro 5,421 thousand (31 December 2006: Euro 510 thousand). Bonds do not include any equity conversion option or any other derivative feature.

As at 31 December 2006 securities held for trading at fair value of Euro 1,179 thousand had been pledged to third parties in sale and repurchase agreements. These securities have been reclassified as pledged assets on the face of the balance sheet. No securities held for trading had been pledged to third parties as at 31 December 2007.

The total amount of the change in fair value estimated using a valuation technique that was recognized in profit or loss during 2007 was positive in the amount of Euro 21,147 thousand (2006: negative in the amount of Euro 3,566 thousand). There are no financial instruments measured at fair value using a valuation technique that is not supported by observable market prices or rates.

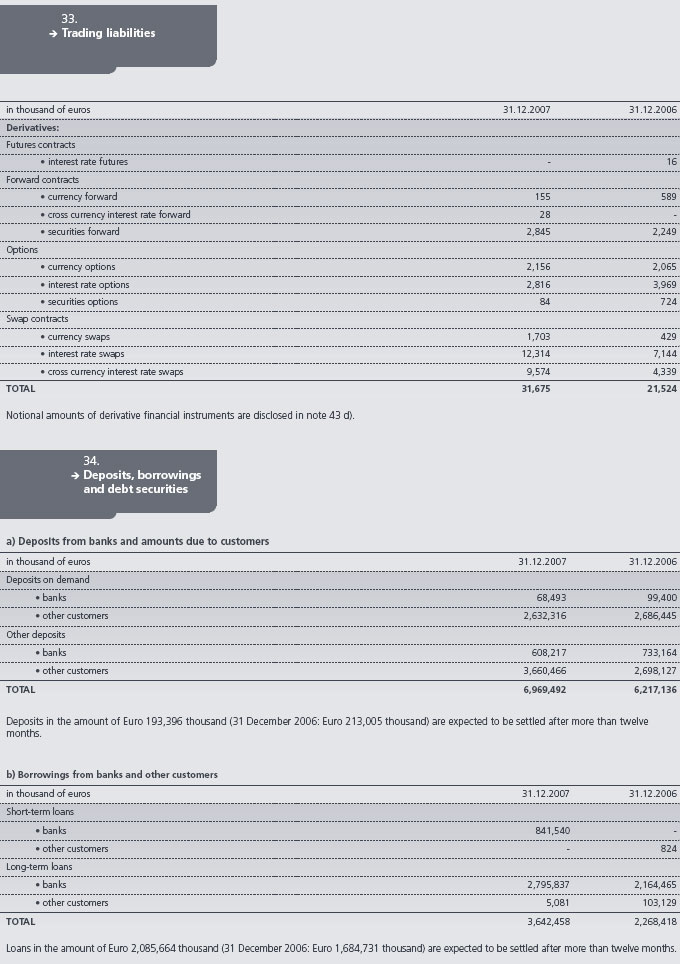

Notional amounts of derivative financial instruments are disclosed in note 43 d).

As at 31 December 2007 other securities include commercial papers in the amount of Euro 277,277 thousand.

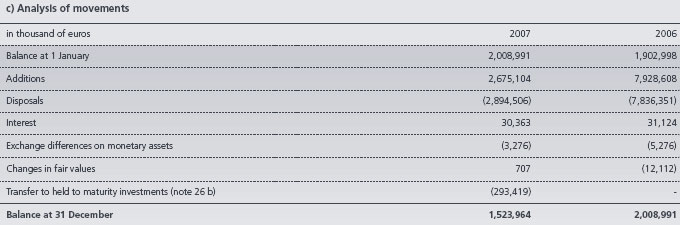

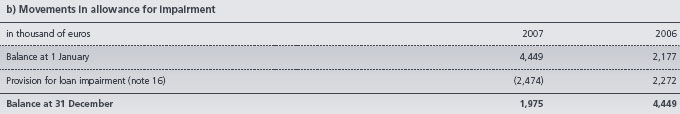

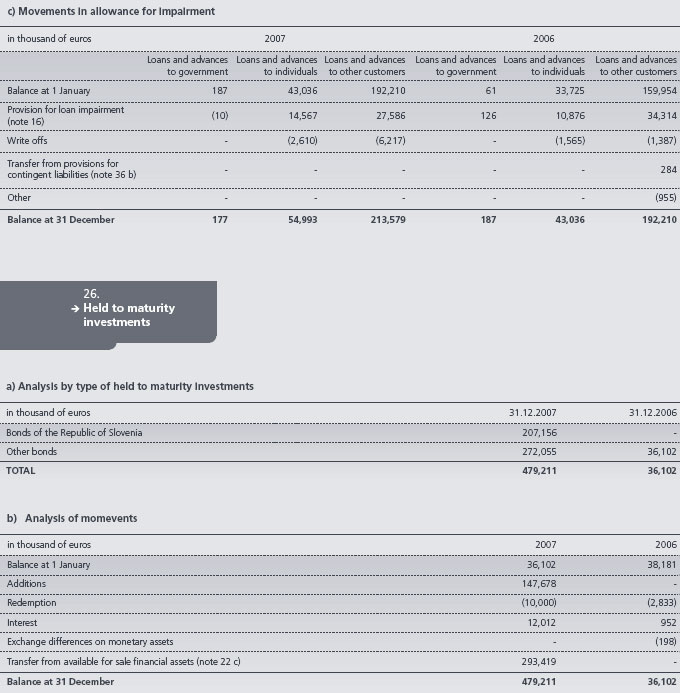

In 2007 the Bank reclassified available for sale financial assets in the amount of Euro 293,419 thousand to held to maturity investments, since it has the positive intention and ability to hold these investments to maturity. Reclassification was done at fair value at the date of transfer.

As at 31 December 2007 the investment securities amounting to Euro 1,512,799 thousand (31 December 2006: Euro 1,053,638 thousand) were listed on the stock exchange.

As at 31 December 2007 the Bank has no available for sale financial assets with original maturity up to three months (31 December 2006: Euro 600,527 thousand).

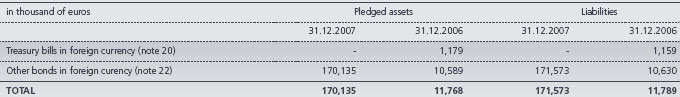

Securities at fair value of Euro 170,135 thousand (31 December 2006: Euro 10,589 thousand) had been pledged to third parties in sale and repurchase agreements for periods not exceeding 1 month. These have been reclassified as pledged assets on the face of the balance sheet.

Available for sale financial assets in the amount of Euro 418,105 thousand (31 December 2006: Euro 786,341 thousand) have a remaining contractual maturity of more than twelve months.

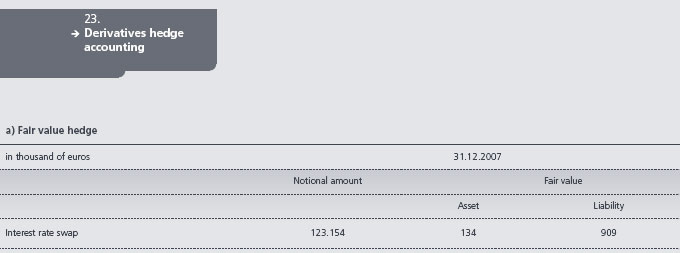

The Bank decided to swap interest rate on hedged item by entering into interest rate swap with the same characteristics. Hedging is based on harmonization of cash flows from hedged item and hedging instrument. This enables the Bank to decrease positive interest gap in particular periods and to decrease exposure to interest rate risk.

Net losses on hedging instruments amounted to Euro 2,084 thousand in year 2007 (2006: 0) and gains on hedged items were Euro 2,014 thousand (2006: 0).

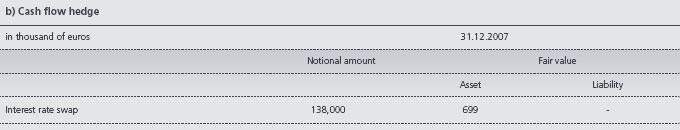

With cash flow hedge the Bank hedges three balance sheet items (issued securities and loans). The common characteristic of all three deals is the fixation of interest rate for the whole period. Due to the specific structure of the balance sheet according to interest maturity the Bank needed to extend interest maturity for some liabilities in order to ensure efficient interest rate risk management.

Cash flows are harmonized (quarterly or semiannually) in all cases of cash flow hedges based on interest rate swaps. With the fixation of the interest rate for these items the Bank decreased its exposure to interest rate risk at the macro level.

A gain on hedging instrument in the amount of Euro 699 thousand (2006: 0) was recognized directly in equity, as well as the corresponding deferred income tax asset in the amount of Euro 154 thousand (2006: 0). There was no ineffectiveness that the Bank should have recognized in the income statement.

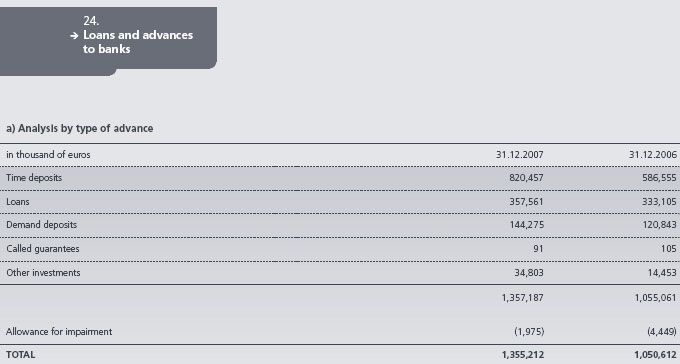

Loans and advances to banks in the amount of Euro 253,515 thousand (31 December 2006: Euro 215,544 thousand) are expected to be recovered after more than twelve months.

Loans and advances to banks in the amount of Euro 738,187 thousand (31 December 2006: Euro 153,754 thousand) have original maturity up to three months and are included within cash equivalents.

As at 31 December 2007 investment securities amounting to Euro 479,211 thousand (31 December 2006: Euro 36,102 thousand) were listed on the stock exchange.

Held to maturity investments in the amount of Euro 401,551 thousand (31 December 2006: Euro 25,073 thousand) have a remaining contractual maturity of more than twelve months.

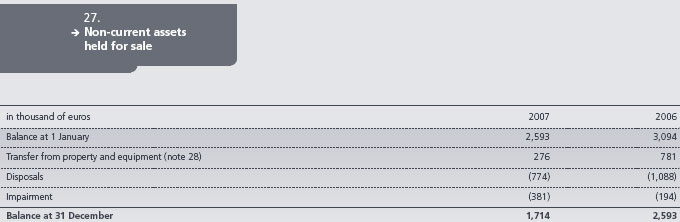

Non current assets held for sale include business premises which are in the course of sale and assets received as collateral. The value of non current assets held for sale that the Bank obtained by taking possession of collateral held as security and recognized them in the balance sheet is Euro 224 thousand (2006: Euro 533 thousand).

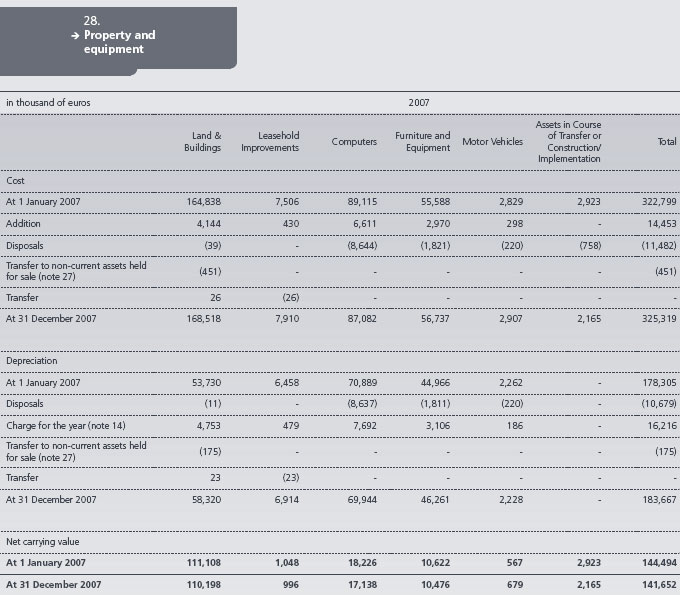

The value of property and equipment that the Bank obtained by taking possession of collateral held as security and recognized them in the balance sheet is Euro 7 thousand (2006: Euro 7 thousand).

NLB Tutunska banka a.d., Skopje, NLB Montenegro banka a.d., Podgorica, NLB LHB Banka a.d., Beograd, NLB Leasing d.o.o., Ljubljana and NLB Leasing d.o.o., Koper are treated as subsidiaries according to the majority voting power held by the NLB Group.

In the year 2007 the Bank newly acquired shares in Kasabank Priština, New Bank of Kosova and NLB d.o.o. Beograd and increased its share to 100% in three Slovenian banks which are going to be merged with NLB in the year 2008 (note 5). With additional purchases the Bank increased its share and voting rights in NLB Tutunska banka a.d., Skopje, NLB Continental banka a.d. Novi Sad and LHB Internationale Handelsbank AG, Frankfurt.

In the year 2007 the Bank also increased its investments in NLB Leasing d.o.o., Ljubljana, NLB Leasing d.o.o. Maribor, NLB Leasing d.o.o. Koper and Lizing d.o.o.e.l. Skopje.

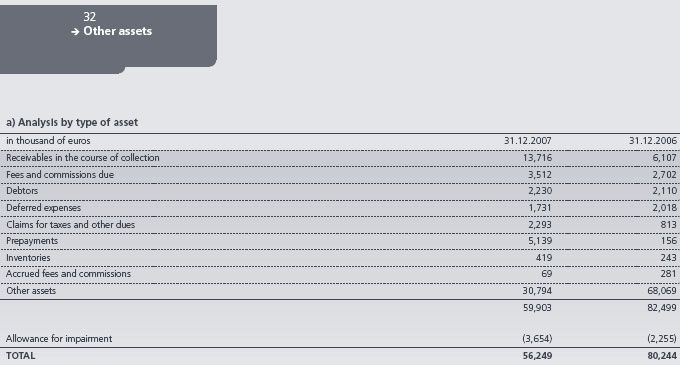

All other assets, except for inventories and claims for taxes and other dues, are financial assets and are measured at amortized cost.

Receivables in the course of collection are temporary balances which, according to the functionality of the information support system, are transferred to the appropriate item of other assets within next few days after occurrence.

As at 31 December 2007 other assets include receivables in the amount of Euro 13,066 thousand, relating to sold securities. In 2006 other assets in the amount of Euro 37,966 thousand related to Euro cash delivered in advance to Slovenian banks and other companies. Other assets as at 31 December 2006 include receivables of the Trieste branch relating to documentary letters of credit in the amount of Euro 20,320 thousand.

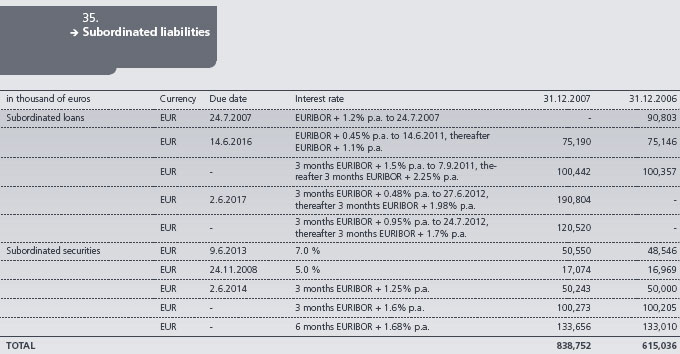

c) Debt securities in issue

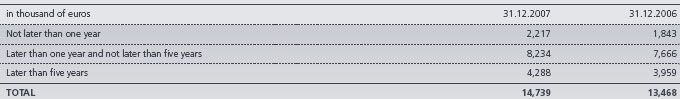

All debt securities in issue relate to issued bonds and are denominated in Euro. 72.1 % of them have fixed interest rates (31 December 2006: 74.8 %) and 27.9 % have floating interest rates (31 December 2006: 25.2 %). As at 31 December 2007 all debt securities in issue are quoted on active markets (31 December 2006: Euro 426,736 thousand). Issued securities in the amount of Euro 383,989 thousand (31 December 2006: Euro 369,327 thousand) have remaining maturity of more than 12 months.

During the presented years there were no defaults on the securities in issue.

In accordance with the Regulation on capital adequacy of banks and savings banks, four subordinated long-term loans and issued subordinated securities are included in the Bank’s Tier 2 capital. The issued subordinated securities do not contain any provisions on conversion to capital or any other liabilities.