Performance Analysis

Retail Banking

Retail Banking

The NLB Group, together with its skilled advisory personnel, provides the general public with top-notch and comprehensive financial services in Slovenia and abroad. Along with classic banking services, the Group members also offer their customers an ever growing number of specialized financial services – a variety of mutual and other investment funds, asset management, banking insurance, stock brokerage services, leasing, factoring, pension insurance plans and so on.

The NLB Group has the largest network of branch offices and ATM machines in Slovenia and operates in all regions throughout the country. The NLB Group increased the number of its branch offices in the markets of SE Europe by almost a third, almost doubled the network of ATM machines and the number of retail establishments that honor card products. In December 2007, the NLB Group thus had a network of 565 branch offices, 340 of which are in the markets of SE Europe.

Customers have their choice of numerous other state of the art banking services: such as electronic, phone and mobile phone banking and the most extensive ATM network in Slovenia.

The NLB Group has the leading market share in retail banking in Slovenia and enjoys an excellent reputation and a high degree of customer satisfaction according to various independent surveys. It is also the market share leader in classic banking services, with its other financial services gaining ground as well. In individual SE European markets, NLB Group banks are among the largest in terms of customers, branch offices and business volume.

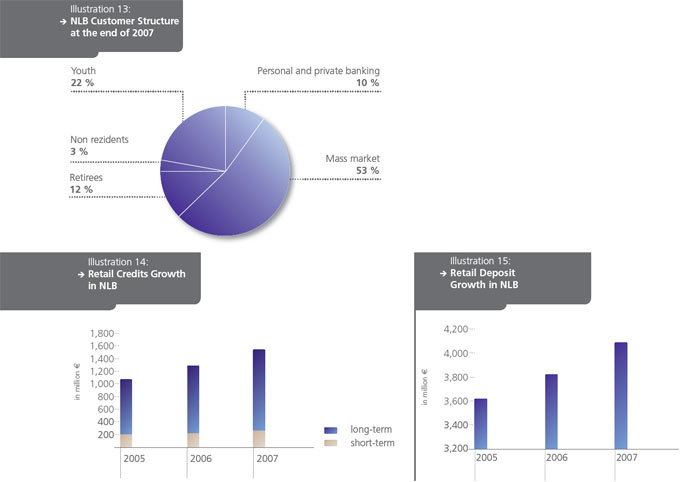

The NLB Group has for a number of years been upgrading and adjusting its portfolio and services to meet the specific interests and demands of its diverse customer base. To the most demanding and affluent, it offers private banking, to the demanding, personal banking, to the young – from birth to first regular employment - it offers special programs, and to retirees, two silver accounts. The members of the NLB Group have a 38.9% share of all personal accounts in Slovenia, with NLB holding a 32.9% share. At the end of 2007, NLB introduced the NLB Sales Portal, making possible an even more personal approach for every customer, offering better consulting services and creating special offers that meet the needs of clients in view of their desires and financial means.

The NLB recorded 13.5% growth in the value of retail loans. Because of the adoption of the Euro, the preponderance of loans were denominated in this currency, even though the share of loans in CHF also rose, though it is still amounts to only 4.3% of total loans. In the area of longterm loans, the fastest growing are mortgage secured loans, which compared to the end of 2006, grew by 51.5%.

The growth of retail deposits was up by 4.4%in 2007. The bank actively promoted the restructuring of household funds from short to long-term investments and savings.

Customers also invested some of the savings into other investment vehicles. The NLB Group network offers access to 13 mutual funds, 2 guaranteed funds and 6 bankinsurance funds. In 2007, the NLB Group expanded its investment offerings with another mutual fund and three NLB Vita funds.

In credit card operations, the Bank introduced chip technology in 2007, improved credit card security and increased customer confidence by developing credit rankings. NLB patrons held 1.28 million cards, with which they made almost 40 million purchases. Pay now cards still prevail; the growth of pay later cards was noticeably higher than last year (16%). The NLB Group members in SE Europe are active in developing and marketing bankcards and this is reflected in the rapid growth of business and large number of credit card holders.

More than 260,000 NLB customers used e-banking and banking by phone, which includes both classic telephone as well as mobile phone banking. In 2007, NLB Klik e-banking grew the most, by 16%. NLB Klik e-banking customers make on average, about half a million transactions a month.

Annual Report 2007