NLB Group

Financial markets

Financial markets

Transactions in financial instruments

Stockbrokerage

Stockbrokerage services are intended for investors

who wish to make their own decisions regarding

investments in financial instruments, and who

assume the associated risks and are prepared to

dedicate more of their own time to the active

management of their assets.

At the end of 2010, NLB worked with 14,651

stockbrokerage customers, who executed 31,155

transactions during the year in the total amount of

more than EUR 433 million. Income from

stockbroking was up 26.4% on 2009.

Other NLB Group companies providing

stockbrokerage services are Convest, a member of

the Belgrade stock exchange, and NLB Tutunska

banka, a member of the Macedonian Stock

Exchange in Skopje.

Portfolio management and investment advice

Portfolio management is based on the fact that

the customer pays funds into a selected portfolio

with a specific investment policy and leaves the

management function to the discretion of experts.

The Bank also offers institutional investors special

share and bond portfolios, whose investment

policies are fully adapted to the investor's needs.

Improved conditions on the capital markets and

the increased willingness of customers to invest in

financial instruments characterized 2010. The

Bank recorded net inflows of EUR 22.3 million in

2010, while the total value of assets under

management amounted to EUR 101.9 million

(38.1% growth and 12.8% growth in the

number of customers with respect to the

balances at the end of 2009). The Bank's results

were well above-average compared with other

Slovenian mutual funds managers, as net inflows

in portfolio management reached the level of net

inflows of all mutual funds in Slovenia in 2010

(EUR 17.4 million).

Organization and process of securities issuing

The service of issuing securities is appropriate for

customers searching for an alternative type of

financing and primarily sources with longer

maturities and deferred payment of liabilities.

- designing a structure and defining conditions of securities that will be appropriate with regard to the needs of the issuer and demands of potential investors;

- performing legal, formal and administrative tasks;

- organizing and executing initial offering of securities (including organization, implementation and monitoring of the subscription and payment of securities), with or without NLB underwriting commitment;

- issuing securities in dematerialized form by entering them on the holders' accounts in the Central Securities Registry of dematerialized securities with the KDD - Central Securities Clearing Corporation; and

- listing securities for trading on the organized market of the Ljubljana Stock Exchange,

NLB participated in the issuance of securities by

other issuers in 2010. NLB organized and carried

out the third consecutive offering of SID banka

bonds in the total nominal value of EUR 69 million

and the first sale of new shares to increase the

capital of Unior, Novoles, Adria Airways and

Gorenje, which were offered to existing

shareholders and to selected investors.

Advisory services on providing financial

resources to finance projects and regular

operations of companies

The Bank offers its customers assistance in setting

up financing models, selecting optimal financial

structure and instruments, divesting unnecessary

assets and investments, carrying out due diligence

reviews of operations to assess the value of assets

of companies under consideration for strategic

buyouts or purchase of participating interest, etc.

In 2010, NLB participated in the process of

providing financial resources on foreign markets

(funds from EIB, EBRD and commercial banks and

obtaining bank guarantees to secure EIB funds) in

two major investment projects in Slovenia:

financing the construction of the 600 MW Block 6

at the Šoštanj thermal power plant and the

construction of a natural gas distribution network

for Geoplin.

Organization of syndicated loans, guarantees

and provision of agency services

NLB offers syndication services for private

capital projects and infrastructure projects of

national importance. In 2010, NLB provided financial resources for major Slovenian

companies, together with banks of the NLB

Group and other Slovenian banks. The value of

the approved syndicated loans and syndicated

guarantees issued to Slovenian residents

(transactions in which NLB served as agent)

amounted to EUR 422.1 million in 2010.

Trading

Similar to the entire financial industry, 2010 was a

very demanding year in the trading segment. The

financial crisis continued, with interest rates

reaching record-low levels, while volatility was high

on all markets. Trading is difficult and risky in such

conditions. The Bank therefore reduced its

exposure in all positions.

• Currency trading

The Bank concluded 34,365 forex trading

transactions in 2010 in the total amount of EUR

9.4 billion, the highest annual level in the Bank's

history. The Bank works with all major

international banks in this segment. The volume of

transactions has risen continuously from year to

year, and was up 51% on the previous year.

• Securities trading

Together with fourteen foreign banks and two

Slovenian banks, NLB functions as a liquidity

custodian on the MTS Slovenia trading platform.

Listing and trading on this platform means

competing with the world’s largest banks. Eight

Slovenian government bonds are currently traded

on the aforementioned platform. Liquidity

custodians are committed to buying and selling at

least EUR 2 million of each bond at any time. Total

trading on the market exceeded EUR 21 million in

2010. NLB is an active market participant.

● Derivatives trading

NLB further enhanced trading in its own name and

on its own account in 2010, compared with 2009.

The volume of trading in futures contracts was up

50% in 2010 compared with the previous year.

The increase is primarily the result of a wider range

of futures contracts and the preparation of a good

basis for transacting with companies in this area in

the future.

The Bank executed currency swaps in the amount

of EUR 2.4 billion in 2010, the majority in the

following currency pairings: EUR/CHF, EUR/USD

AND EUR/CZK.

• Trading in interbank deposits and treasury bills

The Bank trades daily in interbank deposits in all

major currencies. There were a total of 4,580

transactions (all currencies and all banks

together) in the amount of EUR 26,762 billion.

The majority of transactions (68% of total

turnover) were executed with foreign banks.

NLB also provides primary subscription services

for treasury bills issued by the Ministry of

Finance of the Republic of Slovenia.

● Trading in cash

The Bank concluded 6,752 foreign currency

purchase/sale transactions in 2010 in the total

amount of EUR 436 million. The majority of

transactions in 2010 were in the Croatian kuna

in the amount of EUR 128 million or 29% of

total turnover. The second most important

currency was the Swiss franc, in which the bank

recorded transactions of EUR 125 million. The

the US dollar also accounted for a significant

proportion of turnover, with EUR 40 million in

purchase/sale transactions.

● Syndicated issues of Slovenian government

bonds

Twelve foreign and three Slovenian banks

comprise the group of primary dealers for the

Ministry of Finance. The tasks of primary dealers

are to issue and maintain the liquidity of

Slovenian government bonds on the organized

MTS Slovenia market. The Ministry of Finance

issued two government bonds in 2010: RS68

bonds in the amount of EUR 1 billion and RS67

bonds in the amount of EUR 1.5 billion. NLB

served as one of the main organizers (lead

manager) in the issue of the latter.

Transactions with customers

A major step forward was made in 2010 in the

sale of financial instruments to customers. The

Bank takes into account previously planned

objectives and focuses on the quality of services,

with an emphasis on the individual treatment of

and a personal relationship with the customer.

The Bank also aims to remain the leading

provider of services in Slovenia in this segment.

Despite the continuing financial crisis and the

deterioration of the economic situation,

turnover in financial instruments with customers

was up in 2010. Purchases/sales of foreign

currencies (66%) and deposits (17%) account

for the highest proportions of turnover.

Derivatives, the proportion of which is rising from year to year, account for the remainder of

transactions.

NLB places a great deal of emphasis on the

development of new products and tracking the

wishes of its customers. The Bank followed

market trends in 2010 and introduced two new

products: "asset swap" and "swaption". The

first product was introduced in April 2010, while

second is available since January 2011. NLB

began a project in 2010 to introduce trading in

synthetic futures contracts, which it plans to

begin offering customers at the beginning of

2012. Thus, the range of synthetic futures

contracts will be expanded from the current

currencies futures to synthetic futures

transactions involving commodities, interest

rates, etc.

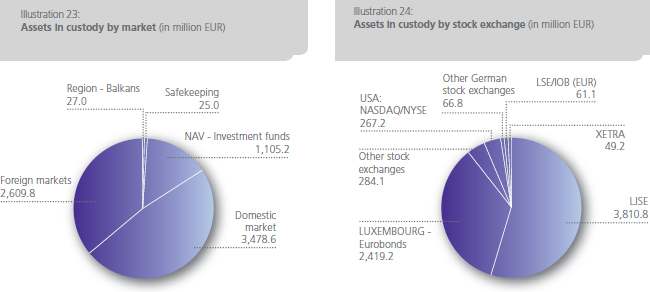

Custody services

The long trend of growth in assets in custody

continued in 2010. Despite the adverse conditions

on the financial markets, revenue from custody

services exceeded the planned level by 37%. The

value of assets in custody stood at EUR 7.25 billion

at the end of the year, up 30% on a very

successful year in 2009. The Bank recorded a

similar increase in assets on the domestic and

foreign capital markets.

On the domestic market, successful cooperation

continued with Clearstream Banking Luxembourg

in transactions with Slovenian government bonds

on the MTS Slovenia platform.

Growth in operations on foreign markets was

stable in 2010 with regard to the volume of assets

in custody and the number of transactions. In

addition to the domestic market, the majority of

transaction were executed in the US, Germany, the

UK, France and on the Eurobond market. New

features introduced by US tax legislation under the

FATCA, and thus in the operations of global

financial institutions, were the subject of intense

study during the second half of the year.

Operations in the investment fund segment

were characterized by a sharp decline in

securities transactions in the context of an

increase in cash deposits and a slight increase in

outflows from funds.

Despite the uncertain situation on the capital

market, the Bank assesses its custody activities for

investment funds as successful. The marketing of

new investment and pension funds has already

provided positive results, as the Bank received into

custody two cover funds from one of the largest

pension companies in Slovenia, and thus increased

the volume of assets in investment and pension

funds by more than 47%.

As part of regional custody services, the Bank

established a sub-custody network of NLB Group

companies on the markets of Serbia, Bosnia and

Herzegovina, Montenegro and Macedonia. In

addition to custody services in the sub-custody

network, Group banks independently market

custody services on their local markets aimed at

transactions on domestic and foreign markets and

the transactions of pension and investment funds.

Annual Report 2010