Audited Financial Statements of NLB d.d. and the NLB Group

Notes to the financial statements

Notes to the financial statements

1. GENERAL INFORMATION

Nova Ljubljanska banka d.d. Ljubljana (hereinafter: NLB

or the Bank) is a joint stock entity providing universal

banking services. The NLB Group (hereinafter: the

Group) operates in more than twelve countries.

The Bank is incorporated and domiciled in Slovenia.

The address of its registered office is Trg Republike 2,

Ljubljana. The Bank’s shares are not listed on the stock

exchange.

The Bank’s largest shareholders are the Republic of

Slovenia, owning 33.10% of shares, and KBC Bank

N.V. Brussels (hereinafter: KBC), owning 30.57% of

shares.

All amounts in the financial statements and in the

notes to the financial statements are expressed in

thousands of euros unless otherwise stated.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies adopted for the preparation of the separate and consolidated financial statements are set out below.

2.1. Statement of compliance

The principal accounting policies applied in the

preparation of the separate and consolidated financial

statements have been prepared in accordance with the

International Financial Accounting Standards

(hereinafter: the IFRS) as adopted by the European

Union (hereinafter: EU). Additional requirements under

the national legislation are included where

appropriate.

The separate and consolidated financial statements

comprise the income statement and statement of

comprehensive income, the statement of financial

position, the statement of changes in equity, the

statement of cash flows, significant accounting policies

and the notes.

2.2. Basis of presentation of financial statements

The financial statements have been prepared under the

historical cost convention as modified by the

revaluation of available for sale financial assets and

financial assets and financial liabilities at fair value

through profit or loss, including all derivative contracts,

and investment property.

The preparation of financial statements pursuant to

the IFRS requires the use of estimates and assumptions

that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and

liabilities at the date of the financial statements, and

the reported amounts of revenue and expenses during

the reporting period. Although these estimates are

based on management’s best knowledge of current

events and activities, actual results may ultimately

differ from those estimates. Accounting estimates and

underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognized

in the period in which the estimate is revised. Critical

accounting policies and estimates are disclosed in note

2.31.

The principal accounting policies applied in the

preparation of these financial statements are set out

below. These policies have been consistently applied to

all the years presented.

2.3. Comparative amounts

Except when a standard or an interpretation permits or

requires otherwise, all amounts are reported or

disclosed with comparative amounts. Where IAS 8

applies, comparative figures have been adjusted to

conform to changes in presentation in the current year.

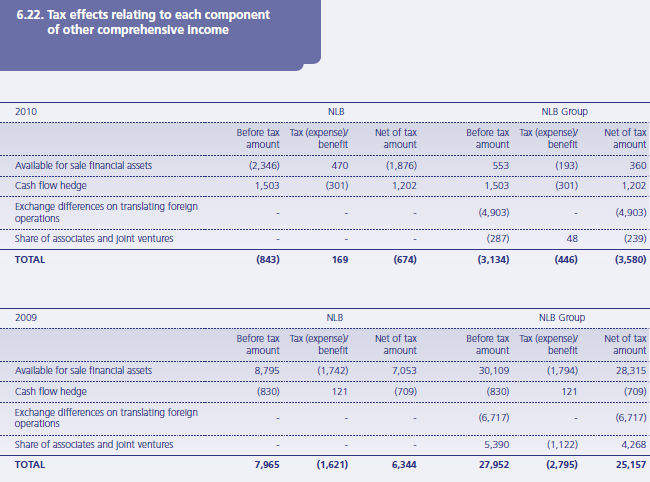

In 2009 exchange differences of EUR 6,717 thousand

arising on the translation of foreign operations to the

presentation currency were presented in the

consolidated statement of changes in equity under the

item "other". In the 2010 consolidated financial

statements this amount is now presented in the

statement of comprehensive income for 2009 as the

item "foreign currency translation". There is no

significant impact on other amounts previously

reported in 2009.

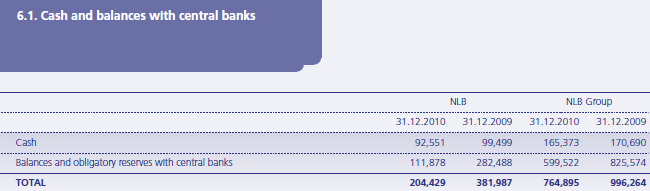

In the 2009 consolidated and separate financial

statements the Group and Bank did not classify

obligatory reserves with central banks as cash and cash

equivalents. The amounts as at December 31, 2009

and December 31, 2008 were EUR 454,046 thousand

and EUR 449,614 thousand for the Group respectively

and EUR 151,303 thousand and EUR 141,410

thousand for the Bank respectively. In the 2010

consolidated and separate financial statements

obligatory reserves have been classified as cash and

cash equivalents as they represent the requirement to

maintain an average balance during a monthly period

and accordingly are available to meet the liquidity

needs of the Group and Bank. As a result the increases

in cash and cash equivalents in 2009 for the Group

and Bank presented in the consolidated and separate

financial statements are EUR 320,111 thousand and

EUR 265,661 thousand respectively. The increases

previously reported for 2009 were EUR 315,972

thousand and EUR 255,768 thousand respectively.

2.4. Consolidation

Subsidiary undertakings, which are those entities in

which the Group, directly or indirectly, has an interest of more than one half of the voting rights or otherwise

has the power to exercise control over operations,

have been fully consolidated. Subsidiaries are

consolidated from the date on which effective control

is transferred to the Group and are no longer

consolidated from the date that control ceases. Where

necessary, the accounting policies of subsidiaries have

been amended to ensure consistency with the policies

adopted by the Group. The financial statements of

consolidated subsidiaries were prepared as of the

parent entity’s reporting date. Non-controlling interests

are disclosed in the consolidated statement of changes

in equity. Non-controlling interest is that part of the

net results and of the equity of a subsidiary

attributable to interests which are not owned, directly

or indirectly, by the Bank. The Group measures noncontrolling

interest on a transaction by transaction

basis, either at fair value, or the non-controlling

interest's proportionate share of net assets of the

acquiree.

Inter-company transactions, balances and unrealized

gains on transactions between Group entities are

eliminated. Unrealized losses are also eliminated unless

the transaction provides evidence of impairment of the

asset transferred.

The Group applies a policy of treating transactions

with non-controlling interests as transactions with

equity owners of the Group. For purchases from noncontrolling

interests, the difference between any

consideration paid and the relevant share acquired of

the carrying value of net assets of the subsidiary is

deducted from equity. Gains or losses on sales to noncontrolling

interests are also recorded in equity. For

sales to non-controlling interests, the differences

between any proceeds received and the relevant share

of non-controlling interests are also recorded in equity.

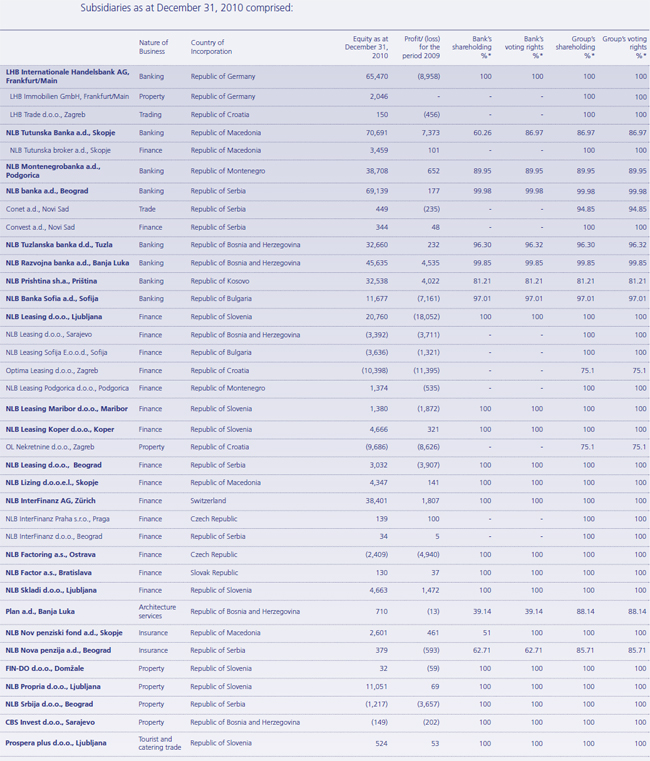

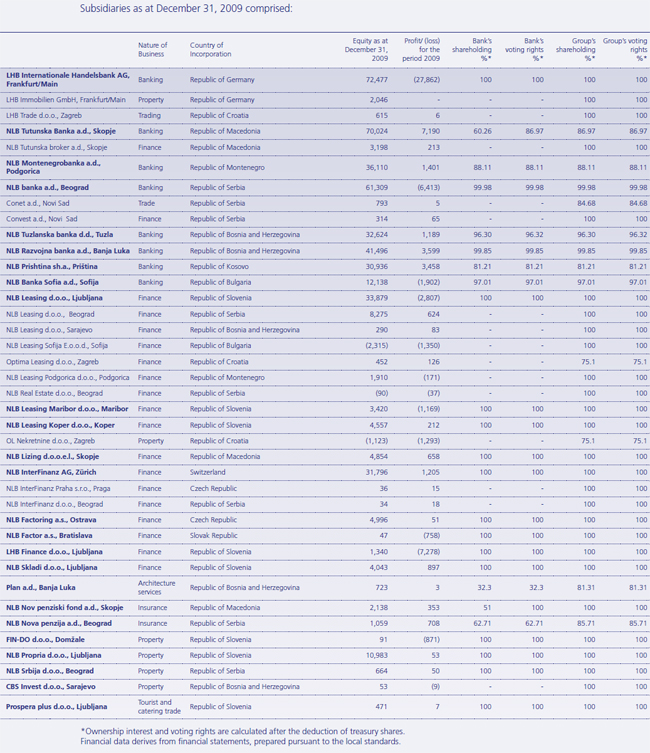

The Group’s subsidiaries are presented in note 6.14.

2.5. Investments in subsidiaries, associates and joint ventures

In the separate financial statements, investments in

subsidiaries, associates and joint ventures are

accounted for at cost. Dividends from a subsidiaries,

joint ventures or associates are recognised in income

statement when the Bank’s right to receive the

dividend is established.

In the consolidated financial statements, investments

in associates are accounted for using the equity

method of accounting. These are undertakings in

which the Group generally holds between 20% and

50% of voting rights, and over which the Group

exercises significant influence, but does not control.

The Group’s share of its associates’ post-acquisition

profits or losses is recognized in the income statement,

its share of post-acquisition movements in other

comprehensive income is recognized in other

comprehensive income. The cumulative postacquisition

movements are adjusted against the

carrying amount of the investment. When the Group’s

share of losses in an associate equals or exceeds its

interest in the associate, including any other unsecured

receivables, the Group does not recognize further

losses, unless it has incurred obligations or made

payments on behalf of the associate.

Joint ventures are those entities over whose activities

the Group has joint control, as established by

contractual agreement. In the consolidated financial

statements investments in joint ventures are accounted

for using the equity method of accounting.

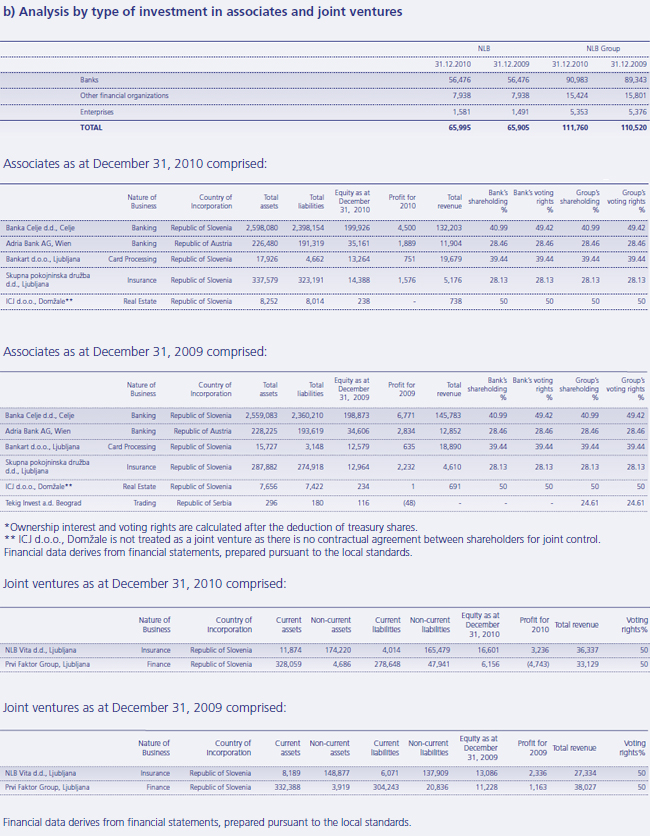

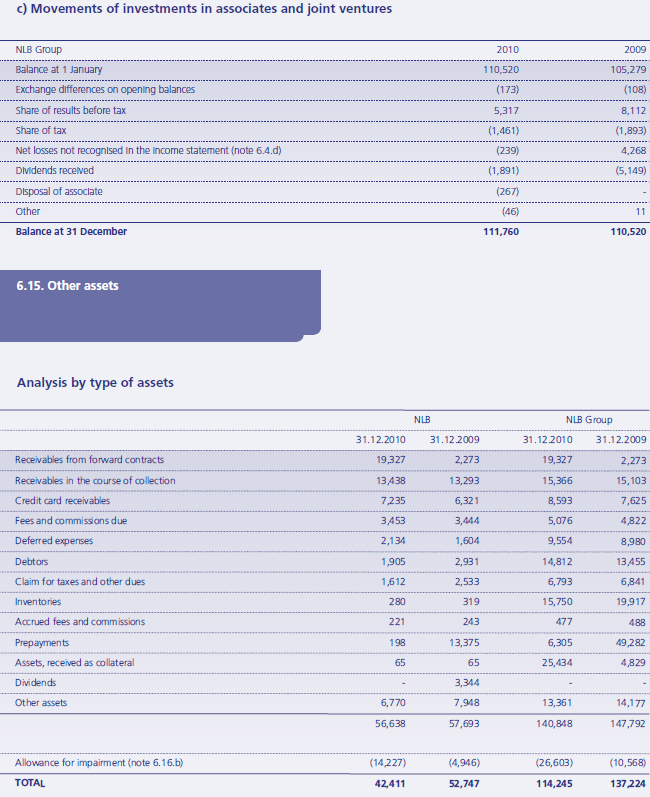

The Group’s principal associates and joint ventures are

presented in note 6.14.

2.6. Goodwill and excess of acquirer’s interest

Goodwill is measured by deducting the net assets of

the acquiree from the aggregate of the consideration

transferred for the acquiree, the amount of noncontrolling

interest in the acquiree and fair value of an

interest in the acquiree held immediately before the

acquisition date. Any negative amount (“negative

goodwill”) is recognised in profit or loss, after

management reassesses whether it identified all the

assets acquired and all liabilities and contingent

liabilities assumed and reviews appropriateness of their

measurement.

The consideration transferred for the acquire is

measured at the fair value of the assets given up,

equity instruments issued and liabilities incurred or

assumed, including fair value of assets or liabilities

from contingent consideration arrangements but

excludes acquisition related costs such as advisory,

legal, valuation and similar professional services.

Transaction costs incurred for issuing equity

instruments are deducted from equity; transaction

costs incurred for issuing debt are deducted from its

carrying amount and all other transaction costs

associated with the acquisition are expensed.

The goodwill of associates and joint ventures is

included in the value of investments.

2.7. Mergers of Group entities

Merger of entities within the Group is a business combination involving entities under common control.

For such mergers the Group applies merger accounting

principles and uses carrying amounts of merged

entities, as reported in the consolidated financial

statements. No goodwill arises on mergers of Group

entities and any difference between net assets merged

and the cost of investment is recorded directly in

equity.

Mergers of entities within the Group do not affect the

consolidated financial statements.

2.8. Foreign currency translation

Functional and presentation currency

Items included in the financial statements of each of

the Group's entities are measured using the currency

of the primary economic environment in which the

entity operates (i.e. the functional currency). The

financial statements are presented in euros, which is

the Group’s presentation currency.

Transactions and balances

Foreign currency transactions are translated into the

functional currency at the exchange rates prevailing at

the dates of the transactions. Foreign exchange gains

and losses resulting from the settlement of such

transactions and from the translation of monetary

assets and liabilities denominated in foreign currencies

are recognized in the income statement, except when

deferred in other comprehensive income as qualifying

cash flow hedges.

Translation differences resulting from changes in the

amortized cost of monetary items denominated in

foreign currency and classified as available for sale

financial assets, are recognized in the income

statement.

Translation differences on non-monetary items, such as

equities at fair value through profit or loss, are

reported as part of the fair value gain or loss in the

income statement. Translation differences on nonmonetary

items, such as equities classified as available

for sale, are included together with valuation reserves

in the valuation (losses)/gains taken to other

comprehensive income and accumulated in revaluation

reserve in equity.

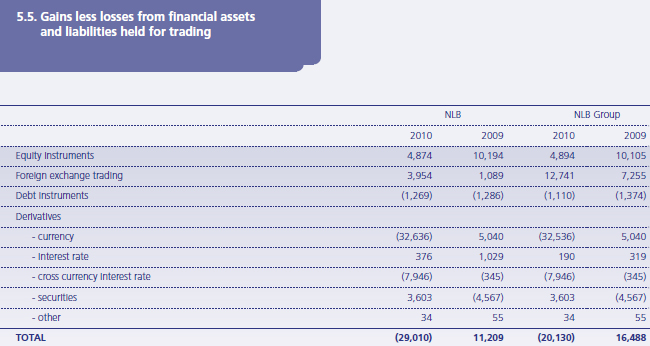

Gains and losses resulting from foreign currency

purchases and sales for trading purposes are included

in the income statement as gains less losses from

financial assets and liabilities held for trading.

Group entities

The financial statements of all the Group entities that

have a functional currency different from the

presentation currency are translated into the

presentation currency as follows:

- assets and liabilities for each statement of financial position presented are translated at the closing rate at the reporting date;

- income and expenses for each income statement are translated at average exchange rates;

- components of equity are translated at the historic rate; and

- all resulting exchange differences are recognized in other comprehensive income.

Goodwill and fair value adjustments arising from the

acquisition of a foreign entity are treated as assets and

liabilities of the foreign entity and translated at the

closing rate.

During consolidation, exchange differences arising

from the translation of the net investment in foreign

operations are transferred to other comprehensive

income. When a foreign operation is partially disposed

of or sold such exchange differences are recognized in

the income statement as part of gains or losses on the

sale.

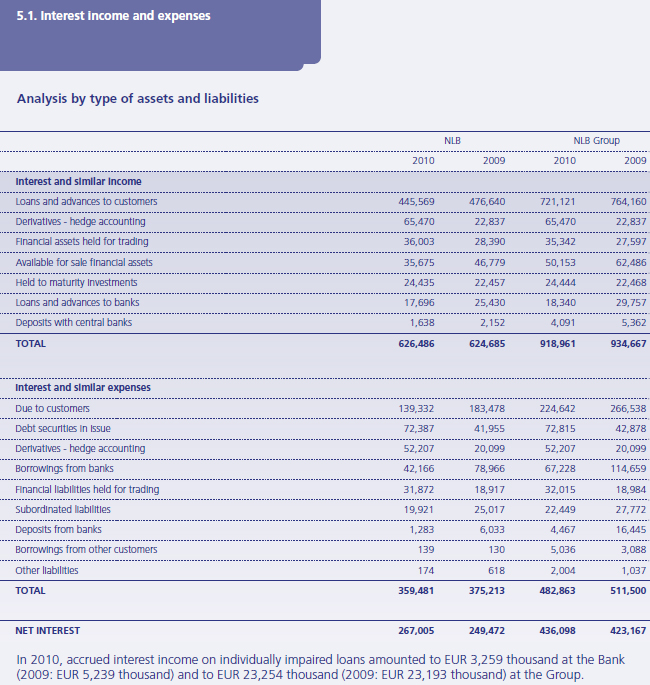

2.9. Interest income and expenses

Interest income and expenses are recognized in the

income statement for all interest-bearing instruments

on an accrual basis using the effective interest rate

method. The effective interest rate method is a

method used to calculate the amortized cost of a

financial asset or financial liability and to allocate the

interest income or interest expense over the relevant

period. The effective interest rate is the rate that

precisely discounts estimated future cash payments or

receipts over the expected life of the financial

instrument or a shorter period when appropriate, to

the net carrying amount of the financial asset or

financial liability. Interest income includes coupons

earned on fixed-yield investments and trading

securities and accrued discounts and premiums on

securities. The calculation of the effective interest rate

includes all fees and points paid or received between

parties to the contract and all transaction costs, but

excludes future credit risk losses. Once a financial asset

or a group of similar financial assets has been

impaired, interest income is recognized using the rate

of interest used to discount the future cash flows for

the purpose of measuring the impairment loss.

Interest income and expenses from all financial assets

and liabilities are disclosed as part of net interest

inflow and income of economic benefits is probable.

2.10. Fee and commission income

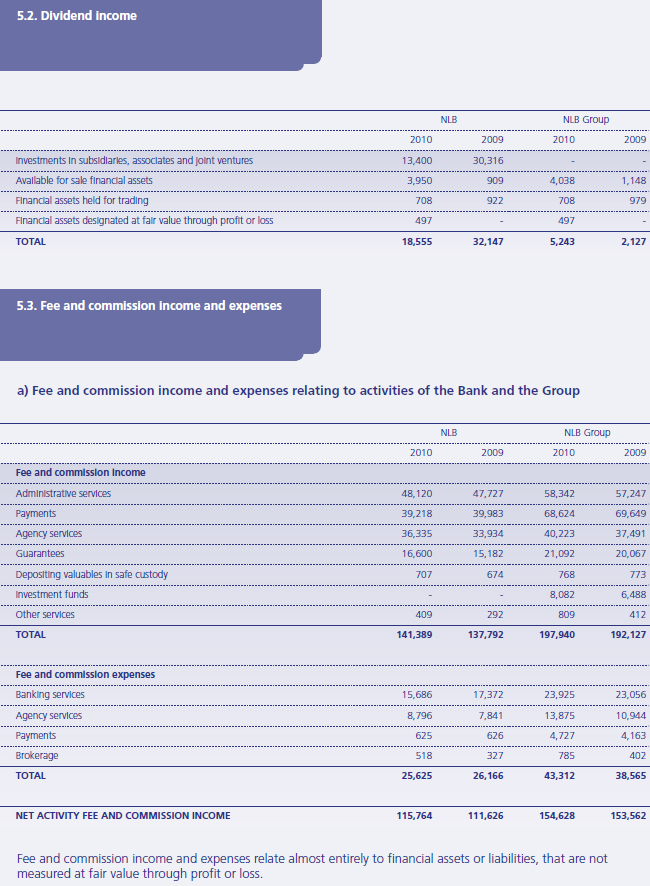

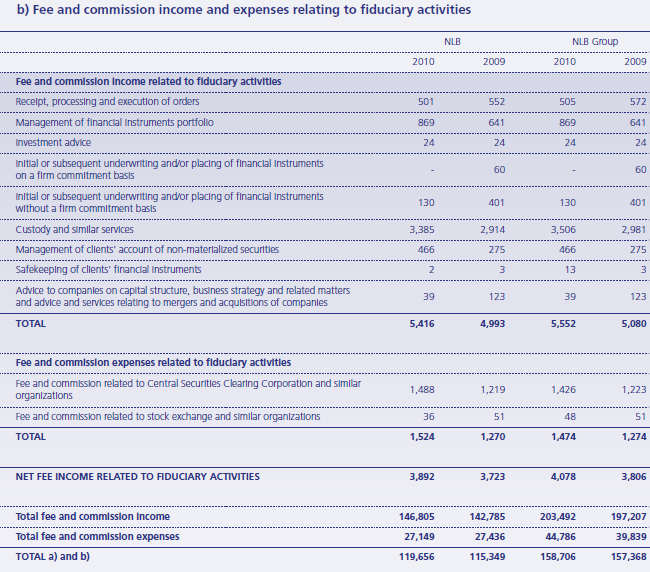

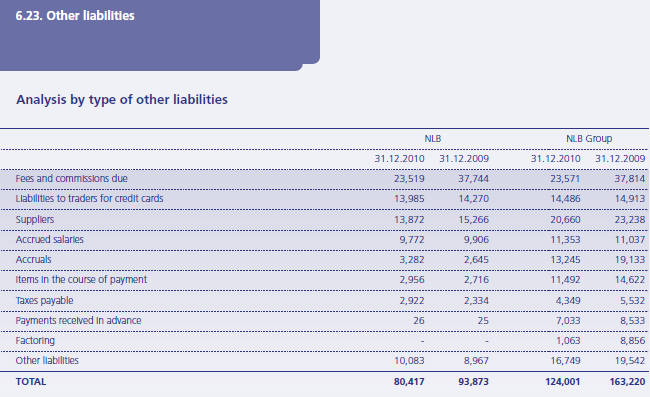

Fees and commissions are generally recognized when the service has been provided. Fees and commissions consist mainly of fees received from payment services and from the managing of funds on behalf of legal entities and individuals, together with commissions from guarantees. Fees and commissions that are integral to the effective interest rate of financial assets and liabilities are presented within interest income or expenses.

2.11. Dividend income

Dividends are recognized in the income statement when the Group’s right to receive payment is established and inflow of economic benefits is probable.

2.12. Financial instruments

a) Classification

The classification of financial instruments on initial

recognition depends on the instruments’ characteristics

and management’s intention. In general, the following

criteria are taken into account:

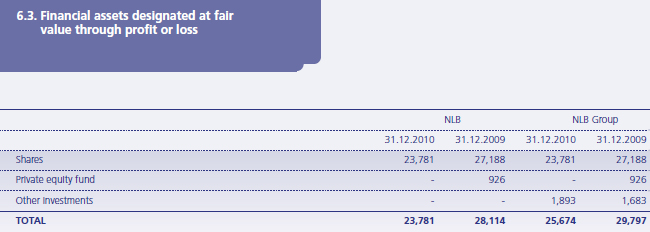

Financial instruments at fair value through profit

or loss

This category has two sub-categories: financial

instruments held for trading and financial instruments

designated at fair value through profit or loss at

inception. A financial instrument is classified in this

group if acquired principally for the purpose of selling

in the short term or if so designated by management.

Derivatives are also categorized as held for trading

unless they are designated as hedging instruments.

The Group designates financial instruments at fair

value through profit or loss if:

- it eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise from measuring assets or liabilities on a different basis;

- a group of financial assets, financial liabilities or both is managed and its performance is evaluated on a fair value basis, in accordance with a documented risk management or investment strategy, and information about the group is provided internally on that basis to the Group’s key management; or

- a financial instrument contains one or more embedded derivatives that could significantly modify the cash flows otherwise required by the contract.

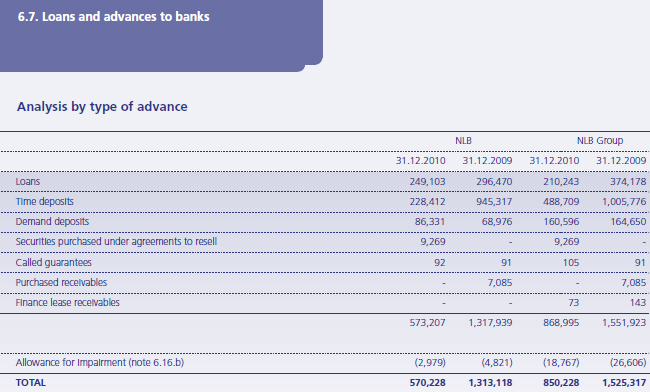

Loans and advances

Loans and advances are non-derivative financial

instruments with fixed or determinable payments that

are not quoted on an active market, other than: (a)

those that the Group intends to sell immediately or in

the short term, which are classified as held for trading,

and those that the Group, upon initial recognition,

classifies at fair value through profit or loss; (b) those

that the Group, upon initial recognition, classifies as

available for sale; or (c) those for which the Group may

not recover substantially all of its initial investment, for

reasons other than deterioration in creditworthiness.

Held to maturity investments

Held to maturity investments are non-derivative

financial instruments with fixed or determinable

payments and a fixed maturity that the Group has the

positive intention and ability to hold to maturity.

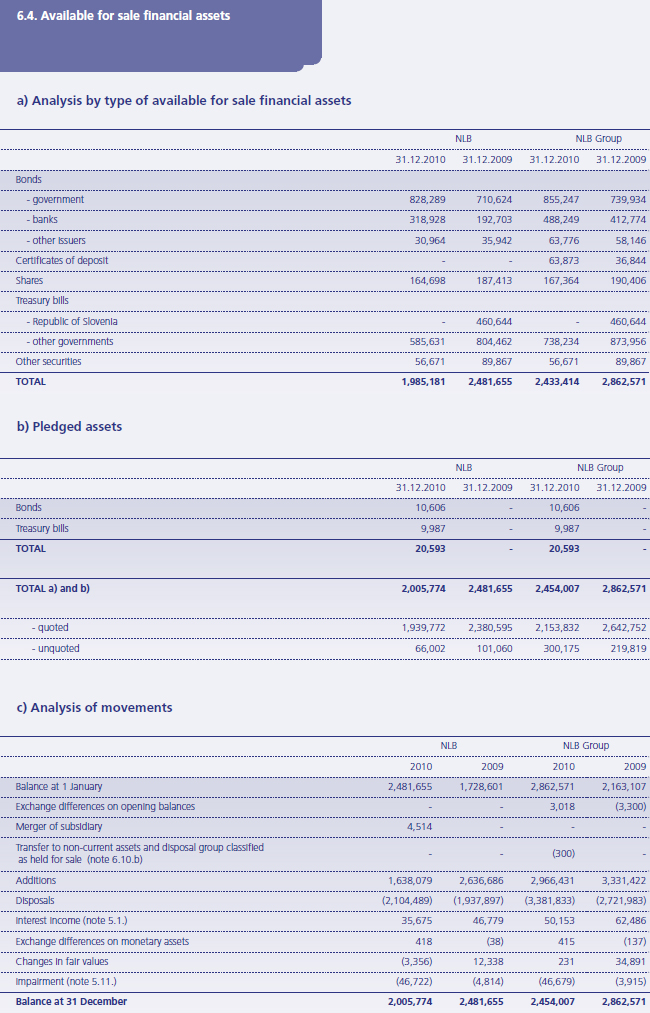

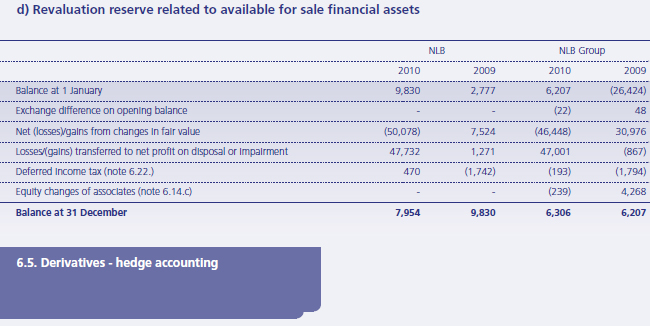

Available for sale financial assets

Available for sale financial assets are those intended to

be held for an indefinite period of time, which may be

sold in response to needs for liquidity or changes in

interest rates, exchange rates or equity prices.

b) Measurement and recognition

Financial assets are initially recognized at fair value plus

transaction costs for all financial assets not carried at

fair value through profit or loss.

Financial assets carried at fair value through profit and

loss are initially recognized at fair value, and

transaction costs are expensed in the income

statement.

Regular way purchases and sales of financial

instruments at fair value through profit or loss, and

instruments held to maturity and available for sale, are

recognized on the trading date. Loans and advances

are recognized when cash is advanced to the

borrowers.

Financial assets at fair value through profit or loss and

available for sale financial assets are subsequently

measured at fair value. Gains and losses from changes

in the fair value of financial assets at fair value through

profit or loss are included in the income statement in

the period in which they arise. Gains and losses from

changes in the fair value of available for sale financial

assets are recognized in other comprehensive income

until the financial asset is derecognized or impaired, at

which time the cumulative amount previously included

in other comprehensive income is recycled in the

income statement. However, interest calculated using

the effective interest rate method and foreign currency

gains and losses on monetary assets classified as

available for sale are recognized in the income

statement. Dividends on available for sale equity

instruments are recognized in the income statement

when the Group’s right to receive payment is

established.

Loans and held to maturity investments are carried at

amortized cost.

c) Day one gains or losses

The best evidence of fair value at initial recognition is

the transaction price (i.e. the fair value of the

consideration given or received), unless the fair value

of that instrument is evidenced by comparison with

other observable current market transactions in the

same instrument (i.e. without modification or

repackaging) or based on a valuation technique whose

variables include only data from observable markets.

If the transaction price on a non-active market is

different than the fair value from other observable

current market transactions in the same instrument or

is based on a valuation technique whose variables

include only data from observable markets, the

difference between the transaction price and fair value

is recognized immediately in the income statement

(“day one gains or losses”).

In cases where the data used for valuation is not fully

observable in financial markets, day one gains or losses

are not recognized immediately in the income

statement. The timing of recognition of deferred day

one gains or losses is determined individually. It is

either amortized over the life of the transaction,

deferred until the instrument’s fair value can be

determined using market observable inputs or realized

through settlement.

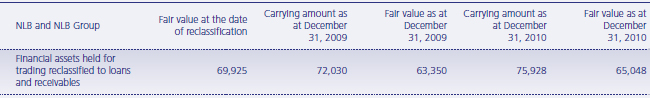

d) Reclassification

Financial assets that are eligible for classification as loans and advances can be reclassified out of the held for trading category if they are no longer held for the purpose of selling or repurchasing them in the near term. Financial assets that are not eligible for classification as loans and receivables may be transferred from the held for trading category only in rare circumstances. Additionally, instruments designated at fair value through profit and loss and held to maturity instruments cannot be reclassified.

e) Derecognition

A financial asset is derecognized when the contractual rights to the cash flows from the financial asset expire or the financial asset is transferred and transfer qualifies for derecognition. A financial liability is derecognized only when it is extinguished, i.e. when the obligation specified in the contract is discharged, cancelled or expires.

f) Fair value measurement principles

The fair value of financial instruments traded on active

markets is based on the current bid price at the

reporting date, excluding transaction costs. If there is

no active market, the fair value of the instruments is

estimated using discounted cash flow techniques or

pricing models.

If discounted cash flow techniques are used, estimated

future cash flows are based on management’s best estimates and the discount rate is a market based rate

at the reporting date for an instrument with similar

terms and conditions. If pricing models are used,

inputs are based on market based measurements at

the reporting date.

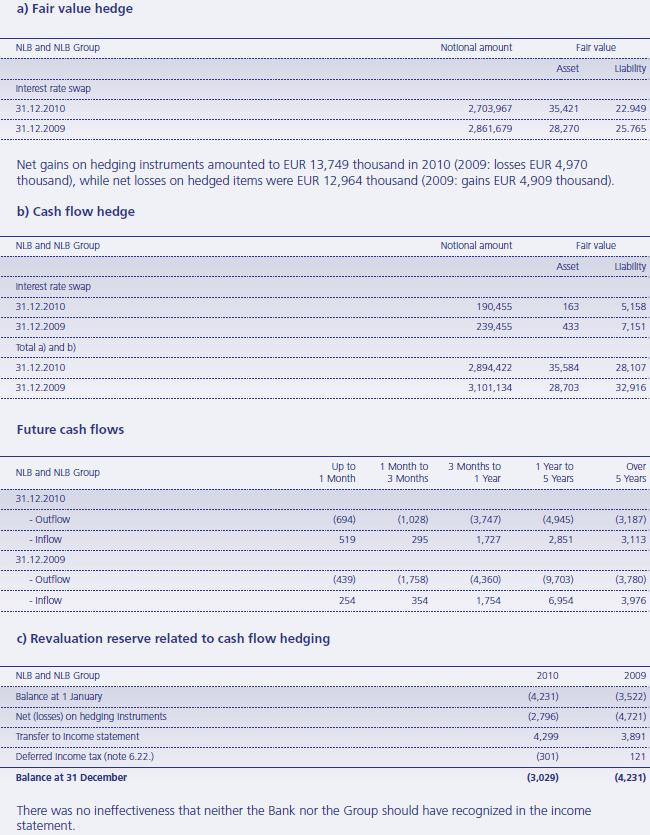

g) Derivative financial instruments and hedge accounting

Derivative financial instruments, including forward and

futures contracts, swaps and options, are initially

recognized in the statement of financial position at fair

value. Derivative financial instruments are subsequently

re-measured at their fair value. Fair values are obtained

from quoted market prices, discounted cash flow

models or pricing models, as appropriate. All

derivatives are carried at their fair value within assets

when the derivative position favorable to the Group,

and within liabilities when the derivative position

unfavorable to the Group. Changes in fair value are

determined on a clean-price basis.

The method of recognizing the resulting fair value gain

or loss depends on whether the derivative is

designated as a hedging instrument, and if so, the

nature of the item being hedged. The Group

designates certain derivatives as either:

- hedges of the fair value of recognized assets or liabilities or firm commitments (fair value hedge); or

- hedges of highly probable future cash flows attributable to a recognized asset or liability, or a highly probable forecasted transaction (cash flow hedge).

Hedge accounting is used for derivatives designated in

this way provided certain criteria are met.

The Group documents, at the inception of the

transaction, the relationship between hedged items

and hedging instruments, as well as its risk

management objective and strategy for undertaking

various hedge transactions. The Group also documents

its assessment, both at hedge inception and on an

ongoing basis, whether the derivatives that are used in

hedging transactions are highly effective in offsetting

changes in fair values or cash flows of hedged items.

The actual results of a hedge must always fall within a

range of 80% to 125%.

Fair value hedge

Changes in the fair value of derivatives that are

designated and qualify as fair value hedges are

recognized in the income statement, together with any

changes in the fair value of the hedged asset or liability

that are attributable to the hedged risk. Effective

changes in the fair value of hedging instruments and

related hedged items are reflected in “fair value

adjustments in hedge accounting” in the income

statement. Any ineffectiveness is recorded in “Gains

less losses on financial assets and liabilities held for

trading”.

If a hedge no longer meets the hedge accounting

criteria, the adjustment to the carrying amount of the

hedged item for which the effective interest rate

method is used is amortized to profit or loss over the

remaining period to maturity. The adjustment to the

carrying amount of a hedged equity security is

included in the income statement upon disposal of the

equity security.

Cash flow hedge

The effective portion of changes in the fair value of

derivatives that are designated and qualify as cash flow

hedges is recognized in other comprehensive income.

The gain or loss relating to the ineffective portion is

recognized immediately in the income statement in

“Gains less losses on financial assets and liabilities held

for trading”.

Amounts accumulated in equity are recycled as a

reclassification from other comprehensive income to

the income statement in the periods when the hedged

item affects profit or loss.

When a hedging instrument expires or is sold, or when

a hedge no longer meets hedge accounting criteria,

any cumulative gain or loss existing in other

comprehensive income and previously accumulated in

equity at that time remains in other comprehensive

income and in equity and is recognized in profit or loss

only when the forecasted transaction is ultimately

recognized in the income statement. When a

forecasted transaction is no longer expected to occur,

the cumulative gain or loss that was reported in other

comprehensive income is immediately transferred to

the income statement.

2.13. Impairment of financial assets

a) Assets carried at amortized cost

The Group assesses impairments of financial assets

individually for all individually significant assets where

there is objective evidence of impairment; all other

financial assets are impaired collectively. According to

the Regulation on credit risk loss assessment of the

Bank of Slovenia financial asset or off-balance sheet

liability is individually significant if total exposure to the

client exceeds 0.5% of bank’s equity. In years 2010

and 2009 all exposures to banks, all exposures to other

legal entities with A and B rating whose exposure

exceeds EUR 6,500 thousand, all legal entities rated C,

whose exposure exceeds EUR 500 thousand and all

exposures to D and E legal entities, whose exposure

exceeds EUR 10 thousand are considered individually

significant assets by the Bank. If the Group determines

that no objective evidence of impairment exists for an

individually assessed financial asset, it includes the

asset in a group of financial assets with similar credit

risk characteristic and collectively assesses them for

impairment.

The Group assesses at each reporting date whether

there is objective evidence that a financial asset or

group of financial assets is impaired. A financial asset

or group of financial assets is impaired and impairment

losses are incurred if, and only if, there is objective

evidence of impairment as a result of one or more

events that occurred after the initial recognition of the

asset and that event has an impact on the future cash

flows of the financial asset or group of financial assets

that can be reliably estimated.

The criteria that the Group uses to determine that

there is objective evidence of an impairment loss

include:

- delinquency in contractual payments of principal or interest;

- cash flow difficulties experienced by the borrower;

- breach of loan covenants or conditions;

- initiation of bankruptcy proceedings;

- deterioration of the borrower’s competitive position;

- deterioration in the value of collateral; and

- downgrading below investment grade level.

The estimated period between the occurrence of

problems, which prevent the client from paying his

obligations to the Group, and identification of these

problems by the Group varies from between three and

six months.

If there is objective evidence that an impairment loss

on loans and advances or held to maturity investment

has been incurred, the amount of the loss is measured

as the difference between the asset’s carrying amount

and the present value of estimated future cash flows.

The carrying amount of the asset is reduced through

an allowance account and the amount of the loss is

recognized in the income statement. The calculation of

the present value of the estimated future cash flows of

collateralized financial assets reflects the cash flows

that may result from foreclosure, less cost of obtaining

and selling the collateral. Off-balance sheet liabilities

are also assessed individually and where necessary

related provision are recognized as liabilities.

For the purpose of collective evaluation of impairment,

the Group uses migration matrices, which illustrate the

expected migration of customers between internal

rating classes. The probability of migration is assessed

on the basis of past years’ experience, i.e. annual

migration matrices for different types of customers.

These data may be adopted for the predicted future

trends since historic experience does not necessarily

reflect the actual economic movements. Exposures to

individuals are additionally analyzed with regard to

type of products. Based on the expected migration of

clients in D and E rating class and assessment of

average repayment rate for D and E rated customers,

the Group recognizes collective impairments.

If the amount of impairment subsequently decreases

due to an event occurring after the write down, the

reversal of the loss is recognized as a reduction in the

allowance for loan impairment.

When a loan is uncollectible, it is written off against

the related allowance for loan impairment. Such loans

are written off after all the necessary procedures have

been completed and the amount of the loss has been

determined. Subsequent recoveries of amounts

previously written off decrease the amount of the

provision for loan impairment in the income statement.

The objective criteria that the Group uses to determine

that a loan should be written off include:

- the debtor no longer performs his regular activities (termination of the legal entity);

- the Group holds no adequate collateral to be used for repayment; and

- judicial recovery proceedings have been concluded.

b) Assets classified as available for sale

The Group assesses at each reporting date whether

there is objective evidence that available for sale

financial assets are impaired. In the case of equity

investments classified as available for sale, a significant

or prolonged decline in the fair value of a security

below its cost is considered in determining whether

the assets are impaired. If any such evidence exists for

available for sale financial assets, the cumulative loss is

reclassified from other comprehensive income and

recognized in the income statement as an impairment

loss. Impairment losses recognized in the income

statement on equity instruments are not reversed

through the income statement; subsequent increases

in their fair value after impairment are recognized in

other comprehensive income.

If, in a subsequent period, the fair value of a debt

instrument classified as available for sale increases and

the increase can be objectively related to an event

occurring after the impairment loss was recognized,

the impairment loss is reversed through the income

statement.

The following factors are considered in determining

impairment losses on debt instruments:

- default or delinquency in interest or principal payments;

- liquidity difficulties of the issuer;

- breach of contract covenants or conditions;

- bankruptcy of the issuer;

- deterioration of economic and market conditions; and

- deterioration in the credit rating of the issuer below the acceptable level.

Impairment losses recognized in the income statement are measured as the difference between the carrying amount of the financial asset and its current fair value. The current fair value of the instrument is its market price or discounted future cash flows, when the market price is not obtainable.

c) Renegotiated loans

Loans that are subject to either collective or individual impairment assessment and whose terms have been renegotiated due to deterioration of the borrower’s financial position are no longer considered to be past due but are treated as new loans. Such loans continue to be discounted using the original effective interest rate. In subsequent years, the asset is disclosed as renegotiated loan only if renegotiated again.

d) Repossessed assets

In certain circumstances, assets are repossessed following the foreclosure on loans that are in default. Repossessed assets are initially recognized in the financial statements at their fair values and are sold as soon as practical in order to reduce exposure (note 7.1.j). After initial recognition, repossessed assets are measured and accounted for in accordance with the policies applicable for the relevant assets categories.

2.14. Offsetting

Financial assets and liabilities are offset and the net amount reported in the statement of financial position when there is a legally enforceable right to offset the recognized amounts and there is an intention to settle on a net basis, or to realize the asset and settle the liability simultaneously.

2.15. Sale and repurchase agreements

Securities sold under sale and repurchase agreements

(repos) are retained in the financial statements and the

counterparty liability is included in financial liabilities

associated with the transferred assets. Securities sold

subject to sale and repurchase agreements are

reclassified in the financial statements as pledged

assets when the transferee has the right by contract or

custom to sell or re-pledge the collateral. Securities

purchased under agreements to resell (reverse repos)

are recorded as loans and advances to other banks or

customers, as appropriate.

The difference between the sale and repurchase price

is treated as interest and accrued over the life of the

repo agreements using the effective interest rate

method.

2.16. Property and equipment

All items of property and equipment are initially

recognized at cost. They are subsequently measured at

cost less accumulated depreciation and any

accumulated impairment loss.

Each year, the Group assesses whether there are

indications that assets may be impaired. If any such

indication exists, the recoverable amounts are

estimated. The recoverable amount is the higher of the

fair value less costs to sell and value in use. If the

recoverable amount exceeds the carrying value, the

assets are not impaired. If the carrying amount exceeds

the recoverable amount, the difference is recognized

as a loss in the income statement.

Items of property and equipment, which do not

generate cash flows that are largely independent, are

included in cash generating unit and later tested for

possible impairment.

Depreciation is calculated on a straight-line basis over

the assets’ estimated useful lives. The following annual

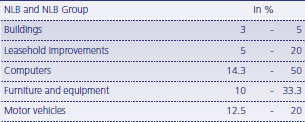

depreciation rates were applied:

Depreciation does not begin until the assets are

available for use.

The assets' residual values and useful lives are

reviewed, and adjusted if appropriate, on each

reporting date.

Gains and losses on the disposal of items of property

and equipment are determined as a difference

between the sale proceeds and their carrying amount,

and are recognized in the income statement.

Maintenance and repairs are charged to the income

statement during the financial period in which they are

incurred. Subsequent costs that increase future

economic benefits are recognized in the carrying

amount of an asset and the replaced part, if any, is

derecognised.

2.17. Intangible assets

Intangible assets include software licenses, goodwill

(note 2.6.) and customer relationships. Intangible

assets are stated at cost, less accumulated amortization

and impairment losses.

Amortization is calculated on a straight-line basis at

rates designed to write down the cost of intangible

asset over its estimated useful life. The core banking

system is amortized over a period of ten years, other

software over a period of three to five years and

customer relationships over a period of twelve to

fifteen years.

Amortization does not begin until the assets are

available for use.

2.18. Investment property

Investment property includes buildings held for leasing and not occupied by the Group. Investment property is stated at fair value determined by a certified appraiser. Fair value is based on current market prices. Any gain or loss arising from a change in fair value is recognized in the income statement. If there is a change in use due to the commencement of owner occupation, investment property is transferred to owner occupied property.

2.19. Non-current assets and disposal group classified as held for sale

Non-current assets and disposal group are classified as

held for sale if their carrying amount will be recovered

through a sale transaction rather than through

continuing use. This condition is deemed to be met

only when the sale is highly probable and the asset is

available for immediate sale in its present condition.

Management must be committed to the sale, which

should be expected to qualify for recognition as a

completed sale within one year from the date of

classification. Non-current assets and disposal group

classified as held for sale are measured at the lower of

the assets’ previous carrying amount and fair value less

costs to sell.

During subsequent measurement, certain assets and

liabilities of disposal group that are outside the scope of IFRS 5 measurement requirements are measured in

accordance with the applicable standards (e.g.

deferred tax assets, assets arising from employee

benefits, financial instruments, investment property

measured at fair value and contractual rights under

insurance contracts). Tangible and intangible assets are

not depreciated. The effects of sale and valuation are

included in the income statement as a gain or loss

from non-current assets held for sale.

Liabilities directly associated with disposal groups are

reclassified and presented separately in the statement

of financial position.

2.20. Accounting for leases

A lease is an agreement whereby the lessor conveys to

the lessee, in return for a payment or series of

payments, the right to use an asset for an agreed

period of time. Lease agreements are accounted for in

accordance with their classification as finance leases or

operating leases at the inception of the lease. The key

classification factor is the extent to which the risks and

rewards incidental to ownership of a leased asset lie

with the lessor or lessee.

The Group as lessee

Leases in which a significant portion of the risk and

rewards of ownership are retained by the lessor are

classified as operating leases. Payments made under

operating leases are charged to the income statement

on a straight-line basis over the period of the lease.

When an operating lease is terminated before the

lease period has expired, any payment required to be

made to the lessor by way of penalty is recognized as

an expense in the period in which termination takes

place.

Finance leases are recognized as an asset and liability

at amounts equal to the fair value of the leased asset

or, if lower, the present value of the minimum lease

payments. Leased assets are depreciated in accordance

with the Group’s policy over the shorter of the

estimated useful life of the asset and the lease term, if

there is no reasonable certainty that the Group will

obtain ownership by the end of the lease term. Lease

payments are apportioned between interest expenses

and the reduction of the outstanding liability so as to

produce constant periodic rate of interest on the

remaining balance of the liability.

The Group as lessor

Payments under operating leases are recognized as

income on a straight-line basis over the period of the

lease. Assets leased under operating leases are

presented in the statement of financial position as

investment property or as property and equipment.

The Group classifies a lease as a finance lease when

the risks and rewards incidental to ownership of a

leased asset lie with the lessee. When assets are leased

under a finance lease, the present value of the lease

payments is recognized as a receivable. Income from

finance lease transactions is amortized over primary

lease period using the effective interest rate method.

Finance lease receivables are recognized at an amount

equal to the net investment in the lease, including the

unguaranteed residual value.

Sale-and-leaseback transactions

The Group also enters into sale-and-leaseback

transactions (in which the Group is primarily a lessor),

under which the leased assets are purchased from and

then leased back to the lessee. These contracts are

classified as finance leases or operating leases,

depending on the contractual terms of the leaseback

agreement.

2.21. Cash and cash equivalents

For the purpose of the statement of cash flows, cash and cash equivalents comprise cash and balances with central banks, debt securities held for trading, loans to banks and debt securities not held for trading with an original maturity of up to 90 days.

2.22. Borrowings

Borrowings are initially recognized at fair value net of

transaction costs. Borrowings are subsequently stated

at amortized cost and any difference between the

amount initially recognized and the redemption value

is recognized in the income statement over the period

of the borrowings using the effective interest rate

method.

If the Group purchases its own debt, it is derecognized

from the statement of financial position. Any

difference between the carrying amount of the

purchased debt and the amount paid is recognized

immediately in the income statement.

2.23. Provisions

Provisions are recognized when the Group has a present legal or constructive obligation as a result of past events and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate of the amount of the obligation can be made.

2.24. Financial guarantees

Financial guarantees are contracts that require the

issuer to make specific payments to reimburse the

holder for a loss it incurs because a specific debtor fails

to make payments when due, in accordance with the

terms of debt instruments. Such financial guarantees

are given to banks, financial institutions and other

bodies on behalf of the customer to secure loans,

overdrafts and other banking facilities.

Financial guarantees are initially recognized at fair

value, which is normally evidenced by the fees

received. The fees are amortized to the income

statement over the contract term using the straightline

method. The Group’s liabilities under guarantees

are subsequently measured at the greater of:

- the initial measurement, less amortization calculated to recognize fee income over the period of guarantee; or

- the best estimate of the expenditure required to settle the obligation.

2.25. Inventories

Inventories are measured at the lower of cost and net realizable value. Cost is determined using the weighted average cost method.

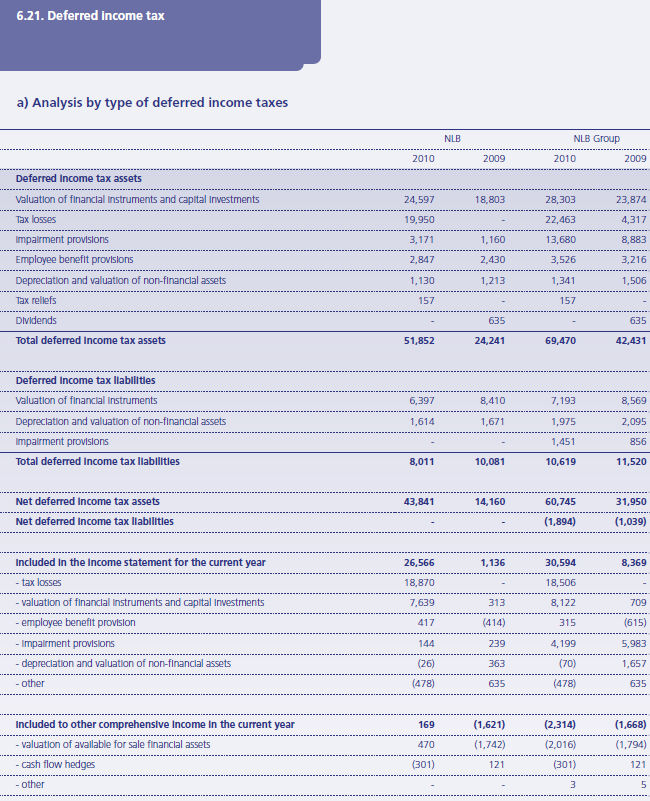

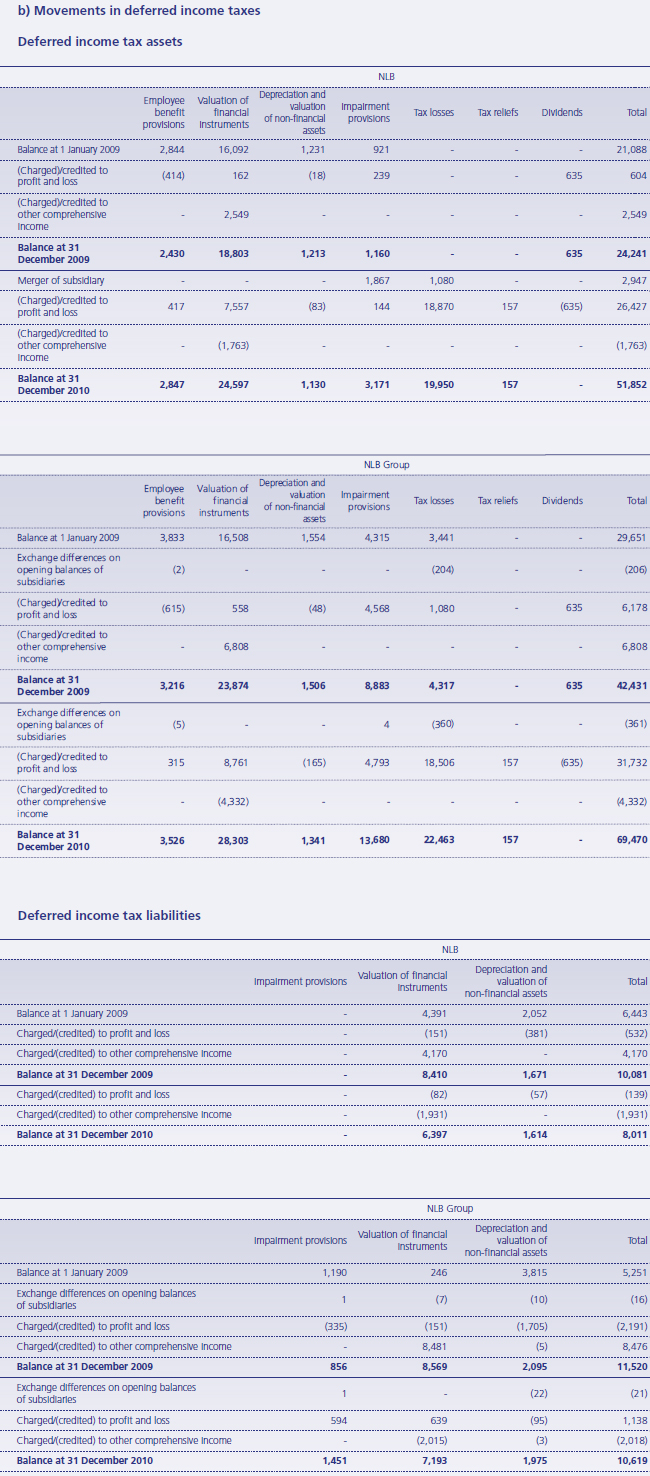

2.26. Taxes

Income tax in the Group is calculated on taxable profits

at the applicable tax rate in the respective jurisdiction.

The tax rate for 2010 in Slovenia is 20% (2009: 21%).

Deferred income tax is calculated, using the balance

sheet liability method, for all temporary differences

arising between the tax bases of assets and liabilities

and their carrying amounts for financial reporting

purposes.

Deferred tax assets are recognized if it is probable that

future taxable profit will be available against which the

temporary differences can be utilized.

Deferred tax related to the fair value re-measurement

of available for sale investments and cash flow hedges

is charged or credited directly to other comprehensive

income.

Deferred tax assets and liabilities are measured at tax

rates enacted or substantively enacted at the end of

the reporting period that are expected to apply to the

period when the asset is realized or the liability is

settled. At each reporting date, the Group reviews the

carrying amount of deferred tax assets and assesses

future taxable profits against which temporary taxable

differences can be utilized.

Deferred tax assets for temporary differences arising

from investments in subsidiaries, associates and joint

ventures are recognized only to the extent that it is

probable that:

- the temporary differences will be reversed in the foreseeable future; and

- taxable profit will be available.

In 2010, the Group recorded a net loss. The deferred tax assets recognized at December 31, 2010 are based on future profitability assumptions and business plans for future years. Tax assets may be adjusted in the event of changes to these assumptions.

2.27. Fiduciary activities

The Group provides asset management services to its

clients. Assets held in a fiduciary capacity are not

reported in the Group’s financial statements, as they

do not represent assets of the Group. Fee and

commission income charged for this type of service is

broken down by items in note 5.3.b). Further details

on transactions managed on behalf of third parties are

disclosed in note 6.29.

Based on the requirements of Slovenian legislation, the

Group has additionally disclosed in note 6.29. assets

and liabilities on accounts used to manage cash assets

from fiduciary activities, i.e. information related to the

receipt, processing and execution of orders and related

custody activities.

2.28. Employee benefits

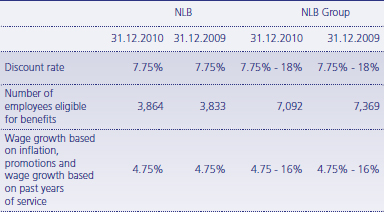

Employee benefits include jubilee long service benefits, retirement indemnity bonuses and termination benefits. Provisions for employee benefits are calculated by an independent actuary. The main assumptions included in the actuarial calculation are as follows:

According to legislation, employees retire after 35-40

years of service, when, if they fulfil certain conditions,

they are entitled to a lump-sum severance payment.

Employees are also entitled to a long service bonus for

every ten years of service.

These obligations are measured at the present value of

future cash outflows considering future salary

increases and then apportioned to past and future

employee service based on benefit plan terms and

conditions. All gains and losses arising from changes in

assumptions and experience adjustments are

recognized immediately in the income statement.

The Group pays contributions to the state pension

schemes according to the local legislation. The Bank

contributes 8.85% of gross salaries. Once

contributions have been paid, the Group has no

further obligation. Contributions constitute costs in the

period to which they relate and are disclosed in labor

costs in the income statement.

2.29. Share capital

Dividends on ordinary shares

Dividends on ordinary shares are recognized in equity

in the period in which they are approved by the Bank’s

shareholders.

Treasury shares

If the Bank or other member of the Group purchases

the Bank’s shares, the consideration paid is deducted

from total shareholders’ equity as treasury shares. If

such shares are subsequently sold, any consideration

received is included in equity. If the Bank's shares are

purchased by the Bank itself or other Group entities,

the Bank creates reserves for treasury shares in equity.

Share issue costs

Costs directly attributable to the issue of new shares

are recognized in equity as a reduction in the share

premium account.

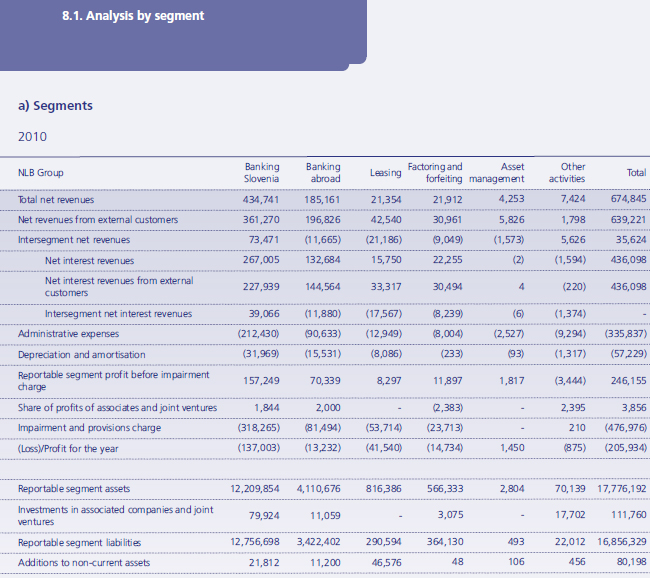

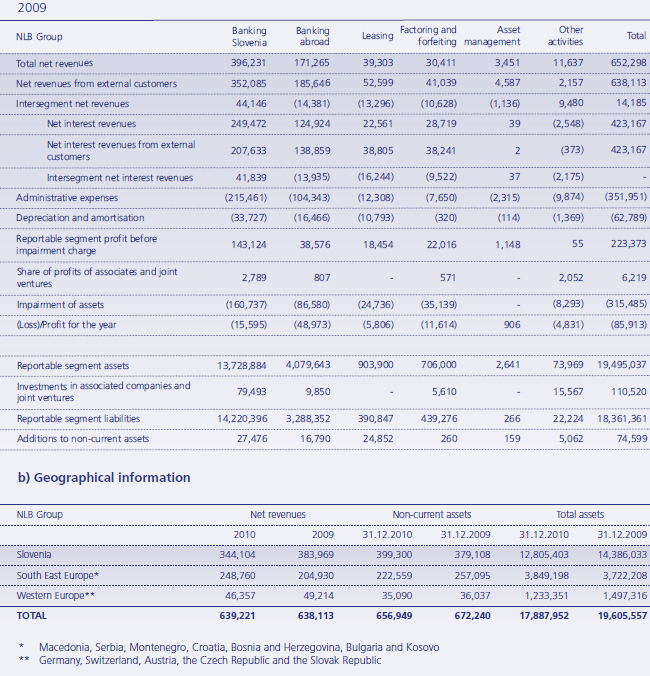

2.30. Segment reporting

Operating segments are reported in a manner

consistent with internal reporting to the executive

body, which makes decisions, regarding the allocation

of resources and assesses the performance of a specific

segment.

All transactions between business segments are

conducted on an arm’s length basis. Income and

expenses directly associated with each segment are

included in determining segment’s performance.

In accordance with IFRS 8, the Group has the following

reportable segments: banking Slovenia, banking

abroad, leasing, factoring and forfeiting, asset

management and other segments.

2.31. Critical accounting estimates and judgments in applying accounting policies

The Group's financial statements are influenced by accounting policies, assumptions, estimates and management judgement. The Group makes estimates and assumptions that affect the reported amounts of assets and liabilities within the next financial year. All estimates and assumptions required in conformity with IFRS are best estimates undertaken in accordance with the applicable standard. Estimates and judgements are evaluated on a continuing basis, and are based on part experience and other factors, including expectations with regard to future events.

a) Impairment losses on loans and advances

The Group reviews their loan portfolio to assess

impairment. In determining whether an impairment

loss should be recorded in the income statement,

Group verifies whether there are any data indicating

that there is a measurable decrease in the estimated

future cash flows from the portfolio of loans. This

evidence may include observable data indicating that

the solvency of borrowers has deteriorated or that

economic conditions and circumstances have

deteriorated. Future cash flows in a group of financial

assets are estimated based on past experience and

losses on assets with credit risk characteristics similar

to those assets in the group. Individual estimates are

based on projections of future cash flows taking into

account all relevant information regarding the financial

position and solvency of a borrower. Projected cash

flows are verified by an independent department. Lowvalue

exposures, including the majority of loans to

individuals, are verified collectively. The methodology

and assumptions used to estimate future cash flows

are reviewed regularly to reduce differences between

estimated and actual losses.

The Group uses a sensitivity analysis to assess the

impact of less probable negative events on

impairments and provisions. Results of the simulation

are based on the balance of loans and impairment as

at December 31, 2010 and provide an assessment of

required impairments within one year assuming the

realization of the defined scenario.

Stress test using transition matrices

In the scenario historical transition matrices for

financial institutions and other legal entities were used.

The matrices for legal entities were also used for

individuals. Exposure to the central government was

not subject to the stress test. The methodology used is

an extrapolation based on average transition matrices,

which were calculated for the period in which the

credit portfolio deteriorates. In addition, the transition

matrices were corrected in a manner that excludes the

possibility of client rating.

The scenario assumes that total credit exposure will

not change in the one year period and the rating

structure deterioration reflected through migration

matrices will require additional impairments. As a

result of the stress scenario the Bank will require

additional impairment of EUR 297 million and the

coverage of credit portfolio with impairments will

increase from 7.81% to 10.62%. For the Group the

same stress scenario results in an increase of

impairment by EUR 344 million and increase of the

coverage of credit portfolio with impairments from

8.62% to 10.25%.

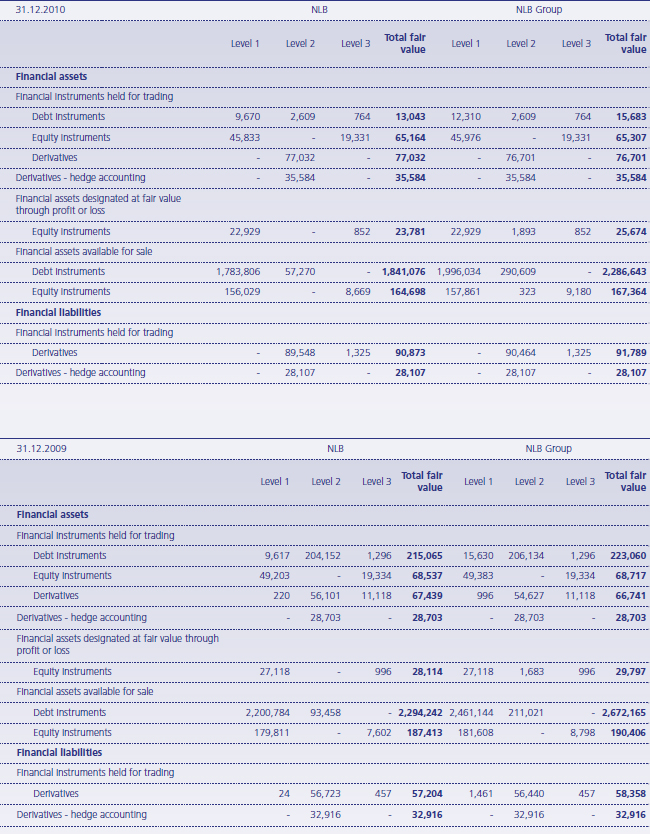

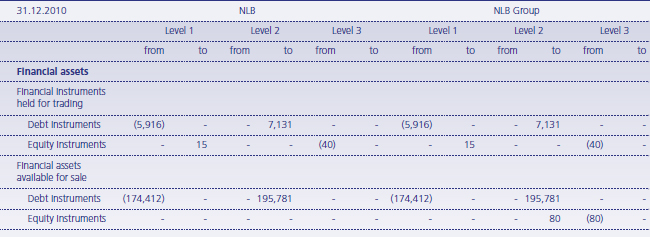

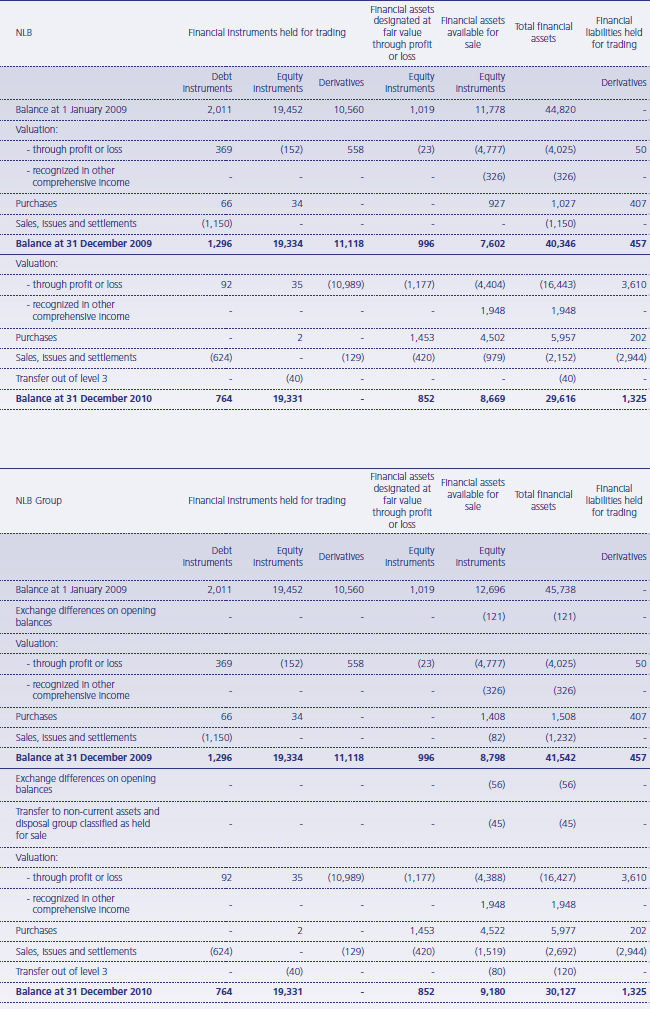

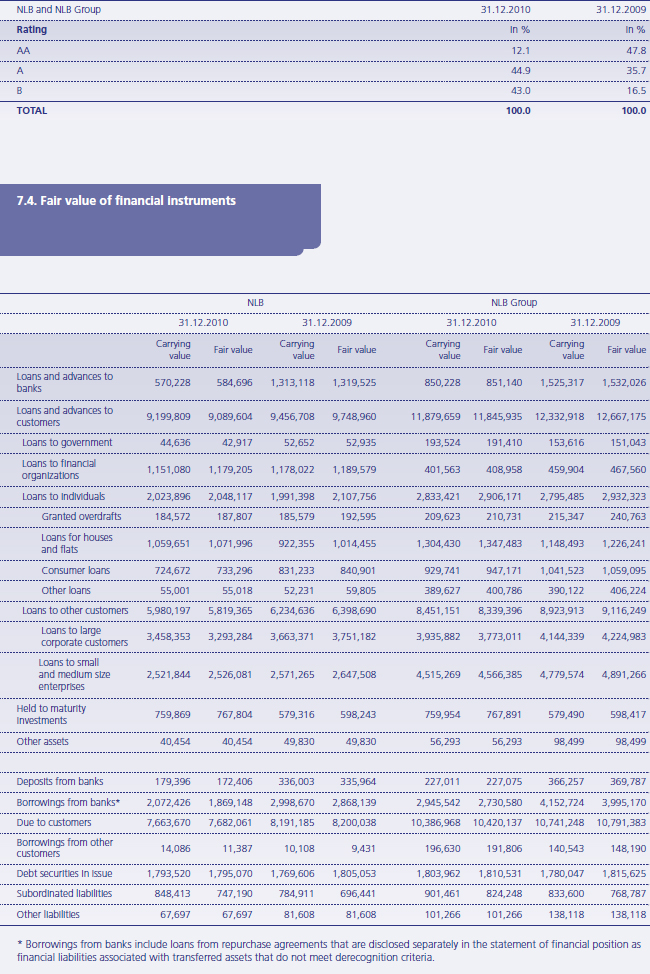

b) Fair value of financial instruments

The fair values of financial investments traded on the

active market are based on current bid prices (financial

assets) or offer prices (financial liabilities).

The fair values of financial instruments that are not

traded on the active market are determined by using

valuation models. These include a comparison with

recent transaction prices, the use of a discounted cash

flow model, valuation based on an option pricing

model and other frequently used valuation models.

These valuation models reflect current market

conditions at the measurement date, which may not

be representative of market conditions either before or

after the measurement date. Management reviewed

all applied models as at the reporting date to ensure

they appropriately reflect current market conditions,

including the relative liquidity of the market and

applied credit spread. Changes in assumptions

regarding these factors could affect the reported fair

values of financial instruments held for trading and

available for sale financial assets.

The fair values of derivative financial instruments are

determined on the basis of market data (mark-tomarket),

in accordance with the methodology for the

valuation of derivative financial instruments. The

market exchange rates, interest rates, yield and

volatility curves used in valuation are based on the

market snapshot principle. Market data is saved daily

at 4 p.m. and later used for the calculation of the fair

values (market value, NPV) of financial instruments.

The Group applies market yield curves for valuation.

c) Available for sale equity instruments

Available for sale equity instruments are impaired, if

there has been a significant or prolonged decline in

fair value below historical cost. The determination of

what is significant or prolonged is based on

assessments. In making these assessments, the Group

takes into account several factors, including share price

volatility. Impairment may also be indicated by

evidence regarding deterioration in the financial

position of the instrument issuer, deterioration in

sector performance, changes in technology, and a

decline in cash flows from operating and financing

activities.

Had all the declines in fair value below cost been

considered significant or prolonged, the Bank would

have incurred additional impairment losses of EUR 85

thousand (2009: EUR 18,728 thousand), while the

Group would have incurred additional impairment

losses of EUR 256 thousand (2009: EUR 19,144

thousand) from the reclassification from the statement

of comprehensive income to the income statement for

the current year.

d) Held to maturity instruments

The Group classifies non-derivative financial assets with fixed or determinable payments and a fixed maturity as held to maturity investments. Before making this classification, the Group assesses its intention and ability to hold such investments to maturity. If the Group is unable to hold these investments until maturity, it must reclassify the entire group to as available for sale financial assets. The investments would therefore be measured at fair value, resulting in an increase in the value of investments of EUR 7,937 thousand (December 31, 2009: increase by EUR 18,927 thousand) and a corresponding increase in other comprehensive income.

e) Impairment of investment in subsidiaries, associates and joint ventures

The process of identifying and assessing the impairment of goodwill and other intangible assets is inherently uncertain, as the forecasting of cash flows requires the significant use of estimates, which themselves are sensitive to the assumptions used. The review of impairment represents management's best estimate of the factors such as:

- Future cash flows from individual investments depend on estimated cash flow for those periods for which formal plans are available and on assumptions regarding sustainability of and growth in cash flows in the future. The cash flows used represent management's assessment of future performance at the time of testing.

- The discount rate derived from the capital asset pricing model and used to discount future cash flows is based on the cost of equity allocated to an individual investment. The discount rate reflects the impact of range of financial and economic variables, including the risk-free rate and risk premium. The value of variables used is subject to fluctuations outside management's control.

If recoverable amount is value in use, the discounted

cash flow method is used. When the recoverable

amount is fair value less costs to sell, the value was

determined based on binding offers and the estimated

liquidation value.

If the discount rates in the discounted cash flows

model differ by +/- 1%, the estimated value in use of

the equity investments would be lower in case of

increased discount rate by a maximum of EUR 6.5

million and in case of decreased discount rate the

value in use of equity investments would be higher by

a maximum of EUR 8.3 million.

f) Goodwill and other intangible assets

In the consolidated financial statements, goodwill and

other intangible assets are allocated to cash-generating

units (hereinafter: CGUs), which represent the lowest

level within the Group at which these assets are

monitored by management. Each Group entity

presents a separate CGU. The recoverable amount of

each CGU was determined based on value-in-use

calculations. The calculation of value in use is based on

cash flow projections in the three-year financial plans

approved by management. The Group performed a

test for impairment of goodwill and other intangible

assets at the end of the year for all subsidiaries.

Additional information regarding impairment testing of

goodwill and other intangible assets is disclosed in

note 6.13.

The goodwill for NLB Prishtina, Priština, represents

individually significant amount of goodwill in the

Group and amounts to EUR 9,738 thousand. When

testing for possible impairment, the following

assumptions were used: discount rate of 13%, growth

rate for residual value 3.5% p.a. and target capital

ratio of 17%. According to the test goodwill was not

impaired. If the discount rate increases by 1

percentage point, the recoverable amount of the

goodwill would be lower by EUR 2,803 thousand.

g) Taxes

The Group operates in countries governed by different laws. The deferred tax assets recognized at December 31, 2010 are based on profit forecasts for the next five-year period and take into account expected manner of recovery of the assets, that is, whether the value will be recovered through use, sale or liquidation. Changes in the assumptions as to the likely manner of recovery of assets could lead to the recognition of currently unrecognized deferred tax assets or to the derecognition of previously created deferred tax assets. Failure to meet profit forecasts could impact previously created deferred tax assets. The Group believes that this effect would be immaterial since the majority of deferred tax assets relates to tax losses which, in accordance with the Slovenian Corporate Income Tax Act, can be carried forward indefinitely.

2.32. Implementation of new and revised International Financial Reporting Standards

During the current year, the Group adopted all new

and revised standards and interpretations issued by the

International Accounting Standards Board (hereinafter:

the IASB) and the International Financial Reporting

Interpretations Committee (hereinafter: the IFRIC) that

are effective for accounting periods beginning on

January 1, 2010.

The following new standards and amendments to

existing standards were adopted early

- IAS 24 (amendment) - Related Party Disclosures (effective for annual periods beginning on or after January 1, 2011 with earlier application permitted). The revised standard simplifies the definition of a related party and provides a partial exemption from the disclosure requirements for government-related entities. If the exemption is applied, the entity shall disclose the nature and amount of each individually significant transaction. The amendment impacts presentation.

Accounting standards and amendments to existing standards effective for annual periods beginning on or after January 1, 2010 that were endorsed by EU and adopted by us

- IFRS 2 (amendment) - Group Cash-settled Sharebased Payment Transactions, Share-based Payment (effective for annual periods beginning on or after January 1, 2010). The amendments provide a clear basis to determine the classification of share-based payment awards in both consolidated and separate financial statements. The amendments incorporate into the standard the guidance in IFRIC 8 and IFRIC 11, which are withdrawn. The amendments expand on the guidance given in IFRIC 11 to address plans that were previously not considered in the interpretation. The amendments also clarify the defined terms in the Appendix to the standard. The amendment does not affect the Group’s financial statements.

- IAS 39 (amendment) – Financial instruments: Recognition and measurement – Eligible hedged items (effective for annual periods beginning on or after July 1, 2009 with earlier application permitted). The amendment provides guidance for two situations. With the designation of a one sided risk in a hedged item, IAS 39 concludes that a purchased option designated in its entirety as the hedging instrument of a one sided risk will not be perfectly effective. The designation of inflation as a hedged risk or portion is not permitted except in particular situations. The amendment does not significantly affect the Group’s financial statements.

- IFRIC 17 – Distributions of non-cash assets to owners (effective for annual periods beginning on or after July 1, 2009 with earlier application permitted). This addresses how the non-cash dividends distributed to shareholders should be measured. A dividend obligation is recognized when the dividend was authorized by the appropriate entity and is no longer at the discretion of the entity. This dividend obligation should be recognized at the fair value of the net assets to be distributed. The difference between the dividend paid and the amount carried forward of the net assets distributed should be recognized in profit and loss. The interpretation does not affect the Group’s financial statements.

- IFRIC 18 - Transfer of assets from customers (effective for annual periods beginning on or after July 1, 2009 with earlier application permitted). This clarifies how to account for transfer of items of property, plant and equipment by entities that receive such transfers from their customers. The interpretation also applies to agreements in which an entity receives cash from a customer when that amount of cash must be used only to construct or acquire an item of property, plant and equipment, and the entity must than use that item to provide the customer with ongoing access to supply of goods and or services. The interpretation does not affect the Group’s financial statements.

- IFRS 1 (amendment) - First-time Adoption of International Financial Reporting Standards (effective for the first IFRS financial statements for a period beginning on or after July 1, 2009). The revised IFRS 1 retains the substance of its previous version but within a changed structure in order to make it easier for the reader to understand and to better accommodate future changes. The amendment does not affect the Group’s financial statements.

- IFRS 1 (amendment) - Additional Exemptions for First-time Adopters, First-time Adoption of IFRS (effective for annual periods beginning on or after January 1, 2010). The amendments exempt entities using the full cost method from retrospective application of IFRSs for oil and gas assets and also exempt entities with existing leasing contracts from reassessing the classification of those contracts in accordance with IFRIC 4, 'Determining Whether an Arrangement Contains a Lease' when the application of their national accounting requirements produced the same result. The amendment does not affect the Group’s financial statements.

- Annual improvements to the IFRS 2009. The improvements consist of a mixture of substantive changes and clarifications. Amendments to IFRS 2, IAS 38, IFRIC 9 and IFRIC 16 are effective for annual periods beginning on or after July 1, 2009. Amendment in IFRS 2 clarifies, that contribution of business in common control transactions and formation of joint ventures are not within the scope of IFRS 2. IAS 38 is supplemented for measuring the fair value of an intangible asset, acquired in a business combination. Amendment in IFRIC 9 excludes embedded derivatives in contracts acquired in common control transaction and joint ventures from its scope. Amended IFRIC 16 removes the restriction that hedging instrument may not be hold by the foreign operation, that itself is being hedge. Amendments that are affective for annual periods beginning on or after January 1, 2010, with earlier application permitted are amendments to IFRS 5, IFRS 8, IAS 1, IAS 7, IAS 17, IAS 18, IAS 36 and IAS 39. IFRS 5 sets disclosure requirements for non-current assets or disposal groups classified as held for sale or discontinued operations. IAS 7 is amended, such that only expenditure which results in a recognized asset is eligible for classification as investing activities. IAS 17 permits the classification of certain long-term land leases as finance leases even without transfer of ownership of the land at the end of the lease. IAS 18 provides additional guidance for determining whether an entity acts as a principal or an agent. IAS 36 clarifies that a cash generating unit shall not be larger than an operating segment before aggregation. Amended IAS 39 includes in its scope option contracts that could result in business combinations, clarifies the period of reclassifying gains or losses on cash flow hedging instruments (if a hedged instrument is a forecast transaction) from other comprehensive income to profit or loss for the year and states that a prepayment option is closely related to the host contract if upon exercise the borrower reimburses economic loss of the lender. The amendments do not significantly affect the Group’s financial statements.

Accounting standards and amendments to existing standards effective for annual periods after January 1, 2010 that were endorsed by EU but not early adopted by us

- IAS 32 (amendment) - Classification of Rights Issues (effective for annual periods beginning on or after February 1, 2010). The amendment exempts certain rights issues of shares with proceeds denominated in foreign currencies from classification as financial derivatives. The amendment does not affect the Group’s financial statements.

- IFRIC 19 - Extinguishing Financial Liabilities with Equity Instruments (effective for annual periods beginning on or after July 1, 2010). This IFRIC clarifies the accounting when an entity renegotiates the terms of its debt with the result that the liability is extinguished through the debtor issuing its own equity instruments to the creditor. A gain or loss is recognized in profit or loss based on the fair value of the equity instruments compared to the carrying amount of the debt. The amendment does not affect the Group’s financial statements.

- IFRIC 14 (amendment) - Prepayments of a Minimum Funding Requirement (effective for annual periods beginning on or after January 1, 2011). This amendment will have a limited impact as it applies only to entities that are required to make minimum funding contributions to a defined benefit pension plan. It removes an unintended consequence of IFRIC 14 related to voluntary pension prepayments when there is a minimum funding requirement. The amendment does not affect the Group’s financial statements.

- IFRS 1 (amendment) - Limited Exemption from Comparative IFRS 7 Disclosures for First-time Adopters (effective for annual periods beginning on or after July 1, 2010). Existing IFRS preparers were exempt from presenting comparative information for the new disclosures required by the March 2009 amendments to IFRS 7, Financial Instruments: Disclosures. This amendment to IFRS 1 provides first-time adopters with the same transitional provisions as included in the amendment to IFRS 7. The amendment does not affect the presentation aspects.

- Annual improvements to IFRS 2010. The improvements consist of a mixture of substantive changes and clarifications and are affective for annual periods beginning on or after January 1, 2011, with earlier application permitted. IFRS 1 First-time Adoption of the IFRS and IFRIC 13 Customer Loyalty Programmes do not affect the Group’s financial statements. IAS 27 clarifies the transition rules for amendments to IAS 21, 28 and 31 made by the revised IAS 27 (as amended in January 2008). Amendments in IAS 34 refer to interim financial reporting and affect the presentation of the Group’s interim financial statement. Disclosure requirements in IFRS 7 emphasize the link between quantitative and qualitative disclosures regarding the nature and extent of financial risk and eliminates disclosures for renegotiated loans that would otherwise be past due or impaired, while disclosures regarding the fair value of collateral is replaced with a more general requirement, i.e. clarification of effect of collateral on mitigating the credit risk. Amendments to IFRS 3 require measurement of non-controlling interests at fair value, in certain cases provides guidance on an acquirer’s sharebased payment arrangements that were not replaced or were voluntarily replaced as a result of a business combination, and requires that the contingent considerations from business combinations that occurred before the effective date of revised IFRS 3 are calculated using the previous IFRS 3. The amendment in IAS 1 clarifies the requirements for the presentation and content of the statement of changes in equity. Reconciliation between the carrying amount at the beginning and the end of the period for each component of equity must be presented in the statement of changes in equity, but its content is simplified by allowing an analysis of other comprehensive income by item for each component of equity to be presented in the notes. The amendments do not significantly affect the Group’s financial statements.

Accounting standards and amendments to existing standards issued but not endorsed by EU:

- IFRS 9 - Financial Instruments IFRS 9 issued in

November 2009 replaces those parts of IAS 39

relating to the classification and measurement of

financial assets. IFRS 9 was further amended in

October 2010 to address the classification and

measurement of financial liabilities. Key features of

the standard are as follows:

- Financial assets are required to be classified into two measurement categories: those to be measured subsequently at fair value, and those to be measured subsequently at amortized cost. The decision is to be made at initial recognition. The classification depends on the entity’s business model for managing its financial instruments and the contractual cash flow characteristics of the instrument.

- An instrument is subsequently measured at amortized cost only if it is a debt instrument and both (i) the objective of the entity’s business model is to hold the asset to collect the contractual cash flows, and (ii) the asset’s contractual cash flows represent only payments of principal and interest (i.e. it bears only “basic loan features”). All other debt instruments are to be measured at fair value through profit or loss.

- All equity instruments are to be measured subsequently at fair value. Equity instruments that are held for trading will be measured at fair value through profit or loss. For all other equity investments, an irrevocable election can be made at initial recognition, to recognize unrealized and realized fair value gains and losses through other comprehensive income rather than profit or loss. There is to be no recycling of fair value gains and losses to profit or loss. This election may be made on an instrument-byinstrument basis. Dividends are to be presented in profit or loss, as long as they represent a return on investment.

- Most of the requirements in IAS 39 for classification and measurement of financial liabilities were carried forward unchanged to IFRS 9. The key change is that an entity will be required to present the effects of changes in own credit risk of financial liabilities designated as at fair value through profit or loss in other comprehensive income.

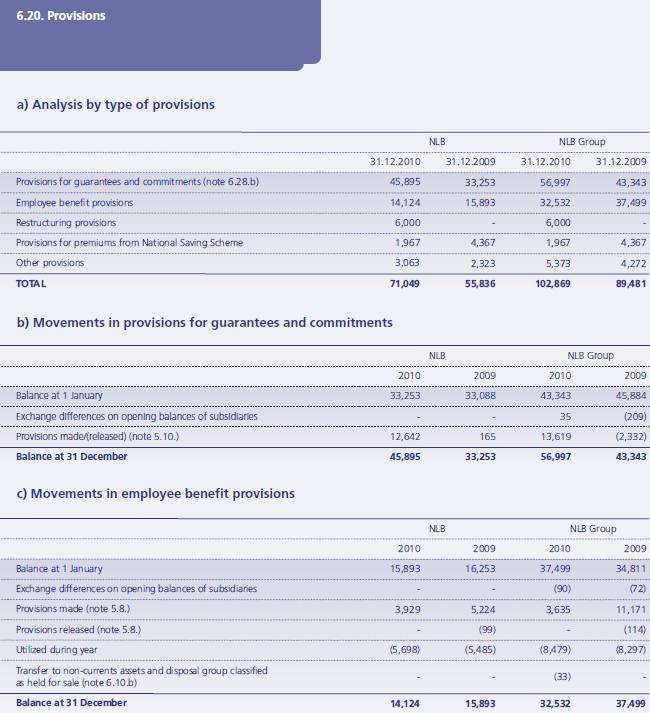

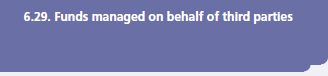

- Adoption of IFRS 9 is mandatory from January 1, 2013, while earlier adoption is permitted, but the EU has not yet endorsed it. The Group is considering the implications of the standard, the impact on the Group and the timing of its adoption.