NLB Group

Presentation

Presentation

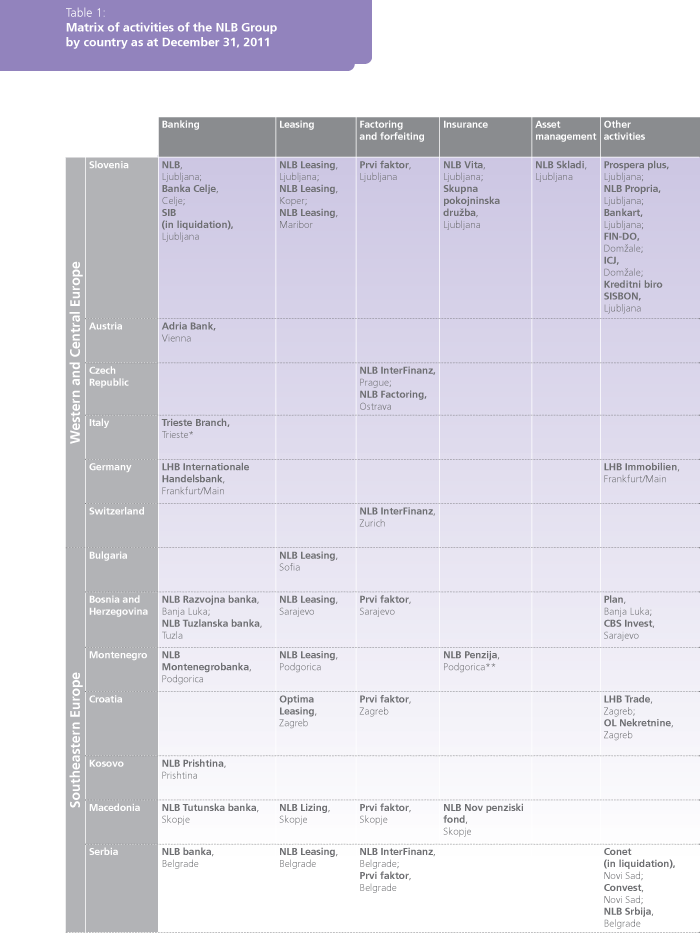

The NLB Group is the largest Slovenian banking and financial group. As at December 31, 2011, it comprised NLB and 47 banks and companies, and a branch and representative offices abroad. Banking is the NLB Group's most important activity, while the Group also provides other financial services, such as insurance, asset management, leasing, factoring and forfeiting.

- 11 banks and 1 branch abroad;

- 9 leasing companies;

- 10 factoring and forfeiting companies;

- 4 insurance companies;

- 1 asset management company; and

- 14 companies performing other activities.

Banking

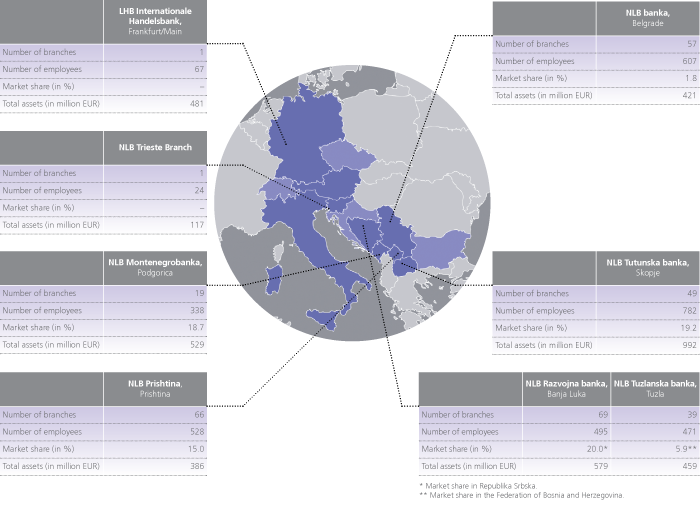

The NLB Group is a Slovenian banking and financial group that has given a great deal of attention over the last 10 years to expanding to the markets of SE Europe. The NLB Group is present in the banking sector on the following markets of SE Europe: Bosnia and Herzegovina, Macedonia, Serbia, Montenegro and Kosovo.

Bosnia and Herzegovina

The NLB Group operates in both entities, the Federation of Bosnia and Herzegovina and Republika Srpska.

NLB Razvojna banka is a full-service bank that is also registered for securities trading. It has the second largest business network in Republika Srpska. It is the largest bank in Republika Srpska in terms of the number of customers, and the second largest in terms of total assets.

NLB Tuzlanska banka is a full-service bank with over a hundred years of tradition in providing financial services in the Federation of Bosnia and Herzegovina. It is the fifth largest bank in the Federation of Bosnia and Herzegovina in terms of total assets.

Montenegro

NLB Montenegrobanka operates as a full-service commercial bank and has been owned by the NLB Group since 2003. In that time, it has become one of the most reputable and well-known banks in the country, and is the second largest bank in terms of total assets.

Macedonia

NLB Tutunska banka operates as a full-service commercial bank and is one of the most successful companies of the NLB Group. It has operated as part of the NLB Group since 2000. The bank targets retail customers, and small and medium-sized enterprises (SMEs). It is the third largest bank in the country in terms of total assets.

Serbia

NLB banka is a universal commercial bank that provides banking services to individuals, corporates, banks and international institutions. It ranks sixteenth in the country in terms of total assets.

Kosovo

The NLB Group has been present in Kosovo since the spring of 2007. NLB Prishtina is the third largest bank in Kosovo. It provides a solid foundation for comprehensive banking and financial services, and offers high-quality customer services on the emerging Kosovo banking market.

The NLB Group is also active in banking in certain European Union countries.

Germany

LHB Internationale Handelsbank operates as a bank specializing in operations with SE Europe. The bank was in the divestment process at the end of 2010 owing to a change in NLB's strategy. The NLB Group also operates in EU countries via the associated bank Adria Bank in Austria and the Trieste Branch in Italy.

The Trieste Branch, which operates as an NLB branch, transacts primarily with medium-sized enterprises from northern Italy that conduct business with Slovenia and Central and SE Europe. The bank has an office in Trieste.

Non-banking activities

Leasing

With 10 active companies, leasing represents an important activity for the NLB Group. The NLB Group's leasing activity was reorganized with the aim of adapting to the new market conditions and amended strategy, and optimizing operations. In addition to the restructuring of leasing companies on the markets of SE Europe, the reorganization of the leasing activity also included the merger of leasing companies in Slovenia (NLB Leasing Ljubljana, NLB Leasing Koper and NLB Leasing Maribor).

Leasing companies together employ 165 people. The Group’s leasing companies in Slovenia hold a 9.2% market share, placing them second in the country. The NLB Group also has a high market share in the leasing segment in Macedonia (28%) and Montenegro (17%).

Factoring and forfeiting

The NLB Group provides factoring and forfeiting services in Slovenia through the Prvi faktor Group. It also provides these services on the markets of SE Europe, in Switzerland, in the Czech Republic and in Slovakia.

NLB InterFinanz Zürich primarily provides forfeiting services, but also offers other commercial banking products.

NLB Factoring focuses mainly on factoring services (including the collection of receivables, administration and insurance) and on short-term and investment loans, and the financing of real estate and development activities. The company is in the process of divestment.

The NLB Group has a 50% stake in the companies of the Prvi faktor Group, (with SID banka owning the other 50%). Prvi faktor Group companies specialize in offering comprehensive factoring services (e.g. the purchase, insurance and management of receivables on the domestic and foreign markets). The largest company in the group is Prvi faktor Zagreb, which is also the leading factoring company in Croatia. The parent company, Prvi faktor Ljubljana, is a member of the international factoring association, Factor Chain International (FCI), while Prvi faktor Belgrade is part of the International Factoring Group (IFG).

Following a change in the Bank's strategy, factoring is no longer a strategic activity of the NLB Group. Thus, the divestment of equity holdings in existing factoring companies is planned in the future.

Asset management

The NLB Group has provided asset management services via NLB Skladi since 2004. The company is among the leading providers of investment fund management services in Slovenia. Its market share is 21.1% (in terms of mutual fund assets from non-privatization sources). In addition to the general advantages of mutual funds, NLB Skladi offers additional advantages, such as flexible savings plans, competitive commission rates and management costs in line with international standards, highly transparent investment policies, timely information for investors, and high-quality investor services provided by the NLB Group's banking network.

Life and pension insurance

The NLB Group provides life and pension insurance services.

NLB Vita, which is 50% owned by the NLB Group (the other 50% is owned by the Belgian KBC Group), offers life insurance products tailored to fit special needs and sold exclusively through the banking network. NLB Vita holds a 5.9% share of the Slovenian life insurance market.

Skupna pokojninska družba is an associate of the NLB Group, and is one of the leading providers of voluntary supplementary pension insurance in Slovenia. The company holds a 24.1% market share in terms of funds collected.

The NLB Group also provides pension insurance services in Macedonia, where NLB Nov penziski fond offers compulsory and voluntary pension insurance. It holds a 47.2% market share in terms of the number of participants in the compulsory pension fund, and a 32.5% share of the voluntary pension fund.

• • •

In 2010, NLB adopted a strategy that redefines the strategic markets and activities of the NLB Group. The Group's strategic markets remain certain countries of the former Yugoslavia, while NLB is withdrawing from other markets. The NLB Group has also changed its focus with respect to complementary banking services, with factoring and leasing becoming non-strategic activities.

In line with the aforementioned strategy, NLB has begun selling off its investments and activities on non-strategic markets. The expected result of these measures is organizational and financial consolidation, and the strengthening of the NLB Group's capital, which will facilitate increased focus on the markets and activities that proved most profitable and prospective in the past. NLB continues to search for synergies, to consolidate and to rationalize the operations of the NLB Group companies on these markets. A great deal of emphasis is placed on the further development of corporate governance, in particular through the continuation of the process of harmonizing business standards started in the past, and the transfer of know-how and best practices within the Group according to the "business line" system.

Activities in 2011 were in line with the Bank's new strategic objectives. In the scope of gradual withdrawal from non-strategic markets, the process of divestment on the Bulgarian market continues, with the sale of NLB Banka Sophia in July 2011 and the planned sale or liquidation of NLB Leasing Sofia. The voluntary liquidation of NLB Nova penzija was completed in March with the company's deletion from the Business Register of the Republic of Serbia on March 18, 2011. The liquidation of NLB Factor and NLB Tutunska broker was also completed in the final quarter of 2011 (the companies have not yet be deleted from the register).

Other non-strategic investments are also in the process of divestment. With the aim of divesting NLB InterFinanz, that company's 26.72% participating interest in NLB Tutunska banka was transferred to NLB in June 2011. The sale of equity holdings in Adria Bank and LHB Internationale Handelsbank was initiated in 2011, but is not yet complete. Alternative possibilities for divestment are being analyzed for companies that were not sold in the first round of the sales process.

NLB's purchase of NLB Leasing Sarajevo from NLB Leasing Ljubljana was entered in the companies register in February 2011 as part of the reorganization of the leasing activity within the NLB Group. Special project teams were established on the markets where leasing companies operate (e.g. Macedonia, Montenegro, Bosnia and Herzegovina and Slovenia) as part of the ongoing reorganization.

Capital increases were made at the following companies in 2011 to ensure an appropriate level of capital at NLB Group companies: NLB Serbia, NLB Leasing Sarajevo, NLB Factoring, Optima Leasing, Prvi faktor Sarajevo, NLB Nov penziski fond, NLB Leasing Maribor, NLB Razvojna banka, NLB Factor, NLB Leasing Ljubljana and LHB Internationale Handelsbank.