Klikpro

24/7

Access to the bank

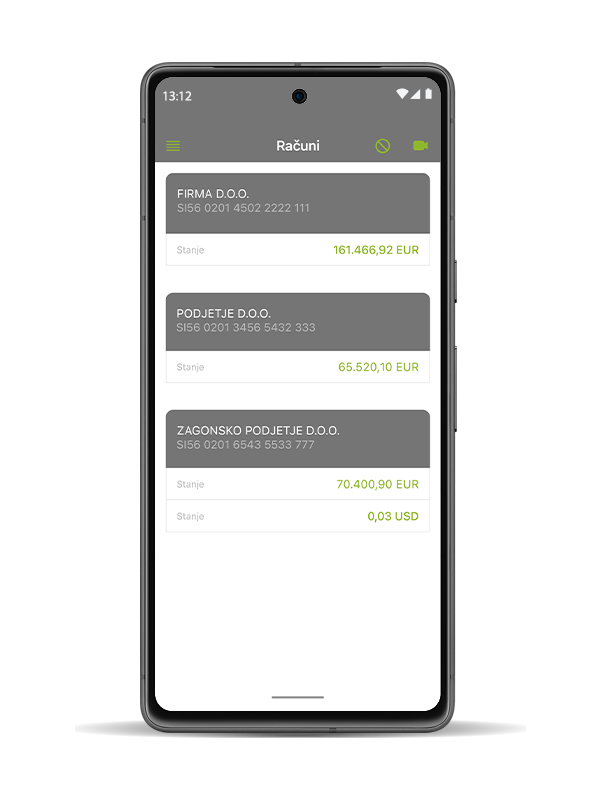

Klikpro is a mobile banking app that allows you to manage everyday banking tasks on your smartphone. It works on Apple iOS, Android and Huawei devices.

Is Klikpro suitable for my business?

If you want 24/7 insight into your financial operations, you’re in the right place.

Klikpro is designed for companies, entrepreneurs, sole proprietors and associations that hold an NLB Business Account. It can also be used by authorized company representatives.

You can make payments from all your business accounts in supported currencies by manually entering details (“Payment order”), scanning a QR code (“Scan and pay”), or repeating a previous transaction (“Repeat payment”).

You can schedule payments up to 180 days in advance. For completed payments, you can request an official Payment Confirmation in the Payment Archive.

The balance and transactions on your business cards include details of all payments made with the card.

If your card is lost or you suspect misuse, you can block it immediately by calling directly from the mobile banking app.

In the Financing section, you can apply for a quick loan or an overdraft on your business account in just a few minutes – without visiting a branch and with remote document signing.

In the Requests section, you can also submit general requests (loan, guarantee, invoice factoring, tax cash register, SMS Alarm, SMS Reminder, etc.).

Ordering an overdraft or a deposit is especially easy in the Balance Details section.

Through Sent Requests, you can view your submitted requests and track the status of active or completed ones.

The Requests section allows you to submit various predefined requests (loan, guarantee, invoice factoring, tax cash register, SMS Alarm, SMS Reminder, etc.).

Ordering an overdraft or a deposit is especially simple in the Balance Details section.

In the Sent Requests section, you can view your submitted requests and track the status of active or completed ones.

In the Document Archive section, you have access to key documents such as transaction account statements, business card statements, interest rate lists, and more.

Easy and free access to useful general information – even if you're not yet our client:

Locations of NLB ATMs, branches and business centres

Currency exchange and exchange rates for business needs

VAT calculator (price with or without VAT)

A demo video that shows you how it works

Bank contact information

Your security element is a one-time password (OTP) generator integrated into the mobile bank.

You activate it using a serial number (sent via email) and security codes (sent via SMS).

To activate the mobile bank, enter the serial number and security codes, and set your PIN.

After activation, you can access the mobile bank using:

your PIN

fingerprint (Touch ID for iOS or Fingerprint for Android)

facial recognition (Face ID for supported iOS devices – currently iPhone X and newer)

Technical requirements

To use the Klikpro mobile bank, your device must run a supported operating system.

We recommend using the latest versions that comply with required security standards.

Minimum supported operating systems:

Android 9

iOS 15

HarmonyOS 9

If your mobile device does not meet security standards (e.g. rooted or jailbroken, modified system settings), the NLB Klikpro app may not work.

Access will also be blocked if your device has malicious or potentially dangerous apps that allow remote access or pose a security risk.

Learn more about recommended browsers and operating systems.