Audited financial statements for NLB d.d.

Notes to financial statements

Notes to financial statements

1. GENERAL INFORMATION

Nova Ljubljanska banka d.d., Ljubljana ("the Bank" or "NLB") is incorporated in Slovenia as a joint stock company providing universal banking services. The largest shareholders of Nova Ljubljanska banka d.d. are the Republic of Slovenia, owning 33.10% of the shares, and KBC Bank N.V., Brussels ("KBC Bank"), owning 30.57% of the shares.

The address of its registered office is: Nova Ljubljanska banka d.d., Ljubljana, Trg republike 2, Ljubljana.

All amounts in the financial statements and in the notes to the financial statements are expressed in thousands of euros unless otherwise specified.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The principal accounting policies adopted for the preparation of the financial statements are set out below:

2.1. Statement of compliance

The financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as adopted by the European Union (EU).

Separate financial statements of the Bank have been prepared in addition to consolidated financial statements according to the requirements of local legislation.

The Bank has also prepared consolidated financial statements in accordance with IFRS as adopted by the EU for the Bank and its subsidiaries (the Group). In the consolidated financial statements, subsidiary undertakings, which are those companies in which the Group, directly or indirectly, has an interest of more than half of the voting rights or otherwise has the power to exercise control over the operations, have been fully consolidated. The consolidated financial statements can be obtained from the Bank’s registered office.

Users of these stand alone financial statements should read them together with the Group’s consolidated financial statements as at and for the year ended 31 December 2009 in order to obtain full information on the financial position, results of operations and changes in financial position of the Group as a whole.

2.2. Basis of preparation of financial statements

The financial statements have been prepared under the historical cost convention as modified by the revaluation of available for sale financial assets, financial assets and financial liabilities at fair value through profit or loss, including all derivative contracts and investment property.

The preparation of financial statements in conformity with IFRS requires the use of estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although these estimates are based on management’s best knowledge of current events and actions, actual results may ultimately differ from those estimates. Accounting estimates and underlying assumptions are reviewed on an ongoing basis. Revisions of accounting estimates are recognized in the period in which the estimate is revised Critical accounting estimates are disclosed in note 2.26.

The principal accounting policies applied in the preparation of these financial statements are set out below. These policies have been consistently applied to all the years presented.

2.3. Foreign currency translation

Functional and presentation currency

Items included in the financial statements are measured

using the currency of the primary economic environment

in which the Bank operates. The financial statements are

presented in euros, which is the Bank’s functional and

presentation currency.

Transactions and balances

Foreign currency transactions are translated into

functional currency at the exchange rates prevailing at

the dates of the transactions. Foreign exchange gains and

losses resulting from the settlement of such transactions

and from the translation of monetary assets and liabilities

denominated in foreign currencies are recognized in the

income statement, except when deferred in other

comprehensive income as qualifying cash flow hedges.

Translation differences resulting from changes in the amortized cost of monetary items denominated in foreign currency and classified as available for sale financial assets, are recognized in profit or loss.

Translation differences on non-monetary items, such as equities at fair value through profit or loss, are reported as part of the fair value gain or loss in the income statement. Translation differences on non-monetary items, such as equities classified as available for sale, are included in the revaluation reserve in other comprehensive income.

Gains and losses resulting from foreign currency purchases and sales for trading purposes are included in the income statement as gains less losses from financial assets and liabilities held for trading.

2.4. Interest income and expense

Interest income and expense are recognized in the income statement for all interest-bearing instruments on an accruals basis using the effective yield method. The effective interest rate method is a method of calculating the amortized cost of a financial asset or financial liability and of allocating the interest income or interest expense over the relevant period. The effective interest rate is the rate that exactly discounts estimated future cash payments or receipts through the expected life of the financial instrument or when appropriate, a shorter period to the net carrying amount of the financial asset or financial liability. Interest income includes coupons earned on fixed income investment and trading securities, accrued discounts and premiums on securities and interest from interest rate swaps. The calculation of effective interest rate includes all fees and points paid or received between parties to the contract and all transaction costs but does not consider future credit losses. Once a financial asset or a group of similar financial assets has been written down as a result of an impairment loss, interest income is recognized using the rate of interest used to discount the future cash flows for the purpose of measuring the impairment loss.

Interest income and expense from all financial assets and liabilities are disclosed as part of net interest income.

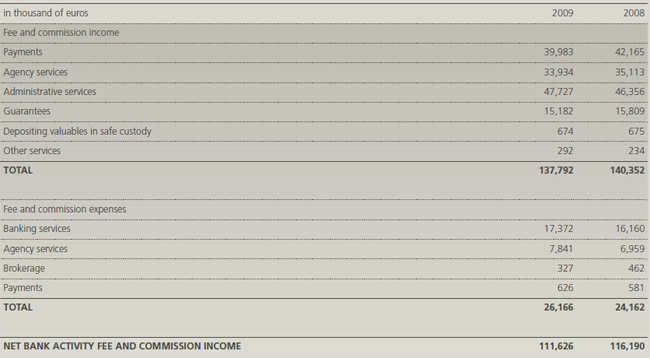

2.5. Fee and commission

Fees and commissions are generally recognized when the service has been provided. Fees and commissions consist mainly of fees received from payment services and from the managing of funds on behalf of legal entities and individuals, together with commissions from guarantees. Fees and commissions that are integral to the effective interest rate of financial assets and liabilities are presented within interest income or expense.

2.6. Dividend income

Dividends are recognized in the income statement when the Bank’s right to receive payment is established.

2.7. Financial instruments

a) Classification

Classification of financial instruments at initial recognition depends on instrument's characteristics and management intention. In general a bank follows the next criteria:

Financial instruments at fair value through profit or loss

This category has two sub-categories: financial

instruments held for trading and financial instruments

designated at fair value through profit or loss at

inception. A financial instrument is classified in this group

if acquired principally for the purpose of selling in the

short term or if so designated by management.

Derivatives are also categorized as held for trading unless they are designated as hedging instruments.

The Bank designates a financial instrument as at fair value through profit or loss when:

- It eliminates or significantly reduces a measurement or recognition inconsistency that would otherwise arise from measuring assets or liabilities on different basis or

- A group of financial assets, financial liabilities or both is managed and its performance is evaluated on fair value basis, in accordance with documented risk management or investment strategy, and information about the group is provided internally on that basis to the Bank’s key management or

- A financial instrument contains one or more embedded derivatives that can significantly modify the cash flows otherwise required by the contract.

Loans and receivables

Loans and receivables are non-derivative financial

instruments with fixed or determinable payments that are

not quoted in an active market, other than: (a) those that

the Bank intends to sell immediately or in the short term,

which are classified as held for trading, and those that

the Bank upon initial recognition designates as at fair

value through profit or loss; (b) those that the Bank upon

initial recognition designates as available for sale; or (c)

those for which the Bank may not recover substantially all

of its initial investment, other than because of credit

deterioration.

Held to maturity investments

Held to maturity investments are non-derivative financial

instruments with fixed or determinable payments and

fixed maturity that the Bank has the positive intention

and ability to hold to maturity.

Available for sale financial assets

Available for sale financial assets are those intended to be

held for an indefinite period of time, which may be sold

in response to needs for liquidity or changes in interest

rates, exchange rates or equity prices.

b) Measurement and recognition

Financial assets are initially recognized at fair value plus transaction costs for all financial assets not carried at fair value through profit or loss.

Financial assets carried at fair value through profit and loss are initially recognized at fair value, and transaction costs are expensed in the income statement.

Regular way purchases and sales of financial instruments at fair value through profit or loss, held to maturity and available for sale, are recognized on trade date. Loans are recognized when cash is advanced to the borrowers. All other purchases and sales are recognized as derivative forward transactions until settlement.

Financial assets at fair value through profit or loss and financial assets available for sale are subsequently measured at fair value. Gains and losses from changes in the fair value of the financial assets at fair value through profit or loss are included in the income statement in the period in which they arise. Gains and losses from changes in the fair value of available for sale financial assets are recognized in other comprehensive income until the financial asset is derecognized or impaired, at which time the effect previously included in other comprehensive income is recognized in the income statement. However, interest calculated using the effective interest method and foreign currency gains and losses on monetary assets classified as available for sale are recognized in the income statement. Dividends on available for sale equity instruments are recognized in the income statement when the Bank’s right to receive payment is established.

Loans and held to maturity investments are carried at amortized cost.

c) Day one profit

The best evidence of fair value at initial recognition is the transaction price (that is, the fair value of the consideration given or received), unless the fair value of that instrument is evidenced by comparison with other observable current market transactions in the same instrument (that is, without modification or repackaging) or based on a valuation technique whose variables include only data from observable markets.

Where the transaction price in a non-active market is different to the fair value from other observable current market transactions in the same instrument or is based on a valuation technique whose variable include only data from observable markets, the Bank recognizes the difference between the transaction price and fair value in the income statement (day one profit or loss). In cases where the data used for valuation is not “fully marketable” day one profits are not recognized.

The timing of recognition of deferred day one profit and loss is determined individually. It is either amortised over the life of transaction, deferred until the instrument’s fair value can be determined using market observable inputs, or realised through settlement.

d) Reclassification

Financial assets that are eligible for classification as loans and receivables can be reclassified out of held for trading category if they are no longer held for the purpose of selling or repurchasing them in the near term. Financial assets that are not eligible for classification as loans and receivables, may be transferred from held for trading category only in rare circumstances. Additionally instruments designated at fair value trough profit and loss and instruments held to maturity cannot be reclassified.

e) Derecognition

A financial asset is derecognized when the contractual rights to the cash flows from the financial asset expire or the financial asset is transferred and transfer qualifies for derecognition. A financial liability is derecognized only when it is extinguished - i.e. when the obligation specified in the contract is discharged, cancelled or expires.

f) Fair value measurement principles

The fair value of quoted financial instruments in active markets is based on current bid price at the balance sheet date excluding transaction costs. If there is no active market, the fair value of the instruments is estimated using discounted cash flow techniques or pricing models.

Where discounted cash flow techniques are used, estimated future cash flows are based on the management’s best estimates and the discount rate is a market-related rate at the balance sheet date for an instrument with similar terms and conditions. Where pricing models are used, inputs are based on market related measures at the balance sheet date.

g) Derivative financial instruments and hedge accounting

Derivative financial instruments, including forward and futures contracts, swaps and options, are initially recognized on the balance sheet at fair value. Derivative financial instruments are subsequently remeasured at their fair value. Fair values are obtained from quoted market prices, discounted cash flow models or pricing models, as appropriate. All derivatives are carried at their fair value within assets when favorable to the Bank, and within liabilities when unfavorable to the Bank. Changes in fair value are determined on a clean price basis. Interest accruals are recorded separately from fair value measurement.

The method of recognizing the resulting fair value gain or loss depends on whether the derivative is designated as a hedging instrument, and if so, the nature of the item being hedged. The Bank designates certain derivatives as either:

- Hedges of the fair value of recognized assets or liabilities or firm commitments (fair value hedge) or

- Hedges of highly probable future cash flows attributable to a recognized asset or liability, or a forecasted transaction (cash flow hedge).

Hedge accounting is used for derivatives designated in this way provided certain criteria are met.

The Bank documents, at the inception of the transaction, the relationship between hedged items and hedging instruments, as well as its risk management objective and strategy for undertaking various hedge transactions. The Bank also documents its assessment, both at hedge inception and on an ongoing basis, of whether the derivatives that are used in hedging transactions are highly effective in offsetting changes in fair values or cash flows of hedged items. Actual results of the hedge must always fall within a range of 80 – 125 percent.

Fair value hedge

Changes in the fair value of derivatives that are

designated and qualify as fair value hedges are

recognized in the income statement, together with any

changes in the fair value of the hedged asset or liability

that are attributable to the hedged risk. Effective changes

in fair value of hedging instruments and related hedged

items are reflected in “fair value adjustments in hedge

accounting”. Any ineffectiveness is recorded in “Gains

less losses on financial assets and liabilities held for

trading”.

If the hedge no longer meets the criteria for hedge accounting, the adjustment to the carrying amount of a hedged item for which the effective interest method is used is amortized to profit or loss over the period to maturity and recorded as net interest income. The adjustment to the carrying amount of a hedged equity security is included in the income statement when the equity security is disposed of as part of the gain or loss on the sale.

Cash flow hedge

The effective portion of changes in the fair value of

derivatives that are designated and qualify as cash flow

hedges is recognized in other comprehensive income. The

gain or loss relating to the ineffective portion is recognized

immediately in the income statement – “Gains less losses

on financial assets and liabilities held for trading”.

Amounts accumulated in equity are recognized in the income statement in the periods when the hedged item affects profit or loss.

When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria for hedge accounting, any cumulative gain or loss existing in other comprehensive income at that time remains in other comprehensive income and is recognized when the forecasted transaction is ultimately recognized in the income statement. When a forecasted transaction is no longer expected to occur, the cumulative gain or loss that was reported in other comprehensive income is immediately transferred to the income statement.

Derivatives that do not qualify for hedge accounting

Certain derivative instruments do not qualify for hedge

accounting. Changes in the fair value of such derivative

instruments are recognized immediately in the income

statement within ”Gains less losses on financial assets

and liabilities held for trading”.

2.8. Impairment of financial assets

a) Assets carried at amortized cost

On each reporting date the Bank assesses whether there is objective evidence that a financial asset or group of financial assets is impaired. A financial asset or group of financial assets is impaired and impairment losses are incurred if, and only if, there is objective evidence of impairment as a result of one or more events that occurred after the initial recognition of the asset and that event has an impact on the future cash flows of the financial asset or group of financial assets that can be reliably estimated.

The criteria that the Bank uses to determine that there is objective evidence of an impairment loss include:

- Delinquency in contractual payments of principal or interest,

- Cash flow difficulties experienced by the borrower,

- Breach of loan covenants or conditions,

- Initiation of bankruptcy proceedings,

- Deterioration of the borrower’s competitive position,

- Deterioration in the value of collateral and

- Downgrading below investment grade level.

The estimated period between a loss occurring and its identification is determined by management for each identified portfolio. In general, the periods used vary between three and six months.

If there is objective evidence that an impairment loss on loans and receivables or held to maturity investment has been incurred, the amount of the loss is measured as the difference between the asset’s carrying amount and the present value of estimated future cash flows discounted at the financial asset’s original effective interest rate. The carrying amount of the asset is reduced through an allowance account and the amount of the loss is recognized in the income statement. If a loan or held to maturity investment has a variable interest rate, the discount rate for measuring any impairment loss is the current effective interest rate determined under the contract.

Calculating the present value of the estimated future cash flows of collateralized financial assets reflects the cash flows that may result from foreclosure, less the cost of obtaining and selling the collateral, whether or not foreclosure is probable.

To collectively evaluate impairment, the Bank uses migration matrices, which show expected migration of customers between internal rating classes. The probability of migration is assessed on the basis of past years’ experience, that is annual migration matrices for different types of customers. Exposures to individuals are additionally analyzed with regard to type of products. Based on the migration matrices and assessment of average repayment rate for D and E rated customers, the Bank recognizes impairment losses also for clients that currently show no signs of impairment, but on the basis of past experience the Bank justifiably estimates that some losses have already incurred.

If the amount of the impairment subsequently decreases due to an event occurring after the write down, the reversal of loss is recognized as a reduction of an allowance for loan impairment.

When a loan is uncollectible, it is written off against the related allowance for loan impairment. Such loans are written off after all the necessary procedures have been completed and the amount of the loss has been determined. Subsequent recoveries of amounts previously written off decrease the amount of the provision for loan impairment in the income statement.

Objective criteria that the Bank uses to determine that a loan should be written off include:

- The debtor no longer performs his regular activities (termination of the legal entity),

- The Bank holds no adequate collateral to be used for repayment and

- Judicial recovery proceeding have concluded

b) Assets classified as available for sale

The Bank assesses at each reporting date whether there is objective evidence that financial assets available for sale are impaired. In the case of equity investments classified as available for sale, a significant or prolonged decline in the fair value of security below its cost is considered in determining whether the assets are impaired. If any such evidence exists for available for sale financial assets, the cumulative loss is removed from equity and recognized in the income statement as an impairment loss. Impairment losses recognized in the income statement on equity instruments are not reversed through the income statement; subsequent increases in their fair value after impairment are recognized in other comprehensive income.

If, in a subsequent period, the fair value of a debt instrument classified as available for sale increases and the increase can be objectively related to an event occurring after the impairment loss was recognized, the impairment loss is reversed through the income statement.

Bank considers the following factors in determining impairment losses on debt instruments:

- Default or delinquency in interest or principle payments,

- Liquidity difficulties of the issuer,

- Breach of contract covenants or conditions,

- Bankruptcy of the issuer,

- Deterioration of economic and market conditions and

- Deterioration in the credit rating of the issuer (bellow the acceptable level).

Impairment losses recognized in the income statement are measured as the difference between the carrying amount of the financial asset and its current fair value. Current fair value of the instrument is represented by its market price or discounted future cash flows, when the market price is not obtainable.

c) Renegotiated loans

Loans that are either subject to collective impairment assessment or individually significant and whose terms have been renegotiated due to deterioration of the borrower’s financial position are no longer considered to be past due but are treated as new loans. Such loans continue to be discounted using the original effective interest rate. In subsequent years, the asset is considered to be past due and disclosed only if renegotiated.

d) Repossessed property

In certain circumstances, property is repossessed following the foreclosure on loans that are in default. Repossessed properties are initially recognized in the financial statements at their fair values and are sold as soon as practicable in order to reduce outstanding indebtedness (note 6.1.i). After initial recognition they are measured at fair value.

2.9. Offsetting

Financial assets and liabilities are offset and the net amount reported in the statement of financial position when there is a legally enforceable right to set off the recognized amounts and there is an intention to settle on a net basis, or to realize the asset and settle the liability simultaneously.

2.10. Sale and repurchase agreements

Securities sold under sale and repurchase agreements (repos) are retained in the financial statements and the counterparty liability is included in financial liabilities associated to the transferred assets. Securities sold subject to sale and repurchase agreements are reclassified in the financial statements as pledged assets when the transferee has the right by contract or custom to sell or repledge the collateral. Securities purchased under agreements to resell (reverse repos) are recorded as loans and advances to other banks or customers, as appropriate.

The difference between the sale and repurchase price is treated as interest and accrued over the life of the repo agreements using the effective interest rate method.

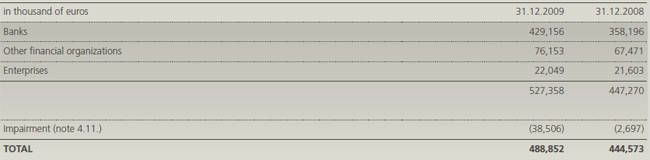

2.11. Investments in subsidiaries, associated and jointly controlled companies

Investments in subsidiaries, associated and jointly controlled companies are accounted for using the cost method.

Under the cost method the investor recognizes a dividend from subsidiary, jointly controlled entity or associate in profit or loss when its right to receive the dividend is established.

2.12. Property and equipment

All property and equipment is initially recognized at cost. Subsequently it is measured at cost less accumulated depreciation and any accumulated impairment loss.

Each year the Bank assesses whether there are indications that assets may be impaired. If any such indication exists, the Bank estimates the recoverable amount. The recoverable amount is the higher of net selling price and value in use. If the recoverable amount exceeds the carrying value, the assets are not impaired. If the recoverable amount is below the carrying value, the difference is recognized as a loss in the income statement.

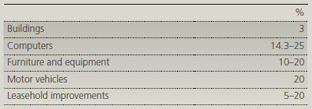

Depreciation is provided on a straight-line basis over their estimated useful lives. The following are approximations of the annual rates used:

Assets in the course of transfer or construction are not depreciated until they are available for use.

The assets' residual values and useful lives are reviewed, and adjusted if appropriate, on each balance sheet date.

Gains and losses on disposal of property and equipment are determined by reference to their carrying amount and are taken into account in determining operating profit. Maintenance and repairs are charged to the income statement during the financial period in which they are incurred.

Day-to-day servicing costs are recognized in profit or loss as incurred. Subsequent costs that increase future economic benefits are recognized in the carrying amount of an asset.

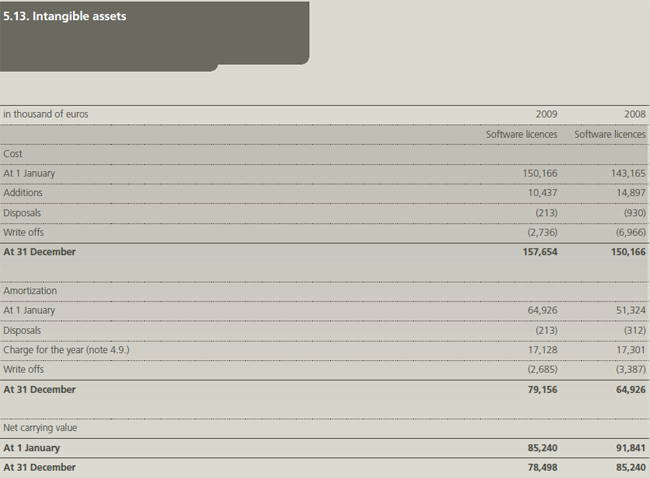

2.13. Intangible assets

Intangible assets, which relate solely to software licenses, are stated at cost, less accumulated amortization and impairment losses.

Amortization is provided on a straight-line basis at rates designed to write off the cost of software over its estimated useful life. Core banking systems are amortized over a period of 10 years and other software over a period of three to five years.

Assets in the course of transfer or construction/implementation are not amortized until they are available for use.

2.14. Investment property

Investment property includes buildings held for rental yields and not occupied by the Bank. Investment property is stated at fair value determined by an independent registered valuer. Fair value is based on current market prices. Any gain or loss arising from a change in fair value is recognized in the income statement. If there is a change in use due to the commencement of owner occupation, investment property is transferred to owner occupied property.

2.15. Non-current assets held for sale

Non-current assets are classified as held for sale if their carrying amount will be recovered through a sale transaction rather than through continuing use. This condition is regarded as met only when the sale is highly probable and the asset is available for immediate sale in its present condition. Management must be committed to the sale, which should be expected to qualify for recognition as a completed sale within one year from the date of classification. Non - current assets classified as held for sale are measured at the lower of the assets’ previous carrying amount and fair value less costs to sell. The effects of sale and valuation are included in the income statement as profit or loss from non - current assets held for sale.

2.16. Accounting for leases

• Where the Bank is the lessee

Leases in which a significant portion of the risks and rewards of ownership are retained by the lessor are classified as operating leases. Payments made under operating leases are charged to the income statement on a straight-line basis over the period of the lease. When an operating lease is terminated before the lease period has expired, any payment required to be made to the lessor by way of penalty is recognized as an expense in the period in which termination takes place.

Leases of property and equipment where the Bank has substantially all of the risks and rewards of ownership are classified as finance leases. Financial leases are recognized as an asset and liability at amounts equal to the fair value of the leased asset or, if lower, the present value of the minimum lease payments. Leased assets are depreciated over the shorter of the estimated useful life of the asset and the lease term, if there is no reasonable certainty that the Bank will obtain ownership by the end of the lease term. Lease payments are apportioned between finance charge and the reduction of the outstanding liability.

At the moment the Bank has no assets held under finance lease.

• Where the Bank is the lessor

All leases in which the Bank is the lessor are operating leases. Payments are recognized as an income on a straight-line basis over the period of the lease. Assets leased under operating leases are presented in the statement of financial position as an investment property.

2.17. Cash and cash equivalents

For the purpose of the cash flow statement, cash and cash equivalents comprise cash and balances with the Central Bank except for obligatory reserve, securities held for trading, loans to banks and debt securities not held for trading with original maturity of up to 90 days.

2.18. Borrowings

Borrowings are recognized initially at fair value, that is their issue proceeds (fair value of consideration received) net of transaction cost incurred. Borrowings are subsequently stated at amortized cost and any difference between net proceeds and the redemption value is recognized in the income statement over the period of the borrowings using the effective interest method.

If the Bank purchases its own debt, it is removed from the statement of financial position. Difference between the carrying amount of the purchased debt and the amount paid is recognized immediately in the income statement.

2.19. Provisions

Provisions are recognized when the Bank has a present legal or constructive obligation as a result of past events and it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate of the amount of the obligation can be made.

2.20. Financial guarantee contracts

Financial guarantee contracts are contracts that require the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payments when due, in accordance with the terms of debt instruments. Such financial guarantees are given to banks, financial institutions and other bodies on behalf of the customer to secure loans, overdrafts and other banking facilities.

Financial guarantee contracts are initially recognized at fair value which is equal to the fee received. Fee is amortized to the income statement by using the straight-line method. The Bank’s liabilities under guarantees are subsequently measured:

- At the higher of the initial measurement, less amortization calculated to recognize fee income and

- The best estimate of the expenditure required to settle the obligation.

2.21. Inventories

Inventories are measured at the lower of cost and net realizable value. Cost is determined using the weighted average cost method.

2.22. Taxation

Slovenian income tax is calculated on taxable profits at the rate prescribed by the Corporate Income Tax Law. Tax rate for 2009 is 21%, following that year income tax rate will stabilize at 20%, based on current Income Tax Law.

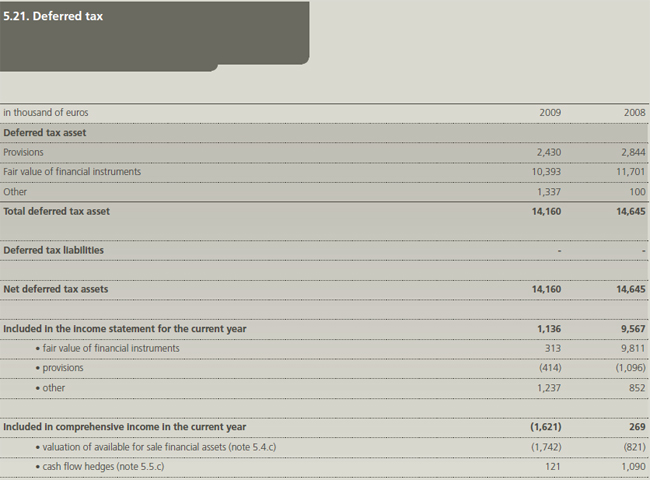

Deferred income tax is provided in full, using the balance sheet liability method, for all temporary differences arising between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes.

Deferred tax assets are recognized where it is probable that future taxable profit will be available against which the temporary differences can be utilized.

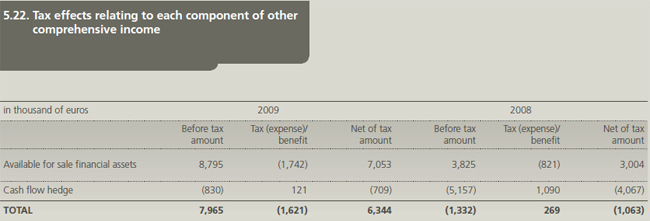

Deferred tax related to fair value re-measurement of available for sale investments and cash flow hedges is charged or credited directly to other comprehensive income and subsequently recognized in the income statement together with the deferred gain or loss.

Deferred tax assets and liabilities are measured at tax rates that are expected to apply to the period when the asset is realized or the liability is settled. At each balance sheet date a Bank reviews the carrying amount of deferred tax assets and assesses future taxable profits that can be used to utilize temporary taxable differences.

In the year 2009 the Bank recorded net loss as a result of financial crisis. The deferred tax assets recognized at 31 December 2009 have been based on future profitability assumptions and business plans for coming years. In the event of changes to these assumptions, the tax assets may be adjusted.

Deferred tax asset for temporary differences arising from investments in subsidiaries, associated and jointly controlled companies are recognized to the extend that, and only to the extent that, it is probable that:

- The temporary difference will reverse in the foreseeable future and

- Taxable profit will be available.

In year 2009 the Bank didn’t recognized deferred tax asset for impairment of investments in subsidiaries (see note 5.14.a).

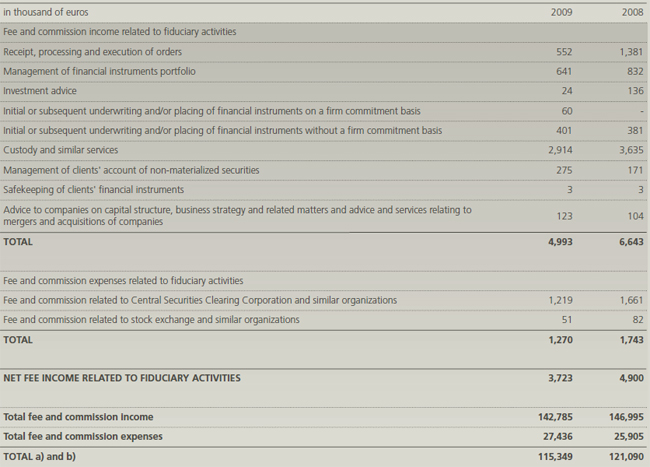

2.23. Fiduciary activities

The Bank provides Asset Management services to its clients. Assets held in a fiduciary capacity are not reported in the Bank’s financial statements, as they do not represent assets of the Bank. Fee and commission income charged for this type of service is divided by items in note 4.3.b). Further details on transactions managed on behalf of third parties are disclosed in note 5.28.

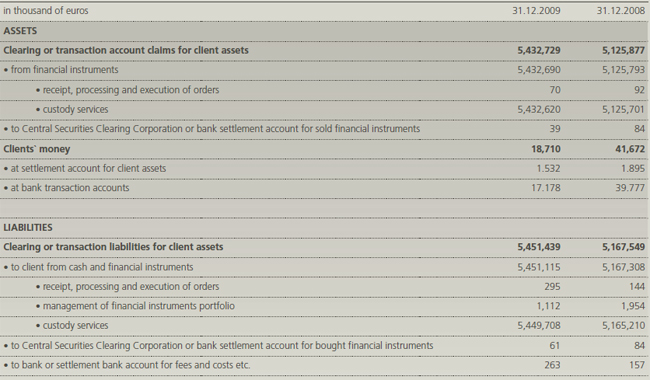

Based on the requirements of local legislation, Bank has additionally disclosed in note 5.28 assets and liabilities on accounts used to manage cash assets from fiduciary activities, for example information related to receipt, processing and execution of orders and related custody activities.

2.24. Employee benefits

Employee benefits include jubilee benefits, retirement indemnity bonuses and other long-service benefits.

Valuations of these obligations are carried out by independent qualified actuaries. The main actuarial assumptions included in the calculation of the obligation for other long-term employee benefits are:

- Applicable discount rate (7.75%),

- Number of employees eligible for benefits (all employees of the Bank) and

- Future salary increases using general salary inflation index, promotions and increases in salaries according to past years of service (4.75%).

According to Slovenian legislation, employees retire after 35-40 years of service, when, if they fulfill certain conditions, they are entitled to an indemnity paid in lump sum. Employees are also entitled to a long service bonus for every ten years of service.

These obligations are measured at the present value of future cash outflows. All gains and losses are recognized in the income statement.

The Bank contributes to the State Pension Scheme (8.85% of gross salaries). The Bank makes payments to a contribution plan according to Slovenian legislation. Once contributions have been paid, the Bank has no further payment obligation. The regular contributions constitute net periodic costs for the year in which they are due and are included in employee costs as they are incurred.

Provisions for termination benefits are provided as a result of an offer made to employees in order to encourage retirements before the normal retirement date.

2.25. Share capital

Dividends on ordinary shares

Dividends on ordinary shares are recognized in equity in

the period in which they are approved by the Bank’s

shareholders.

Treasury shares

Where the Bank purchases treasury shares, the

consideration paid is deducted from total shareholders’

equity as treasury shares until they are cancelled. Where

such shares are subsequently sold, any consideration

received is included in shareholders’ equity. If some of the

Bank’s shares are held by the Bank or its subsidiaries, the

Bank is obliged to have reserves for treasury shares.

Share issue costs

Incremental costs directly attributable to the issue of new

shares are shown in equity as a deduction from the

proceeds.

2.26. Critical accounting estimates and judgments in applying accounting policies

a) Impairment losses on loans and advances

The Bank reviews its loan portfolio to assess impairment on a monthly basis. In determining whether an impairment loss should be recorded in the income statement, the Bank makes judgments as to whether there are any observable data indicating that there is a measurable decrease in the estimated future cash flows from a portfolio of loans before the decrease can be identified with an individual loan in that portfolio. This evidence may include observable data indicating that there has been an adverse change in the payment status of borrowers in a group, or national or local economic conditions that correlate with defaults on assets in the group. Management uses estimates based on historical loss experience for assets with credit risk characteristics and objective evidence of impairment similar to those in the portfolio when scheduling its future cash flows. Individual estimates are based on future cash flows assessed by accounting officers using all relevant information on counterparty and its ability to meet specific obligations. Low-value exposures are reviewed on the pool basis. This includes all loans to individuals. The methodology and assumptions used for estimating both the amount and timing of future cash flows are reviewed regularly to reduce any differences between loss estimates and actual loss experience.

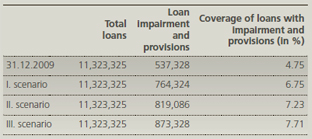

The Bank uses sensitivity analysis to assess the impact of relatively less probable negative events on impairment and provisions. The results of the simulation shown in the table below are based on the value of loans, impairment and provisions as of 31 December 2009 and provide an assessment of required impairment and provisions within one year assuming the realization of each scenario. The assessments are based on three different scenarios:

I. Basic stress scenario:

The first scenario incorporates internal expert

predictions on the deterioration of loan portfolio based

on the variation of CR (coverage of non-performing loan

portfolio with total impairment and provisions) and %

NPL (percentage of non-performing loans). The scenario

assumes a decrease of CR to 90% and an increase of

the NPL (non-performing loan) percentage to 7.5%

within a one-year period. As at 31 December 2009

percentage of NPL was 4.49% and percentage of CR

was 105.75%.

II. Scenario of changing % NPL (percentage of nonperforming loans):

The second scenario assumes an increase of NPL with an

average monthly index of 104.98% in the next twelve

months; the assumption is based on historic data from

the last twenty months (between 31 March 2008 and

31 December 2009). At the same time CR gradually

decreases to 90%.

III. Stress test based on transition matrices:

In the third scenario historic transition matrices for financial

institutions and legal entities were used. Matrices for legal

entities were also used for private persons, whereas the

exposure to the central government was not subjected to a

stress test. The methodology used is extrapolation based

on average transition matrices, which were calculated for

the period of credit portfolio deterioration. Furthermore

the matrices were corrected in a manner that excludes a

possibility of client upgrade.

Table: Results of three portfolio deterioration scenarios

All three scenarios assume a fixed total exposure amount. The impact of stress scenarios results in impairment and provisions increase within a one-year period and impact the coverage of loans with impairment and provisions. The first scenario requires a 42% increase of impairment and provisions, the second requires an additional 52%, and the third scenario requires an increase of impairment and provisions from Euro 537 million to Euro 873 million (by 63%).

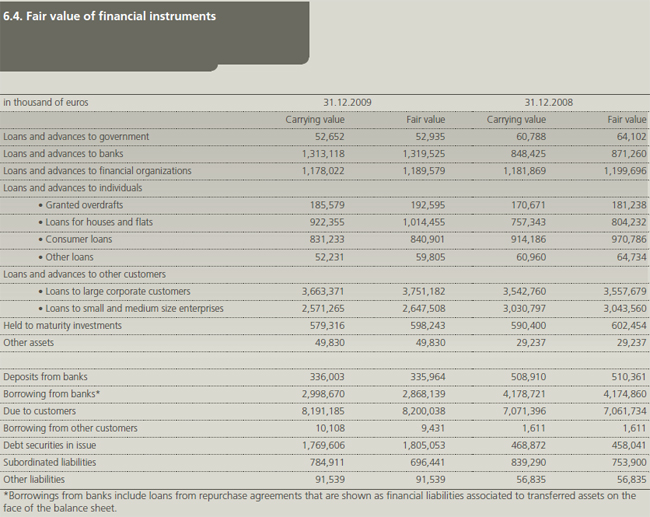

b) Fair value of financial instruments

The fair values of quoted investments in active markets are based on current bid prices (financial assets) or offer prices (financial liabilities). The fair values of financial instruments that are not quoted in active markets are determined by using valuation techniques. These include the use of recent arm’s length transactions, discounted cash flow analysis, option pricing models and other valuation techniques commonly used by market participants. The valuation models reflect current market conditions at the measurement date which may not be representative of market conditions either before or after the measurement date. As at the balance sheet date management has reviewed its models to ensure they appropriately reflect current market conditions, including the relative liquidity of the market and credit spreads. Changes in assumptions about these factors could affect reported fair values of trading assets and liabilities and available for sale financial assets.

The Bank measures fair values of derivative financial instruments by using market prices (Mark to Market), in accordance with the Methodology for Valuation of Derivative Financial Instruments. Foreign exchange rates, interest rates and volatility curves are based on the Market Snapshot principle. Market data is saved daily at 4 p.m. and later used for calculation of fair values (Market value, NPV) of derivative financial instruments. For valuation of derivatives the Bank applies market yield curves.

c) Impairment of available for sale equity investments

The Bank determines that available for sale equity investments are impaired when there has been a significant or prolonged decline in the fair value below its cost. The determination of what is significant or prolonged requires judgment. In making this judgment, the Bank evaluates among other factors, the normal volatility in share price. In addition, impairment may be appropriate when there is evidence of deterioration in the financial health of the investee, industry and sector performance, changes in technology, and operational and financing cash flows.

In 2009 NLB recorded impairment loss on investments in the amount of Euro 4.8 million (2008: in the amount of Euro 60.6 million).

d) Held to maturity investments

The Bank classifies non-derivative financial assets with fixed or determinable payments and fixed maturity as held to maturity investments. Before making this classification the Bank evaluates its intention and ability to hold such investments to maturity. If the Bank fails to keep these investments to maturity other than for the specific circumstances it will be required to reclassify the entire class as available for sale. The investments would therefore be measured at fair value not amortized cost. If the entire class of held to maturity investments is tainted, the fair value would increase by Euro 18,927 thousand (31 December 2008: increase by Euro 12,054 thousand), with a corresponding entry in the fair value reserve in shareholders’ equity.

e) Impairment of investments in subsidiaries, associated and jointly controlled entities

The process of identifying and evaluating impairment is inherently uncertain because it require significant management judgment in making a series of estimates, the results of which are relatively sensitive to the assumptions used. The review of impairment represents management's best estimate of the factors such as:

- Future cash flows of the investments are sensitive to the cash flow projected for the periods for which detailed forecasts are available and to assumptions regarding the long-term pattern of sustainable cash flow thereafter. The cash flow used represent management's view of future business prospects at the time of assessment.

- Discount rate derived from a Capital Asset Pricing Model and used to discount future cash flows is based on the cost of equity assigned to an individual investment. Discount rate reflects range of financial and economic variables including risk free rate and risk premium. The variables are subject to fluctuations outside management's control.

Management believes that the sensitivity analysis of impairment testing is adequately robust to reasonably possible changes in underlying assumptions.

f) Income taxes

The deferred tax assets recognized at 31 December 2009 have been based on future profitability assumptions over a five year horizon. In the event of changes to these profitability assumptions, the tax assets recognized may be changed.

g) Employee benefits

The present value of the employee benefits depends on factors that are determined on an actuarial basis using a number of assumptions. Any changes in these assumptions will impact the carrying amount of the obligation. The Bank determines the appropriate discount rate at the end of each year. This is the interest rate that should be used to determine the present value of estimated future cash outflows expected to settle the obligation. In determining the appropriate discount rate, the Bank considers the interest rate of high quality corporate bonds.

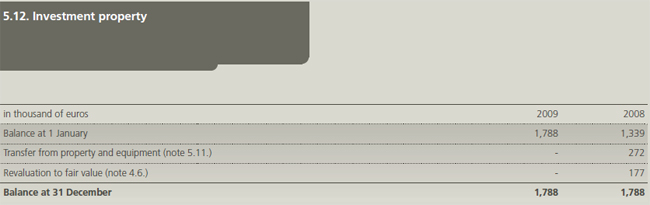

h) Investment properties

Management estimates the fair values of investment properties by discounting expected net rentals at market yields.

2.27. Adoption of new and revised International Financial Reporting Standards

In the current year, the Bank has adopted all of the new and revised Standards and Interpretations issued by the International Accounting Standards Board (the IASB) and the International Financial Reporting Interpretations Committee (IFRIC) of the IASB that are effective for accounting periods beginning on 1 January 2009.

The following new standards and amendments to standards have been early adopted:

- IFRS 3 (amendment), Business Combinations and consequential amendments to IAS 27 (amendment), Consolidated and Separate Financial Statements, IAS 28 (amendment), Investments in Associates and IAS 31(amendment), Interests in Joint Ventures, effective prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after 1 July 2009. The revised IFRS 3 continues to apply the acquisition method to business combinations with some significant changes. For example, all payments to purchase a business are to be recorded at fair value at the acquisition date, with contingent payments classified as debt subsequently re-measured through the income statement. There is a choice, on an acquisition by acquisition basis, to measure the non controlling interest in the acquiree either at fair value or at non controlling interest's proportionate share of the acquireer’s net assets. All acquisition related costs should be expensed. This will enhance the relevance, reliability and comparability of information about business combinations, transactions with non controlling shareholders, changes of the entity’s status and their effects on financial statements. The most important impact on consolidated financial statements of amended standards relates to treatment of transactions with non controlling owners. All effects of such transactions are recognized within equity without any changes of goodwill. This amendment does not impact separate financial statements.

Accounting standards and amendments to existing standards effective on or after 1 January 2009 that were endorsed by EU:

- IFRS 2 (Amendment) Share based payment – Vesting conditions and cancellations. The changes pertain mainly to the definitions of vesting conditions and the regulations for the cancellation of a plan by a party other than the company. These changes clarify that vesting conditions are solely service and performance conditions. As a result of the amended definition of vesting conditions, non vesting conditions should now be considered when estimating the fair value of the equity instrument granted. In addition, the standard describes the posting type if the vesting conditions and non vesting conditions are not fulfilled. The amendment does not effect on the Banks financial statements.

- IFRS 5 (Amendment) - Non-current Assets Held for Sale and Discontinued Operations. The amendment proposes that all assets and liabilities of a subsidiary should be classified as held for sale if the parent has a sale plan involving loss of control of the subsidiary. The amendment also clarifies the relevant disclosures for subsidiary required for discontinued operations. The amendment does not effect on the Banks financial statements.

- IFRS 7 (Amendment) - The amendment requires enhanced disclosures about fair value measurements of financial instruments and liquidity risk management. In particular the amendment requires disclosure of fair value measurement by level of a fair value measurement hierarchy. The amendment does not effect the Bank’s operations, but it requires additional disclosures.

- IFRS 8 - Operating segments. IFRS 8 replaces IAS 14. It requires a “management approach” under which segment information is presented on the same basis as that used for internal reporting purposes to the group executive board, which makes decisions on the allocation of resources and assess the performance of the reportable segments. It does not effect the Bank’s operations and disclosures, since segment reporting is disclosed only in consolidated financial statements.

- IAS 1 (Amendment) - Presentation of financial statements. The amendment to the standard requires entities to present all non-owner changes in equity either in one statement of comprehensive income or in two statements (a separate income statement and a statement of comprehensive income). Each component of equity, including each item of other comprehensive income, should be reconciled between the carrying amount at the beginning and the end of the period. The amendment also requires presenting a statement of financial position (balance sheet) as at the beginning of the earliest comparative period in a complete set of financial statements when the entity applies an accounting policy retrospectively or makes a retrospective restatement. The amendment impacts presentation aspects.

- IAS 16 (Amendment) - Property, Plant and Equipment and consequential amendment to IAS 7 - Statement of Cash Flows. Entities whose primary activities comprise renting and subsequently selling assets should present proceeds from the sale of those assets as revenue. Such assets should be classified as inventories from the point that the assets cease to be leased and become held for sale. A consequential amendment to IAS 7 states that cash flows arising from the purchase, rental and sale of such assets are classified as cash flows from operating activities. The amendment impacts presentation aspects.

- IAS 19 (Amendment) - Employee Benefits. The amendment clarifies the distinction between short-term and long-term employee benefits and supplements the definition of benefit obligation. The amendment achieves consistency with IAS 37 - Provisions, Contingent Liabilities and Contingent Assets, which states that contingent liabilities should not be recognized, but should be disclosed. The amendment does not effect the Bank’s financial statements.

- IAS 20 (Amendment) - Accounting for Government Grants and Disclosure of Government Assistance. The amendment requires benefits arising from government loans at below-market interest rates to be accounted for as government grants, with the benefit calculated as the difference between the proceeds and the initial fair value of the loan, net of transaction costs. The amendment does not effect the Bank’s financial statements.

- IAS 23 (Amendment) - Borrowing costs. The amendment requires an entity to capitalize borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. The option of immediately expensing those borrowing costs has been removed. The definition of borrowing costs has been amended and adjusted to method in IAS 39 - Financial Instruments: Recognition and Measurement. Consequently the borrowing costs are measured according to the effective interest rate method. The amendment does not have a material effect on the Bank’s financial statements.

- IAS 28 (Amendment) - Investments in Associates and consequential amendments to IAS 32 - Financial Instruments: Presentation and IFRS 7 Reclassification of Financial Assets. The amendment proposes that an investment in an associate should be treated as a single asset for impairment testing. The impairment is not allocated to any assets included within the investment, for example goodwill. Accordingly, reversals of this impairment should be recognized as an adjustment to the investment to the extent that the recoverable amount of the associate increases. The amendment does not effect the Bank’s financial statements.

- IAS 29 (Amendment) - Financial Reporting in Hyperinflationary Economies. The amendment to the standard requires that types of assets and liabilities should be measured at fair value and not by the historical cost approach. The amendment does not effect the Bank’s financial statements.

- IAS 32 (Amendment) - Puttable Financial Instruments and Obligations Arising on Liquidation and IAS 1 Amendment. The amendment requires classification as equity of some financial instruments that meet the definition of a financial liability. Puttable financial instruments that present a residual interest in the net assets of the entity are now classified as equity provided that specific conditions are met. Similar to those requirements is the exception to the definition of financial liability for instruments that entitle the holder to a pro rata share of the net assets of an entity only on liquidation. The amendment does not effect the Bank’s financial statements.

- IAS 36 (Amendment) - Impairment of Assets. The amendment requires increased disclosures if fair value less costs to sell is calculated on the basis of discounted cash flows. The amendment impacts disclosure aspects.

- IAS 38 (Amendment) - Intangible Assets. The amendment clarifies that expenditure on advertising and promotional activities can only be recognized as an expense at the time that the benefit of the goods or services becomes available to the entity. The standard no longer contains the provision that states that there is ’rarely, if ever’ existence of founded reason for using an amortization method that allows lower rates than straight-line amortization method. The amendment does not effect the Bank’s financial statements.

- IAS 39 (Amendment) - Financial instruments: Recognition and Measurement. The amendment clarifies that it is possible to reclassify derivatives used as a hedging instrument into and out of the fair value through profit or loss category in specific circumstances. The amendment permits the designation of assets, liabilities, firm commitments or highly probable forecast transactions as hedged items only when they involve a party external to the entity. When remeasuring the carrying amount of a debt instrument on cessation of fair value hedge accounting, the amendment clarifies that a revised effective interest rate (calculated at the date fair value hedge accounting ceases) is used. This will not give rise to any changes to the Bank’s financial statements.

- IAS 40 (Amendment) - Investment Property and consequential amendment to IAS 16 - Property, Plant and Equipment. Property that is under construction or development for future use as investment property is classified as investment property. Where the fair value model is applied, such property is, therefore, measured at fair value. However, where the fair value of investment property under construction is not reliably measurable, the property is measured at cost until the earlier of the date construction is completed or the date at which fair value becomes reliably measurable. The amendment does not effect the Bank’s financial statements.

- IFRIC 15 - Agreements for the Construction of Real Estate. This interpretation applies to the accounting for revenue and associated expenses by entities that undertake the construction of real estate directly or through subcontractors. It does not have any impact on the Bank’s financial statements.

- IFRIC 16 - Hedges of a Net Investment in a Foreign Operation (effective from 1 October 2008). The interpretation clarifies the accounting treatment in respect of net investment hedging. This includes the fact that the net investment hedging relates to differences in functional currency not presentation currency, and hedging instruments may be held anywhere in the group. It does not have impact on the Bank’s financial statements.

Accounting standards and amendments to standards issued but not yet effective:

The following standards and interpretations have been issued and are mandatory for the accounting periods beginning on or after 1 July 2009.

- IFRS 1 and IAS 27 (Amendment) - Cost of an investment in a subsidiary, jointly controlled entity or associate. The amended standard allows first time adopters to use a deemed cost of either fair value or the carrying amount under previous accounting practice to measure the initial cost of investments in subsidiaries, jointly controlled entities and associates in the separate financial statements. The amendment also removes the definition of the cost method from IAS 27 and requires an entity to present dividends from investments in subsidiaries, jointly controlled entities and associates as income in the separate financial statements of the investor. The amendment will not impact the Bank’s financial statements.

- IAS 39 (Amendment) – Financial instruments: Recognition and measurement – Eligible hedged items. The amendment provides guidance for two situations. With the designation of a one sided risk in a hedged item, IAS 39 concludes that a purchased option designated in its entirety as the hedging instrument of a one sided risk will not be perfectly effective. The designation of inflation as a hedged risk or portion is not permitted expect in particular situations. This will note give rise to any changes to the Bank’s financial statements.

- IFRIC 17 – Distributions of non cash assets to owners. This addresses how the non cash dividends distributed to shareholders should be measured. A dividend obligation is recognized when the dividend was authorized by the appropriate entity and is no longer at the discretion of the entity. This dividend obligation should be recognized at the fair value of the net assets to be distributed. The difference between the dividend paid and the amount carried forward of the net assets distributed should be recognized in profit and loss.The application of IFRIC 17 will have no impact on the financial statements of the Bank.

- IFRIC 18 - Transfer of assets from customers. This clarifies how to account for transfer of items of property, plant and equipment by entities that receive such transfers from their customers. The interpretation also applies to agreements in which an entity receives cash from a customer when that amount of cash must be used only to construct or acquire an item of property, plant and equipment, and the entity must than use that item to provide the customer with ongoing access to the supply of goods and or services. The Bank is not impacted by applying IFRIC 18.

- IFRIC 19 – Extinguishing financial liabilities with equity instruments. It classifies the requirements at IFRSs when an entity renegotiates the terms of a financial liability with its creditor and the creditor agrees to accept the entity’s shares or other equity instruments to settle the financial liability fully or partially. The Bank is not impacted by IFRIC 19.

- IFRS 9 – Financial instruments part 1: Classification and measurement. IFRS 9 was issued in November 2009 and replaces those parts of IAS 39 relating to the classification and measurement of financial assets. The key features are as follows:

- Financial assets are required to be classified into two measurement categories: those to be measured subsequently at fair value, and those to be measured subsequently at amortized cost. The decision is to be made at initial recognition. The classification depends on the entity’s business model for managing its financial instruments and the contractual cash flow characteristics of the instrument.

- An instrument is subsequently measured at amortized cost only if it is a debt instrument and both the objective of the entity’s business model is to hold the asset to collect the contractual cash flows, and the asset’s contractual cash flows represent only payments of principal and interest (that is, it has only basic loan features). All other debt instruments are to be measured at fair value through profit or loss.

- All equity instruments are to be measured subsequently at fair value. Equity instruments that are held for trading will be measured at fair value through profit or loss. For all other equity instruments, an irrevocable election can be made at initial recognition, to recognize unrealized and realized fair value gains and losses through other comprehensive income rather than profit or loss. There is to be no recycling of fair value gains and losses to profit or loss. This election may be made on an instrument by instrument basis. Dividends are to be presented in profit or loss, as long as they represent a return on investment.

- Adoption of IFRS 9 is mandatory from 1 January 2013, earlier adoption is permitted. The Bank is considering the implications of the standard, the impact on the Bank and the timing of its adoption.

3. EVENTS AFTER REPORTING DATE

In March 2010 Supervisory Board of NLB d.d. approved merger with subsidiary company LHB Finance d.o.o. Merger will be formally registered in May 2010 with the accounting date of merger as at 31 December 2009.

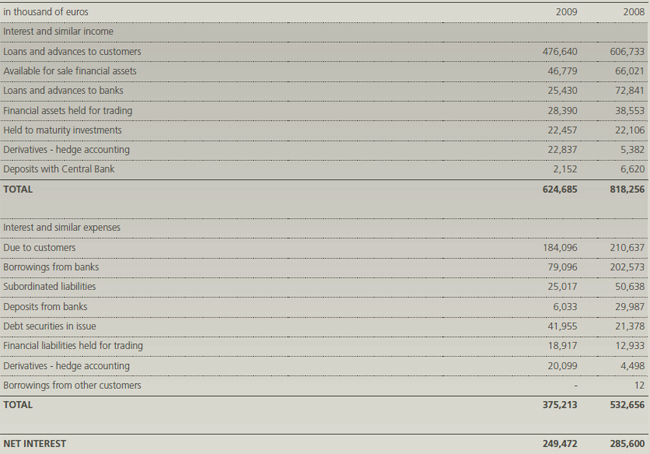

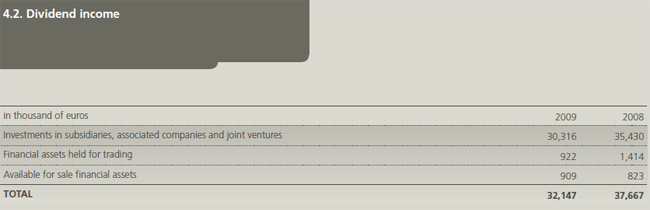

4. NOTES TO THE INCOME STATEMENT

Analysis by type of assets and liabilities

Interest income accrued on impaired financial assets in 2009 is Euro 5,239 thousand (2008: Euro 4,209 thousand).

a) Fee and commission income and expenses relating to activities of the Bank

b) Fee and commission income and expenses relating to fiduciary activities

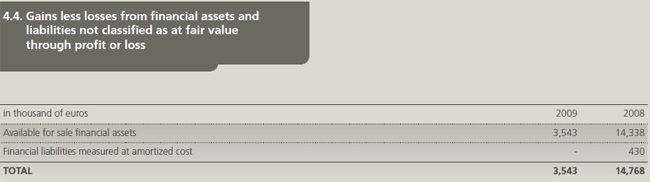

Foreign exchange translation net losses on financial assets and liabilities not classified as at fair value through profit or loss, amounted to Euro 5,142 thousand in 2009 (2008: net gains Euro 39,534 thousand).

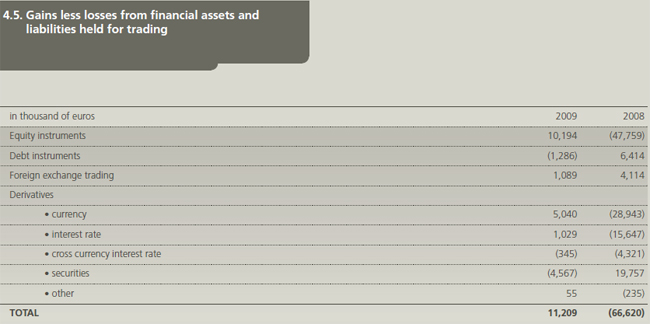

The Bank uses currency derivatives to hedge its currency exposure. For this purpose their effects need to be considered in relation to currency exchange differences within the Income statement. From the business perspective these derivatives represent effective hedging instruments that are not accounted for using hedge accounting principles. In the Bank’s financial statements they are accounted for as financial instruments held for trading.

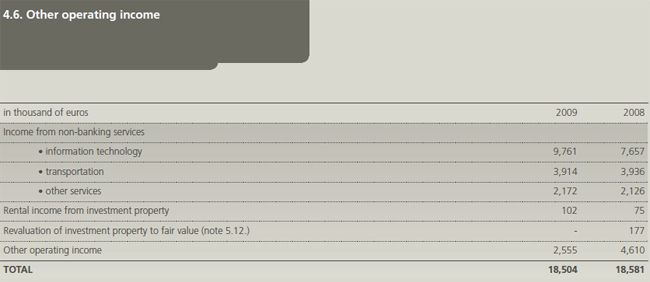

Other income includes bonuses from insurance premiums and compensated court taxes.

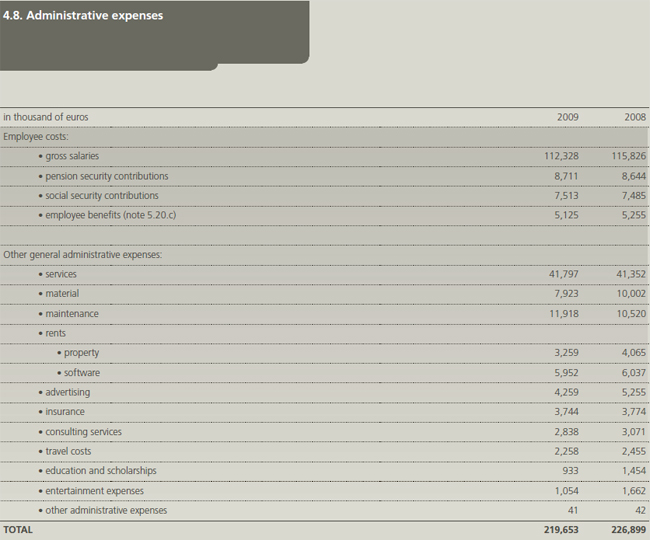

The number of employees in the Bank as at 31 December 2009 was 4,050 (31 December 2008: 4,097).

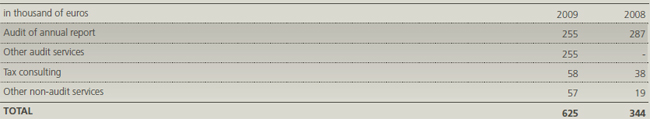

External audit services

External audit services include payments to statutory auditor in the amount of Euro 500 thousand (2008: Euro 271 thousand).

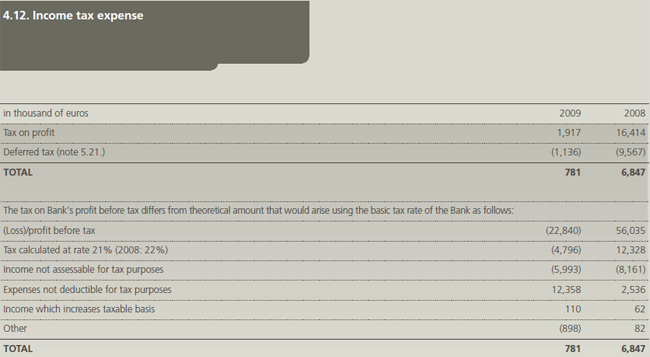

Income not assessable for tax purposes relates mainly to dividend income, which can be, if fulfilling all requirements of the Corporate Income Tax Law, can be eliminated from the tax base.

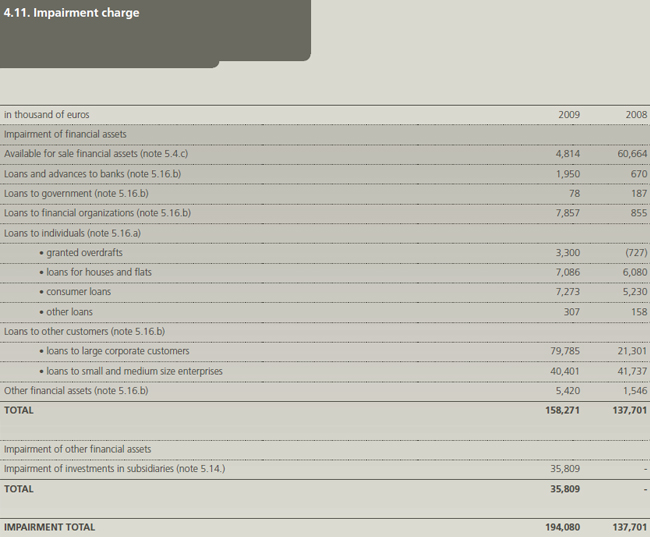

The expenses not deductable for tax purposes in 2009 relate to impairment of investment in subsidiaries (see note 5.14.a).

The tax authorities may at any time inspect the books and records within 5 years subsequent to the reported tax year, and may impose additional tax assessments and penalties. The Bank’s management is not aware of any circumstances that may give rise to a potential material liability in this respect.

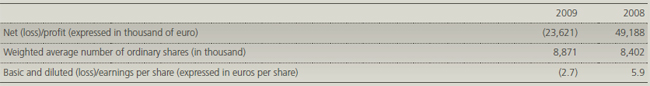

Basic earnings per share are calculated by dividing the net profit by the weighted average number of ordinary shares in issue, less treasury shares.

Subordinated loans and debt securities in issue have no future conversion options and consequently there are no potential dilutive ordinary shares.

5. NOTES TO THE STATEMENT OF FINANCIAL POSITION

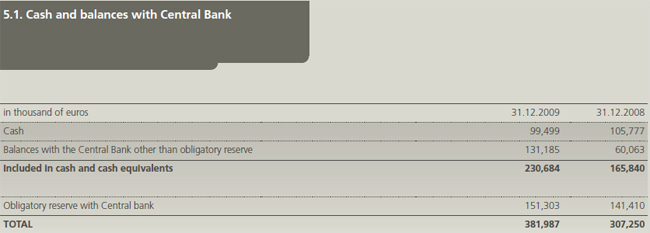

The Bank is required to maintain an obligatory reserve with the Bank of Slovenia, relative to the volume and structure of its customer deposits.

The current requirement of the Bank of Slovenia regarding the calculation of the amount to be held as obligatory reserve is 2% of all time deposits with maturity up to two years.

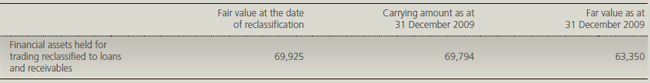

During the year 2009 the Bank reclassified certain bonds from trading category to loans and receivables group. The Bank reclassified high quality corporate bonds that are not traded in the market and for which it has positive intent and ability to hold for the foreseeable future or until maturity rather than trade in the short term.

The following table shows the carrying values at 31 December 2009 and fair values of the assets reclassified:

For the years ended 31 December 2009 and 31 December 2008, fair value gains of Euro 179 thousand and Euro 586 thousand, prior to reclassification, were recognized in the income statement on the reclassified bonds.

Effective interest rates on financial assets reclassified into loans and receivables group as at their respective dates of reclassification fell into the range 4.15% - 4.23%. Interest income recognized after reclassification amounted to Euro 2,836 thousand.

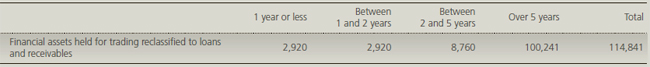

Estimated amounts of undiscounted cash flows the Bank expects to recover from reclassified bonds as at the date of reclassification.

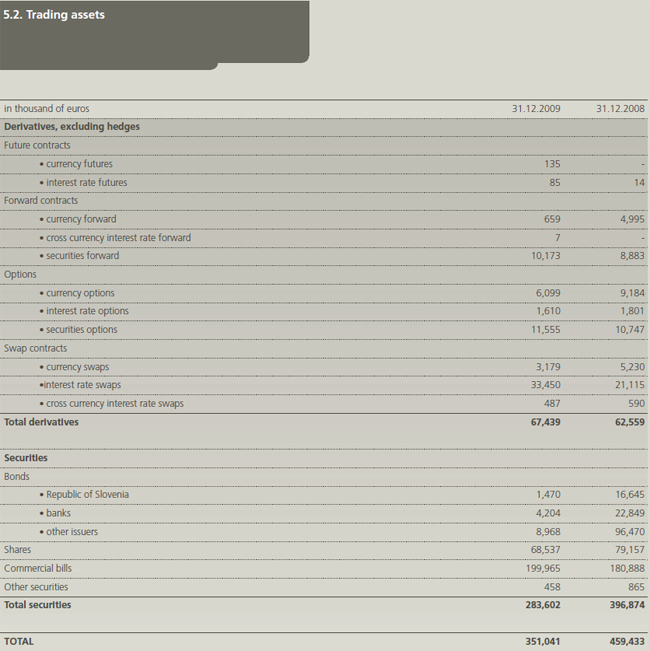

As at 31 December 2009 securities held for trading amounting to Euro 58,820 thousand were quoted on the stock exchange (31 December 2008: Euro 340,519 thousand).

As at 31 December 2009 and 31 December 2008 the Bank has no trading assets with original maturity up to three months that would be included within cash equivalents.

The total amount of the change in fair value estimated using a valuation technique that was recognized in profit or loss during 2009 was positive in the amount of Euro 14,664 thousand (2008: negative in the amount of Euro 31,606 thousand).

Notional amounts of derivative financial instruments are disclosed in note 5.29.d).

Financial assets designated at fair value through profit or loss also include private equity fund in the form of venture capital investments. These investments are managed and evaluated on a fair value basis and total return in accordance with the investment strategy which among other terms also defines the required returns and exit strategy.

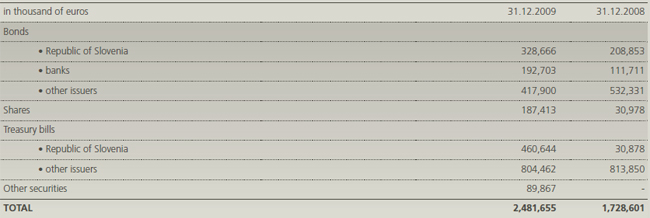

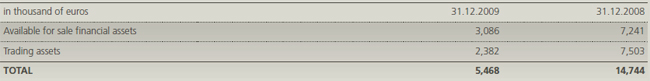

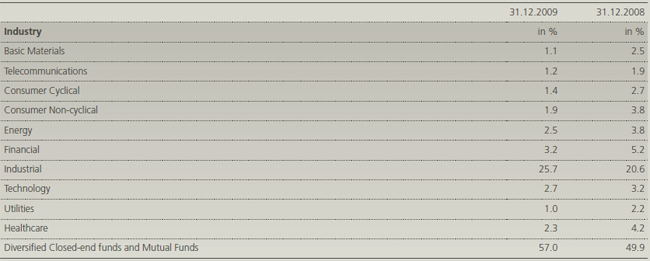

a) Analysis by type of available for sale financial assets

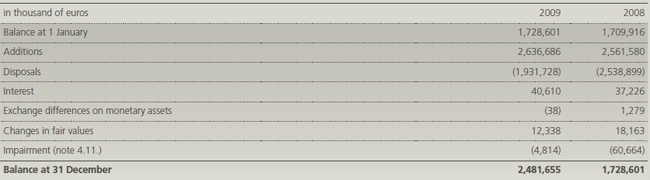

b) Analysis of movements

As at 31 December 2009 the investment securities amounting to Euro 2,380,595 thousand (31 December 2008: Euro 1,709,296 thousand) were quoted on the stock exchange.

As at 31 December 2009 and as at 31 December 2008 the Bank has no available for sale financial assets with original maturity up to three months.

As at 31 December 2009 the Bank has no securities pledged to third parties in sale and repurchase agreements (31 December 2008: Euro 400,682 thousand). For 2008 these securities were presented separately in the statement of financial position as pledged assets.

Impairment of equity securities in the amount of Euro 4,814 thousand (31 December 2008: Euro 60,664 thousand) has been recorded due to decline of prices in Ljubljana Stock Exchange (note 4.11.).

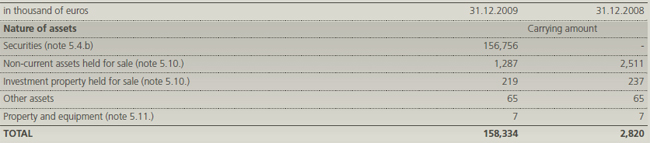

The value of financial assets, available for sale that the Bank obtained by taking possession of collateral held as security and recognized them in the statement of financial position is Euro 156,756 thousand (31 December 2008: nil).

Available for sale financial assets in the amount of Euro 715,057 thousand (31 December 2008: Euro 521,933 thousand) have a remaining contractual maturity of more than twelve months.

c) Revaluation reserve

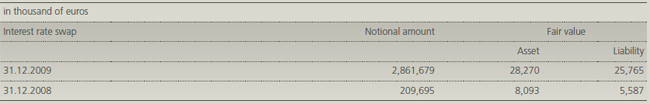

a) Fair value hedge

Net losses on hedging instruments amounted to Euro 4,970 thousand in 2009 (2008: gains Euro 3,281 thousand) and gains on hedged items were Euro 4,909 thousand (2008: losses Euro 3,208 thousand).

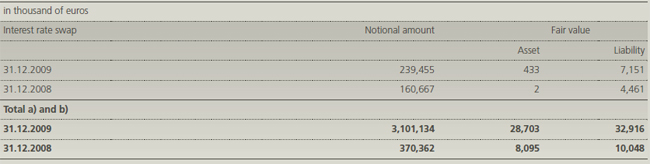

b) Cash flow hedge

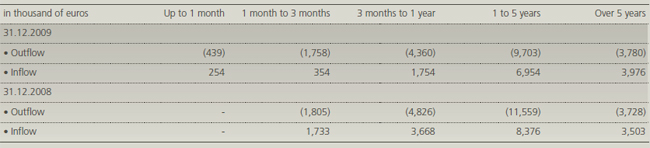

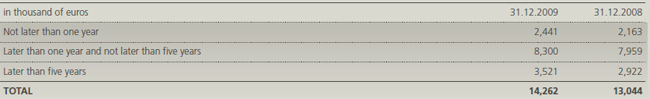

Future cash flows

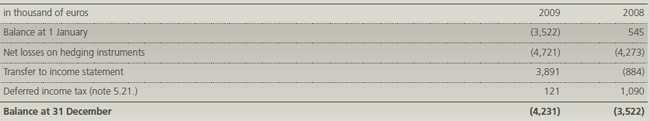

c) Revaluation reserve

A loss on hedging instruments in the amount of Euro 830 thousand (2008: loss Euro 5,157 thousand) was recognized directly in other comprehensive income, as well as the corresponding deferred income tax asset in the amount of Euro 121 thousand (31 December 2008: income tax asset Euro 1,090 thousand). Effect net of tax was loss Euro 709 thousand (2008: loss Euro 4,067 thousand). There was no ineffectiveness that the Bank should have recognized in the income statement. Effects are recycled to net interest income in the income statement.

The Bank implemented two types of hedging relationships for interest rate risk. The most often used solution is fair value micro hedge, but the Bank used cash flow micro hedge as well. The Bank measures hedge effectiveness by using the dollaroffset method.

The Bank hedges its interest rate exposure by using different financial instruments (IRS, FRA, OIS, IR Futures), however, hedge relationships were imposed only in case of hedging by Interest Rate Swaps.

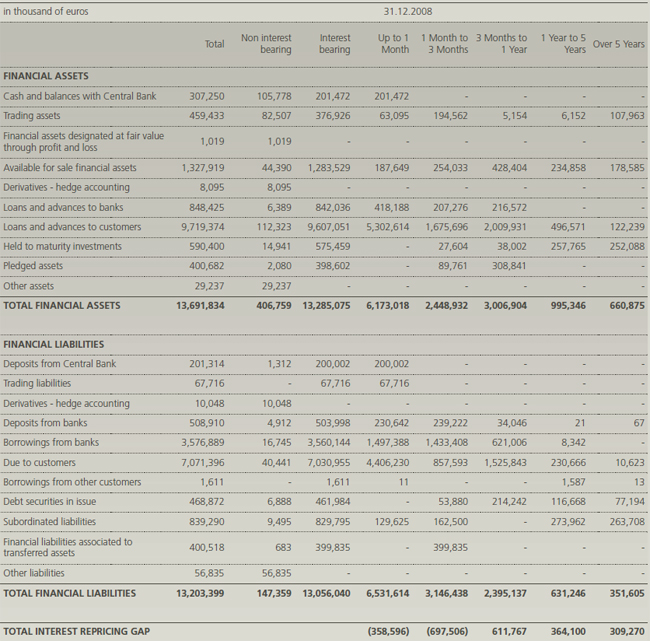

The Bank measures its interest rate exposure by using the repricing gap analysis and by calculating sensitivity of balance sheet and off balance sheet items from economic value of capital point of view. For a portfolio of banking book securities a duration limit is set.

The Bank hedges open positions within individual time buckets and because long positions are more common than short ones, Fair Value Hedges are mainly done for hedging fixed rate assets. Some Cash Flow Hedges were introduced for the same reason - swapping the floating interest rate of certain liabilities into the fixed rate to fund fixed rate assets.

The Bank rarely hedges the fair value of liabilities; however some fixed rate bonds issued were swapped into floating to reduce the repricing gap within certain time buckets.

Cash flows of the hedging instrument match cash flows of the hedging item (principal terms match) in each hedging relationship.

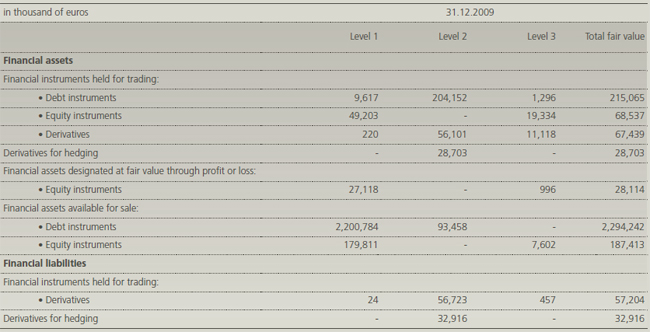

IFRS 7 specifies a hierarchy of valuation techniques based on whether the inputs to those valuation techniques are observable or unobservable. Observable inputs reflect market data obtained from independent sources; unobservable inputs reflect the Bank’s assumptions. These two types of inputs have created the following fair value hierarchy:

- Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities. This level includes listed equity securities and debt instruments on exchanges and exchanges traded derivatives.

- Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (that is, as prices) or indirectly (that is, derived from prices). The source of input parameters like yield curve and counterparty credit risk is Reuters.

- Level 3 – Inputs for the asset or liability that are not based on observable market data. This level includes equity investments and derivatives linked to these investments.

This hierarchy requires the use of observable market data when available. The Bank considers relevant and observable market prices in its valuations where possible.

a) Financial instruments, measured at fair value in financial statements

In 2009 there were no transfers of financial instruments between fair value levels of measurement.

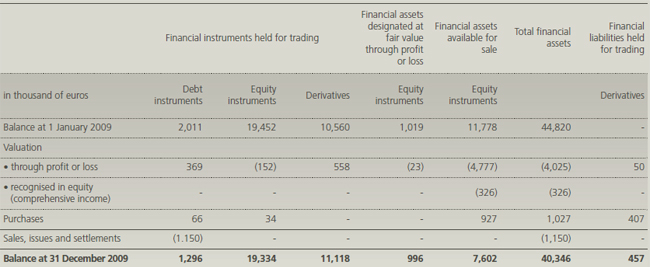

b) Financial instruments valued by 3rd level

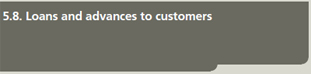

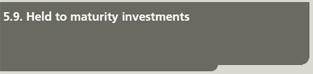

Analysis by type of advance

Loans and advances to banks in the amount of Euro 199,017 thousand (31 December 2008: Euro 240,804 thousand) are expected to be recovered after more than twelve months.

Loans and advances to banks in the amount of Euro 569,757 thousand (31 December 2008: Euro 376,938 thousand) have an original maturity up to three months and are included within cash equivalents.

Analysis by type of advance

In the case of securities purchased under agreements to resell the Bank records these securities as a collateral (the Bank becomes their legal owner), but the borrower is entitled to coupon interest and dividends. During the presented years the Bank did not sell or repledge any of the securities purchased under agreements to resell.

Loans and advances to customers in the amount of Euro 4,543,186 thousand (31 December 2008: Euro 4,664,680 thousand) are expected to be recovered after more than twelve months.

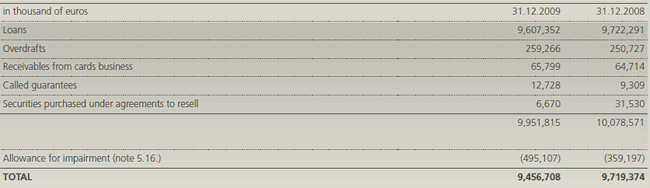

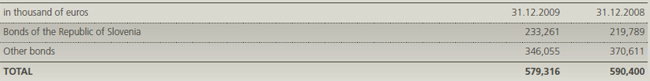

a) Analysis by type of held to maturity investments

b) Analysis of movements

As at 31 December 2009 and 31 December 2008 all held to maturity investments were quoted on the stock exchange.

Held to maturity investments in the amount of Euro 492,428 thousand (31 December 2008: Euro 509,854 thousand) have a remaining contractual maturity of more than twelve months.

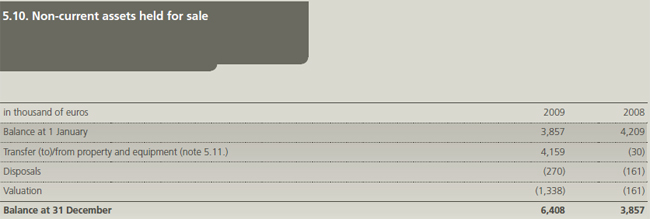

Non-current assets held for sale include business premises which are in the course of sale and assets received as collateral. The amount of non-current assets held for sale that the Bank obtained by taking possession of collateral held as security and recognized them in financial statements is Euro 1,506 thousand (2008: Euro 2,748 thousand).

The effects of valuation and sale are included in the income statement in item Net (loss)/profit from non-current assets held for sale.

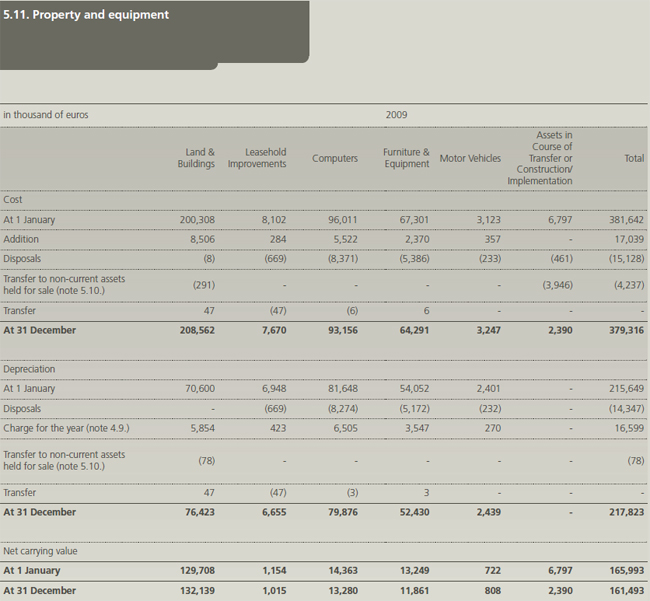

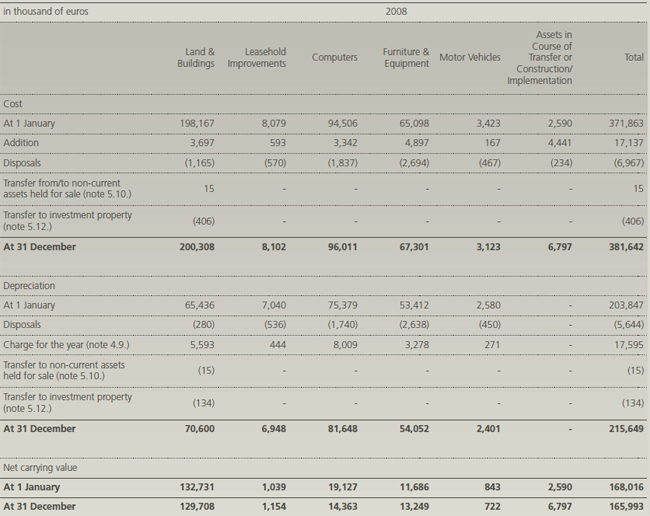

The amount of property and equipment that the Bank obtained by taking possession of collateral held as security and recognized them in the balance sheet is Euro 7 thousand (2008: Euro 7 thousand).

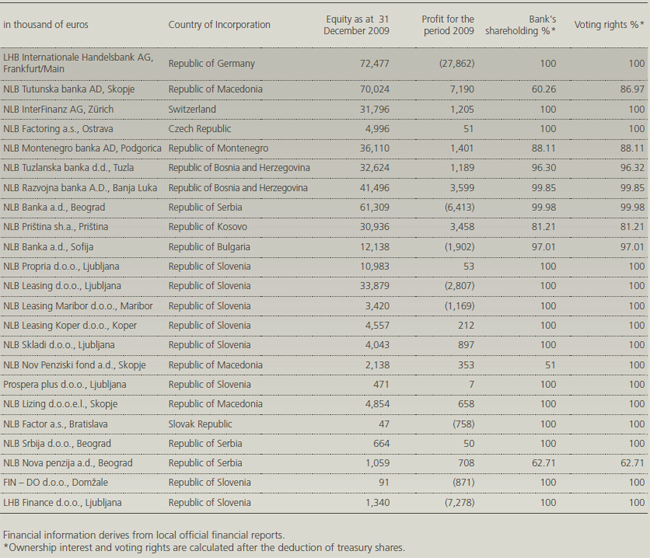

a) Analysis by type of investment in subsidiaries

As a consequence of global financial crisis and difficult conditions the Bank performed an impairment test of individual investments in subsidiaries as at 31 December 2009. According to the requirements of IFRS and internal methodology the Bank calculated recoverable amount of each investment. The calculation is based on the value in use concept including following assumptions:

- A financial budget for a three years period approved by Management Board and supervisors;

- Extrapolation of approved plans for a five years period considering stable growth rate;

- A growth rate of the cash flow in residual period between 3% - 3.5%;

- A discount rate between 13.8 % - 17 %;

- Target capital ratios of an individual bank between 12% - 15%.

The financial budgets of individual companies are based on previous experiences and assessment of future economic conditions that will impact an individual subsidiary’s business and the quality of the credit portfolio. The discount rates used are based on assessment of general and specific risk that an individual subsidiary’s business is exposed to. The discount rates are calculated on the basis of CAPM model.

According to the management the growth rates used in the residual period correspond with long term growth rates in those markets and industry.

In the year 2009 the Bank recorded an impairment loss in the amount of Euro 35,809 thousand for investments in LHB Internationale Handelsbank AG, Frankfurt/Main, NLB Tuzlanska banka d.d., Tuzla and NLB Razvojna banka A.D., Banja Luka.

Majority of impact relates to effects derived from financial crises, larger impairment provisions, higher interest rates on deposits, large decline in GDP for Balkans region, change in capital regulation that requires additional capital increases or results in smaller dividend payout.

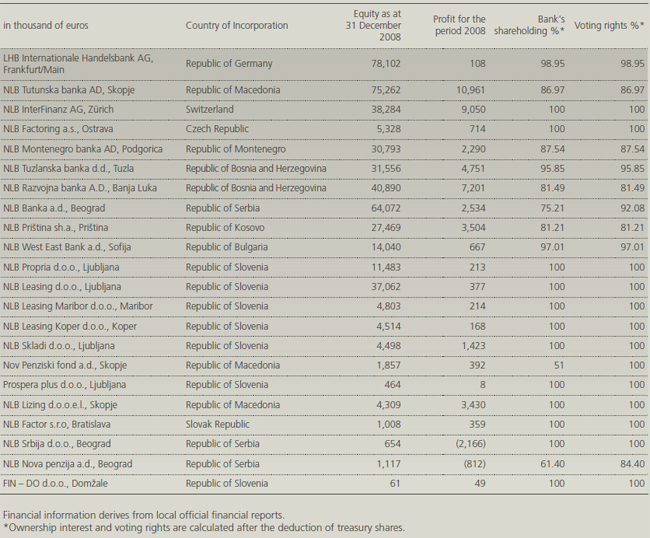

The Bank's subsidiaries as at 31 December 2009 are:

NLB increased in 2009 its ownership interest in following banks:

- NLB Razvojna banka a.d., Banja Luka from 81.50% to 99.85%,

- LHB Internationale Handelsbank AG, Frankfurt/Main from 98.95% to 100%,

- NLB Banka a.d., Beograd from 92.54% to 99.98%.

The Bank's subsidiaries as at 31 December 2008 are:

b) Analysis by type of investment in associated companies and jointly controlled

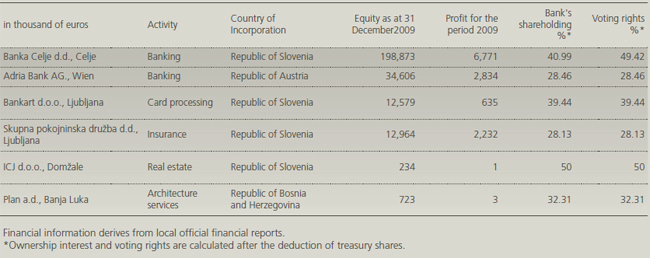

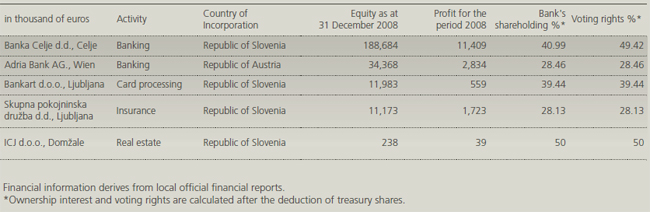

Associated companies of the Bank are:

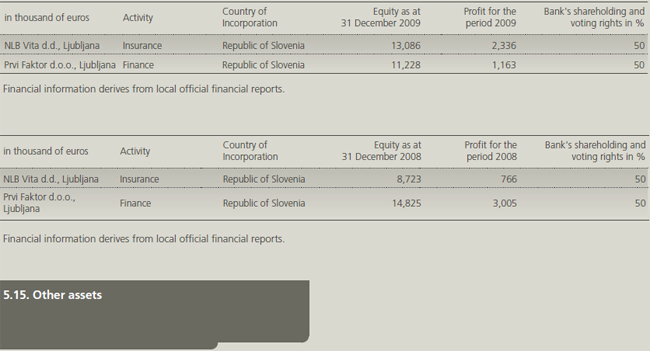

Jointly controlled companies are:

Analysis by type of assets