NLB Group

Risk Management

Risk Management

Risk management is crucial to achieving the strategic objectives of the NLB Group. Using standard risk management methods allows for qualitative assessment of all types of risks, presents timely responses, and reduces exposure to risks.

NLB and its subsidiaries first follow the regulations of the Bank of Slovenia, but additional risk management is also internally regulated.

The limits concerning the extent and the variety of risks the NLB Group members are willing to accept in their business operations are expressed in terms of appetite and tolerance for taking risks. The framework of risk appetite and tolerance is defined by the amount of capital and planned capital profitability, as well as by international ratings and other qualitative and quantitative risk measurements. The way to control the Bank’s risk is to minimize risk exposure in order to fulfill the NLB Group’s planned business objectives, to minimize damages from operational risks, and to optimize the use of regulatory and internal capital, while taking into account the limits to NLB’s appetite and tolerance for risk.

The NLB Group’s risk management is based on the following principles:

- Risk management’s independence from specific business areas and free decisionmaking.

- Units responsible for risk management support the Bank’s business operations by not restricting their independent decisions. Fulfilling the Bank’s business objectives must not involve overly high risks. The NLB Group’s entire organizational structure is set up accordingly to ensure effective cooperation of the risk-management units with the Bank’s business sections and other financial institutions of the NLB Group.

- A long tradition of using various instruments to manage and assess risk (e.g., management of regulatory and internal capital, proactive determination of the necessary amount of provisions or impairment, risk position, diversification, and other modern methods to manage the portfolio, scoring models, internal ratings, economic capital, etc.).

- Risk-management decisions are based on a comprehensive assessment of various risk factors. As a rule, no decision must be made based only on the result of some specific quantitative model.

- The NLB Group’s risk appetite is roughly determined by NLB’s international ratings, as well as qualitative and quantitative elements arising from them.

- Regular implementation of adequate reporting and minimum risk-management standards in NLB’s subsidiaries and other financial companies of the NLB Group.

In 2009, NLB’s consolidation process and the implementation of the risk-management model in members of the NLB Group were continued. Moreover, the NLB Group reinforced its central risk monitoring system. Among other things, this system was also imposed by the economic recession in Slovenia and in most countries in which members of the NLB Group operate.

The most important risk the NLB Group is exposed to is credit risk, which requires very careful and accurate handling during a recession. The same applies to exposure to liquidity risk, which is marked by the negative impact of the global financial crisis on market liquidity and liquidity financing. Furthermore, market risk and operating risk, as well as all other risks set forth by legislation and the Basel II provisions, are important.

Credit Risk Management

The NLB Group performs credit risk management at two levels: controlling risks for individual clients (i.e., debtors) and supervising credit portfolio risks for members of the NLB Group.

At the level of an individual client (depending on the stage of the relationship with the client) appropriate processes are followed 1) prior to, 2) during, and 3) after entering into a contract. In the first phase, information about the client (which should, among other things, result in an objective assessment of the client’s financial standing and credit rating, as well as determination of the upper limit of indebtedness) is key. In the second phase, it is essential to draw up an appropriate contract, stipulating insurance and obligations.

The third phase consists of various forms of monitoring the client with respect to regular loan repayment and other relevant data that affect the client’s creditworthiness or the necessity to form and/or change the amount of established impairments.

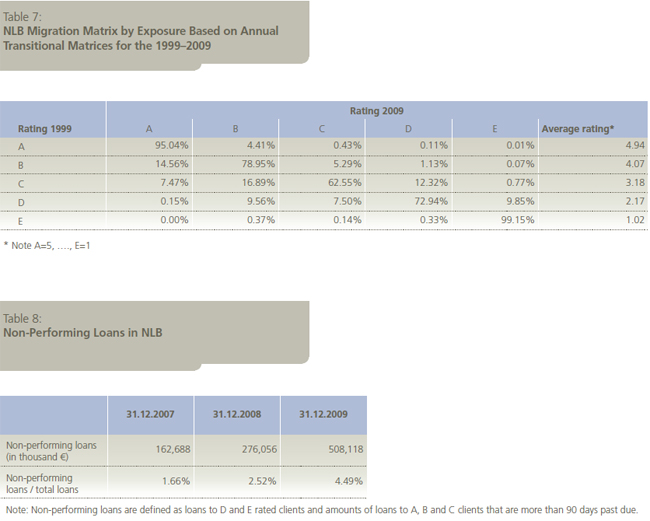

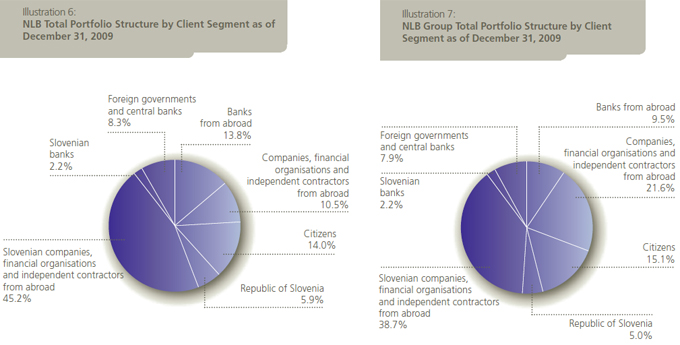

The credit portfolios are regularly reviewed by category (credit rating, country, type and size of client, activity, insurance, non-performing/expired receivables, currency exposure, etc.). Monitoring includes an analysis of changes and on the bases on time-sensitive dynamics, an assessment of risk trends and the concentration of credit portfolios. One of the more important instruments for reviewing and assessing the quality of the credit portfolio and characteristics of internal rating systems, as well as the level of exposure to system risks, is the rating migration matrix of clients within credit-rating categories along with related methods to determine time-sensitive portfolio changes. Furthermore, appropriate methods regularly assess and measure the level of concentration or diversification of credit portfolios. NLB regularly reviews the business practices and credit portfolios of its members to ensure that they are operating in accordance with the minimum risk-management standards of the NLB Group. This ensures appropriate uniform practices for managing and reporting credit risks at the consolidated level.

The financial crisis coincided with and accelerated the following trends in credit policy:

- Need for more qualitative insurance, while consistently considering insurance coverage ratios, whose value is measured on the basis of the true value concept;

- Increased establishment of impairments of receivables and reserves for liabilities;

- More accurate and strict credit handling of clients;

- Central review and advising on approval of investments by NLB Group members.

Liquidity Risk Management

To efficiently manage exposure to liquidity risk and to avoid liquidity gaps, the Bank applies several indicators and liquidity models, and also prepares various scenarios for exceptional situations, taking into consideration the Bank’s specific crisis or a system crisis affecting the wider economic environment. Furthermore, the Bank adopted a crisis strategy as an action plan to control exposure to liquidity risks in the case of a liquidity crisis.

Liquidity risk management is carried out in compliance with the relevant policies and strategies defined by the responsibility policies and rules. Minimal standards for liquidity risk management were implemented in NLB Group members by the Bank’s NLB Group Liquidity Risk-Management Strategy.

Market Risk Management

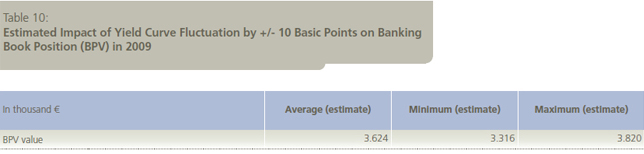

The NLB Group’s exposure to various market risks (foreign exchange rate risks, interest rate risk in the banking book, and other market risks in the trading book) is comparatively small. The NLB Group is relatively conservative in its approach to managing exposure to market risk, which is also indicated by appropriate system limits and processes defined by policies and other documents adopted at the Group level. The NLB Group Assets and Liabilities Committee carries out precise evaluations of all kinds of market risks and individual limits.

Some of the NLB Group’s activities are decentralized, whereas others can only be performed by NLB; the example of the latter are services connected to the trading book performed by NLB for other members of the NLB Group because, in accordance with the regulations of the Bank of Slovenia, NLB is the only bank that has trading activities within the Group. NLB’s main focus is to provide customer service (“back to back” transactions) and asset management, whereas trading for ones own account is carried out on a lower scale. The other Group members mainly monitor foreign exchange and interest rate risks that are primarily the result of structural fluctuations and macroeconomic conditions. NLB is conservative in its approach to managing exposure to foreign exchange rate risks. It minimizes such risks by closing open positions within set limits on a daily basis. Regarding exposure to interest rate risks, NLB actively manages open positions by applying derivative financial instruments in accordance with the “hedge accounting” principle. Most of these risks arise from the first-rate EMU debt securities (ECB-eligible) portfolio because the Bank formed an appropriate level of secondary liquidity reserves that, under the given circumstances, allow efficient operational liquidity risk management.

Monitoring and managing exposure to market risks is in general supported by modern internal methodologies tailored to comply with the Basel standards. Furthermore, stress tests are performed on a regular basis. The Group saw the implementation of a standardized current reporting system that ensures adequate control over the market risks that all companies of the NLB Group are exposed to. The methodologies comply with the requirements of the regulators on an individual and group level, and current reporting to a regulator follows a standardized approach. In compliance with the Bank of Slovenia requirements, the NLB Group provides adequate capital funds to cover potential unexpected losses due to exposure to foreign exchange rate and other market risks.

Operational Risk Management

In order to monitor and manage exposure to operational risks, NLB implemented a system to monitor loss events, as well as to identify and assess operational risks. To assess potential losses, fundamental risks are identified and evaluated.

Within the NLB Group, knowledge and methodologies are transferred at the level of both the Bank and the other members. All companies have adopted documents that are in compliance with NLB standards. Thus, NLB’s model of monitoring and managing operational risks has been implemented in the entire NLB Group.

Annual Report 2009