NLB Group

Retail Banking

Retail Banking

The NLB Group provides the general public with comprehensive, high-quality, and competitive financial services in Slovenia and abroad, always complying with its clients’ and individuals’ diverse requirements and needs. NLB’s retail banking is based on mutual understanding, trust, and cooperation. NLB’s services and modern marketing channels comply with the global trend. Among the banks in Slovenia, NLB has a leading market share in traditional banking services, as well as modern marketing channels. Together with the NLB Group members, it is also successfully establishing itself among other financial suppliers.

NLB provides its clients with a business network, including 158 branch offices for retail banking and 710 ATMs at customers’ disposal throughout Slovenia. NLB’s branch office and ATM network is completed by an additional 338 branch offices and 409 ATMs throughout the markets of SE Europe. Skilled advisory personnel in the branch offices provide NLB’s various customer segments with comprehensive financial advisory services and various other services. By linking traditional marketing channels and advisory services with modern marketing services, the Bank ensures its clients quick access to advisory and financial services without having to visit a branch office.

By the end of 2009, more than 839,000 residents of Slovenia had opened a personal account with NLB, which is 41% of Slovenia’s population. NLB’s services include twelve different personal accounts, catering to the special needs of its various client segments.

Private banking and the Platinum Package, which ensure top-notch features and advisory services, quality asset management, and other specialized financial services, are intended for the most demanding and most affluent customers. The Gold Package and personal banking services are tailored towards highly demanding and financially powerful clients. Personal bank advisors ensure their customers comprehensive financial advisory services, as well as banking via traditional as well as modern channels. Personal and private banking is used by 11% of NLB’s clients. NLB’s services for young people cover their needs for banking services from birth to full employment. Furthermore, NLB provides young people with attractive rates; for example, free management of personal accounts and more attractive interest rates for savings and loans. Furthermore, in 2009, the Bank dedicated more attention to senior citizens, young families, new clients, and NLB employees. The Bank prepared new packages, providing customers with additional financial benefits, while offering them more services. This contributed to NLB successfully achieving its sales objectives.

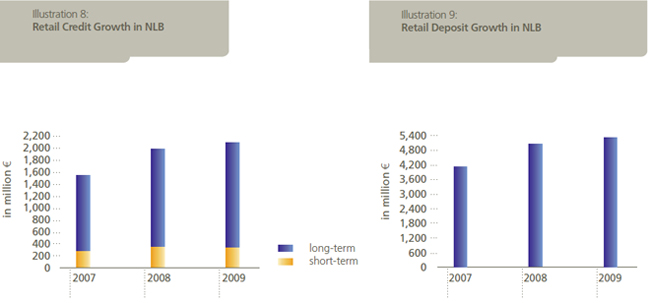

In retail deposits, NLB actively promoted the provision of its own funds. The “Super Deposit” marketing, communication, and sales campaign contributed to restructuring short-term investments into long-term investments. The growth of all household deposits amounted to 5% in 2009, whereas the long-term deposit portfolio grew by 38.6%. In 2009, the share of long-term deposits in all deposits of natural persons increased to 38.5%, equaling a market share of 44.4% of all long-term deposits of Slovenia’s population.

Due to the circumstances on the financial markets, clients directed fewer funds into other investment vehicles offered by the NLB Group. NLB’s services cover the entire national and international financial markets, offering different profitability and risk levels. The NLB Group’s services include 15 NLB Skladi mutual funds, two guaranteed funds, and eight bank-insurance funds. The second half of the year will be characterized by reviving other financial investment vehicles through marketing packages in connection with traditional deposits and a new selection. Furthermore, NLB introduced new forms of insurance: individual accident insurance for personal account holders and collective life insurance for clients requesting exceptional overdraft limits.

In retail loans, NLB’s portfolio achieved a 4.7% increase in 2009. The biggest increase was achieved in mortgage credits, the volume of which increased by 23.1% in 2009, and by real estate loans (including the National Housing Savings Scheme, NSVS), which grew by 8.7%. On the other hand, a decrease in car loans and personal, non-secured loans was characteristic in 2009. Despite unfavorable conditions, NLB preserved its stable financial position with regard to natural persons in 2009, maintaining a low percentage of outstanding claims in this segment.

In credit card operations, the Bank increased customer confidence by gaining new partners for the “EnKa” loyalty program. In 2009, NLB prepared special “EnKa” campaigns designed for young people, retirees, and wealthier customers. NLB patrons held 1.4 million cards with which they made purchases totaling €1.7 billion. By number and volume, BA Maestro debit cards still prevail. In 2009, NLB started to upgrade the POS network with IP and GPRS terminals, and also introduced secure MasterCard and Visa payment systems in compliance with the valid international 3D Secure standard.

In 2009, NLB Klik e-banking was upgraded with new features to increase safety by introducing additional security passwords for payments, and new contentrelated features applied to bringing the Bank’s business operations in line with the national SEPA payment system and the Payment Services and Systems Act, and e-invoices (i.e., e-login). At the end of 2009, NLB Klik already covered 28.2% of applicable personal accounts.

NLB’s revamped Web Portal, totaling an average monthly user number of 800,000, is being continuously improved with new functionalities, upto- date information, and services. The portal also allows direct communication with NLB’s advisory staff or subscription to the NLB e-newsletter.

On the SE European markets, the amount of retail accounts exceeded one million and is continuously growing. Despite the economic situation, which mostly affected the Serbian and Montenegrin region, household assets increased by 23%. In 2009, the NLB Group banks on the SE European markets continued to modernize their branch offices to comply with NLB standards and thus enable them to utilize modern business operations and change from transaction to advisory banks even faster. More than one-third of the branch offices, of which the majority are in the most important locations, were modernized. Above all, the NLB Group expanded its network of branch offices in line with opportunities and in areas of low presence. The Bank further optimized its business network by merging banks (NLB Banka, Beograd). Therefore, the total number of branch offices could be decreased. In 2009, the ATM network grew by 20%. Furthermore, the NLB Group banks introduced personal banking services for their best clients. The changed and adapted services provide services of the highest quality and contribute to reinforcing client satisfaction. In 2009 adopted minimum standards for the retail sector will contribute to an even quicker harmonization of the business operations in the region, thus allowing the introduction of modernized business operations. Moreover, the NLB Group banks saw the introduction of the “NLB Welcome” service, offering all NLB Group customers simplified processes in the case of loss or theft of personal and bank documents by all NLB Group branch offices, while personal banking customers enjoy additional benefits and appropriate handling. The card sector, which is one of the major development potentials on the SE European markets, is developed in all banks. Turnover with cards grew by 29% compared to 2008.

Annual Report 2009