NLB Group

NLB Corporate Governance

NLB Corporate Governance

NLB, as the parent bank and in line with established business principles, provides corporate governance for the NLB Group by following fundamental doctrines of corporate administration and management as well as other standards that ensure effective business supervision.

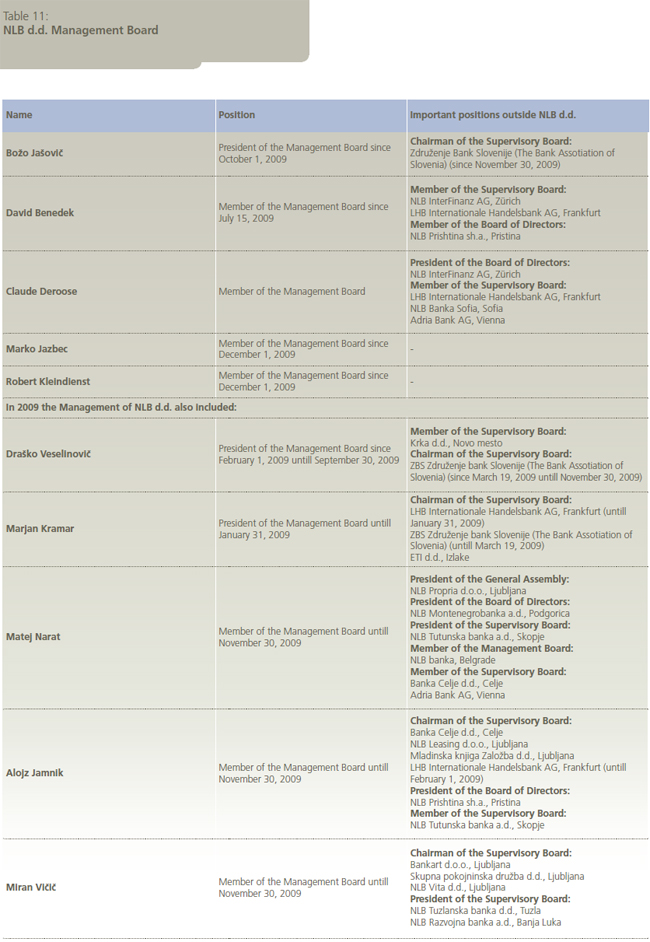

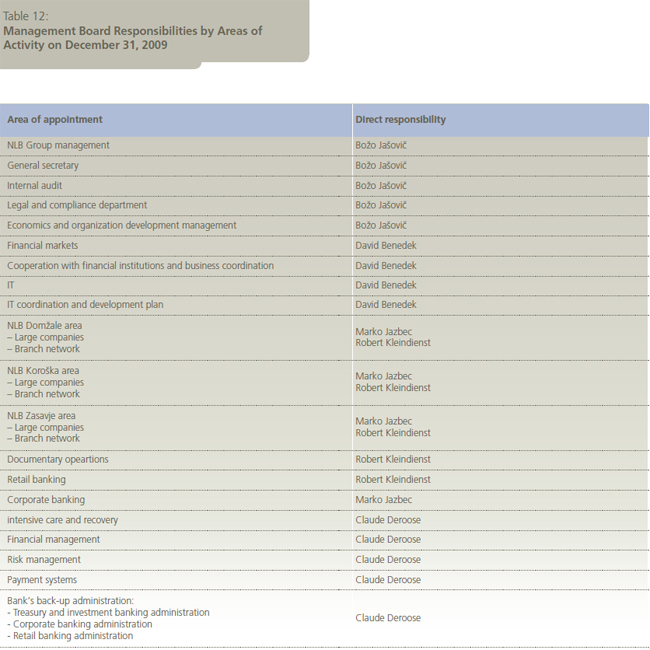

Management Board

The NLB Management Board leads, represents and acts on behalf of the bank, independently and on its own responsibility, as provided for by law and the provisions of the Statute of the Bank. In compliance with the Statute, the Supervisory Board can nominate and appoint three to six members (the president and five members) to the Management Board. The president and the members are appointed for a term of five years and can be reappointed, or removed before their term expires, in accord with the regulations and Statute of the Bank.

On January 31, 2009 the term of the President of the Management Board, Marjan Kramar, who had led the Bank since February 1, 2004, expired. As of February 1, 2009 Draško Veselinovič was appointed to take on Marjan Kramar’s position. On April 20, 2009 Draško Veselinovič offered to resign; however, in agreement with the Bank’s Supervisory Board, he exercised his office as President of the Management Board until September 30, 2009. Due to Draško Veselinovič’s resignation, Božo Jašovič was appointed President of the Management Board on October 1, 2009.

On November 2, 2009 NLB’s Supervisory Board concluded an agreement on early termination of the terms of office with three members of NLB’s Management Board, whose terms of office were terminated early as of November 30, 2009 (i.e., Alojz Jamnik, Matej Narat, and Miran Vičič). All three kept appropriate positions within NLB.

Marko Jazbec and Robert Kleindienst were appointed as members of the Bank’s Management Board as of December 1, 2009 for a term of five years. The members of the Supervisory Board, David Benedek and Claude Deroose, will continue their term. David Benedek’s term will expire on July 14, 2014, and Claude Deroose’s term will expire on July 15, 2012.

Collective Decision-Making Bodies

- The NLB Credit Committee determines credit ratings, sets debt ceilings and approves commercial banking investments. The committee’s decisions are made in compliance with the NLB Book of Rules on Mandates and Authorizations. The Credit Committee meets once a week. At least three members of the Management Board need to be present. The president of the Credit Committee is a member of the Management Board responsible for corporate banking.The Committee constitutes a quorum when at least three Management Board members are present.

- The Credit Committee for Natural Persons decides on the approval of credits and other investment proposals, the conditions of which deviate from regular bank offers and exceed the business network’s director’s authorization determined by a Management Board decision. The Committee’s decisions are made in line with the NLB Book of Rules on Mandates and Authorizations. The Credit Committee meets once a week. The president of the Committee is a member of the Management Board responsible for retail banking. The Committee constitutes a quorum when at least three members of the Committee are present, of which at least one must be a member of the Management Board.

- The NLB Assets and Liabilities Committee monitors conditions on financial markets and analyses the condition, changes and trends in the Bank’s assets and liabilities. It also formulates resolutions to carry out the configuration of the balance sheet in line with business policies and that make possible the regular operation and implementation of planned objectives. Meetings are convened twice a month and at least three Management Board members need to be present. The president of the Committee is a Management Board member in charge of financial markets. The Committee constitutes a quorum when the majority of the Committee members are present.

- The NLB Group Assets and Liabilities Committee monitors and discusses the business operations of the NLB Group members, of which NLB is the majority owner, as well as of all NLB Group members in leasing and factoring activities, and, to a narrower extent, of the remaining NLB Group members. Meetings are convened at least quarterly; however, usually every two months. At least two Management Board members need to be present. The Management Board’s President is the president of the Committee. The Committee constitutes a quorum when the majority of its members are present.

Decision-Making and Advisory Bodies of the Bank

- The NLB Cost Committee is a decisionmaking and advisory body responsible for monitoring the allocation and approval of all NLB corporate costs.

Advisory Bodies of the NLB Management Board

- The NLB Price Policy Committee is the coordinating and consulting body in charge of proposing resolutions for commercial interest rates and tariffs that conform to the NLB business policy and goals.

- The NLB Trading and Marketing Risk Committee is the coordinating and consulting body of the Bank’s management in charge of defining, adopting and supervising the implementation of policies and methodologies of the Bank in trading.

- The NLB Operating Risk Committee is the coordinating and consulting body of the Management Board responsible for administrating and monitoring operational risks for NLB, as well as for transferring this methodology to the consolidated NLB Group members.

- The College of the Bank is the advisory and consulting body of the Management Board that acts as both a sounding board and gobetween for ideas and suggestions that fall within the decision-making authority of the Management Board.

- The Strategic Conference of the NLB Group jis a special body of the Management Board with a consulting nature. It is convened once a year. At the meeting, the NLB Group’s strategic and business objectives for the coming year are discussed.

- The Business Conference of the NLB Group is convened once a year. At the meeting, the NLB Group’s strategic and business objectives are discussed.

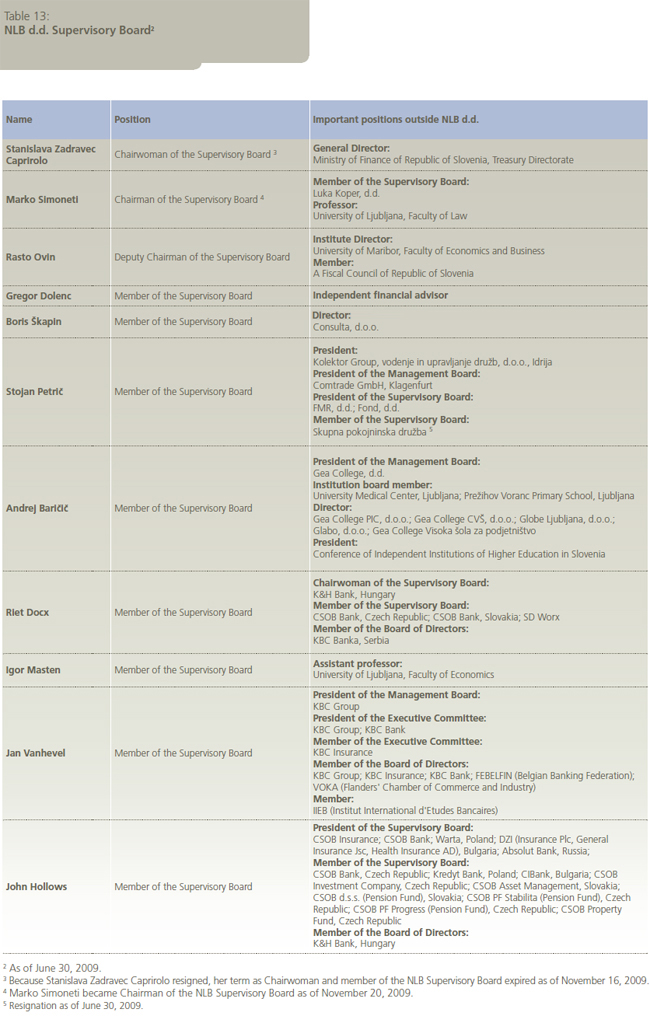

The Supervisory Board

The NLB Supervisory Board tracks and supervises the management and the performance of the Bank. It operates in accordance with provisions of the laws regulating banks and companies, as well as the NLB Statute, which in article 24 defines its responsibilities. Unless otherwise stipulated in the Statute, the Supervisory Board constitutes a quorum when properly convened and when at least half of its members are present or represented, including the chairman or his deputy.

In line with the Statute, the Supervisory Board has 11 members appointed and discharged by the shareholders or Supervisory Board.

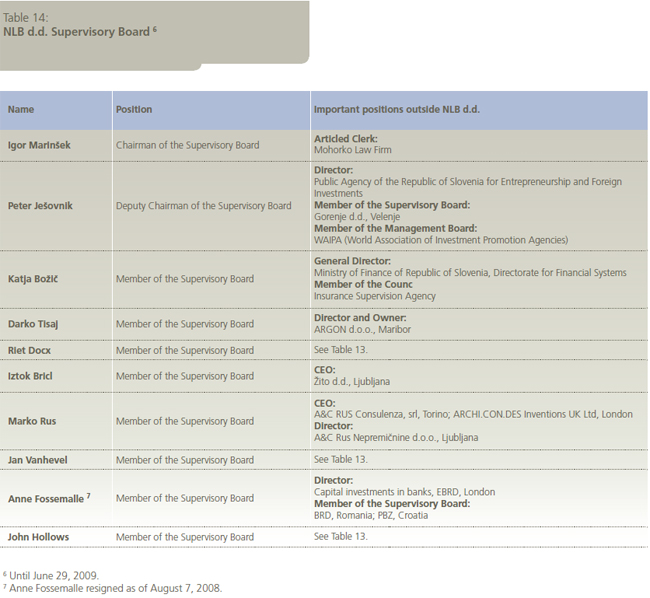

Until June 30, 2009 the Supervisory Board was composed of the following members: Igor Marinšek (president), Peter Ješovnik (vicepresident), Katja Božič, Iztok Bricl, Riet Docx, John Hollows, Marko Rus, Darko Tisaj, and Jan Vanhevel.

The new Supervisory Board was appointed at the shareholders’ meeting on June 30, 2009 for a term that ends four years after their appointment, following the NLB General Meeting of Shareholders and their approval of the annual report. After Stanislava Zadravec Caprirolo resigned, Marko Simoneti was appointed as President of the Supervisory Board.

Responsibilities of the Supervisory Board

The responsibilities of the Supervisory Board are:

- To review and supervise the management and operations of the Bank and, in cases of proven misconduct, to propose solutions;

- To review the reports of the Management Board and supervise its leadership of the Group, and in cases of proven misconduct, propose measures to rectify the problem;

- To report the results of its findings about the Bank’s performance to shareholder meetings whenever necessary, or at a minimum, when the annual report is released, as well as to approve measures to improve the Bank’s performance;

- To discuss the internal auditor’s reports and its revisions and, based on these reports, to propose adoption of direct corrective measures;

- To approve the adoption of the general acts of the Bank as determined by Statute, except for acts that require approval by the General Meeting, or the acts based on laws or officially passed resolutions of the General Meeting;

- To approve those decisions of the Management Board as required by legal provisions or by the Statute;

- To prepare proposals for the General Meeting and carry out the tasks defined by the General Meeting, unless regulations require otherwise;

- To examine and approve the annual report and proposals for the use of the total profit recognized in the balance sheet, as well as to prepare a written report about the results of these investigations for the General Meeting;

- To decide to adopt the strategy, annual financial plan and business plan of the Bank;

- To discuss and review reports on the performance of the Bank throughout the year;

- To establish credit and guarantee limits, as well as all other limits for the Bank’s operations;

- To approve all activities that involve changes in the status of corporations or companies where the Bank has majority interest;

- To determine ceilings for long-term indebtedness;

- To appoint members of the Management Board;

- To adopt the Rule Book for its work;

- To define the criteria for compensating the Management Board and to continuously review their fulfillment;

- To conclude contracts with the Bank’s Management Board members, whereas the Bank is obliged to disclose the data on individual remuneration of the Management Board and Supervisory Board members in the Bank’s annual report, including notes to the criteria under the preceding indent;

- To approve those changes in the wording of the Statute, that in compliance with the Statute require legal approval by the General Meeting or by the Management Board.

Commissions of the Bank’s Supervisory Board

- The Strategy and Development Commission oversees the Bank’s strategic objectives and development, and also drafts proposals concerning Supervisory Board decisions, especially by discussing, reviewing, and assessing the entire medium-term or long-term strategic plan of NLB and the NLB Group, as well as more important elements of the Bank’s strategic and development plan. It analyses the adequacy of NLB’s and the NLB Group’s organization and corporate management, discusses sales and purchases of business shares in the NLB Group from a strategic viewpoint, and discusses the annual financial and business plans of NLB and the NLB Group on the basis of the adopted medium-term/long-term strategy and development. The Strategy and Development Commission comprises the following members: Rasto Ovin, president; Gregor Dolenc, member; John Hollows, member; Marko Simoneti, member; and Boris Škapin, member.

- The Audit Commission monitors and prepares draft proposals for Supervisory Board decisions concerning internal audits and legal compliance of the Bank’s business operations for external and internal audit reports; it evaluates auditing procedures, evaluates and adopts recommendations or decisions in connection with the documents of external regulators, assesses internal control, and evaluates and recommends computer standards and policies to be applied in the Bank. The Audit Commission comprises the following members: Andrej Baričič, president; Riet Docx, member; John Hollows, member; Stojan Petrič, member; and Sergeja Slapničar, external independent member.

- The Risks Commission monitors and prepares draft proposals for Supervisory Board decisions concerning all areas of risk relevant to the Bank’s business operations. The Risks Commission comprises the following members: Igor Masten, president; Riet Docx, member; Andrej Baričič, member; Stojan Petrič, member; and Boris Škapin, member.

- The Remuneration and Appointment Commission oversees basic strategic questions and prepares draft proposals for Supervisory Board decisions concerning the appointment and dismissal of Management Board members, determines the manner of recruiting and selecting Management Board candidates, concludes and oversees the content of individual employment contracts with members of the Management Board, oversees the remuneration of Management Board members, and determines remuneration criteria. The Remuneration and Appointment Commission comprises the following members: Marko Simoneti, president; Boris Škapin, member; Gregor Dolenc, member; and John Hollows, member.

General Meeting of NLB Shareholders

The General Meeting of NLB Shareholders meets and decides at either regularly scheduled or extraordinary meetings to adopt resolutions in compliance with the law and the provisions of the Bank’s statute. The responsibilities of the General Meeting of NLB Shareholders are stipulated by the Companies Act and the Banking Act, as well as the NLB Statute. It mainly decides on and adopts:

- The Bank’s statute or amendments to the statute;

- The Rules Book on the work of the General Meeting of NLB Shareholders,

- The annual report if not accepted by the NLB Supervisory Board or if the Management Board and the Supervisory Board leave the decision on the adoption of the annual report to the General Meeting;

- The use of the balance profit;

- The discharge of the Management Board and the Supervisory Board;

- Changes of the Bank’s basic capital;

- Annual limits and characteristics of the issue of securities, changeable in shares, and equity shares of the Bank;

- The appointment and dismissal of Supervisory Board members;

- The remuneration of Supervisory Board members, and profit participation of Supervisory Board and Management Board members as well as of Bank employees;

- The organization that will carry out the audit of the Bank’s financial statements; and

- Changes in the status, mergers, and discontinuation of the Bank.

In compliance with the law, shareholders have rights as holders of shares or capital shares in NLB’s basic capital. Furthermore, the shareholders hold determined ownership and corporation (membership) rights. In particular, shareholders are entitled to share in the profits (dividends), to share in any surplus in the event of liquidation (bankruptcy assets), to vote in compliance with the number of shares, and to be informed. They exercise their rights by participating in the General Meeting and by requesting certain information from the management or supervisory bodies. “Qualified” shareholders hold special rights.

Representatives of the NLB shareholders held their General Meeting on June 30, 2009. A total of 90.14% of the shareholders were represented. The NLB Annual Report for the previous business year and the Supervisory Board’s report were presented, and all proposed resolutions were adopted.The proposed distribution of profit was accepted as dividends in the amount of €0.33 per share. In addition, the proposal regarding amendments to NLB’s Statute was accepted and the Supervisory Board members were elected. PricewaterhouseCoopers was appointed as NLB auditor for 2009.

NLB does not have any shareholders with special control rights.

NLB does not have limitation of voting rights. In compliance with the law, voting rights are attached to all NLB shares (except for possible treasury shares).

NLB’s rules on the appointment and change of management or supervisory board members do not deviate from the legal rules. The General Meeting of NLB Shareholders is responsible for the election and dismissal of the members of the Supervisory Board, whereas the appointment and dismissal of NLB Management Board members falls within the competence of the Supervisory Board. Furthermore, the NLB rules on the adoption and amendment of the NLB Statute do not deviate from the rules stipulated by the Companies Act, meaning that the General Meeting of NLB Shareholders adopts and amends the Bank’s Statute in compliance with the procedures stipulated by law.

The NLB Management Board was authorized by the General Meeting of June 30, 2009 to increase NLB’s basic capital by a maximum amount of €37,163,879.15 (authorized capital) once or several times over a period of five years from entering the change in the Register of Companies.

The increase is subject to the Supervisory Board’s consent; however, it does not need an additional resolution by the General Meeting. The authorized increased capital amount allows the issue of a total of 4,452,976 new ordinary or preference shares.

NLB Group Corporate Governance

NLB, as the parent bank in the NLB Group, provides corporate governance for the NLB Group by following its own internal regulations and operating, in compliance with the laws of the Republic of Slovenia and the countries in which the NLB Group members operate.

On the basis of the Corporate Governance Policy of the NLB Group, NLB regulates the comprehensive administration and management of the Group as one of its essential business purposes, and defines the roles, competencies, and responsibilities of individual bodies and organizational units to ensure that they function cooperatively and harmoniously in their efforts to achieve the Bank’s business objectives.

NLB constantly endeavors to supplement and improve the corporate-governance system of the NLB Group as a combination of the regulations of NLB and NLB Group members, and the principles of good business practice. NLB Group Corporate Governance is thus carried out:

- In accord with fundamental corporate rules and through the various agents of the NLB Group members:

- by implementing managerial entitlements at the general meetings of NLB Group members;

- by proposing NLB representatives to be nominated as members of supervisory boards;

- by proposing executive appointments for the members of the NLB Group;

- by the cooperative participation of NLB representatives in various committees and commissions of the NLB Group members.

- Through appropriate mechanisms for effectively monitoring operations, harmonizing business standards and distributing information within the Group:

- by business area (or the “business line” principle) in accord with the principles for professional collaboration of activities within the NLB Group;

- via the NLB Group Assets and Liabilities Committee, which adopts decisions concerning the business management of NLB Group members at the proposal of NLB specialist services;

- by convening strategic conferences (all the NLB Group members discussing development priorities of the NLB Group);

- by regional meetings at which all members of the NLB Group in that country gather to discuss, develop and coordinate the Group’s priorities for their respective markets.

The NLB Internal Audit Center and external supervisors (Bank of Slovenia, external auditors) provide additional supervision of the NLB Group.

To oversee corporate governance within the Group, NLB established the following:

- The NLB Group Corporate Governance Directorate was established by the NLB Management Board in April 2009 as an upgrade to the NLB Group Management Center. In addition to established forms of corporate management, the Directorate also performs corporate management by individual areas and members. By performing the function of NLB Group corporate governance, the Directorate assures management and supervision of NLB Group members, harmonisation of the rules of operation of NLB Group members with NLB d.d. standards, preparation of individual members’ plans, and monitors their implementation.

- The NLB Group Assets and Liabilities Committee, as an expert body, monitors and reviews the business operations of the NLB Group members, of which NLB is the majority owner, as well as of all NLB Group members in leasing and factoring activities, and, to a narrower extent, of other NLB Group members. The Committee monitors the conditions on the financial markets on which the NLB Group members operate and analyses the situation, changes, and trends in the members’ asset and liabilities structure, and also drafts policies to enhance conformity with the structure of the NLB Group members’ asset and liabilities structure, which comply with the NLB Group’s strategy and its integrated “business line” and facilitate normal business operations of the members, as well as fulfilling the plans of the NLB Group.

The Committee mainly monitors and reviews the following:

- Conditions on the financial markets;

- Regulations concerning balance statement and capital management of the NLB Group members and NLB Group;

- The system of monitoring and managing of the asset and liabilities structure and exposure to market risks within individual NLB Group members;

- Business results;

- Management of non-credit risks in the business operations of NLB Group members;

- Exposure to credit risk; and

- Capital management of the NLB Group members and the NLB Group.

Annual Report 2009