NLB Group

SMEs and Corporate Banking

SMEs and Corporate Banking

NLB is a bank that listens to its clients’ changing needs and offers a comprehensive portfolio of services they require for their business, including its expansion on both the Slovenian and international markets. As a result, its clients can take advantage of NLB’s synergistic expansion of its business operations and simultaneously use the synergy offered by the NLB Group’s presence on the markets, towards which the Slovenian economy is also inclined.

In 2009, corporate banking was characterized by restrained economic activity, which resulted in decreased credit activities. In 2009, the volume of corporate loans decreased by 2.7% compared to 2008. In spite of adverse economic and market conditions, NLB succeeded in keeping a stable company investment portfolio.

Banking with Small and Medium- Sized Enterprises (SMEs)

At the end of 2009, 62,749 corporate accounts of medium-sized, small, and micro-sized enterprises, as well as independent contractors, were open at NLB. NLB provides demanding small and medium-sized enterprises with a comprehensive portfolio of services, custody, and consulting offered by 20 specialized branch offices established to work with companies and independent contractors. Less-demanding customers may also opt for custody provided by the branch offices for retail banking. Custodians, in cooperation with various experts, provide enterprises with optimum solutions for their businesses.

In 2009, NLB fulfilled the objectives set by the Policy and Strategy for the SME Business Segment. The Bank marketed a customer-tailored package (the “Business Package”) intended for new and current customers, prepared special accounting service offers, including numerous benefits provided by NLB and other NLB Group subsidiaries, and promoted the use of key services. In order to obtain long-term resources for small business loans, NLB upgraded its EIB loan portfolio with loans from assets provided by the Council of Europe Development Bank (CEB) and the Slovenian Export and Development Bank (SID). Furthermore, the Bank’s subsidiaries developed products for the small-business segment. In 2009, NLB Vita presented life insurance for legal entities, as well as private undertakings wishing to take out a loan, which was particularly attractive to family-run enterprises. In electronic banking, NLB improved the functionality of its Proklik e-banking service and E-Invoicing System, providing users with a wide range of opportunities to economize and simplify their transactions.

Despite marketing various services and promoting loans from the EIB fund, loans given to small businesses and independent contractors by the NLB network decreased by 3.9% in 2009.

In comparison to the previous year, in 2009, the growth of deposits from small businesses slowed down. Deposits increased by only 3.0%, with demand deposits and short-term deposits prevailing.

In 2009, the business network of the SE European markets saw a combined increase in both loans and deposits. The process of establishing specialized branch offices for enterprises and independent contractors is still in progress, but business operations with small and medium-sized enterprises have already been decentralized in banks at all 159 locations.

The Bank encourages the growth of international and Slovenian small businesses by cooperating with EU funds, state institutions that support the development of small businesses, chambers of trade and commerce, and municipalities, as well as by organizing various professional training events for companies.

Corporate Banking

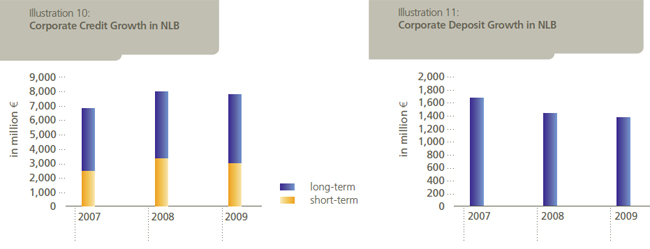

Compared to the previous year, the credit portfolio in the corporate segment declined by 4%. With respect to maturity, the structure of the credit portfolio changed slightly in 2009. The share of long-term loans, which represented the largest share within the credit portfolio structure at 65%, increased by 4%, whereas short-term loans accounted for the remaining 35% of the credit portfolio.

The Slovenian government implemented several anticrisis measures to relieve the credit crunch. On the basis of the adopted Republic of Slovenia Guarantee Scheme Act and in compliance with the authorization of the Ministry of Finance, in the middle of 2009 SID Bank started to implement Republic of Slovenia guarantee schemes for companies and cooperative institutions. The purpose of the Republic of Slovenia guarantees was to lessen the effects of the economic and financial crises and to improve companies’ liquidity. NLB actively participated in the implementation of the Republic of Slovenia guarantee schemes. At auctions, it obtained a guarantee quota in the amount of €67 million, on the basis of which it granted €127.9 million worth of loans guaranteed by the Republic of Slovenia.

Corporate deposits were an important source for managing liquidity in 2009. At the end of 2009, deposits had grown by 8.0% compared to the end of 2008. The deposit structure saw a gradual increase in the share of long-term deposits, which amounted to 8% at the end of 2009, compared to 5.6% at the end of 2008. At 57.8%, short-term deposits accounted for the largest share, and demand deposits totaled 34.2%.

In 2009, NLB successfully upgraded its overall system of managing its business relationship with joint NLB Group clients. In order to improve investment approval processes at the NLB Group level and the proactive approach towards credit risk management, NLB set up a practical solution, ensuring information support at the NLB Group level. Thus, NLB improved the conditions for synergistic effects on all strategic markets, while also ensuring support to the traditionally export-oriented Slovenian economy.

International Financing

The NLB Group has been active in international banking for several years. With its network of banks and non-banking institutions, the Bank maintained and strengthened its business relationships with foreign banks and multilateral financial institutions, which, given the adverse conditions on the financial markets, was of key importance, especially regarding the funding activities on international markets.

In accordance with the NLB Group’s strategic policies, the Bank further developed and expanded its international business operations, especially on the markets where the NLB Group has banks and non-bank members. Furthermore, NLB adapted its international expansion and business policies to the tougher conditions on the international markets and to economic movements. Despite adverse circumstances, NLB succeeded in maintaining a stable volume of its international business portfolio, totaling almost €1 billion.

Due to restricted access to financial and capital markets, NLB directed the majority of its business operations in international credit activities towards ensuring financial resources to NLB Group members. Thereby, NLB indirectly facilitated funding NLB Group clients, thus supporting the NLB Group members’ aspired market position.

In direct financing of foreign strategic clients, the majority of loans were intended for financing operating current assets, allowing for synergistic effects at the NLB Group level, because under the unstable economic conditions companies decided to invest only in exceptional cases.

In export financing and insurance, NLB concentrated on the markets with export-oriented clients. Apart from the strategic markets where the NLB Group is already present, these also include the former Soviet markets, where most of the business is done with Russia, as well as to a smaller extent with Ukraine, Belarus, Kazakhstan, and other countries. Regarding its financing activities of export businesses, the Bank followed the trade flows in these countries.

Regarding larger projects on foreign markets, NLB cooperates with the Slovenian Export and Development Bank, which offers commercial and non-commercial risk insurance for businesses. The cooperation with the Slovenian Export and Development Bank mainly applies to financing exports to the Russian and other former Soviet markets.

....................................

The Bank maintains and upgrades a comprehensive portfolio of services for SMEs and Corporates.

Cash Management

Liquidity and greater cash management efficiency are of central importance for companies. Therefore, cash management services are an important instrument for the NLB Group, especially for companies operating internationally. The NLB Group thus provides a broad range of comprehensive solutions that clients are using increasingly more.

Assistance in Obtaining EU Grants

In order to maximize the opportunities for Slovenia from the financial standpoint during the 2007–2013 period, NLB provides counseling services to private and public businesses when their projects are eligible for financing by non-fundable grants from the EU. The Bank provides a full range of services: it informs its clients of current availability of public tenders, advises in the preparation of project proposals, helps devise optimal financing for projects, and approves appropriate investments. By offering such a broad range of services to companies seeking free EU funding, NLB also assumes its role as a leading financial institution in this field.

Documentary Business

In 2009, the volume of NLB bank guarantees continued to grow. Due to the economic situation in the world and in Slovenia, the guarantee portfolio structure underwent a change. There was an increase in the volume of credit repayment guarantees issued, as well as other payment guarantees. Letters of credit and collection transactions showed a slight fall compared to the previous year.

The fall in letters of credits was noted by all world banks (research by the International Chamber of Commerce). The trend toward using specialized instruments (such as domestic letters of credit, document dependent transfers, use of fiduciary accounts, etc.) continued to grow and attract interest from clients.

Regarding the use of international checks, the volume of these checks remained static, confirming the prevalent trend throughout the world. However, an increase in the amount of falsified checks and check fraud attempts were noted.

Card Operations

NLB has issued 51,389 business charge cards, of which 73.6% are debit cards. NLB offered business partners from various branches the possibility of various bonus systems for its loyal clients, using different campaigns as part of the EnKA loyalty program.

Electronic Operations

In 2009, NLB’s Proklik e-banking service was adapted to handle domestic payments within SEPA and the Payment Services and Systems Act. At the end of 2009, Proklik had 44,488 users, which represents an 8.8% increase compared to 2008. In 2009, NLB’s new E-Account service became even more popular among users of NLB Proklik and NLB Klik because the bank has made it possible to register and prepare invoices online (within the e-bank) as part of its E-Invoicing System. In addition to issuing and receiving invoices, e-account users can now register through the e-bank and receive e-invoices from the issuers included, manually enter e-invoices via NLB Proklik, and save e-invoices in the e-archive.

Annual Report 2009