NLB Group

Report of the Supervisory Board of NLB

Report of the Supervisory Board of NLB

The Supervisory Board of NLB was appointed on June 30, 2009 for the period of time until the conclusion of the Bank's General Meeting of Shareholders, which makes decisions regarding the annual report for the fourth financial year after the election of members. The Supervisory Board comprised the following members in 2011: Marko Simoneti (Chairman), Rasto Ovin (Deputy Chairman), Andrej Baričič, Jurij Detiček, Riet Docx, John Hollows, Anton Macuh, Igor Masten, Stojan Petrič, Boris Škapin and Jan Vanhevel (until May 16, 2011).

Based on the resignation of Jan Vanhevel from his position as member of the Supervisory Board, a proposal on the election of a replacement member was submitted at the General Meeting of Shareholders on June 30, 2011. The proposal, however, was not approved. NLB's Supervisory Board therefore functioned with 10 members during the second half of 2011.

Professional support to the Supervisory Board in its work was provided by four committees in 2011: the Risk Committee, the Audit Committee, the Remuneration and Appointment Committee and the Strategy and Development Committee.

Work of the Supervisory Board

In 2011, the Supervisory Board met at eleven regular and four correspondence sessions, at which it discussed regular reports on the operations of NLB and the NLB Group, as well as other current matters and important issues.

- discussed and approved the 2010 Annual Report, adopted the report on the Supervisory Board's work for the previous year, drafted the Bank's corporate governance statement for 2010 in cooperation with the Management Board and approved the Management Board's proposal on the use of distributable profit;

- discussed materials and approved proposals to adopt resolutions at the General Meeting of Shareholders, including proposed changes to the articles of association regarding authorized capital and the proposed election of a replacement member to the Supervisory Board;

- regularly discussed quarterly reports on the operations of the Bank and the Group;

- regularly monitored activities relating to the implementation of the Bank's strategic guidelines and submitted proposals to the Management Board regarding possible measures in specific areas, including the program for divesting non-strategic investments, the sale of seized participating interests in companies and the cost reduction program. It also approved the retail banking restructuring program for the period 2011–2015;

- discussed the capital projection for the Bank and Group for the period 2011–2013, gave its consent to the Management Board's proposal to increase the Bank's capital and regularly monitored the projection of capital adequacy and capital management activities. It also discussed the results of EBA stress tests;

- approved NLB's restructuring program for the period 2011–2015, which served as the basis for the program submitted to the European Commission by the Republic of Slovenia, and regularly monitored activities relating to the European Commission's decision in this matter;

- regularly discussed internal audit reports, and was regularly briefed on letters from the Bank of Slovenia and external regulators and regularly monitored the implementation of their recommendations. It regularly discussed in detail reports regarding the Bank's participation in the Republic of Slovenia's guarantee schemes, reports regarding trends in the Bank's lending activities, reports regarding customers subject to intensive care through measures to actively manage risks, and reports regarding write-offs, conversions and major lending transactions;

- discussed reports regarding measures and activities carried out by the Bank with regard to non-performing loans and for improving operations. It discussed and provided guidelines to the Management Board regarding the Bank's organizational structure in the area of resolving non-performing loans;

- approved and rejected the Bank's exposure to customers in accordance with the Banking Act, and approved exposures to persons in a special relationship with the Bank. It also gave its consent to NLB's borrowing on foreign markets in the form of "club" loans;

- set remuneration criteria for the Management Board in 2011 and approved the remuneration policy for employees whose work is of a specific nature; and

- appointed Guy Snoeks as new member of the Management Board following the resignation of Claude Deroose. Mr. Snoeks is responsible for risk management, payment systems and back-office services and investment evaluation.

Verification and approval of the 2011 Annual Report

On April 5, 2012, NLB's Management Board submitted the 2011 Annual Report, with the audited financial statements of NLB and the consolidated financial statements of the NLB Group, including the auditor's opinion, to the Supervisory Board. According to the auditor, the financial statements and accompanying notes present a true and credible picture of the Bank's and the NLB Group's financial position as at December 31, 2011, and are in line with the International Financial Reporting Standards. Based on its review of the business report, the auditor finds that the information provided in the business section of the annual report is in line with the Bank's and the NLB Group's financial statements.

The Supervisory Board had no comments on the report provided by the auditors of PricewaterhouseCoopers d.o.o., Ljubljana. After carefully verifying the audited annual report for the 2011 financial year, the Supervisory Board had no comments and adopted it unanimously.

Assessment of the Supervisory Board’s work

The Supervisory Board carried out a self-assessment of its work in 2011 in accordance with best practices and on the basis of the proposed methodology of the Slovenian Directors' Association. In an anonymous survey, the members of the Supervisory Board stated that they believe the quality of the Supervisory Board's work is very high, although there are some differences in individual areas. Among the positive findings were assessments regarding the independence of Supervisory Board members, their presence, the functioning and quality of contributions made by individual members to the overall work of the Supervisory Board, the monitoring of the implementation of resolutions and the quality of the work of the Supervisory Board' committees. The method used to select candidates for the Supervisory Board is somewhat problematic, but is objectively conditional on agreement between the two largest shareholders, who exercise control over the Bank through a shareholder's agreement. Opportunities to improve the functioning of the Supervisory Board, which the Supervisory Board will attempt to implement in the coming period, lie primarily in the initiation of new members of the Supervisory Board to their functions, the professional development of Supervisory Board members in specific banking areas and the more in-depth discussion of personnel and organizational issues at meetings of the Supervisory Board and its specialized committees.

Members of the Supervisory Board received additional training primarily in the form of seminars organized by the Slovenian Directors' Association, the Bank Association of Slovenia and the Capital Assets Management Agency of the Republic of Slovenia.

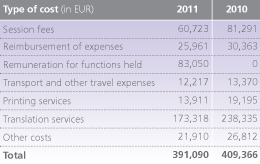

The Supervisory Board also discussed and approved a report on the costs of its work. The costs are largely conditional on the fact that the Supervisory Board and its committees work in both the Slovene and English languages.

Costs of the Supervisory Board for the period January 1 to December 31, 2011 and comparison with 2010:

During discussions it was determined that Supervisory Board members were highly active in matters last year, which is understandable given the difficult operating conditions and active restructuring of the Bank. In 2011, there were eleven regular sessions and four correspondence sessions of the Supervisory Board, eight regular sessions of the Audit Committee, six regular sessions of the Risk Committee, five regular sessions of the Strategy and Development Committee and two regular sessions of the Remuneration and Appointment Committee.

At meetings of the Supervisory Board, members took into account the general rules of corporate governance relating to conflicts of interest (e.g. the Companies Act, the Corporate Governance Code and banking regulations) in their decisions regarding specific matters. Members briefed the Supervisory Board on the existence of conflicts of interest in specific matters and excused themselves from related discussions and decisions. Eight different members of the Supervisory Board were excused or excused themselves in four separate matters. In addition to signing a statement of independence in accordance with the Corporate Governance Code, Supervisory Board members also signed a statement of independence pursuant to the code of the Capital Assets Management Agency of the Republic of Slovenia. Conclusion

The Supervisory Board would like to thank the Bank's owners, the Management Board and all employees for their contribution and efforts last year which, due to the burdens of the past and the difficult economic conditions in Slovenia and abroad, did not produce the desired positive operating results. Special thanks also go to the Bank's many customers, who have remained loyal to the NLB Group during a period of major global financial turmoil and numerous organizational changes. They remain satisfied with our services and believe that we are on the right path to restructuring the Bank and finding an exit from the crisis. Great challenges also await the NLB Group in the future. These challenges can be met successfully and the planned turnaround in operations achieved on the basis of new strategic guidelines.

Supervisory Board of NLB

Marko Simoneti

Chairman of the Supervisory Board