NLB Group

Corporate governance

Corporate governance

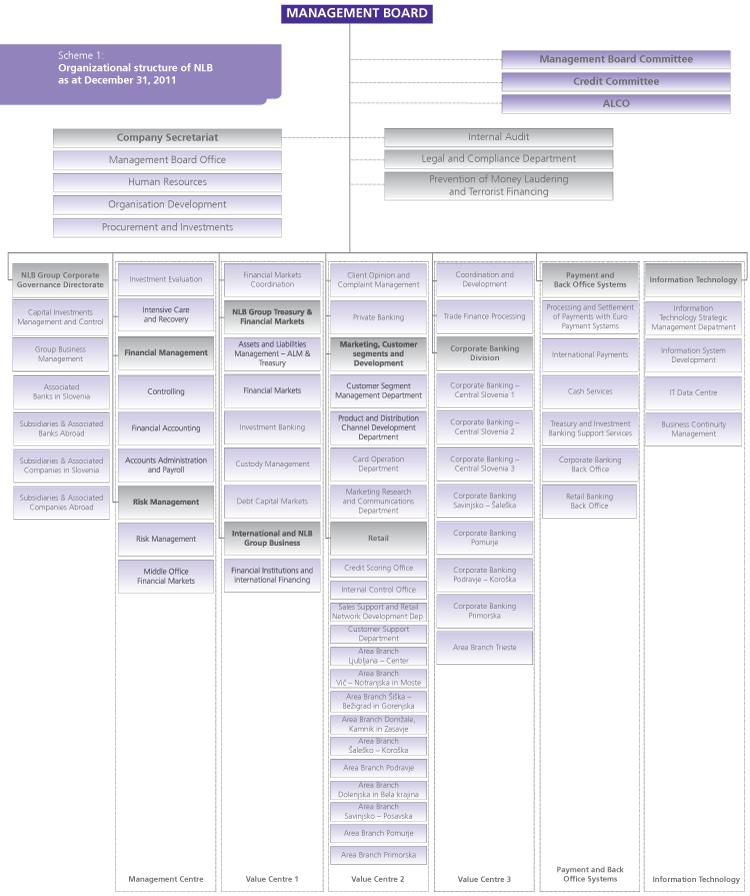

In accordance with valid legislation, NLB employs a two-tier system of corporate governance, by which the Bank is managed by the Management Board and its operations are supervised by the Supervisory Board. The Bank's bodies are the General Meeting of Shareholders, Supervisory Board and Management Board.

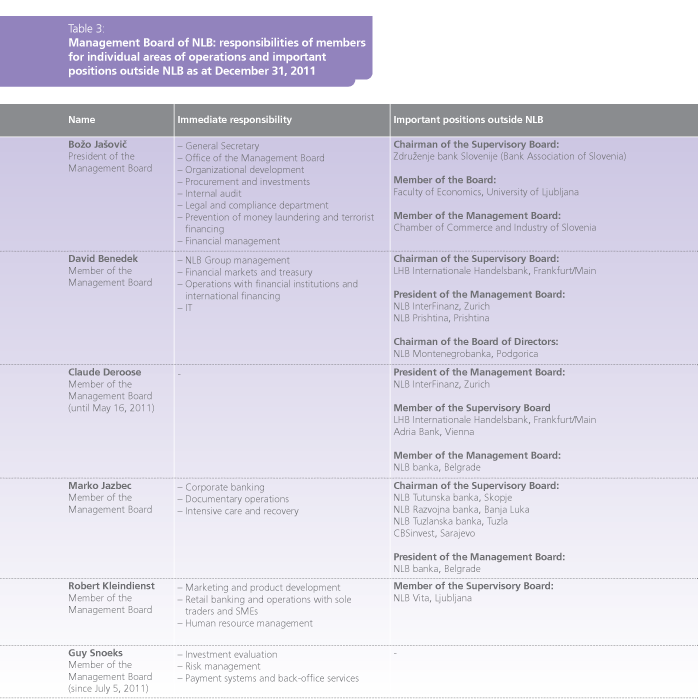

Management Board

NLB's Management Board leads, represents and acts on behalf of the Bank, independently and on its own responsibility, as provided for by the law and the Bank's articles of association. In accordance with the articles of association, the Supervisory Board may appoint (and recall) three to six members (a president and up to five members) to the Management Board. The president and members are appointed for a term of five years, and may be reappointed or recalled before their term expires in accordance with the law and the Bank's articles of association.

The terms of Božo Jašovič and David Benedek expire on September 30, 2014 and July 14, 2014 (Božo Jašovič resigned on December 20, 2011), respectively, while the terms of Marko Jazbec and Robert Kleindienst expire on November 30, 2014 (Robert Kleindienst resigned on February 2, 2012). Guy Snoeks was appointed to the Management Board on July 5, 2011 due to the resignation of Claude Deroose.

Collective decision-making bodies

- The NLB Corporate Credit Committee determines credit ratings and makes decisions on the reclassification of customers, sets maximum borrowing limits and approves commercial banking investments. The committee meets once a week and comprises five members. The committee's chairman is member of the Management Board, Marko Jazbec.

- The NLB Retail Credit Committee decides on the approval of loans and other investment proposals, the conditions of which deviate from standard banking products and services and which represent additional risks for the Bank. The committee meets once a week and comprises five members. Member of the Management Board, Marko Jazbec, serves as the committee's chairman.

- The NLB Assets and Liabilities Committee monitors conditions on the financial markets and analyses the balance, changes to and trends in the Bank's assets and liabilities. It also adopts decisions with respect to achieving the desired balance sheet structure that are in line with the Bank's business policy and that facilitate normal operations and the implementation of established plans. The committee meets once a month and comprises five members. Member of the Management Board, David Benedek, serves as the committee's chairman.

- The NLB Group Assets and Liabilities Committee monitors and discusses the operations of NLB Group companies involved in banking, leasing and factoring and whose majority owner is NLB, including the financial company NLB InterFinanz and the joint venture Prvi Faktor. The committee typically meets quarterly and comprises 13 members. The President of the Management Board, Božo Jašovič, serves as the committee's chairman.

- The NLB Information Technology Committee confirms the Bank's annual development plan by setting priorities. It is also responsible for approving changes to priorities and for overall control in areas tied to the realization of established objectives by the envisaged deadlines and in line with the planned budget. The committee generally meets five times a year. Member of the Management Board, David Benedek, serves as the committee's chairman.

- The NLB Operational Risk Committee is a collective decision-making body of the Bank's Management Board responsible for monitoring, guiding and supervising operational risk management at NLB, and for transferring this methodology to NLB Group companies. Meetings are typically convened every two months. The committee comprises 14 members. Member of the Management Board, Guy Snoeks, serves as the committee's chairman.

Advisory bodies of the Bank's Management Board

- The NLB Price Policy Committee is the Management Board's coordinating and advisory body responsible for drafting resolutions regarding interest rates, tariffs and internal transfer prices in line with NLB's business policy and objectives.

- The NLB Trading and Market Risk Committee is the Management Board's coordinating and advisory body responsible for defining, adopting and supervising the implementation of the Bank's policies and methodologies in the area of trading.

- The College of the Bank is the advisory body of the Management Board where opinions and suggestions regarding matters that fall under the decision-making authority of the Management Board are shared.

- The Strategic Conference of the NLB Group and the Business Conference of the NLB Group are typically convened once a year. The NLB Group's strategic and business objectives are discussed at meetings.

Supervisory Board

NLB's Supervisory Board monitors and supervises the management and operations of the Bank. It carries out its tasks in accordance with the provisions of the laws governing banks and companies and NLB's articles of association, which define the Supervisory Board's responsibilities in Article 24. In accordance with the articles of association, the Supervisory Board has 11 members appointed and recalled by the Bank's General Meeting of Shareholders from candidates proposed by the shareholders or the Supervisory Board.

At the General Meeting of Shareholders of June 30, 2009, a new Supervisory Board was appointed for a term of four years. Following the resignation of member of the Supervisory Board Jan Vanhevel on May 16, 2011, the General Meeting of Shareholders of June 30, 2011 did not appoint a replacement. Stojan Petrič resigned on January 24, 2012. The Supervisory Board, therefore, functions with 9 members.

Marko Simoneti (53)

Dr. Marko Simoneti received his doctorate in economics from Cornell University in the US. He lectures as an associate professor of money and finance at the Faculty of Law at the University of Ljubljana. Prior to that, he was the President of the Management Board of the Ljubljana Stock Exchange from 2004 to 2009, Director of the Central and Eastern European Privatization Network (CEEPN) from 1993 to 2004 and Director of the Privatization Agency of the Republic of Slovenia from 1990 to 1993.

He is a member of the Supervisory Board of Luka Koper.

Rasto Ovin (63)

Dr. Rasto Ovin received his doctorate in economics. He is a professor of economic theory and economic policy at the Department for Economic Policy, and Chair of the Institute for Economic Diagnosis and Prognosis at the Faculty of Economics and Business at the University of Maribor. He served as head of the most distinguished projects at the faculty, and served as Deputy Dean, Vice Chancellor and Dean of the Faculty of Economics and Business at the University of Maribor.

He is a member and Deputy Chairman of the Fiscal Council of the Republic of Slovenia.

Andrej Baričič (49)

Dr. Andrej Baričič received his doctorate in law and property management, and is the Director of the consultancy company ASC in London. The company provides consultancy services to non-financial corporations in the area of corporate governance. Dr. Barčič gained the majority of his work experience in management positions in the banking sector, higher education and as a consultancy project manager in Slovenia and Austria.

He is a member of the boards of the University Medical Center in Ljubljana, the Bežigrad General Secondary School and the Prežihov Voranc Primary School in Ljubljana. He is also President of the Olimpija Academic Sports Association in Ljubljana.

Jurij Detiček (60)

Jurij Detiček received his bachelor's degree in economics, and was President of the Management Board of Adria Bank in Vienna from 1999 to 2010, prior to his retirement. Prior to his work at Adria Bank, Mr. Detiček was an executive director for many years at NLB in the areas of international transactions, treasury, risk management, payment transactions and finance. He was a member of the Management Board of the former Ljubljanska banka (from 1992 to 1994), and Director of the International Transactions Sector prior to that. He was also the chairman or member of the supervisory boards of many NLB Group banks and companies, both in Slovenia and abroad.

He is a member of the Supervisory Board of KB 1909 in Gorizia, Italy and Deputy Chairman of the Supervisory Board of Granolio in Zagreb, Croatia.

Riet Paula Docx (61)

Riet Paula Docx, MSc received her master's degree in applied economics from the University of Antwerp in Belgium. She has been Director of the Central and Eastern Europe and Russia Directorate at KBC since 2005. From 1994 to 2004, she was Regional Director for Retail Operations at KBC. Prior to that, she was the General Director of the Omniver and Omniver Leven general and life insurance companies from 1987 to 1994. She served in various functions at Benelux Bank from 1976 to 1987.

She is a member of the Supervisory Board of SD Worx in Belgium.

John Arthur Hollows (55)

John Arthur Hollows, MSc received his master's degree in law and economics at the University of Cambridge in the United Kingdom. He is an Associate of the Chartered Institute of Bankers in the United Kingdom. He has been a member of the KBC Group's Board of Directors since 2011 and Executive Committee since 2009, and Chief Risk Officer since 2010. He was Executive Director for Central and Eastern Europe and Russia in the KBC Group from 2009 to 2010, and General Director for Central and Eastern Europe and Russia from 2006 to 2009. He was the Director of K&H Bank in Hungary from 2003 to 2006, and Director of the Asia Pacific Region at KBC Bank from 1999 to 2003. From 1996 to 1999, Mr. Hollows was Director of the Shanghai KBC Branch. Prior to that, he was employed by Barclays Bank from 1978.

He is also Director and member of the Board of Directors and Executive Committee at KBC Bank and KBC Insurance, and a member of the Board of Directors of KBC Global Services.

Anton Macuh (68)

Anton Macuh received his bachelor's degree in economics. Before his retirement, Mr. Macuh was the NLB Management Board's special representative for trade finance from 2002 to 2006. From 1995 to 2001, he was Director of LB InterFinanz, Zurich. He served as a consultant to NLB's Management Board from 1993 to 1995. From 1992 to 1993, Mr. Macuh was Director of the Agency of the Republic of Slovenia for the Rehabilitation of Banks and Savings Banks. Prior to that, he served in several management functions in the former Ljubljanska banka Group both in Slovenia and abroad, including Executive Vice President and President of LBS Bank New York (from 1989 to 1990) and Director of Ljubljanska banka's representative office in London (from 1981 to 1985).

He was also the chairman or member of the supervisory boards of many NLB Group companies, both in Slovenia and abroad.

Igor Masten (36)

Dr. Igor Masten received his doctorate in economics, and is an associate professor in the Department for Money and Finance and the Department for Statistics at the Faculty of Economics at the University of Ljubljana. From 2008 to 2009, he conducted research at the Robert Schumman Centre for Advanced Studies at the European University Institute. From 2005 to 2008, he was an assistant professor at the Faculty of Economics at the University of Ljubljana. Prior to that, Dr. Masten was a guest professor at the University of Siena and conducted research at the European Central Bank.

Stojan Petrič (62)

Stojan Petrič received his bachelor's degree in economics. He has been the President of the Kolektor Group in Idrija since 2004, and was Director of the company Kolektor in Idrija from 1994 to 2004. Prior to that, he served as Director of Sales and Manager of the External Trade Sector, and in various other functions at the aforementioned company.

Mr. Petrič is Chairman of the Supervisory Boards of the companies FMR and Fond, and Director of the company Comtrade in Klagenfurt. He is also a member of the Strategic Council of the President of Slovenia and the Strategic Council of the Prime Minister, Chairman of the General Meeting of the Chamber of Commerce and Industry of Slovenia, member of the Board of Directors of the Managers' Association of Slovenia and member of the board of the Faculty of Economics.

Boris Škapin (64)

Boris Škapin received his master's degree in business and organizational sciences. He is President of the consulting company Consulta in Ljubljana and a member of the Board of Directors and Executive Director of Promos Holding in Zurich. He was a Deputy Executive Director at the World Bank and the International Financial Corporation in Washington D.C. (from 1990 to 1999), assistant and later Deputy of the SFRY (for international relations from 1986 to 1990), Director of the Institute for the Economics of Investments and in charge of cooperation with MIFs at the former Ljubljanska banka (from 1982 to 1986), project manager at the IFC in Washington D.C. for Latin America (from 1975 to 1982) and an economist in the International Relations Sector at Ljubljanska banka (from 1971).

He was also a member of the supervisory boards of several Slovenian companies, a member of the executive boards of international financial institutions abroad (the African Development Bank in Abidjan, RC in New York, AMSCO in Amsterdam and a member of the founding committee of the EBRD in London) and a consultant for numerous companies and banks in Slovenia and abroad.

Sergeja Slapničar (40) – independent external member of the Audit Committee

Dr. Sergeja Slapničar is an associate professor and Chair of the Department for Accounting and Auditing at the Faculty of Economics at the University of Ljubljana, where she has been employed since 1995.

She is a member of the Supervisory Board of Krka and an independent member of the Audit Committee of Telekom Slovenije. Dr. Slapničar is Chairwoman of the conciliation committee for the testing of exchange ratios in the ownership transformation of companies under the Companies Act and an active member and lecturer at the Slovenian Directors' Association. She is also a member of European and US accounting associations.

Responsibilities of the Supervisory Board

The responsibilities of the Bank's Supervisory Board are:

- to monitor and supervise the management and operations of the Bank, and to propose measures to eliminate identified irregularities;

- to review reports of the Management Board and supervise its management of the banking group, and to propose measures to eliminate identified irregularities;

- to report to the Bank's General Meeting of Shareholders with regard to its work and findings as necessary, or at a minimum, when the annual report is released, and to approve measures to improve operations;

- to discuss reports regarding internal supervision and audits, and to propose the adoption of direct measures on the basis of these reports;

- to approve the adoption of the Bank's general acts as determined by the articles of association, except for acts that require approval by the General Meeting of Shareholders, or acts based on laws or valid resolutions adopted by the General Meeting of Shareholders;

- to approve decisions of the Management Board as required by regulations or the articles of association;

- to draft proposals for the Bank's General Meeting of Shareholders and carry out the tasks defined thereby, unless otherwise stipulated by regulations;

- to examine and approve the annual report and the proposal for the use of distributable profit, and to prepare a written report for the General Meeting of Shareholders regarding the results of its examination;

- to approve the Bank's strategy, annual financial plan and business plan;

- to discuss and monitor interim reports on the Bank's operations;

- to set credit and guarantee limits, and other limits related to the Bank's operations;

- to approve all activities that involve changes in the status of companies and other legal entities under the Bank's majority ownership;

- to set the Bank's long-term borrowing limit;

- to appoint and recall members of the Management Board;

- to adopt rules of procedure regarding its work;

- to define remuneration criteria for members of the Management Board and continuously verify their fulfillment;

- to conclude contracts with members of the Bank's Management Board, whereby the Bank is obliged to disclose data regarding individual remuneration of Management Board and Supervisory Board members in the Bank's annual report, including notes to the criteria under the previous indent; and

- to approve changes to the articles of association that relate to the coordination of its wording with valid decisions adopted by the Bank's General Meeting of Shareholders or Management Board.

Committees of the Bank's Supervisory Board

- The Strategy and Development Committee monitors issues regarding the Bank's strategic objectives and development, and drafts proposals concerning Supervisory Board decisions, primarily by discussing, reviewing and assessing the entire medium-term or long-term strategic plan of NLB and the NLB Group, and the more important elements of the Bank's strategic and development plans. It discusses the adequacy of NLB's and the NLB Group's organization and corporate governance, discusses sales and purchases of participating interest in the NLB Group from a strategic point of view, and discusses the annual financial and business plans of NLB and the NLB Group on the basis of the adopted medium-term/long-term strategy and development.

- The Audit Committee monitors and drafts proposals for Supervisory Board decisions concerning internal audits and the legal compliance of the Bank's operations, and for external and internal audit reports. It assesses auditing procedures, assesses and adopts recommendations or decisions related to the documents of external regulators, assesses internal controls, and assesses and recommends accounting standards and policies to be applied at the Bank.

- The Risk Committee monitors and drafts proposals for Supervisory Board decisions concerning all areas of risk relevant to the Bank's operations.

- The Remuneration and Appointment Committee monitors basic strategic issues and drafts proposals for Supervisory Board decisions concerning the appointment and dismissal of Management Board members, determines the methods of recruiting and selecting Management Board candidates, concludes and oversees the content of individual employment contracts with members of the Management Board, oversees the remuneration of Management Board members and sets remuneration criteria and policies.

General Meeting of Shareholders

The General Meeting of NLB Shareholders meets and makes decisions at regular and extraordinary meetings, where it adopts resolutions in accordance with the law and the Bank's articles of association. The responsibilities of the General Meeting of NLB Shareholders are stipulated by the Companies Act, the Banking Act and NLB's articles of association.

The General Meeting of Shareholders makes decisions regarding:

- the Bank's articles of association and changes thereto;

- the rules of procedure of the General Meeting of Shareholders;

- the annual report, if the Supervisory Board has not confirmed the annual report or if the Management Board and the Supervisory Board defer the decision regarding the adoption of the annual report to the General Meeting of Shareholders;

- the use of the distributable profit;

- the discharge of the Management Board and the Supervisory Board;

- changes in the Bank's share capital;

- annual limits and characteristics of the issue of securities convertible to shares, and the Bank's equity securities;

- the appointment and recall of Supervisory Board members;

- the remuneration of Supervisory Board members, and participation in the Bank's profits by members of its Supervisory Board, Management Board and employees;

- the organization that will carry out the audit of the Bank's financial statements; and

- changes in status, mergers and the discontinuation of the Bank's operations.

Representatives of NLB shareholders met at the 17th General Meeting of Shareholders on June 30, 2011. A total of 85.79% of the shareholders were represented. Shareholders were briefed on the approved 2010 annual report, the Supervisory Board's report, information regarding the remuneration of members of the Management Board and Supervisory Board in 2010 and on the rules of NLB's Supervisory Board for defining other rights under the ZPPOGD. Shareholders conferred official approval upon the Management Board and Supervisory Board for the 2010 financial year. Shareholders adopted specific changes to NLB's articles of association, which define in detail the work methods of the Bank's management bodies and General Meeting of Shareholders and facilitate changes to remuneration paid to members of the Supervisory Board.

The shareholders present at the General Meeting appointed PricewaterhouseCoopers as auditor for the 2011 financial year.

The proposal to appoint Dirk Mampaey from the KBC Group to replace Jan Vanhevel (who submitted his resignation in February 2011) as member of NLB's Supervisory Board was not adopted.

The Bank's Management Board also briefed the General Meeting of Shareholders on measures and activities aimed at improving the Bank's operations, with an emphasis on the management of non-performing loans.

Representatives of NLB shareholders met at the 18th General Meeting of Shareholders on October 27, 2011. A total of 85.4% of the shareholders were represented. The General Meeting of Shareholders approved the Bank's authorized capital and the proposed change to NLB's articles of association, by which the General Meeting of Shareholders authorized the Bank's Management Board (with the Supervisory Board's consent and without an additional general meeting resolution) to increase NLB's share capital once or several times over a five-year period in the maximum amount of one half of the Bank's current share capital through the issue of new shares, under the conditions and in the manner set out in the Management Board's decision, which has received the Supervisory Board's consent. The General Meeting of Shareholders also discussed an additional item on the agenda put forth by the Republic of Slovenia, as shareholder, regarding the recall of members of the Supervisory Board and the appointment of new members. The General Meeting of Shareholders did not agree with the recall of four current members of the Supervisory Board. Thus, shareholders did not vote on the Republic of Slovenia's proposal to appoint new members to the aforementioned body.

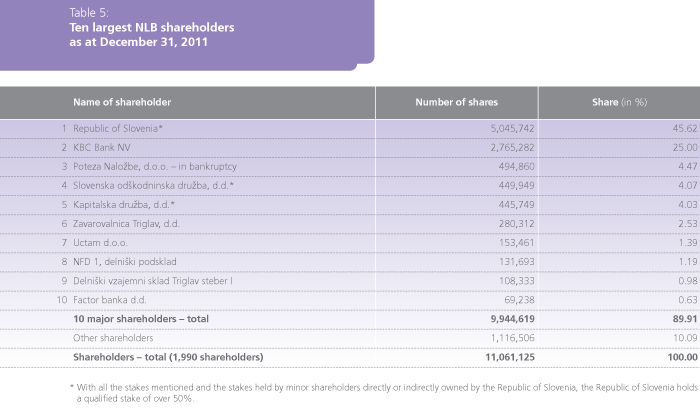

NLB does not have any shareholders with special controlling rights.

NLB has no limitations on voting rights, as voting rights are attached to all NLB shares (except to treasury shares) in accordance with the law.

The composition of shareholders was as follows as at December 31, 2011: 75% domestic and 25% foreign shareholders.

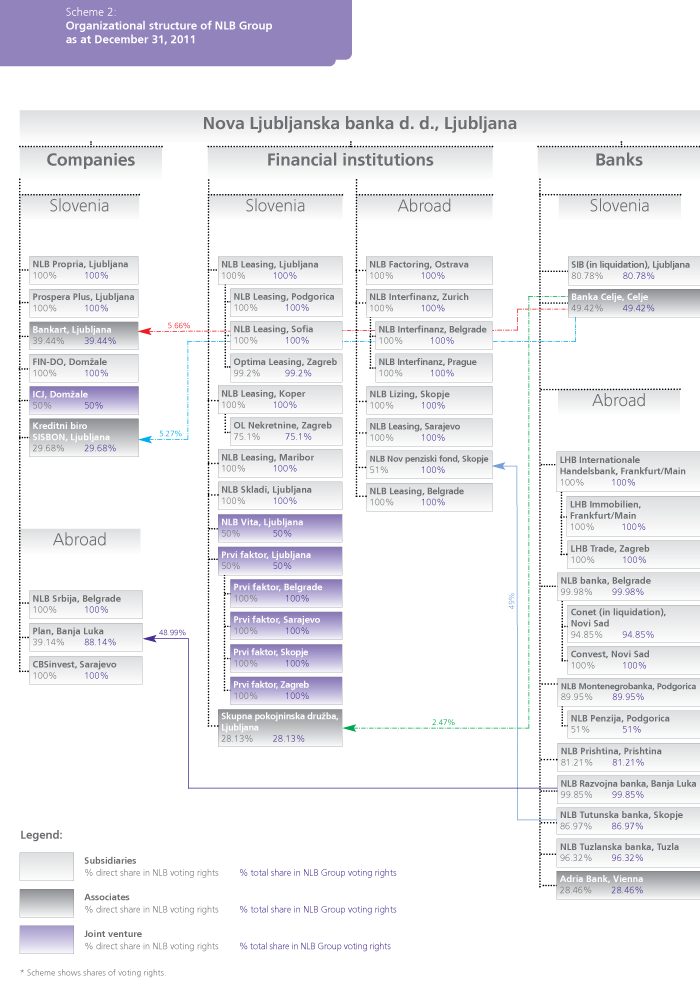

NLB Group corporate governance

NLB, as the parent bank of the NLB Group, provides corporate governance for the NLB Group in accordance with the laws of the Republic of Slovenia and the laws of the countries in which NLB Group companies operate, while taking into account internal rules.

Corporate governance, as one of the Group's core business functions, is comprehensively regulated by the Corporate Governance Policy of the NLB Group, which defines the roles, competencies and responsibilities of individual bodies and organizational units to ensure they function cooperatively and harmoniously to achieve the Bank's business objectives.

NLB continuously supplements and updates the NLB Group's system of corporate governance as a combination of the laws that regulate NLB and NLB Group companies, and in accordance with best business practices. NLB Group corporate governance is therefore implemented:

- in accordance with fundamental corporate rules through various bodies of the NLB Group companies:

- through voting at the general meetings of shareholders of NLB Group companies;

- by appointing NLB representatives to supervisory bodies;

- by proposing executive appointments for NLB Group companies; and

- through the participation of NLB representatives in various committees and commissions of NLB Group companies.

- through mechanisms for effectively monitoring operations, harmonizing business standards and disseminating information within the NLB Group:

- by business area (i.e. according to the "business line" principle), meaning the principle of commercial and professional coordination within the NLB Group;

- through the NLB Group Assets and Liabilities Committee; and

- by convening strategic conferences (where all NLB Group companies discuss the development priorities of the Group) and regional meetings, at which all companies of the NLB Group in a particular country gather to discuss and coordinate the Group's development priorities for specific markets.

NLB's Internal Audit Center and external supervisors (e.g. the Bank of Slovenia and external auditors) provide additional supervision for the NLB Group.

In addition to the NLB Group Assets and Liabilities Committee, the NLB Group Corporate Governance Directorate was established with the aim of implementing corporate governance within the Group. In addition to established forms of corporate governance, the Directorate also implements corporate governance by individual areas and companies. The Directorate provides corporate governance for NLB Group companies, harmonizes the rules of operations of those companies, and drafts plans for individual companies and monitors their implementation.