Management Report

Segment analysis

Segment analysis

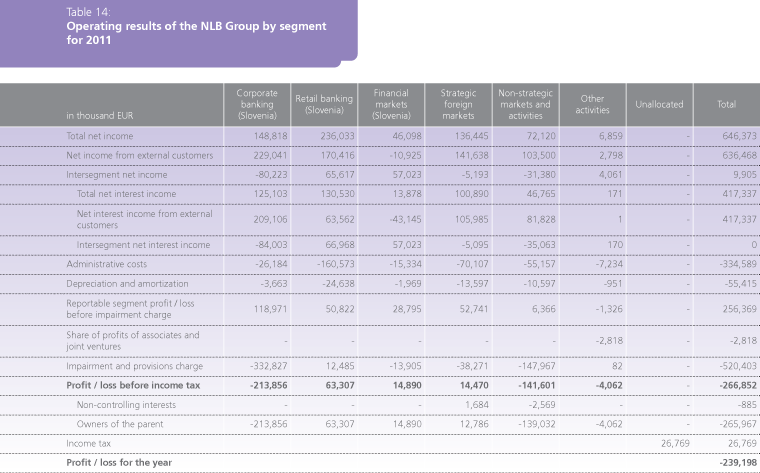

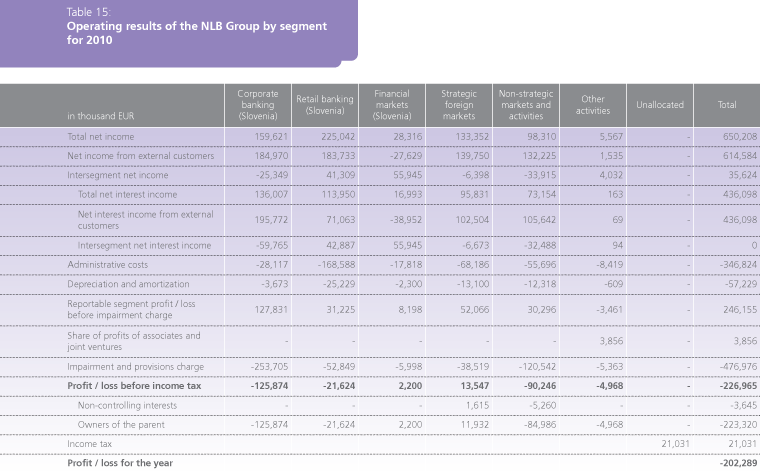

The NLB Group monitors its operations by various segments that are defined in accordance with its strategy and the internal organizational structure of the NLB Group. The NLB Group's operations are monitored to the level of pre-tax profit for the following segments:

- retail banking in Slovenia, which includes operations with individuals, SMEs and sole traders included in NLB d.d.'s business network, and asset management via NLB Skladi;

- corporate banking in Slovenia, which includes NLB’s operations with SMEs;

- financial markets in Slovenia, which include all treasury operations, NLB d.d.'s transactions with financial institutions and investment banking;

- strategic foreign markets, which include the NLB Group's complete operations on the strategic markets of Bosnia and Herzegovina, Montenegro, Kosovo and Macedonia, except leasing companies; and

- non-strategic markets and activities, which include the NLB Group's complete operations on the non-strategic markets of Croatia, Serbia, Germany, Switzerland and the Czech Republic and all leasing companies. Segment results also include the operating results of those companies included in the divestment strategy in 2011 (e.g. NLB Banka Sofia, NLB Factor Bratislava, and NLB Nova penzija Belgrade).

- The remainder includes the NLB Group's investments in associates, the operating results of the NLB Group's non-financial corporations and costs that cannot be allocated to individual segments.

Corporate banking in Slovenia

The negative effects of the financial crisis, which are reflected in the operations of the NLB Group as a deterioration in the quality of the portfolio, are even more evident in the operating results of the corporate banking segment, which generated a loss of EUR 213.9 million in 2011, an increase of 70% on the loss generated the previous year. The main reason for the aforementioned loss is the level of provisions created. Additional impairments in the amount of EUR 332.8 million were created in this segment in 2011, representing two thirds of all impairments and provisions created within the NLB Group.

Contributing further to the loss generated was the impairment of equity securities received by NLB in the redemption of collateral. A total of EUR 27.4 million in impairments were created in 2011 owing to the fall in share prices.

Operating results prior to provisions were also down in 2011. The main reason was a decline in interest income resulting from a contraction in operations. Total assets in this segment were down in 2011 as the result of low economic activity and the active reduction of risk-weighted assets, which is one of the key elements in the implementation of the NLB Group's strategy.

The volume of loans to the non-banking sector in this segment was down EUR 238 million or 4% on the previous year. The maturity structure of the portfolio remains unchanged, with longterm loans accounting for 69% of the portfolio.

The volume of guarantee transactions was down slightly on the previous year, as was the balance of the guarantee portfolio, which is primarily linked to the situation in the construction sector. Letters of credit and collection transactions remained at the level recorded in 2010. NLB noted a slight fall in the number of export letters of credit and collection transactions compared with the previous year, while the amounts of individual transactions were up.

The trend of increased use of special instruments continues, as does the stagnation in the volume of international check transactions, which confirms the prevailing global trend.

The deposit portfolio was up EUR 75 million or 5.5% in value terms at the end of 2011 compared with the previous year to stand at EUR 1,445 million.

Bank financing via the regular rollover of maturing, primarily short-term loans, is a sign of unstable operations for companies. The weak liquidity position of companies and payment indiscipline hinder the greater flow of funds between companies. Payment indiscipline has hit suppliers and manufacturers the hardest. The effects of new legislation governing payment indiscipline and the netting of claims and liabilities may have some impact on corporate balance sheets, but are not enough to completely solve the problem of an inappropriate structure of corporate financing and the additional flow of financing. The corporate banking portfolios of all commercial banks are faced with the serious problem of unpaid overdue claims for the first time in a long time.

Given the current situation, NLB defined corporate lending guidelines in 2011 in terms of activities, customer segments, target markets and lending terms, taking into account the guidelines set out in NLB's Strategy for the period 2010 to 2015 regarding growth and restrictions.

In 2011, NLB continued to upgrade its comprehensive customer management system for shared NLB Group customers. The Bank has improved its investment approval process, taken a proactive approach to credit risk management, and introduced new approaches to identifying, handling and monitoring problematic customers. It has thus improved the conditions for achieving synergistic effects at the NLB Group level on strategic markets, which ensure support for Slovenia's traditionally export-oriented economy.

In the scope of activities relating to business accounts, NLB introduced a new type of account, the NLB Fiduciary Account for real estate companies. Development activities relating to corporate payment transactions focused primarily on ensuring the implementation of SEPA scheme rules of operation.

NLB offered a number of new features to NLB Proklik users in 2011, including a new method for receiving all types of bank notifications and the termination of sending notifications by post and the implementation of payment transactions according to SEPA standards, such as transactions using the new universal payment order, the exchange of SEPA direct debits and SEPA mass payments. NLB was also included in the interbank system for the exchange of e-invoices via the company Bankart. With the NLB e-invoice, the Bank introduced an upgraded standard for the virtual envelopes in which e-invoices and other electronic documents travel through the system.

NLB's only tool in the direct financing of strategic foreign customers is the restructuring of existing loans, as it only approved new loans, primarily aimed at refinancing operating assets, in exceptional cases due to limited financial resources and the uncertain economic conditions.

NLB focused on the markets where exportoriented customers operate in the financing and insuring of export transactions. NLB follows the market flows in these countries in its financing of export transactions.

In the financing of larger, long-term projects on foreign markets, NLB works with SID banka, which insures transactions against commercial and non-commercial risks. The Bank mainly cooperates with SID banka in the financing of exports to Russia and other markets of the former Soviet Union.

Retail banking in Slovenia

The Slovenian retail banking segment generated a profit of EUR 63.3 million in 2011, compared with a loss of EUR 21.6 million generated by the same segment in 2010.

The main reason for the improved results in 2011 was the creation of fewer additional provisions. Additional provisions of EUR 14.2 million were created in 2011, 73% less than in 2010. Impairments totalling EUR 26.6 million and relating to the portfolio of retail customers were also released in 2011 owing to methodological changes. Those methodological changes relate to the elimination of the mark-up due to the calculation of new matrices and owing to a reduction in the percentage applied to E-rated customers. The net positive effect on operating results was EUR 12.5 million. The operating results of the retail segment were positive, even without the effects of the release of impairments.

Interest income was up 15% in 2011 relative to 2010, primarily as the result of a rise in the interest margin, as the scope of both lending and deposit operations contracted. The value of loans in the retail banking segment was down EUR 277 million or 9% in 2011 relative to the previous year, to stand at EUR 2,883 million. Long-term loans account for the majority of the portfolio. Contributing most to the decline in lending activity was the rising costs of sources of financing and reduced borrowing activity on the part of households. The value of deposits was down EUR 179 million or 3% compared with the previous year, to stand at EUR 6,037 million.

Also contributing to the improved results were cost reduction measures, while a drop was seen in non-interest income, which is primarily linked to a decline in the number of payment transactions and the scope of payment card operations, as the result of lower domestic economic activity. NLB partially neutralized the drop in revenue through price policy measures related to personal accounts and payment card operations.

The total value of assets under management stood at EUR 299.3 million at the end of 2011, a drop of 12.3% in year-on-year terms.

Despite the declining scope of transactions in all segments, NLB remains the leading bank with the highest market shares of traditional banking services. A new retail banking strategy was adopted in 2011, which envisages that NLB will continue to position itself in the future as the leading provider of comprehensive personal finance solutions for households, in terms of the quality of services, products and added value and also in terms of efficiency, profitability and integrated marketing. NLB's retail banking segment was also reorganized as part of the implementation of the Bank's new strategy.

Transactions with households

Customers were offered a full range of innovations in 2011 in the scope of existing products, services and added value. The most important innovations are listed below.

A comprehensive financial advisory service was developed for personal banking and mass market customers. NLB offered household customers a new long-term structured deposit in 2011, a relatively safe investment that offers the possibility of exploiting the potentially higher returns associated with a selected sub-fund, while guaranteeing the 100% repayment of principal.

In conjunction with the insurer, Zavarovalnica Triglav, NLB introduced a new insurance in the event of unemployment for loans to retail customers with a maturity of more than 24 months.

NLB Klik e-banking was also upgraded with additional functionalities. The most important new features are the introduction of My Financial Picture (a comprehensive overview of financial assets, costs and income, and an overview of changes to assets and cash flow), the possibility of securities trading and the upgrading of payment systems with elements of SEPA rules.

NLB received a prestigious award from the financial magazine, Euromoney, for best range of private banking services. The Content Marketing Institute in the US ranked NLB's financial advisory services project as one of the 15 most innovative marketing projects in the July issue of the Chief Marketing Officer magazine. The NLB Financial Advisory School received the award for best HRM project of the year.

SMEs

The new Development Strategy for the SME Segment for the period 2012 to 2015 was drafted at the end of 2011. With the aforementioned strategy, NLB updated its segmentation of corporate customers with the aim of the highest-quality handling of the entire portfolio. Special attention is given to adapting the range of products and services to individually identified segments, an important part of which is customer service itself.

With the reorganization and optimization of its business network, NLB is striving for a more rapid and effective decision-making process, with an emphasis on risk management. Within the strategy, a number of opportunities have been identified to improve the Bank's operations in the corporate banking segment, some of which will be implemented as early as 2012. Emphasis will also be placed on improving customer satisfaction, the positive effects of which will also be seen in cross-sales between segments. NLB, as a bank with a wide range of products and services, aims to provide comprehensive services to every customer, and has therefore erased the line between corporate and retail customers.

Asset management

Part of the core of the NLB Group's strategy is its model for linking banking and asset management services.

Deteriorating economic conditions, a drop in equity markets and high net outflows on the Slovenian mutual fund market were characteristic of 2011.

Total assets under management declined in 2011. The majority of the decline in the net value of assets was the result of negative returns on the capital markets, and partly as the result of negative net sales. Nevertheless, NLB Skladi increased its market share in 2011 to 21.1% at the end of the year in terms of mutual fund assets from non-privatization sources.

Nevertheless, NLB Skladi ended the 2011 financial year with a net profit, which was lower than the net profit generated the previous year.

Financial markets in Slovenia

Despite the negative conditions on the financial markets, the NLB Group generated a pre-tax profit of EUR 14.9 million in this segment in 2011, compared with a profit of EUR 2.2 million generated in the same segment in 2010.

The improved results were driven by an increase in income from financial transactions, which include the one-time effect of the early repurchase of a hybrid instrument in the amount of EUR 41.5 million. Net interest income in this segment was down on 2010, primarily owing to a rise in deposit rates on funding secured on the interbank market.

Cost rationalization measures introduced by NLB in 2011 had a positive impact on costs in this segment, which were down 14% compared with 2010 to stand at EUR 15.3 million. The impairment of investments in securities, which amounted to EUR 7.8 million in 2011 (of which Greek government bonds accounted for EUR 2.7 million) had a negative effect on results. Exposure to the so-called PIIGS countries, with whom a loss of EUR 5.6 million was generated, was reduced by EUR 148.5 million in 2011.

Total investments, which primarily comprise investments in liquidity reserves, were unchanged in 2011, while liabilities were down 15% on account of a reduction in debt owing to the repayment of maturing liabilities and the early repurchase of securities (a governmentguaranteed bond and a hybrid instrument).

Transactions in financial instruments

Despite the continuing financial crisis and the deteriorating economic situation, turnover in financial instruments with customers was up minimally in 2011. Purchases and sales of foreign currencies and deposits continued to account for the highest proportions of turnover, while the proportion accounted for derivatives was up sharply.

Customer demand for hedging instruments against interest-rate and currency risks was up in 2011, although the number of actual transactions concluded was down, as customers did not opt for such solutions en masse due to the changing conditions on the financial markets. Nevertheless, the pool of potential customers expanded, while the need for new instruments linked primarily to the prices of precious metals and commodities was confirmed. The proportion of futures contracts linked to commodities was up 10 percentage points to stand at 16% in 2011.

At EUR 7.4 billion, the volume of securities trading was just one third of the volume recorded in 2010.

The total volume of trading in interbank deposits and treasury bills was EUR 40 billion. The majority of transactions (88.2%) were executed with foreign banks.

NLB, together with 12 foreign banks and two domestic banks, comprise the group of primary service providers for the Ministry of Finance. In addition to treasury bills, the Ministry of Finance also issued two government bonds in 2011: RS 69 and RS 70, both in the amount of EUR 1.5 billion. NLB served as one of the main organizers (lead manager) in the issue of the first bond.

NLB is the only Slovenian bank among the 46 international financial institutions that comprise the EFSF Market Group and participate in the initial public offerings of EFSF bonds. Four EFSF bonds were issued in 2011, with NLB serving as co-lead manager in three of the four issues.

Corporate financing

NLB was active again in 2011 in several projects linked to providing various forms of financing to corporates. In 2011, it thus participated in the issue of three bonds (KB 1909 from Gorizia, Italy, Cimos and Petrol) and in the sale and/or issue of shares of Lafarge (issue of shares to employees at the company's subsidiary in Slovenia) and of TPV. It also carried out the process of listing the shares of Unior for trading on the organized market of the Ljubljana Stock Exchange. NLB also successfully completed the sale of participating interests in the companies Carso and El-tec Mulej in 2011.

In the scope of securing sources of financing on foreign markets (e.g. funds from the EIB, EBRD and commercial banks, and the acquisition of bank guarantees for the purpose of drawing EIB funds), NLB helped secure financing for the construction of unit 6 of the Šoštanj thermal power plant, the natural gas transmission network for Geoplin and a new gas-steam unit at TE-TOL Ljubljana in 2011.

NLB also provides syndication services for private equity projects and infrastructure projects of national importance. The value of newly approved syndicated loans to residents of the Republic of Slovenia, for which NLB acted as organizer or agent, amounted to EUR 165 million in 2011.

Custody services

The tightening of conditions on the capital markets has been reflected in the slowing of the long-term trend of rapid growth. The amount of assets invested on foreign markets was down slightly in 2011, while growth of 30% and 20% was recorded on the domestic market and Balkan markets, respectively. The total value of assets in custody was up 12% to stand at EUR 8.152 billion.

The integration of the Slovenian capital market with developed European markets continued in 2011, with the introduction of remote membership custody services. As a selected agent and in cooperation with the international depository/settlement institution Clearstream Banking Luxembourg (CBL) and the Slovenian Central Securities Clearing Corporation (CSCC), NLB extended the possibilities of settling transactions in CBL's settlement system for the equity and debt instruments of Slovenian companies. In conjunction with the Polish central depository (KDPW) and the CSCC, NLB facilitated the listing of securities by Slovenian issuers of financial instruments on the Warsaw Stock Exchange, which opened new investment opportunities for investors.

The managers of investment funds and the cover funds of pension companies and insurers were affected by statutory changes in 2011. The merging of investment funds and acquisitions in asset management began. NLB received into custody a major management company following the merger of two fund managers. The trend of a decline in the number of transactions in financial instruments continued, while there was an increase in payments to investment coupon holders. The majority of payments made by NLB related to the cover funds of pension companies, as the mandatory 10-year period of payments into this type of pension insurance scheme expired this year.

Strategic foreign markets

The NLB Group generated a pre-tax profit of EUR 14.5 million on strategic foreign markets in 2011, an increase of 7% on the previous year.

Operating results prior to provisions were up 1.2% compared with 2010, primarily on account of higher revenues (both interest income and non-interest income), while total costs were up 3%, since the segment is loaded with the higher transfer costs of managing NLB Group members.

All companies operating on strategic foreign markets generated a profit in 2011.

Liquidity problems and limited capital sources forced NLB Group companies to reduce their scope of lending, and thus risk-adjusted assets, to ensure that existing capital was sufficient to meet capital adequacy requirements. Nevertheless, Group banks were able to maintain their market positions in 2011, in terms of total assets, relative to 2010.

The NLB Group's focus on strategic markets is banking, as the primary activity, while the medium-term emphasis is on retail banking. The Group will ensure customer satisfaction and improve profitability by continuing to develop products, while at the same time enhancing the collection of claims and the management of non-performing loans. Life and pension insurance and the management of mutual funds will remain strategic activities moving forward.

NLB Group companies have recently implemented a conservative lending policy. For this reason, the scope of lending is generally lower than a year earlier (the exceptions being NLB Tutunska banka, NLB Prishtina and NLB Tuzlanska banka). On the other hand, growth has been recorded in deposits, which improved the loan-to-deposit ratio. A great deal of effort was also invested in customer service in 2011, with the implementation of a project at the NLB Group level to introduce customer contact centers, while a campaign to promote contemporary sales channels was aimed at encouraging customers to shift to electronic and mobile banking.

NLB Group companies will continue to operate prudently in the near future. The emphasis remains on managing risks, the collection of claims and cost control.

Non-strategic markets and activities

The NLB Group kicked off a project in 2010 with the aim of divestment and withdrawal from non-strategic markets and activities. The first results of the project were seen already in 2011, when four divestment processes were completed. The following companies were divested in 2011: NLB Banka Sofia, NLB Nova penzija, NLB Factor and NLB Tutunska broker (the latter two companies have not yet been deleted from the companies register). In the future, NLB intends to continue selling off its investments on non-strategic markets and in factoring companies.

NLB Group companies on non-strategic markets are more susceptible to the adverse economic conditions, as they are no longer developing owing to their status or impending sale. These companies primarily conclude only current transactions, which also affects their operating results. The NLB Group generated a loss of EUR 141.6 million in the segment of non-strategic foreign investments in 2011, representing some 53% of the total loss generated by the NLB Group. This segment's loss was up 57% compared to 2010. There are two reasons for this: the low volume of new investments has a negative effect on revenues, while provisions for loans and investments have risen owing to the deteriorating portfolio of these companies. Total operating costs are declining, but at a slower rate than the drop in revenues, which has a negative impact on results before provisions. Among non-strategic companies, only NLB Lizing Skopje, NLB Srbija, NLB InterFinanz Zurich, NLB Leasing Koper and NLB Leasing Belgrade generated a profit in 2011.

The NLB Group's primary focuses on nonstrategic markets are tending to open transactions, maintaining the regulatory level of capital and other parameters and actively searching for potential buyers for capital investments on these markets. Another attempt will be made to sell companies that were not sold in the first round as the financial and capital markets recover.

Other subsidiaries operate with the aim of reducing or selling off their portfolio. If not sold, they will be subsequently liquidated or merged with other companies.

Other activities

The segment of other activities includes the activities of the NLB Group's non-financial companies, the operating results of associates and joint ventures and costs that cannot be allocated to individual segments (unoccupied premises owned by the Bank).

The NLB Group generated a loss of EUR 4.1 million in this segment in 2011.

Revenues in this segment are generated by companies involved in support activities, such as property management, maintenance, and catering and tourism services. The majority of these activities are carried out within the NLB Group, and therefore generate only a small portion of revenues on the market.

The contribution made by associates and joint ventures was negative in 2011 in the amount of EUR 2.8 million, while the same companies made a positive contribution in 2010 of EUR 3.8 million.

Provisions were also allocated to this segment in 2010 for the restructuring of the workforce.