Management Report

Operations of the NLB Group in 2011

Operations of the NLB Group in 2011

Introduction

Instability on the financial markets, the Slovenian political crisis, deteriorating credit ratings and the continuing economic crisis characterized 2011, and thus had a negative effect on the operations of the NLB Group, which generated a loss of EUR 239.2 million, while the loss generated by NLB amounted to EUR 233.2 million. Contributing most to the aforementioned losses was the deteriorating economic situation, accompanied by growth in non-performing loans, which required a high level of impairments. Results before provisions were positive and were actually better than the previous year, both at NLB and at the NLB Group level.

The activities of the NLB Group in 2011 were focused on the implementation of measures to achieve strategic objectives, with an emphasis on divestment, improving cost efficiency and portfolio management. The majority of measures are being implemented according to plans. The results are already tangible, primarily in improving cost efficiency and reducing riskadjusted assets, while the divestment process is of a long-term nature. Four procedures were completed in 2011: the sale of NLB Banka Sofia, and the liquidation of NLB Nova Penzija, NLB Factor and Tutunska broker. The majority of activities, in particular sales, which should have been completed in 2011, were postponed to 2012 and later due to the situation on the market.

NLB did not encounter any difficulties in securing funding for ordinary operations in 2011. During the crisis, the Bank has successfully maintained liquidity reserves at pre-crisis levels. It has more than EUR 3 billion in available secondary liquidity reserves. NLB maintained an extensive portfolio of liquid securities in 2011. Funds were secured as required, without difficulty, while NLB's liquidity and position on the international markets was favorable. In 2011, NLB published more tenders for the repurchase of governmentguaranteed bonds, of which EUR 495.7 million were successfully repurchased. In July, the Bank raised a new long-term loan in the amount of EUR 350 million.

NLB Group's existing capital adequacy was unacceptable at the beginning of the year given the current crisis, leading to a capital increase in the amount of EUR 250 million in March. To that end, in March NLB received a temporary order from the European Commission regarding the procedure to secure state aid. In line with requirements, NLB submitted a restructuring program to the European Commission in September. The procedure is still pending.

In May, the Bank of Slovenia imposed a requirement on NLB to further improve its Tier 1 capital adequacy ratio to 9% and its overall capital adequacy ratio to 11.2%. For that reason, the Bank began preparations in 2011 for an additional capital increase in the approximate amount of EUR 400 million. The EBA published a requirement in December to increase the core Tier 1 capital adequacy ratio to 9%, resulting in the identification of a deficit in capital of EUR 320 million.

The ratings agencies Fitch and Moody's downgraded NLB in 2011. The reasons given included the deterioration and concentration of the credit portfolio, a modest financial and capital position and the downgrading of Republic of Slovenia.

Financial review of operations

The NLB Group recorded a loss of EUR 239.2 million in 2011, while the loss recorded by NLB amounted to EUR 233.2 million. Comprehensive income, which includes the effect of revaluation recognized in equity, was negative in the amount of EUR 282.4 million at the NLB Group level and negative in the amount of EUR 279.3 million at NLB.

Income statement

Net interest income, which accounts for the highest proportion of the NLB Group's revenue, amounted to EUR 417.3 million in 2011, down EUR 18.8 million or 4% on the previous year. The main factors in lower revenues were a contraction in operations, costlier refinancing on the wholesale markets and lower revenues from derivatives. On the other hand, the deteriorating quality of the portfolio and the increase in overdue unpaid claims have resulted in an increase in default interest.

Both deposit and lending rates rose in 2011. However, the sharper increase in the latter had a positive impact on the interest margin, which stood at 2.5% at the NLB Group level, an increase of 0.08 percentage points on the previous year. NLB's interest margin improved by 0.17 percentage points to reach 2.06%, while the banks on the markets of the former Yugoslavia achieved higher margins (of between 3.0% and 4.7%). However, the pressure to drive down the margins on the aforementioned markets is very intense. The sharpest decline in net interest income in 2011 was recorded at non-strategic companies that are gradually contracting their operations.

The NLB Group's net non-interest income amounted to EUR 219.4 million in 2011, representing 34% of total revenue. The most important sources of non-interest income are fees and commissions, in particular payment transaction fees. Net fees and commissions amounted to EUR 153.5 million in 2011, down EUR 5.2 million on the previous year. Net income from payment card and ATM operations recorded the sharpest decline owing to a drop in transactions at points of sale. A drop in income from guarantees was also recorded, while income from basic accounts was up in 2011. The banks on the markets of the former Yugoslavia pay a deposit guarantee fee through a system of reciprocal deposit schemes. Fees totalling EUR 7.2 million were paid in 2011 for that purpose.

The NLB Group received EUR 5.5 million in dividends in 2011.

Income from financial transactions totalled EUR 34.8 million in 2011. NLB recorded a gain of EUR 41.5 million (EUR 33.2 million after taxes) in 2011 from the recall of a discounted hybrid instrument, while the NLB Group generated a loss in securities trading.

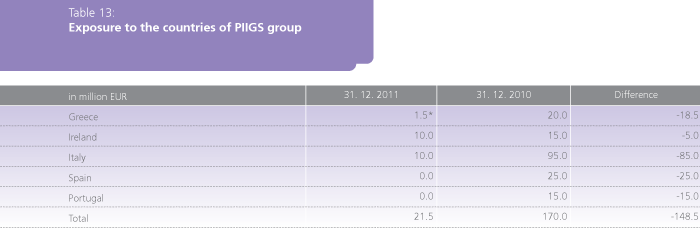

Income from securities trading has been quite volatile in recent years owing to the uncertainty on the capital markets. However, the NLB Group's portfolio of marketable securities accounts for merely 1% of its total assets. Exposure to risk from such transactions is thus relatively low. The securities portfolio of the banking book primarily comprises securities held as secondary liquidity reserves. Exposure to the so-called PIIGS countries, with whom a loss of EUR 5.7 million was generated, was reduced by EUR 147 million in 2011. Exposure to the countries of the aforementioned group was just EUR 23 million at the end of 2011, with the value of Greek bonds having already been impaired to 50%. Thus, net exposure to the PIIGS countries is EUR 21.5 million.

Income from the purchase and sale of foreign currencies remains a stable source of net income from financial transactions. Foreign currency transactions generated income of EUR 14.1 million in 2011, an increase of EUR 1.3 million on the previous year.

Other net income amounted to EUR 25.6 million. Extraordinary events, such as a balance sheet tax at NLB (– EUR 3.1 million), the valuation of real estate held for sale and the effects of the sale of NLB Banka Sofia (+ EUR 4 million)1, affected the level of other net income. The majority of steady income in this category is generated by the sale of IT services, the provision of cash operation services for other banks and rental income.

Activities aimed at the rationalization of operations and cost control have resulted in a decline in costs for several consecutive years. Operating costs including amortization and depreciation amounted to EUR 380.4 million at the NLB Group in 2011, down 3% on the previous year. Labor costs, building maintenance and IT costs recorded the sharpest declines. Amortization and depreciation costs are also being reduced gradually through the optimization of investments.

The cost-to-income ratio (CIR) improved significantly to stand at 59.7% for the NLB Group and 55.8% for NLB.

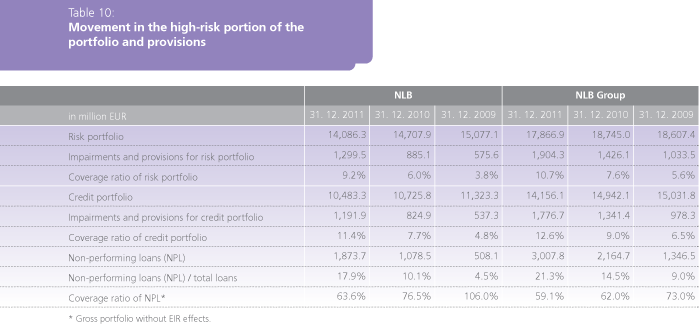

The deepening crisis in the real sector was reflected in the continuing deterioration in the quality of the credit portfolio. The balance of non-performing loans (NPL) has increased in the context of an overall decline in the investment portfolio, i.e. in the number of loans. The balance of NPLs stood at EUR 3 billion at the end of 2011, an increase of EUR 843 million on the end of the previous year, while the proportion of NPLs was up 6.8 percentage points to stand at 21.3%.

Owing to the high growth in NPLs, the NLB Group created additional loan impairments and provisions of EUR 480.6 million in 2011, a significant increase on the already high impairments created the previous year. The majority of impairments and provisions were created for customers from the sectors of construction, manufacturing, services and trade. Despite the high level of impairments, their growth was slower than the growth in NPLs. The coverage of non-performing claims by provisions (i.e. the coverage ratio) was therefore down 2.9 percentage points in 2011 to stand at 59.1%, while the coverage ratio for the entire portfolio was up 3.1 percentage points to stand at 10.7%. The "cost of risk" indicator, which is measured as the ratio of impairments of loans to the average balance of loans during the year, was high in the NLB Group at 315 basis points, an increase of 60 basis points on 2010.

In addition to impairments and provisions for credit risk, available-for-sale securities were also impaired through profit or loss in the amount of EUR 35.3 million in 2011 due to declining market values. The majority of the aforementioned impairments relate to securities received as collateral.

Debt securities were also impaired through equity in the amount of EUR 36.0 million (90% of the aforementioned amount relates to the impairment of Slovenian government bonds due to the downgrading of Slovenia, while equity securities were impaired in the amount of EUR 12.3 million, which is seen in the broader results of the NLB Group.

The negative effects of the operations of subsidiaries are increasingly reflected in the operating results of the parent bank. In 2011, NLB impaired investments in subsidiaries (capital investments and loans) in the total amount of EUR 134.0 million, which represents more than half of the loss generated by the Bank.

The contribution of associates and joint ventures was negative in 2011 owing to the loss generated by Banka Celje.

Statement of financial position

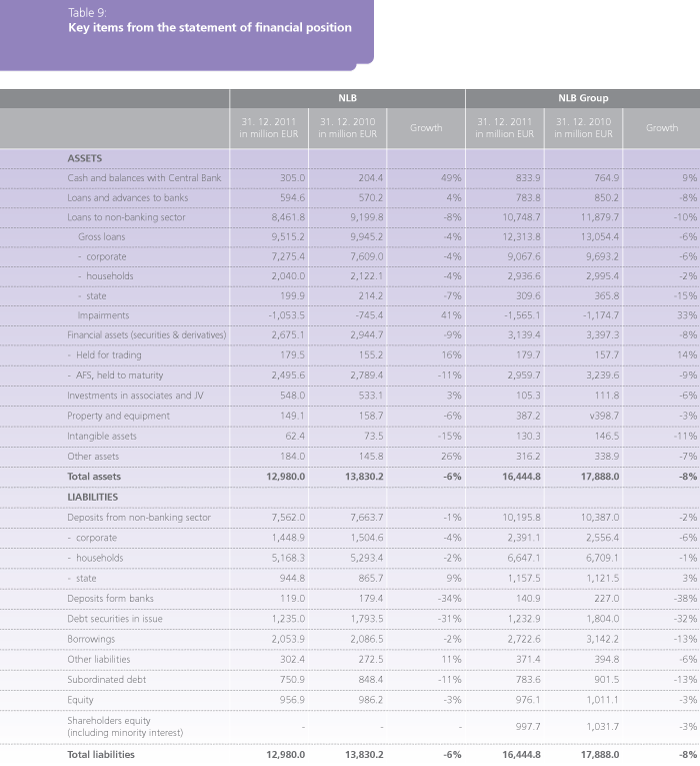

The scope of operations in non-strategic activities (which are in the process of divestment) is declining in line with strategic objectives, while the scope of operations in the NLB Group's strategic activities is also declining in line with the objective of reducing risk-adjusted items. The NLB Group's total assets stood at EUR 16,444.8 million at the end of 2011, down 8% on the end of the previous year. At EUR 12,980.0 million, NLB's total assets were down 6%.

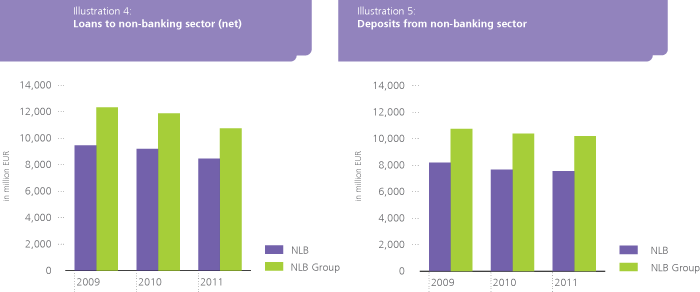

The consequences of the crisis in the real sector were reflected in the deterioration of the NLB Group's credit portfolio and in the need to reschedule loans in the sectors hit hardest by the recession. The NLB Group responded to the conditions with a more conservative lending policy, and by tightening project feasibility and loan approval criteria, and by requiring higherquality collateral. In addition, concerted efforts to reduce the scope of operations in nonstrategic segments began, in particular in the factoring and real estate leasing segments. Gross loans to the non-banking sector amounted to EUR 12,313.8 million in 2011, a decrease of EUR 740.6 million on the end of 2010, while net loans to the non-banking sector were down EUR 1,131.0 million owing to higher impairment costs. The stock of loans was down in all segments, most notably in corporate loans.

Deposits from the non-banking sector amounted to EUR 10,195.8 million at the end of 2011, a decrease of EUR 191.2 million on the end of 2010. Government deposits were up slightly while household deposits and, in particular, corporate deposits were down.

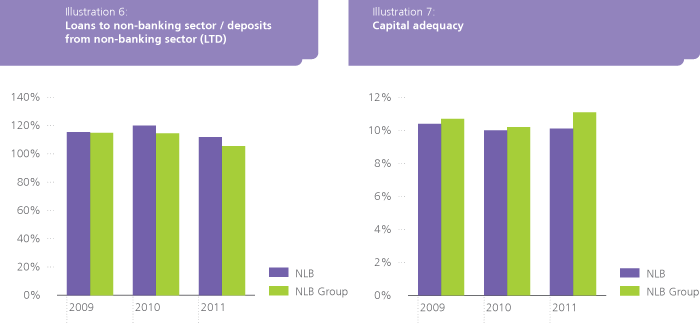

The coverage of loans to the non-banking sector by deposits from the non-banking sector (LTD ratio) stood at 105% at the end of 2011 at the NLB Group, a decrease of 8.9 percentage points on the previous year. A significant decline in loans to the non-banking sector contributed to the improvement in the aforementioned indicator.

The volume of borrowing on the wholesale markets in 2011 was down more than EUR 1 billion on the previous year. Funds for repayment were secured by reducing liquidity reserves in the form of bank deposits and the securities portfolio. Some long-term sources were rolled over, while NLB also raised a syndicated loan in 2011 in the amount of EUR 350 million and received additional long-term funds in the amount of EUR 250 million in the final quarter of the year via a new ECB instrument. LHB Internationale Handelsbank secured ECB funding throughout 2011, its borrowings at the ECB having stood at EUR 60 million at the end of the year. Several partial early repurchases of government-backed NLB bonds were carried out in the second half of the year in the total amount of EUR 495.7 million, while a subordinated hybrid instrument in the amount of EUR 100 million was recalled at the end of the year.

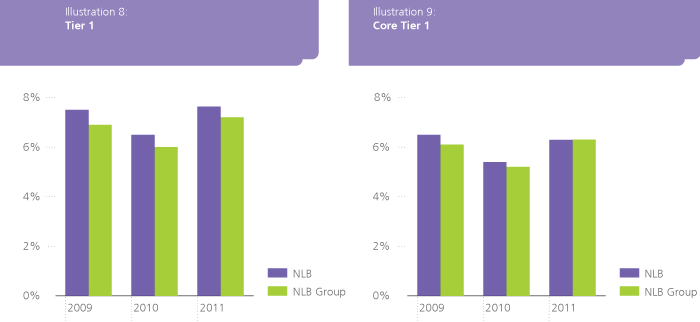

Capital and capital adequacy

The NLB Group's regulatory capital stood at EUR 1,500.0 million at the end of 2011, down EUR 95.3 million on the end of the previous year. All three capital adequacy ratios improved: the Group's overall capital adequacy ratio stood at 11.1%, its Tier 1 ratio at 7.2% and its core Tier 1 ratio, representing the highest-quality Tier 1 capital, stood at 6.3%. The main factors in the improving capital adequacy ratios were the increase in NLB's capital in March 2011 in the amount of EUR 250 million and the decrease in capital requirements for credit risk (of EUR 147.6 million), while the loss generated by the NLB Group in 2011 and the recall of a hybrid instrument in the amount of EUR 100 million had a negative impact on capital.

In 2011, NLB participated in the pan-European stress test conducted by the European Banking Authority (EBA), in cooperation with national supervisory bodies (locally, the Bank of Slovenia), the European Central Bank (ECB), the European Commission (EC) and the European Systemic Risk Board (ESRB). Testing was carried out on the basis of the EBA's common methodology and key common assumptions. The test was used to assess the core Tier 1 capital adequacy ratio of an individual bank.

Taking into account the prescribed methodology and the requirement for a core Tier I ratio of 9%, the calculation showed that NLB had a capital deficit of EUR 320 million as at September 30, 2011, which it must rectify by the end of June 2012. The aforementioned deficit is covered by the additional capital increase proposed by the Bank's Management Board and Supervisory Board. If the capital increase is not carried out by the prescribed deadline, NLB will make use of other measures in the scope of agreed mechanisms at the EU level.

Portfolio

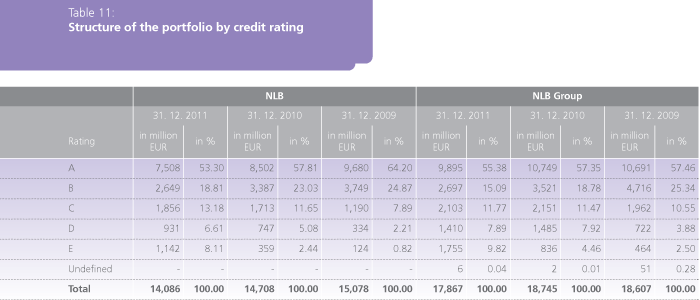

Following initial positive trends of an economic recovery in the first half of 2011, those trends reversed and turned negative during the second half of the year. This was followed by the continuing trend of deterioration in the quality of the credit portfolio. Non-performing loans rose in 2011, both in terms of value and structure. The quality of the portfolio deteriorated most in the sectors of construction, financial holdings and manufacturing, while there were no significant defaults in the export-oriented segment of the economy.

At the end of the year, the amount of the NLB Group's non-performing loans stood at EUR 3,008 million or 21.25% of all loans. Nonperforming loans are defined as all claims against D- and E-rated customers, and claims against A-, B- and C-rated customers that are more than 90 days past due.

The reasons for the deterioration of the portfolio lie in the growing number of overdue unpaid claims and the deteriorating economic position of companies that were reclassified to lower credit ratings as a result. The majority of nonperforming loans derive from claims against Dand E-rated customers, while only 3.2% of non-performing loans is the result of claims against A-, B- and C-rated customers that are more than 90 days past due.

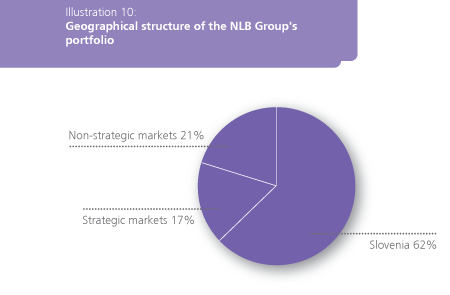

In terms of debtor segment, the corporate sector accounts for the highest proportion (59.2%), followed by households (17.2%), the government (15.9%) and banks (7.7%). The structure is relatively stable, while exposure in all segments has declined in terms of value. In terms of the quality of the portfolio, the most significant deterioration can be seen in the corporate sector.

The majority of the NLB Group's portfolio is accounted for by domestic customers, followed by customers from Bosnia and Herzegovina (6%) and Macedonia (5.8%). Exposure to strategic markets amounts to 79%. The proportion of exposure to strategic markets was up compared with 2010, as the result of the active implementation of the NLB Group's strategy to withdraw from non-strategic markets. The most important non-strategic markets are Serbia (5.1%), Croatia (3.2%), Germany (2.8%) and Austria (1.9%).

The NLB Group responded to the deterioration of its portfolio by creating additional loan impairments, which was not as intense as the growth in non-performing loans due to the collateralization of investments. The coverage of non-performing loans by provisions was therefore down 2.9 percentage points to stand at 59.1% in 2011. In terms of individual activity of the NLB Group, the coverage in the banking segment is above-average at 62%, while coverage in the non-banking segment is significantly lower. The coverage in factoring is 50%, taking into account the fact that the right of recourse applies to factoring claims. The coverage in leasing is even lower at 46%. The majority of transactions are collateralized by the subject of the lease, which remains the property of the leasing company and can be redeemed significantly faster and more effectively. The need for provisions is therefore lower.

Primarily individual provisions were up in 2011 (by EUR 502 million), while collective provisions for households and corporates were down (by EUR 46 million). The aforementioned decline is the result of a reduction in the percentage of collective provisions for E-rated retail customers and the elimination of the safety buffer for the probability of default ratio, which was introduced two years ago when transition matrices did not yet appropriately reflect the risks associated with the portfolio. The transition matrices have deteriorated significantly after two years of poor economic conditions. The use of a safety buffer is therefore no longer required, as confirmed by the Bank of Slovenia.

Liquidity management

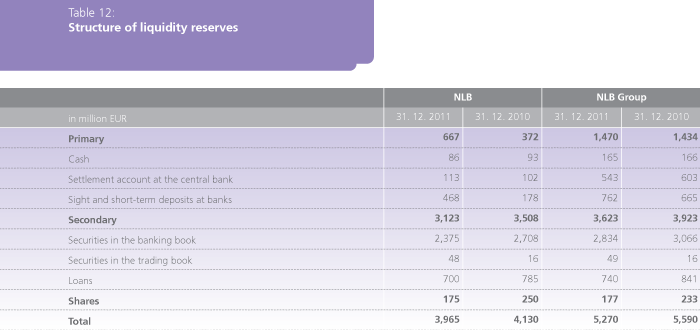

The NLB Group has at its disposal primary and secondary reserves to cover its maturing liabilities. Primary liquidity reserves must be available very soon following the realization of stress test scenarios (immediately, i.e. within one week). This is the ability to generate and secure rapidly realizable and highly liquid assets in the short term. The majority of primary liquidity reserves is represented by cash, funds on settlement accounts at central banks and sight and short-term deposits at other banks. The Bank's secondary liquidity reserves are of exceptional importance in meeting liquidity needs and complying with regulations governing this area. These mainly comprise prime debt securities issued by EU countries and eligible for ECB transactions, while one third of secondary liquidity reserves are accounted for by loans that meet ECB eligibility criteria in full. ECB eligible loans include loans secured by a government guarantee and loans to government agencies.

The Bank includes prime securities and ECB eligible loans, on the basis of which liquid funds can be secured on the market or through the central bank, in its secondary liquidity reserves. The target amount of secondary liquidity reserves depends on the assessed liquidity needs of the Bank, one of the key criteria being the liquidity needs of the NLB Group.

The balance of ECB eligible loans was EUR 740 million at the end of 2011. The total balance of secondary liquidity reserves stood at EUR 5,270 million as at December 31, 2011. ECB eligible loans include loans secured by a government guarantee and loans to government agencies.

The balance of debt securities in the banking book was EUR 2,857 million as at December 31, 2011, a decrease of around EUR 200 million on the end of 2010. Government securities accounted for 82.8% of the aforementioned amount, followed by government-guaranteed bank bonds at 8.2%, bank and corporate securities at 5.95% and bonds issued by multilateral institutions at 1.85%. The Bank has no structured securities in its banking book. The largest proportion of investments in securities is accounted for by Slovenian government securities (31.2%), followed by French securities (11.8%), Belgian securities (10.3%), Dutch securities (10.3%), Austrian securities (6.2%), German government securities (3.8%) and non-government securities with a Republic of Slovenia guarantee (10.8%). Government securities from Portugal, Ireland, Italy, Greece and Spain accounted for 6% of the securities portfolio at the end of the year. Due to the short average maturity in this group, nearly 60% of these investments will mature in 2012. Investments in the PIIGS countries were down sharply in 2011, by EUR 148.5 million. The scope of deposits by the Ministry of Finance was down, while investments in Slovenian government securities were up considerably. A total of 68% of securities in the banking book have a credit rating of AA, while 28% have a rating of AAA.

EUR 1,841 million or 71% of securities were classified as available-for-sale, while EUR 760 million or 29% were classified as held-tomaturity. The modified portfolio duration of the banking book rose from 1.4 years last year to 1.96 years, taking into account interest rate derivatives used to hedge the securities portfolio.

Funding

The market was mainly open to the largest and regular issuers, well-known to investors. Issuers from weaker economies and those less known to investors faced considerably more difficulties in accessing new sources of funding. The adverse conditions on the financial markets also resulted in rising premiums on new sources of funding.

Despite the extremely demanding conditions affecting the financial markets, NLB successfully raised a new syndicated loan in the amount of EUR 350 million with a maturity of two years. The transaction, organized by a consortium of eight international banking groups, was aimed at refinancing and the financing of the NLB Group's operations.

NLB has worked for several years with multilateral financial institutions and development banks in securing long-term sources of funding. These institutions primarily provide long-term, specific purpose credit lines (with maturities of up to 15 years), which NLB uses to finance companies and public sector entities and thus stimulates the technological and sustained development of the Slovenian economy. In 2011, NLB successfully rolled over long-term sources from SID banka in the total amount of EUR 166.3 million.

The Bank used the funds raised through credit lines from multilateral financial institutions and development banks to finance 464 projects in Slovenia in 2011. The funds were primarily used to purchase property, plant and equipment, land, intangible assets and operating assets. NLB secured additional liquidity by borrowing from KAD in the form of a note in the amount of EUR 20 million with a maturity of four years, and via instruments of the ECB, where it participated in three-year, long-term refinancing operations in the amount of EUR 250 million. In addition to NLB, LHB Internationale Handelsbank also made use of ECB instruments in 2011 in the form of long-term refinancing in the amount of EUR 60 million.

International financial institutions, in particular the European Fund for Southeast Europe (EFSE), the European Bank for Reconstruction and Development (EBRD), the Council of Europe Development Bank (CEB) and SID banka, once again played a key role in financing NLB Group companies in 2011. NLB Group companies borrowed a total of EUR 58.48 million from international financial institutions in 2011, of which EUR 10 million was from the EFSE, EUR 5.48 million from the CEB and EUR 4 million from the EBRD. In the scope of borrowing from international financial institutions in 2011, shortterm borrowings in the form of two certificates of deposit in the amounts of EUR 6 million and EUR 3 million were secured from SID banka.

In addition and as the result of successful cooperation with international financial institutions, NLB signed an agreement in June on the raising of a long-term loan from the EBRD in the amount of EUR 30 million. The funds from the aforementioned loan are earmarked for the financing of the projects of SMEs and for NLB Group banks in SE Europe to finance their customers' projects in accordance with the relevant master agreement.

In addition to borrowing from international financial institutions, NLB Group companies also borrowed from commercial banks in Slovenia and abroad in 2011. NLB Group companies raised new loans in the amount of EUR 26 million in 2011, and agreed on the rollover of existing bilateral loans in the amount of EUR 152.9 million. In total, Group companies borrowed EUR 178.9 million in 2011.