Management Report

Macroeconomic environment

Macroeconomic environment

Slovenia

The global economy continued to record relatively encouraging growth in the first half of 2011. The worsening European debt crisis, however, began to hamper that growth towards the middle of the year. The indifference of European politicians' decision-making led to the gradual spread of the Greek public finance crisis to the heart of the monetary union, with an emphasis on Spain and Italy. The costs associated with the refinancing of public debt and fresh funding to cover current public spending began to rise rapidly in the aforementioned countries. The public finance difficulties soon shook the confidence of the corporate sector and households, which was quickly seen in a drop in economic activity. Ratings agencies created additional pressure by downgrading certain euro area countries. The intensity of international trade began to slow, while individual countries began with somewhat more aggressive austerity measures. Certain EMU countries had recorded negative economic growth by the final quarter of last year.

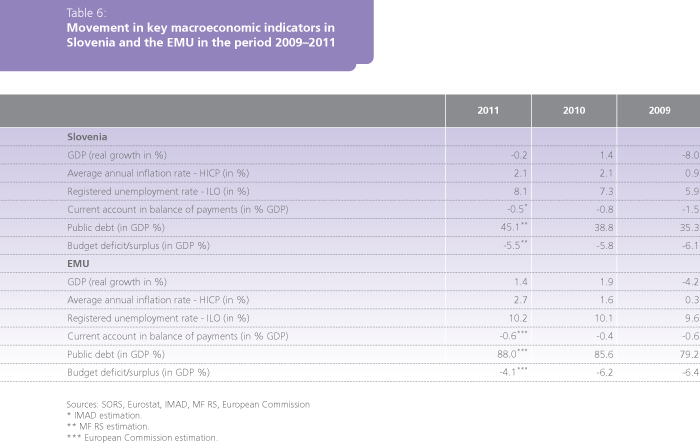

Economic trends in Slovenia tracked those of the euro area overall very closely owing to the highly open nature of the economic system, and in particular due to Slovenia's high dependence on trade within the EMU. Economic growth remained solid in the first quarter, but began to lose momentum and turned negative in the third quarter. Even more pronounced negative growth was recorded again in the final quarter of the year. The drop in GDP in the second half of the year completely wiped out previous growth, with the economy contracting by 0.2% for the year overall. Foreign demand once again played a significant role in GDP growth, as all other components of GDP recorded very weak growth or a decline. Exports were up 12.2% overall last year, despite less intense growth in the second half of the year, while year-on-year growth in imports of 11.2% was recorded.

The deteriorating economic conditions also took a toll on the labor market. Following a weak downward trend during the first half of the year, the unemployment rate began to rise again in the second half to reach 12.1% at the end of the year. A similar trend was demonstrated by the ILO's internationally comparable surveyed unemployment rate.

Inflation rose sharply in the first part of the year, primarily as a result of energy and food prices, which rose very rapidly owing to strong emerging markets. These pressures began to abate with the slowdown in global economic growth and implementations of certain restrictive measures by emerging countries, while weak domestic consumption was unable to keep the pace of growth. Average inflation, as measured by the harmonised index of consumer prices, stood at 2.1% at the end of last year, at the same level recorded in 2010.

Special attention must be paid to the public finance situation. The debt crisis flared up last September when the impact of the peripheral debt crisis began to spread rapidly to Italy, while problems related to the high costs of borrowing spread to certain other countries. Slovenia has also become increasingly risky in the eyes of investors, which was seen in a sharp rise in the required rate of return on government bonds of all maturities. Downgrades by international ratings agencies added fuel to the fire, while the existing situation was further aggravated by the collapse of the government and the subsequent protracted formation of a new executive branch. The ECB helped ease the situation by purchasing primarily Italian and Spanish bonds, which also led to a slight drop in the costs of new Slovenian borrowing. The general government deficit remained high at the end of 2011, standing at 5.5% of GDP, nearly the same level recorded in 2010, while public debt rose sharply to stand at 45.1% of GDP at the end of the year. Here, a constitutional change that will require the government to draft a balanced budget should be mentioned. The aforementioned measure is aimed at preventing further growth in the public debt. Nevertheless, the government will still have the power to spend more than it collects, but only in extraordinary circumstances. The measure also requires the deficit to be closed in the coming years.

Slovenian banking sector

Once again, 2011 was an exceptionally demanding year for the Slovenian banking sector. The total assets of commercial banks operating in Slovenia were down 3.0% or EUR 1.5 billion to stand at EUR 48.8 billion. This was primarily the result of the banks' debt repayments to foreign banks, as the worsening of the European debt crisis simultaneously led to a drop in confidence on the interbank market, thereby increasing risk and the cost of new borrowing. The decline on the liability side was partially offset by government deposits and funds raised at the ECB, which at the end of the year offered an affordable source of liquidity in the form of three-year long-term refinancing operations (LTROs). Capital adequacy remained below the European average which, in addition to the high level of financial leverage in the economy overall, is one of the key factors in the 5.7% decline in the value of loans to nonfinancial corporations. Household demand for new loans was up slightly, with year-on-year growth amounting to 2.2%. The year-on-year decline in lending to the non-banking sector slowed slightly to -4.2%. A somewhat different picture was seen on the deposit side. Households' confidence in the domestic banking sector has not diminished, as seen in figures regarding growth in households deposits, which were up 1.7%. Total deposits of the non-banking sector recorded growth of 2.9%, in part thanks to the government, which deposited 8.5% more at Slovenian banks than a year earlier. Non-performing loans remain a problem. Non-performing claims, i.e. those rated D and E, accounted for 6.02% of the banks' total classified claims at the end of December, compared with 3.69% a year earlier. Claims paid in arrears accounted for 19.1% of total classified claims, while those claims paid more than 90 days in arrears accounted for 11.2%. The balance of impairments and provisions reached EUR 3.2 billion at the end of the year, while the coverage of total claims stood at 6.48%. The operations of banks continued to deteriorate somewhat compared with the end of 2010. Interest income and noninterest income were down around 2%. Despite a slight improvement in cost efficiency, the banking system overall generated a net loss of EUR 356 million under the significant impact of rising impairment and provisioning costs of EUR 1,096 million.

South-eastern Europe

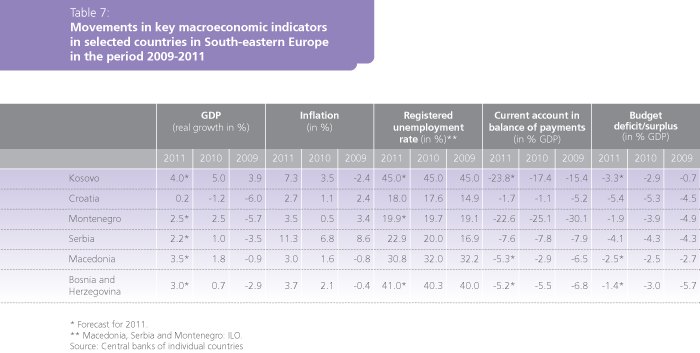

Following a contraction in 2009 and moderate growth in 2010, a positive trend in economic growth continued in the Balkans last year. After being the only country of South-eastern Europe to record a contraction in economic activity in 2010, Croatia recorded low but positive GDP growth of 0.2% last year. Other countries recorded growth of more than 2%, while growth in Macedonia actually exceeded 3%. High economic growth continued in Kosovo, where the latest forecasts indicate that growth reached 4.0% in 2011.

In terms of the movement in consumer prices, Serbia continues to record the highest growth in prices, which rose by 4.5 percentage points more in 2011 than in 2010, with average inflation reaching 11.3%. Despite the high average inflation rate in Serbia in 2011, a sharp declining trend has been present since the middle of the year. Contributing most to the aforementioned trend were lower energy prices on global markets and weakening of costregulated prices and food prices. The declining trend is expected to continue in 2012 according to the Serbian central bank's forecasts. A similar trend in the inflation rate was also seen in Kosovo, where inflation averaged 7.3% in 2011. The lowest inflation in the countries of Southeastern Europe was recorded last year in Croatia and Montenegro, where it averaged 2.3% and 3.1%, respectively.

Movement in industrial output varied by individual country last year in South-eastern Europe. Bosnia and Herzegovina, Serbia and Macedonia all recorded growth in output. After recording a drop in industrial output of 4.8% in 2010, Macedonia recorded growth of 3.3% in 2011. In Serbia, growth was down slightly last year compared with 2010, when growth in industrial output stood at 2.1%. Industrial output was down 1.2% in Croatia in 2011, the same decline that was recorded in 2010.

There was no significant change in the situation on the labor market during 2011 in these countries compared with 2010. One contributing factor is the slow economic recovery in these countries, in particular due to the fallout from the debt crisis. The unemployment rate remains highest in Kosovo and Bosnia and Herzegovina, where more than 40% of the active population is out of work. The unemployment rate is close to 32% in Macedonia, while the unemployment rate in Serbia was 23.7% according to the labor force survey from November 2011. Croatia has the lowest unemployment rate of South-eastern European countries, standing at 18.7% at the end of December and averaging 18.0% for the year.

Following the strengthening of foreign trade in 2010, this positive trend continued in the countries of South-eastern Europe in 2011. The highest growth was recorded in Macedonia, where foreign trade was up 31%. Growth in foreign trade was 20% in Serbia, and 15% in Bosnia and Herzegovina and Montenegro, but remained at the level recorded in 2010 in Croatia.

Banking sector of South-eastern Europe

Positive trends were seen in 2011 in the banking sector of the strategic markets of South-eastern Europe, where banks achieved growth in total loans and total assets, except in Montenegro. Kosovo recorded the highest growth in loans of 16.4% in nominal year-onyear terms, while banks' total assets were up 8.3% in the context of 8.5% growth in deposits. Macedonia was not far behind, with 9.9% growth in total loans and 9.2% growth in deposits, while the total assets of banks were up 9.5%. Reports also continue from Macedonia about a stable banking system with a capital adequacy (of 16.8% in the final quarter of 2011) more than two times higher than the legally prescribed minimum, which increases the banking system's ability to absorb possible negative shocks. The results of stress tests carried out by the National Bank of the Republic of Macedonia also indicate a sufficient level of capital, and that the banking system is resistant to possible external shocks. Poorer results are reported from Montenegro, where total loans and total assets were down 11.1% and 4.6%, respectively in 2011, while deposits were up 1.5%. A positive trend in the banking sector was also seen in Bosnia and Herzegovina where, following low growth in items in 2010, total assets recorded higher growth of 3.4% in 2011, while loans and deposits were up 5.3% and 3.8%, respectively. At 4.8% in 2011, growth in the Croatian banking sector's total assets was lower than the previous year, while growth in total loans and total deposits fell to 7.1% and 1.8%, respectively. The banking sector in Serbia also faced a more difficult time in 2011 than in previous years, with growth in total assets declining to 6.1% in year-on-year terms, while growth in deposits and loans fell to 8.3% and 11.1%, respectively.